A beginning is a delicate time. So opens Dune, Frank Herbert’s science-fiction masterpiece. What was true of galactic politics remains true of your first credit card. You want to start off on the right foot — and that foot could be Discover.

Discover’s credit cards provide excellent value without charging annual fees. This article reviews the cards it offers that best suit credit newbies. We also review several competing cards that deserve consideration if you’re beginning your credit journey.

-

Navigate This Article:

Starter Cards From Discover

You can obtain these Discover starter cards without a credit history. Two are for students, but the third suits anyone who seeks their first credit card.

All offer new cardmembers an unlimited Cashback Match of the cash rewards they post during the first 12 months after account opening. Any of these may be the best credit card for your needs if you have no or limited credit history.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back doesn’t require a credit history for approval, and you can use it to build credit through timely payments. As with all Discover credit cards, this one never charges an annual fee.

Discover monitors and removes your personal information from people-search sites, a significant security benefit for beginners who want to maintain their privacy.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome does not require applicants to have a credit score. As with the card above, you must enroll at a college or trade school on at least a half-time basis to qualify for this card.

The card reports your payments to the three major credit bureaus, which is the most efficient way for newbies to build credit through responsible use. It’s hard to say which of the two is the best Discover credit card for students.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

You must deposit cash to acquire a Discover it® Secured Credit Card. The refundable deposit secures the card against missed payments, making it easy to obtain even without a credit history. It is the best Discover credit card for you if you have limited credit and aren’t a student.

The card helps you build credit by reporting your payments to all three major credit bureaus — Experian, Equifax, and TransUnion. You must pay your bills on time to benefit from this reporting.

Other Good Credit Cards For Beginners

Discover faces stiff competition from several credit card issuers that address the needs of credit newbies. These cards may better fit your needs if you want an unsecured card and aren’t a student. Capital One and Chase issue these cards to consumers with subprime credit, limited credit, or no credit at all.

- No annual or hidden fees. See if you’re approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It’s free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One’s mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card provides several essential features, including fast approval, low fees, account monitoring, and $0 fraud liability. You can get the card without a security deposit even if you have a limited credit history.

You can access Capital One’s CreditWise to receive help with your credit, including free TransUnion or Experian credit reports and scores, dark web security alerts, and a simulator to help you gauge the impact of your financial decisions.

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it’s misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Quicksilver Student Cash Rewards Credit Card never charges annual or foreign transaction fees. It offers students simple cash back rewards and an easy-to-achieve signup bonus. As with most Capital One offerings, this is a Mastercard, not a Visa credit card.

The card charges a late payment fee but doesn’t saddle you with a penalty APR when you miss a payment deadline. You can redeem your rewards via statement credit, check, or gift card. You also can use your rewards to pay for your recent purchases.

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), with 1% on all other purchases

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

Students may prefer the Capital One SavorOne Student Cash Rewards Credit Card to its Quicksilver sibling. This cash back credit card applies elevated reward rates to bonus categories, including dining, entertainment, groceries, and streaming services, that complement the lifestyles of many students.

For additional security, you can pay for online purchases with virtual card numbers from Capital One Eno. And you still get access to CreditWise to help monitor your credit.

Chase Freedom® Student credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Chase Freedom® Student credit card is an excellent option for students looking to save money and build credit. This no-annual-fee Visa credit card offers many perks, including trip cancellation and interruption insurance, eligible purchase protection, and extended warranties.

You can redeem your points through a statement credit, a direct deposit into most US checking and savings accounts, or a gift card. You can also use your points to book a trip through Chase Ultimate Rewards or shop at Amazon.com or the Apple Store.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn’t expire for the life of the account. It’s that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card is an easy-to-get unsecured card that helps you build credit when you use it responsibly. It may increase your credit line when you regularly pay your bills on time, a valuable benefit for newbies who usually start with a minimum credit limit.

If you’re new to credit, you may appreciate the card’s simple cash back scheme that pays a flat rate on all eligible purchases. The card also helps you monitor your account status through personalized email or text reminders.

How to Qualify For Your First Credit Card

Credit card issuers don’t approve every new card application, and having no credit history doesn’t improve your odds of success. US issuers consider several factors when applicants seek their first credit card, generally including the following:

- Address: You must live in the United States

- Age: You must be at least 18

- Income: If you are less than 21, you must prove a source of income to pay your monthly credit card bill

- ID: You will have to provide a Social Security Number or Individual Taxpayer Identification Number

You can calculate your income using wages, tips, commissions, and bonuses. You also may include income from investments, rental property, and financial support from another person (if you’re 21 or older).

