The best student credit cards with no annual fee make it easy to open a credit account and help you achieve something that will benefit you for the rest of your life: a good credit score.

Opening a card and using it responsibly can lead to a higher credit score, which can lead to lower interest rates on loans for a home or car purchase and a better rate on your next credit card. We look at seven cards designed specifically for the needs — and credit histories — of students.

The Best Student Credit Cards With No Annual Fee

Few college students have a credit history, making it difficult to get a credit card. The seven cards we review below are meant for students only. These student credit card options charge no annual fee, so you can save money as you start your journey to hopefully having good credit.

The Discover it® Student Cash Back credit card is our top choice for many reasons. A big one is that it doesn’t charge an annual fee or a late fee on your first late payment, and Discover won’t change the APR (annual percentage rate) for paying late.

The card also has an unlimited cashback reward program. Called Cashback Match, it automatically matches all the cash back you’ve earned at the end of your first year. For example, you could turn $50 cash back into $100. The Match program is only available for the first year and only to new cardmembers.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome card has a feature that pays for referring a friend. It gives a statement credit for each referral that is approved. The Discover it® Student Cash Back card has the same feature.

The chrome card has a 0% introductory interest rate on purchases for the first six months as a cardholder. That can come in handy if you have a lot of college expenses in the next six months and can then pay them off before interest charges accrue.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students offers many cash back opportunities. The cardholder chooses the purchase category in which they want to receive the top cashback reward: gas, online shopping, dining, travel, drug stores, or home improvement and furnishings.

If you’re furnishing your apartment, for example, you can use that category for the top cash back reward that month, and then switch it the next month to gas if you’re planning a road trip. Cash rewards don’t expire.

4. Wells Fargo Cash Back College℠ Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Wells Fargo Cash Back College℠ Card lets students earn cash rewards that can be redeemed for travel, gift cards, merchandise, and of course, cash. Cash redemption options include a paper check, a deposit into a Wells Fargo savings account, withdrawals from a Wells Fargo ATM, or applied as a credit toward an eligible Wells Fargo credit product, such as a loan.

An existing Wells Fargo relationship, meaning some sort of account with the bank, is needed to apply online for the card. Wells Fargo has many online tools and credit education resources, including tips on building credit and using its student credit card wisely to build good credit and a credit history.

(The information related to the Wells Fargo Cash Back College℠ Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

- New applications are temporarily paused as Deserve redesigns this card.

- Earn 1% cash back on all purchases + Amazon Prime Student on us for 1 year

- Cash back earned is automatically redeemed as a statement credit in $25 increments

- Cellphone protection up to $600

- Prequalify in just seconds with no impact on your credit score

- Collision Damage Waiver through Mastercard

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

23.24% (variable)

|

$0

|

None/Limited

|

The Deserve® EDU Mastercard has some unique benefits for a student card. It pays for Amazon Prime Student services for one year, offers cellphone protection, and has no international transaction fees. College students traveling overseas who are looking for travel rewards from their credit card may consider no foreign transaction fees a worthwhile benefit, since not paying the fees can save them plenty of cash.

The 13 Best 5% Cash Back Credit Cards (2024) also makes it easy for international students to apply and be approved for the card. A Social Security number isn’t needed to apply for the EDU Mastercard, which can help college students and professionals from countries outside of the U.S. start their credit journey and build a credit history.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Travel Rewards credit card for Students does just what its name implies and offers points that can be redeemed for travel. And it’s one of the few student cards that offers a signup bonus.

Points for this travel rewards credit card are rewarded for everyday purchases, and the points never expire. There are no blackout dates for redeeming the travel rewards, which can be applied as a statement credit to pay for travel and dining purchases.

What is a Student Credit Card?

A student credit card works like just about any other credit card, allowing a cardholder to make purchases and shop online with the card.

Most college students have little or no income and are unlikely to have much of a credit history let alone a good credit score. Most every card issuer recognizes this and offers a student credit card with a student’s needs and cash limitations in mind.

A student card will typically have a lower credit limit than that of other credit cards for the simple reason that students have limited income and can’t afford high credit card debt. But by making on-time payments and keeping your balance much lower than your credit limit, some cards may give you a periodic credit limit increase. This shows a credit bureau that you’re building credit.

You must prove you’re enrolled in school to get a student credit card. This may require submitting a copy of your transcripts, recent semester’s grades, current semester schedule, or a copy of your student identification card. Each credit card company may define who qualifies as a student differently.

