If you have significant student loan debt, you’re in good company. According to EducationData.org’s 2023 report, the average federal student loan borrower owes $37,574, and the private student loan borrower is hanging on to $54,921.

Because the payments for these obligations can be tough to manage, you may be wondering if you can charge them. In some cases, yes. Although the U.S. Department of the Treasury doesn’t permit federal student loan lenders to accept credit cards, there are exceptions and workarounds.

Here are six ways to pay student loans with a credit card.

1. Try Your Private Lender

Like a lot of people, you may have taken out private student loans to bridge the gap between what Federal loans and your savings couldn’t cover. You may have taken out PLUS loans so you could pay for your child’s education or grad school loans for your post-undergraduate degree.

Not all private student loan lenders will allow you to pay with a credit card, but many do. Contact the bank to find out if yours does.

2. Consolidate Federal Loans With A Private Lender

You may be considering consolidating multiple Federal loans so you only have one payment per month and can get a better overall interest rate. If you refinance them with a private lender that does accept credit cards, you can charge the payments. Just be aware that there are downsides to converting Federal student loans to private.

If you were on a flexible payment arrangement guaranteed by the Department of Education, you will lose it, and you won’t have the same ability to defer or forbear your payments. And if you were interested in the Public Service Loan Forgiveness program, which can wipe out some of your debt, that too will be unavailable.

3. Use A Third-Party Service

While you can’t make direct payments to your Federal student loan with a credit card, you can use a third-party payment platform. There are a number of these companies, including PaySimply and Plastiq. You would create an account with the platform, then add the credit card you want to use. The company will make the transaction for you with a wire transfer or other cash equivalent.

The fees for this service vary but are often in the 2.5% to 3% range. If you were hoping to get financially ahead by maximizing your rewards card this way, those fees will erode your earnings and, in many cases, exceed them.

4. Move The Debt To A 0% APR Balance Transfer Credit Card

Maybe you are nearing the end of your student loan balance and would like to delete the remainder with no interest added at all. In some cases, you can shift a student loan debt to a 0% APR balance transfer credit card. These offers can be very long, such as 18 to 21 months.

Today’s Best Balance Transfer Offer:

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% – 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% – 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

All it would cost is the balance transfer fee, which is typically between 2% and 3% of the transfer. For example, if you have $8,000 left to pay, the balance transfer fee would be between $160 and $240. That fee would be added to your balance.

Some balance transfer cards even offer valuable welcome bonuses if you spend up to a certain amount within a fixed number of months. Not all banks will accept a student loan as a transfer, so be sure to call and confirm before you apply.

5. Make Indirect Student Loan Payment Charges

This strategy requires a little creativity, but can make a lot of sense when you do it right. Run through your budget and calculate the cost of certain expenses that you normally pay with cash but that you can also charge. When they equal the amount of your student loan payment, use your credit card to pay for them instead.

For example, let’s say your student loan payment is $700, and it turns out that your monthly grocery bill is similar. Instead of using your debit card at the supermarket, which you normally select, use your credit card. Although you wouldn’t be charging the loan payment directly, the net effect is the same.

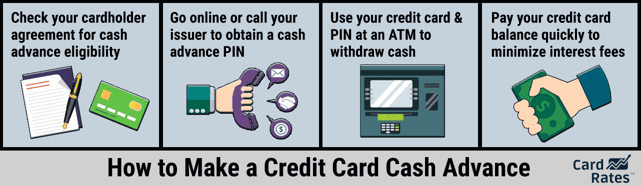

6. Take Out A Cash Advance

Almost all credit card issuers will allow you to withdraw cash from your credit line. Assuming yours does, you may want to take the money out, add it to your checking account and then use the funds to make your student loan payment. Simple! Yes, but determine whether this option makes good sense first.

When you take out a cash advance, interest accumulates on that sum immediately. There is no 25 to 30-day interest-free grace period as there is with purchases. Because the APR for cash withdrawals can be higher than they are for purchases, too, this can be a particularly pricey decision.

How to Manage Credit Cards When You Use Them For Student Loan Payments

Clearly, there are a number of ways that you can pay your student loans with a credit card. A major advantage of having this option is being able to handle a financial emergency on your own.

By charging the payment instead of falling behind, you’ll avoid being hit with a late payment that will be recorded on your credit report. This can protect your credit rating because payment history is the most important scoring factor.

There are, of course, disadvantages as well. Compared to student loans, the interest rates on credit cards can be very high. Therefore if you don’t repay the debt quickly, the fees can make the debt prohibitively expensive.

More problems can arise if you run into serious financial trouble and are considering Chapter 7 bankruptcy to discharge obligations that have grown with the student loan payments. The credit card issuer can challenge the student loan charges, so the court will rule that you’re stuck with that debt.

For this reason, it will be extremely important to approach charging student loan payments prudently. Only do it when you have a plan to pay off the balance quickly. Review your budget and begin to streamline. Omit or reduce anything that you don’t need so you can apply as much money as possible to your debt. Or add to your budget by increasing your income. Do what works for you.

Explore Alternative Options

In the event that you would prefer not to charge your student loans, be sure to explore the options that are available to you when you can’t make a payment.

If you have federal student loans, explore deferments and forbearances, since they will give you a break on payments for a specific number of months with no credit damage. If you feel the problem isn’t going away anytime soon, consider flexible payment arrangements, such as income-contingent plans, which allow you to pay according to the amount you earn.

Private student loans do not offer the same options that federal loans do, but it’s a good idea to reach out to the lender and ask if they can help before you go delinquent. They may offer you a hardship plan that includes freezing your payments for a few months, giving you a bit of relief.

In the end, remember that just because you can doesn’t mean you should. Credit cards are terrific payment tools for the goods and services you want to buy and can afford. They offer great consumer protection, and when you keep the balance to zero, rewards cards can even be a way to turn a profit.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year]) 5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/loans2.jpg?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)

![5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year]) 5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/5-ways-last-try.jpg?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)

![7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year]) 7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Ways-to-Manage-Credit-Card-Debt-When-Interest-Rates-Rise.jpg?width=158&height=120&fit=crop)