Discover credit cards are among those that preapprove your application without impacting your credit score (if you have one). While preapproval does not guarantee final acceptance, it does indicate whether your approval is feasible. Once you’re ready to apply, you’ll submit an application that will likely ask for personal information about yourself, your income, housing costs, and employment or student status.

What Is a Credit Card For Beginners?

Most credit card companies issue cards to consumers with little or no credit history (i.e., credit newbies). The issuers use alternate methods to qualify newbies, focusing on income and housing costs. They offer secured cards that require an initial deposit, cards for college students, and store cards with limited reach.

Some first-time cardholders may have a credit score. You can receive a score by becoming an authorized user of another person’s credit card. You also can establish credit by taking out loans, including student loans.

Student Credit Cards

Many students are credit newbies. Issuers of student credit cards usually don’t require applicants to have a credit history or score, but they must meet the card’s requirements for school enrollment. For example, Discover student cards require two- or four-year college enrollment.

You may have to submit proof of your current enrollment at a qualifying institution. This documentation may include recent semester grades, a copy of your transcripts, a current semester schedule, or your student identification card.

Student credit cards usually have low credit limits because most students have limited income. Your credit card issuer may periodically increase your credit limit as you prove your financial responsibility. You can build credit over time by making on-time payments and keeping your card’s unpaid balance low relative to its credit limit.

Most issuers will replace your student credit card when you graduate or otherwise end your college enrollment. The replacement may resemble the student card minus the “student” label. Your rewards and benefits may change, hopefully for the better, but it’s wise to double-check the disclosures before you accept a new card.

If you didn’t use your card responsibly during your student years, the issuer may cancel the account and collect any remaining balances. The issuer will warn you that it’s about to close your account, so be sure to redeem any unclaimed rewards.

Of course, you may want to close your student account after leaving college because you’d prefer a card from another issuer. Canceling your student card will likely shorten your credit history age, which accounts for 15% of your FICO score.

FICO rewards longer credit histories with higher credit scores, so canceling your credit card may reduce your score. You can avoid damaging your score by accepting the issuer’s replacement card – you’re always free to apply for other cards as well.

Secured Credit Cards

Newbies who aren’t eligible for student cards should consider secured credit cards. These cards are easy to obtain because the required security deposits shield issuers from financial losses when cardholders default on their accounts.

You won’t be able to distinguish whether a credit card is secured by looking at it, as the word “secured” never appears on these cards. This practice protects your financial privacy from prying eyes. But make no mistake – secured credit cards possess several characteristics that distinguish them from unsecured cards, including the following:

- Easy acceptance: Issuers rely on your cash deposit to approve your application for a secured card

- Low costs: Secured cards frequently impose relatively low purchase and cash advance APRs and charge fewer fees than the average unsecured credit card for consumers with limited credit.

- Rewards: You can get a secured card with cash back, miles, or points on eligible purchases. The reward structure may be flat, tiered, or rotating bonus categories.

- Introductory promotions. You may be able to earn a signup bonus by spending a fixed amount on eligible purchases during a set period after account opening. The card also may offer a 0% introductory APR on purchases and balance transfer transactions for six months or more. Fees apply to cash advances and balance transfers.

- Higher credit limits: Many secured cards allow relatively high security deposits (i.e., up to $5,000 or more) and matching credit lines.

- Quick graduation to unsecured cards: You can graduate to an unsecured card after a trial period (typically six months) of timely payments.

Secured credit cards are excellent for consumers who need help building credit.

Store Cards

Store or retail credit cards are additional alternatives for credit newbies. But store cards often have high interest rates and low credit limits. Many store cards are closed-loop; you can use them only at the associated stores.

Closed-loop store cards differ from their open-loop cousins in several ways, including the following:

- No general acceptance: You won’t get very far whipping out your Walmart store card at the Target checkout register. Store cards work at the issuing stores – you can only use a Walmart credit card at Walmart, Sam’s Club, or its associated gas stations – where they permit you to make in-person or online purchases.

- Easy approval: Store credit cards encourage you to shop at the retailer. These cards provide valuable buying power when you don’t have a good credit score, which prevents you from qualifying for open-loop cards.

- Financial mixed bag: Store credit cards typically charge high interest rates (generally, a standard variable purchase APR above 25%) but waive annual fees. You can avoid the interest on purchases by paying your entire balance monthly, a wise practice for all your shopping.