For instance, some don’t require proof of college enrollment, but the credit and income requirements must be met.

Other requirements for student cards may include:

- Being a U.S. citizen or permanent resident.

- Being 18 or older.

- If under 21, showing you earn sufficient income, such as from a part-time job, scholarships, or student grants.

Foreign students who don’t have a Social Security number can apply for the Deserve EDU Mastercard.

If you’re under 21 but at least 18 years old and can’t provide verifiable proof of independent income, you’ll have to have an adult cosigner to be approved for a credit card. This is a requirement of the 2009 CARD Act.

Before this law, a teen could get a credit card on their 18th birthday without a cosigner or income of their own, which Congress (and probably many parents) didn’t think was a great idea for new adults.

Some cards provide a type of student cash through a statement credit for approved referrals. Other cards have perks that traditional cards don’t have, such as cellphone insurance, free Amazon Prime Student services, or statement credits for subscribing to certain streaming services.

Traditional benefits are also common. These include $0 fraud liability, rewards, cash advance withdrawals, no foreign transaction fee, no annual fee, balance transfer transactions, and an introductory APR.

Why Should I Get a Credit Card Without an Annual Fee?

An annual fee for a credit card is typically around $100, though it can reach $500 or so. The annual fee is usually the same every year, though you should be on the lookout for fee increases.

Some cards waive the annual fee for the first year as an enticement to apply, then charge it every year after that.

The credit cards we recommend for students don’t have annual fees. Still, you should check a credit card’s website for fee details in case a credit card company starts charging such fees.

Annual fees are usually associated with premium travel rewards cards or cards for bad credit. Students do not need to pay this fee to get a quality card while in school.

Paying an annual fee is more common with credit cards that offer better benefits than most student credit cards have. Travel rewards, for instance, are offered on some student cards, but other cards often have much higher travel rewards that can make the annual fee worth paying.

As a college student, you should take advantage of the perk of not paying an annual fee for a credit card. And even after you graduate from college, you should still be able to find a credit card without an annual fee.

Paying an annual fee for a credit card while in college is just another expense you don’t need as a student. With so many cards being offered without the fee, it’s easy to find a credit card that doesn’t tack on that extra expense. Why pay $400 or so over four years of college for a credit card when you don’t have to?

Can a Student Get a Credit Card Without a Credit History?

After meeting the simple qualification of being a college student, the other qualification needed to get a student credit card is to undergo a credit check. This means looking at your credit history, which is usually light for young people in college.

Credit card companies normally don’t publish their minimum credit score requirements, though you may find a range that is accepted.

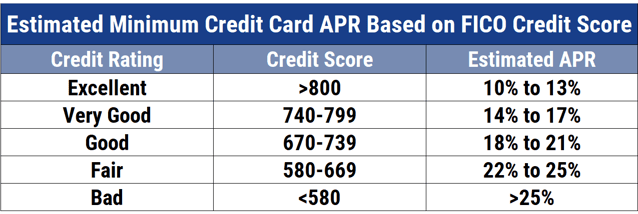

Some credit cards are targeted at people with bad credit, though that’s unlikely to be students who are just starting their financial lives and building a credit history. Applicants with good credit are more likely to receive favorable credit terms from a credit provider than someone with bad credit.

Student credit cards fall somewhere in the middle, mainly because applicants are expected to have little or no credit and a limited income.

Without much of a credit history, students will likely find higher interest rates with credit cards marketed to them. This is to offset some of the risk in providing credit to consumers who don’t yet have a history of paying many bills.

The good news is that student credit cards don’t often charge annual fees, so at least they won’t have to face that hurdle in getting a credit card. Consumers with bad credit are often charged annual fees, as are people who want a card with travel rewards and other perks.

College is a good time to start building credit. Finding a credit card as a student without a credit history is easy and is much easier than if you had bad credit.

How Can a Student With No Income Get a Credit Card?

Being a full-time student is exactly that. It takes up all of your time, leaving you no time to work and earn some cash. Even part-time students can have difficulty earning much money, leaving them with little income to pay their basic bills.

Credit card companies know this and don’t expect students to have much income. And income can come in a variety of ways.

Income is a requirement on credit card applications because card issuers want to know if you make enough money to keep up with payments on your credit card. It also helps determine how big your credit line will be. While income isn’t a major part of a credit application, it is part of one.

The CARD Act of 2009 requires students and anyone younger than 21 to show they have the means to repay a debt before an account can be opened. This means credit card issuers must have proof of an applicant’s income.

