There’s an old saying, “If you dance to the music, you have to pay the piper.” Many people follow the same mindset with credit cards, thinking that interest charges are simply the fee you pay for the convenience of using plastic.

But, believe it or not, there are multiple ways to avoid purchase interest charges on credit cards. Below we’ll look at three ways to avoid these pesky fees so you no longer have to pay the piper, er, bank.

1. Open a Card with a 0% Promotional APR

Hundreds of credit cards are available to consumers today, and if you’re in the market, you likely have more options than ever before. This competition among issuers for your business means they must sweeten the pot if they’re going to get you to apply.

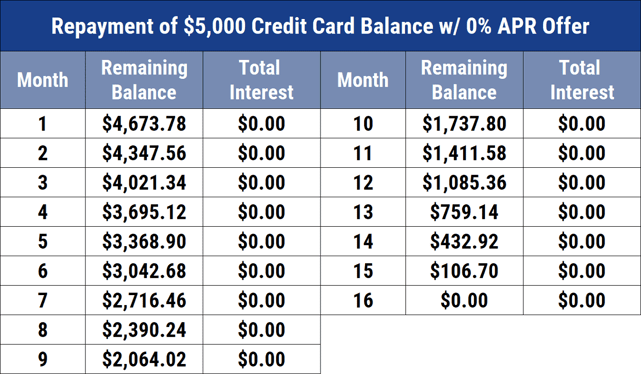

One way they do this is through signup bonuses and promotional offers. One such offer is an extended interest-free period for new cardholders. Some cards offer six months of purchases with a 0% APR and others will extend the promotional period as long as 18 months.

These cards provide a great way to make a large purchase that you’ll need time to pay off because you’ll only owe what you charge to your card — with no extra fees that make it harder to pay off.

Many rewards credit cards also feature extended promotional APR periods — meaning you can still earn rewards while you avoid accruing interest charges on your balance. Our top cards with a 0% APR introductory period offer the best of both worlds.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Before you go on an interest-free shopping spree, be sure to fully read and understand your credit card’s rules surrounding the introductory period. Some card issuers start charging interest based on your card’s balance on the day your introductory period ends.

Others charge interest on the total amount of money you charged during the period — and continue to charge it until you pay your card’s balance in full. Either option can quickly weigh down your wallet, so be sure you pay your balance in full before your introductory period ends.

Otherwise, you’ll negate the interest-free savings by paying hefty fees further down the road.

2. Transfer Your High-Interest Debt to a 0% Card

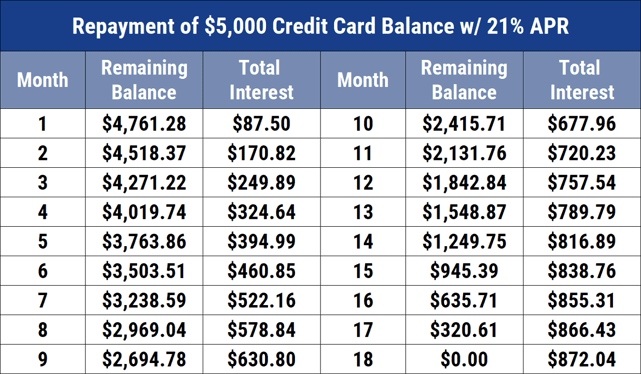

If you’re carrying debt on a credit card from month to month, you’ve likely seen those interest charges eat away at your monthly payments — continuing a vicious cycle of never-ending payments that’s hard to break.

But a good balance transfer card can remove the burden of high-interest debt for a period of time. This gives you an opportunity to chip away at your principal and not spin your tires in an interest mud puddle.

Many credit cards today offer introductory offers that provide 0% interest on balance transfers for between six and 18 months. You typically have to initiate the balance transfer within a certain time frame — typically within three months of opening your card — to take advantage of the offer.

These offers can provide a tremendous amount of relief, as your total monthly payment will be dedicated to eliminating your balance, not interest charges. You’ll no longer see those depressing interest fees hit your statement each month, but you may be subject to a balance transfer fee of between 3% and 5% of the transferred balance.

Our top balance transfer credit cards give you extended repayment periods and flexible terms for any balance transfer you initiate.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

While you won’t earn cash back, points, miles, or other rewards on balance transfers, you could reap a far greater benefit — less debt. Just make sure you pay off your transferred balance before the interest-free period ends. Otherwise, you’ll just shift debt from one card to the other.

Another common pitfall that consumers fall into is charging new debt to the card you pay off using the balance transfer. Once you’ve cleared the high-interest card, you should put that card away and use it only in case of emergency, or cancel the card altogether if it makes sense to do so.

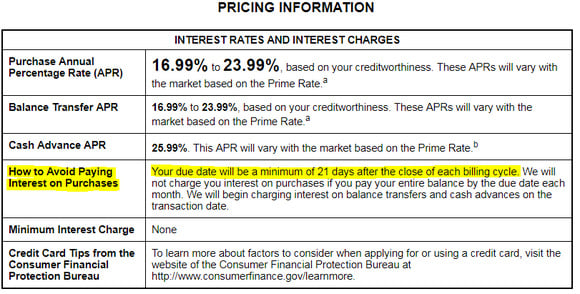

3. Pay Your Balance within the Grace Period

Contrary to popular belief, credit card issuers don’t start charging you interest as soon as you use your card to make a purchase. In fact, they’re legally bound to withhold interest charges for several days after you complete your purchase.

Under the Federal Credit Card Accountability, Responsibility, and Disclosure Act of 2009 (or the CARD Act of 2009), you have at least 21 days to pay your bill without incurring finance charges, known as the grace period.