- Access to deals: Store credit card holders often receive early or exclusive access to special financing, discounts, and other incentives. But these cards have tight credit lines that limit the value of this benefit. Many store cards offer whopping discounts only on the first day, so you may need to fight the temptation to overspend.

- Promotional interest rates: A store card may waive interest on selected purchases, not limited to new cardowners. But you should check whether the deal carries a deferred interest penalty, in which you must pay full interest retroactively if you don’t repay the balance by the expiration date.

On the plus side, store cards usually send your monthly payment data to at least one major credit bureau, just as open-loop cards do. Paying your store card on time can improve your credit score.

Authorized Users

Instead of applying for your own card, consider asking a friend or family member to add you as an authorized user of one of their credit cards. Credit card issuers typically report credit accounts to the major credit bureaus under the primary and authorized users’ names.

An authorized user account can help you build credit through responsible card use. Conversely, failure to make timely payments can hurt your credit and that of the cardowner.

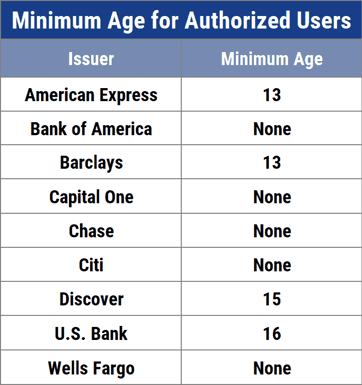

You can become the authorized user of a Discover credit card beginning at age 15.

As an authorized user, you’ll receive a physical card for the account. This arrangement allows you to use the card to make purchases but leaves the owner legally responsible to pay the bills.

Becoming an authorized user is an excellent way to establish your credit history and make it easier to obtain your first credit card.

Is a Discover Card a Good Starter Card?

The Discover student and secured credit cards are excellent starter cards thanks to their low cost, straightforward acceptance, cash back rewards, security protections, and comprehensive credit reporting.

Let’s take a closer look at Discover starter cards:

- Easy acceptance: The Discover starter cards are available to consumers who never used credit. The cards also offer a preapproval check to test the feasibility of your application.

- Low cost: Most Discover cards have a wide standard variable purchase APR range, and the low end beats that of many competitors. Discover cards never charge an annual fee, and their overall fee schedules are attractive.

- Triple reporting: These cards report your payments to all three major credit bureaus. That’s the most efficient way to build credit.

- Introductory 0% APRs: The Discover starter cards offer an intro 0% APR to new cardmembers for purchases and/or balance transfers over a set number of months, after which the APR reverts to the regular rate.

- Rewards: The Discover starter cards provide good cash back rewards. New cardmembers also get an unlimited Cashback Match on all the cash back they post during the first year. The cards pay out the match after the end of the first year, and there is no maximum reward amount.

- Fraud protection: All Discover cards provide $0 liability against fraud and theft. They also reduce your exposure to data theft by helping you remove your personal information from people-search websites that sell it.

- Free FICO scores: These cards provide free FICO scores so you can monitor your progress toward better credit.

- Wide acceptance: 99% of US merchants that accept credit cards welcome Discover cards. Surveys show it to be the most trusted credit card company, ranked highest for ethics, quality, privacy, and customer service.

- Reasonable credit limits: Discover student cards may start with a credit limit as low as $300, but you may receive increases based on your creditworthiness and other factors. The Discover secured card accepts security deposits of $200 to $2,500. Your credit limit will equal your security deposit.

- Flexible cash back redemptions: You can redeem rewards from a Discover cash back credit card in several forms, including PayPal or Amazon.com payments, bank account deposits, statement credits, gift cards, and charitable donations.

Discover and American Express are the only two major US card issuers that also operate their own payment networks. Visa and Mastercard are the other leading networks.

You may be surprised to learn Discover is also an online bank, a division of Discover Financial Services. You can open a checking, savings, or retirement account in addition to a bank credit card at Discover® Bank and receive free access to more than 60,000 ATMs.

What Credit Score Do I Need For a Discover Card?

You may need a credit score of 700 or higher to get most Discover credit cards, but the student and secured cards have more lenient requirements. You may be able to get these cards even if you have bad credit (generally considered a FICO score below 600), limited credit (less than three years of credit history), or no credit at all.

Using a starter credit card responsibly can qualify you for better-quality cards with lower costs and more perks. As mentioned earlier, it will help your credit score if you allow the card issuer to promote you to an unsecured card rather than canceling your starter card.