Income can come from more than a job. But it can’t come from a form of debt, such as a student loan. Debt is not income.

Also, unless your parents are cosigning for the card, money you receive from them as an allowance or any other type of “gift” from family and friends can’t be claimed as income to qualify for a credit card.

Part- or full-time work is obviously income. Other forms of student income include:

- scholarships

- grants

- paid internships

- work-study programs

- other forms of student financial aid, but only after you’ve paid your tuition and other school expenses

That last point is important to remember. The income amount that the credit card company will likely look for is your disposable income after your necessities, such as rent and school expenses are paid. The higher your disposable income, the more able you are to afford a monthly payment on a credit card.

If you don’t have any income as a student, and you can’t get a cosigner for a credit card, another option is to become an authorized user on a parent’s credit card account. Using their card with your name on it will help you build credit.

What Credit Score Do I Need to Get a Credit Card?

If you have no credit history, as many students do, then you’re in a better position than a student with bad credit. That said, it’s hard to know what credit score card issuers are looking for since they don’t usually publish this data.

You don’t start life out with a perfect credit score. As with good grades in school, you have to earn it.

Credit scores are based entirely on information in your credit reports. And you don’t get a credit report until you have a credit history.

That may sound like a chicken-before-the-egg comparison, but the main point is that you only start building a credit history when you open a credit-based account such as a credit card or loan.

Once your first credit account is reported to the credit bureaus, you become eligible for a VantageScore, a common credit scoring model. The other, called the FICO Score 8, is created six months after your credit history is reported. Keep making payments on time early in your credit career, and a fair score can quickly become a good credit score.

Student credit card issuers don’t expect students to have a credit score, but they do require some basic information beyond a verifiable job and being a college student. Annual income is important and can come from more than a job, as listed earlier.

Other information that a student credit card application will likely ask for include:

- Name

- Phone number

- Physical address

- Email address

- Date of birth

- Social Security number (this may be waived for international students)

- Monthly housing payment

A hard credit check is often also required, which will require you to give your permission.

Do I Have to Be Enrolled in College to Get a Student Credit Card?

Yes, most credit card companies that offer student credit cards require the cardholder to be a student. Each issuer may have different rules on how it defines a student. Some may require applicants to be enrolled full time, while some may allow part-time students.

You’ll usually have to be already enrolled in college to be approved for the credit card. Some may accept applicants who have been accepted for the upcoming semester.

Proof of enrollment will usually be required. This can come by showing your transcripts, recent semester’s grades, current semester schedule, or a copy of your student identification card.

You may not come up against the requirement to be a student during the credit card application process. Instead, the lender may ask for verification during its approval process.

What Happens to My Card When I Graduate?

Once you get a credit card as a student, you don’t have to remain enrolled in college to keep the card.

When you graduate — which 33% of students in public colleges and universities do in four years, and 57% accomplish in six years — then you can choose whether you want to keep your student credit card.

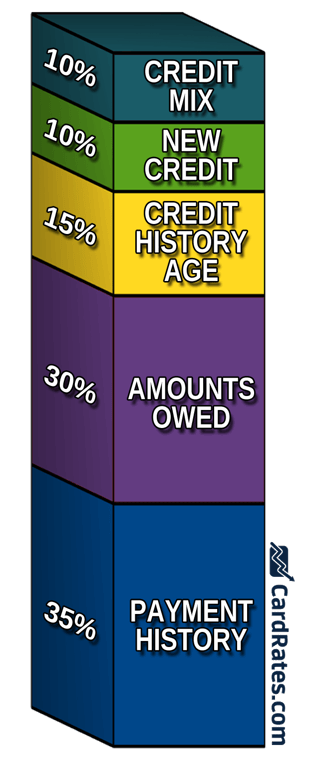

The best choice is to do nothing and keep the card — unless it charges an annual fee. If not, then keeping it will help build your credit history. Leaving the card open helps three of the five main credit-scoring factors:

- amounts owed

- credit mix

- credit history age

Closing the card will raise your credit utilization ratio for the simple reason that you’ll now have less credit available to you. A higher credit utilization ratio can lower a credit score. And that’s based on the assumption that you have at least one other credit card.

Credit history age accounts for up to 15% of a credit score. Your student card will likely be your oldest credit account, so keeping it will only help that part of your credit score as it ages.

A student credit card can also be worth keeping after graduation because the credit card company will likely reclassify your account when you no longer qualify for a student credit card. It may simply move your account to a traditional credit card without a student label. This can automatically give you more benefits and cash back rewards.