Every credit card issuer must deliver your bill to you — whether by mail or electronically — at least 21 days before your next payment is due. Under your grace period, you have at least 21 days from the time you receive your bill to pay off the new balance.

If you do so, you’ll never pay a finance charge. You can find the details of your credit card grace period in your billing statement.

Starting on day 22, though, your issuing bank can — and will — start applying interest charges to your balance. That’s why it’s important to never charge a purchase to your credit card you can’t afford to pay off within three weeks. This will save you the money you’d otherwise pay to the issuing bank in interest.

Even if you cannot pay the entire balance within 21 days, you should always try to make some sort of payment within that time frame. Once a purchase enters day 22 on your card, you’ll start accruing finance charges on that current balance. The lower your balance, the lower the interest charges.

Best of all, you’ll continue to earn rewards from your credit card. One reason rewards cards have high APRs is to offset the cost of the rewards the issuing banks dole out every day. So, when you’re not paying interest, you’re not paying for your rewards.

Why Do I Get Charged Interest on My Credit Card?

A credit card is essentially an on-demand loan. An issuing bank determines how much money it will loan you and allows you to continually withdraw from that amount as needed.

The only difference between a personal loan and a credit card is that your card is a revolving credit line — meaning you can reuse your credit after you’ve paid it off.

Banks issue most credit cards and every bank needs to make money to stay in business. The way banks make money is by lending money and charging interest. The finance charges you pay help fund the bank’s operations and gives it more money to lend to other consumers.

According to Discover, the average U.S. household carries approximately $16,061 in credit card debt, and the average credit card interest rate is around 15%. If you only make the minimum payment, you’ll spend 10 years paying that debt down and incur more than $100 in interest charges each month.

That’s exactly what banks want you to do — and precisely why you should budget well enough to pay your entire balance in full each month or add a card to your wallet with an extended introductory 0% APR.

How Do Credit Cards Calculate Interest Charges?

If your credit card sports the average 15% interest, that doesn’t mean you pay 15% in interest each year. That’s because credit card issuers charge interest daily, although your actual interest rate hinges on an annual percentage.

Determining your interest charges is a three-step process that sounds harder than it really is.

1. Find your daily rate: Divide your APR by 365 (days in a year). Some banks divide it by 360 to factor in certain holidays, but each bank is different.

Once you have that, you can…

2. Find your average daily balance: Start by determining how many days are in your billing period. Your credit card statement should prominently display this.

Starting with your carried-over balance from the previous month, find your card’s total balance for each day within your previous billing cycle. Add those balances and divide it by the number of days in your billing period.

That gives you your average daily balance, which then allows you to…

3. Calculate your daily finance charges: Simply multiply your average daily balance by your daily interest rate. You just may be surprised when you find out how much you’re paying every day for your access to credit.

Do You Get Charged Interest if You Make the Minimum Payment?

Yes — your credit card’s issuing bank charges you interest on any unpaid balance you carry on your card each month. As stated above, credit card issuers calculate your interest charges daily, based on your average daily balance. The lower your balance, the lesser your charges.

The only way to avoid these charges is to follow any of the steps listed above — acquire a 0% introductory APR credit card, transfer your balance to a card with an extended 0% APR offer, or pay your existing principal within your allotted grace period.

If you pay less than the minimum, not only will you still incur finance charges, but you’ll also likely see a late fee on your next bill. On top of that, the credit card issuer could report your late payment to the three major credit reporting bureaus.

Even if you’ve made a partial payment, adding a late payment to your credit report can sink your credit score by as many as 110 points in one fell swoop. And recovering from such a damaging blow can literally take years. That’s why it’s advisable to always pay more than the minimum each month when possible.

How Do I Stop Purchase Interest Charges?

The easiest way to avoid interest charges is to not incur the charge at all. That means either paying your credit card balance in full each month, or taking advantage of a 0% introductory APR credit card, like those listed above.

Whether your card features a 0% introductory period on new purchases, balance transfers, or both, you won’t pay finance charges of any kind during your set period — which usually runs between six and 18 months. But once that period ends, your card’s issuer will immediately begin calculating interest charges based on your average daily balance.

Note that canceling a credit card will not stop interest charges from accruing on your account. The only way that can happen is when the balance is paid in full, but you may be able to negotiate a lower APR.

You also have the option of using a prepaid credit card, which will allow you to make purchases on the web and in other scenarios where cash won’t cut it. However, this is not a line of credit – you deposit your own money onto the card to use when needed. You will never be charged interest, though you may be charged a monthly service fee.

Of course, you can also avoid credit card finance charges by paying with cash. That’s not always easy, but it’s a lot cheaper than carrying a large balance on a credit card.

Don’t Waste Your Hard-Earned Money on Interest Fees

At the end of the day, there’s no reason why you shouldn’t use your credit card to pay — as long as you follow one of our ways to avoid purchase interest charges on credit cards.

This way, you won’t find yourself drowning in finance charges each month, and you could put more of your money toward, well, whatever you want, rather than shipping it off to credit card companies that profit at your expense.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)

![7 Credit Card Fees & How to Avoid Them ([updated_month_year]) 7 Credit Card Fees & How to Avoid Them ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Credit-Card-Fees.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![12 Ways Credit Cards Help Save on Vacations ([updated_month_year]) 12 Ways Credit Cards Help Save on Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Ways-Credit-Cards-Help-You-Save-on-Summer-Vacations.jpg?width=158&height=120&fit=crop)