What is the Average Starting Credit Limit on a Discover Card?

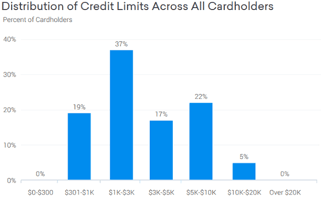

Discover’s starting card credit limits range from $200 to approximately $20,000. All but the secured card offer an initial limit of at least $500. The following chart shows Discover’s average starting credit limit is about $3,000.

The issuer doesn’t publish data on average and maximum credit limits. But it is more forthcoming when it describes the factors it considers when it grants credit limits. These factors include:

- Credit score: Except for beginner cards, Discover generally requires a minimum credit score of approximately 700. Your credit limit should rise in tandem with your score.

- Credit history age: Expect a minimal credit limit from starter cards. Extending your credit history will make you eligible for higher limits. The ideal maximum credit account age is seven years or more.

- Payment record: Previously missed payments will hurt your chances for a higher credit limit. Paying on time is your most powerful tool to leverage your credit line.

- Credit utilization: You can improve your credit score and credit limit by minimizing your credit utilization ratio (i.e., your credit card balance as a percentage of your credit limit). Experts once thought that any CUR below 30% would help your credit, but recently we learned that FICO recommends you keep your total utilization at 1% for maximum benefit. Discover reasons you won’t use up all your credit line if you regularly maintain a low CUR, a factor in your favor.

- Hard inquiries: A creditor usually pulls your credit when you apply for a new loan or credit account. The number of hard inquiries on your credit report doesn’t factor significantly when your credit limit is being determined. But numerous hard inquiries within a short time may indicate financial distress and hurt your chances for a big credit line.

You can ask Discover to raise your limit if it’s too low. But it’s more effective if you wait at least six months between requests. This interval gives you time to demonstrate creditworthy behavior.

What If Discover Denies Me?

Discover probably doesn’t approve 100% of the applications it receives for starter cards. When any issuer turns down your application, it must send you an Adverse Action Notice with the following information:

- Why the creditor rejected your application

- The source (typically a major credit bureau) for your credit scores and reports

- Instructions on how to obtain free copies of your credit reports

- Instructions on how to dispute items on your credit report you consider incorrect, obsolete, or unverifiable

It’s helpful to view an Adverse Action Notice as a valuable tool that tells you what you must do to improve your approval chances next time.

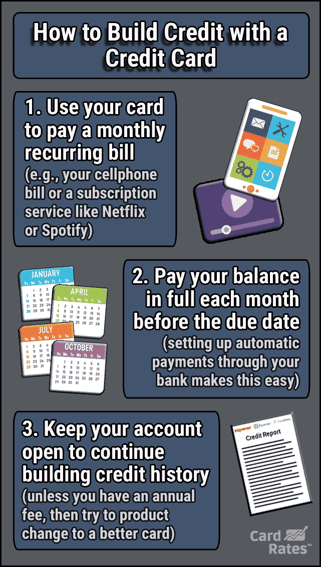

Build Credit With a Discover Card

Discover is one of our favorite credit card companies because it issues products that offer solid value at a modest cost. All Discover cards help you build credit by reporting your payments to all three credit bureaus. We can think of no better way for newbies to begin their credit journeys than to get a Discover student or secured credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Best Capital One Cards for Beginners ([updated_month_year]) 3 Best Capital One Cards for Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/12/Best-Capital-One-Card.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards for Beginners ([updated_month_year] Guide) 11 Best Credit Cards for Beginners ([updated_month_year] Guide)](https://www.cardrates.com/images/uploads/2019/03/credit-cards-for-beginners-feature.jpg?width=158&height=120&fit=crop)

![8 Low Interest Credit Cards For Beginners ([updated_month_year]) 8 Low Interest Credit Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Low-Interest-Credit-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)

![12 Best Travel Credit Cards For Beginners ([updated_month_year]) 12 Best Travel Credit Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Best-Travel-Credit-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)

![Chase Freedom vs. Discover it® Cards ([updated_month_year]) Chase Freedom vs. Discover it® Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Chase-Freedom-vs.-Discover-it.jpg?width=158&height=120&fit=crop)

![Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year]) Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/vs.png?width=158&height=120&fit=crop)

![Is Discover a Good Credit Card? ([updated_month_year]) Is Discover a Good Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Is-Discover-a-Good-Credit-Card.jpg?width=158&height=120&fit=crop)

![Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year]) Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/discovercard2.png?width=158&height=120&fit=crop)