But if you didn’t maintain your account in good standing while you were a student, the card issuer may choose to close your account while you pay off any remaining debt on the card.

Do Student Credit Cards Offer Rewards?

Every card we’ve reviewed above offers rewards. Rewards can come in many forms from student credit cards, and not every card offers them. Always check the terms and benefits of a card before applying.

The rewards rate and type will vary by card, but the most common are cash rewards or rewards points that can be exchanged for gifts or cash. Some cards offer travel rewards. Rewards on student credit cards aren’t usually as great as they are on major credit cards for people with excellent or good credit, but they’re competitive for students with no credit or limited credit.

Expect rewards of 1% to 2% of your spending on eligible purchases on most student cards. Cash rewards for using your card are appealing, but they shouldn’t be the main reason to choose a card.

Most student credit cards offer rewards on eligible purchases.

Rewards work just as they would for any other credit card. You use the card to buy things and are awarded points or cash rewards for every dollar spent.

Some cards pay more than one dollar or point per $1 spent, such as double points for gas or dining out, or 5% cash back on groceries. Some purchase reward categories change quarterly. Some cards pay unlimited cash back on purchases, while others limit it to a certain amount you can earn each quarter, such as $1,000 in spending at gas stations and restaurants.

Some cards offer signup bonuses for spending a certain amount of money when you first get the card. The Bank of America® Customized Cash Rewards credit card for Students offers a cash rewards bonus after spending a set amount of money within 90 days of opening an account.

Even if a card only offers the most basic of rewards, such as 1% cash back on all purchases, it may offer other benefits that make it worth getting as a student.

The Deserve® EDU Mastercard pays cash rewards on net purchases and gives free Amazon Prime Student access for the first year as a cardholder. It also offers a cellphone protection plan when you use the card to pay your monthly phone bill.

A downside to the Deserve® EDU Mastercard is that redeeming rewards is a little difficult. While it pays unlimited cash back on all purchases, the cash back you earn can only be redeemed in $25 increments.

That equates to charging at least $2,500 to qualify for the minimum reward of $25. With an average credit limit of around $800, that requires maxing out the credit card more than three times to get $25 back.

It’s worth knowing that most credit card issuers charge higher interest rates or other fees to offset the costs of rewards they pay out. Carrying a balance from month to month — on a higher interest rate or not — will increase your finance charges and can make the rewards less worthwhile. If you’re paying $25 in interest in a month to eventually get a $25 reward, you’re not gaining anything.

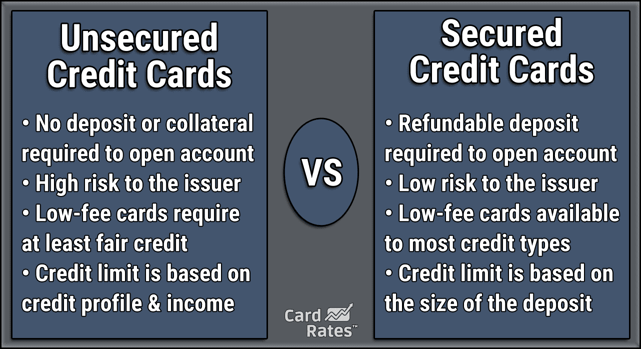

Is a Student Credit Card a Secured Card?

The student credit cards we recommend are not secured cards. Each card is an unsecured credit card that doesn’t require putting down a refundable deposit to serve as your credit limit.

Student cards are designed for college students with limited or no credit histories. Secured cards are designed for nonstudents new to building credit and those who have bad credit. A secured credit card can also be a good way for students to improve their credit scores if they don’t qualify for an unsecured credit card.

A secured credit card requires having a cash deposit, also called a security deposit, to open and maintain the credit card. The deposit serves as the credit limit and can be used as payment if a monthly payment isn’t made. Otherwise, the deposit is returned to the user when the account is closed.

The deposit may also be returned if the secured card is being used well, such as paying the credit card bill on time over several months. Some secured card issuers automatically review accounts around six to eight months and move the card to an unsecured line of credit and then return the cash deposit.

A secured card will usually have low or no fees and can sometimes be upgraded to an unsecured card when the cardholder’s credit has improved. Cash back and other rewards aren’t often a benefit of having a secured credit card, and these cards usually don’t charge an annual fee either.

An unsecured card doesn’t require a deposit for approval. No collateral is required in case of default, which may lead to higher fees for unsecured cards.

Either way, both types of cards report your credit history to each major credit bureau, allowing you to build a positive credit profile and raise your credit score.

What Fees Should I Look Out For?

Fees and interest charges on balances are what make a credit card profitable for credit card issuers. To avoid them, it helps to know what they are and where to find them.

Every card’s website should have a section explaining what its fees are, or at least a link to the credit terms and fees. Part of this will be the Schumer Box. It’s an area where the credit terms and fees are listed in detail, and often in a bold, large font.

The interest rate will be listed, including any introductory rate charged for six months or so after an account is opened. These are often 0% as an enticement to use the card immediately or to transfer balances from other cards and consolidate debt. Pay off a 0% interest balance before it expires, and you can save a lot of cash.

The APR charged on balances depends on your creditworthiness. A rate of 25% or so is common for someone with bad credit, or even for students without a credit history. Whatever the APR, you can avoid it by paying off your credit card balances completely each month by the due date.

Other fees that should be in the Schumer Box may include:

- Annual fees. None of the student credit cards we recommend have annual fees, which average $95 on cards that do charge annual fees.

- Late payment. Paying your credit card bill late will not only mean paying interest on the balance but a late fee of $40 could be charged.

- Returned payment. If your check doesn’t clear or your bank account doesn’t have enough cash in it, expect a fee for that. It could be around $40.

- Balance transfers. You may be charged this fee for transferring a balance from one credit card to another. Fees can range but are usually 3% to 5% of the transfer amount.

- Cash advances. Withdrawing cash from a credit card is costly. Some cards charge a minimum of $10 or 5% of the advance.

- Foreign currency conversion. Look for a card without a foreign transaction fee, and without a charge for converting foreign currency into U.S. dollars. This fee can be as much as 3% of each transaction.

Always read the full terms and disclosures of a card before applying.

How Do I Build Credit With a Student Credit Card?

A student credit card works just like any other credit card in terms of building credit. Use the card responsibly by paying your monthly bill for the card on time, and your credit score will likely increase. If you don’t, the opposite is true.

Just having a credit card in your wallet can be an enticement to spend more, which shouldn’t surprise anyone. If that’s the case with you, then leave your card at home when you go out, and only use it for monthly bills, for example.

Payment history is the biggest factor in a credit score, making up 35% of it. Missing just one monthly payment can cause a credit score to drop quickly, so always make at least the minimum payment before the due date each month. Set up automatic payments to ensure you never pay late.

Payment history is the biggest factor in a credit score, making up 35% of it. Missing just one monthly payment can cause a credit score to drop quickly, so always make at least the minimum payment before the due date each month. Set up automatic payments to ensure you never pay late.

After payment history, amounts owed is the next biggest part of a credit score. This considers your credit card balance and any other debts you owe.

Keeping your credit card balance below 30% of your available limit is beneficial to your score and paying it off every month is even better. This is easier said than done, of course.

Good credit habits start with the knowledge that every time you use your credit card, you’re essentially getting a loan. Credit card debt should be taken seriously, and repaid as soon as you can, preferably during the card’s grace period so you can avoid interest charges and late fees.

Establishing and always following good credit habits will likely improve your credit score, opening the possibility of cheaper loans in the future.

Your Best Options for Student Credit Cards With No Annual Fee

Hopefully, we’ve made it easy to find the best student credit cards with no annual fee. College students are just beginning their financial journey, and a good student credit card without an annual fee can be a good way to build their credit.

A lifetime of good credit will make loans and credit much cheaper, meaning you’ll pay less for a car, a home, or just a night out on the town funded by your card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year]) 14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Rewards-Credit-Cards-with-No-Annual-Fee-Feat.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year]) 7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/No-Annual-Fee-Credit-Cards-with-Rewards.jpg?width=158&height=120&fit=crop)

![7 Secured Credit Cards With No Annual Fee ([updated_month_year]) 7 Secured Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_29251765.jpg?width=158&height=120&fit=crop)

![8 Best Beginner Credit Cards: No Annual Fee ([updated_month_year]) 8 Best Beginner Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Credit-Cards-For-Beginners-With-No-Annual-Fee-1.jpg?width=158&height=120&fit=crop)

![9 Best 0% APR No-Annual-Fee Credit Cards ([updated_month_year]) 9 Best 0% APR No-Annual-Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/09/best-0-apr-no-annual-fee-credit-cards.jpg?width=158&height=120&fit=crop)