After you’ve had your Capital One credit card for a while and you’ve established a history of timely payments, you may be Googling terms like “how to increase credit limit.” Thankfully, Captial One makes it pretty simple to request an increase to your credit limit online or over the phone.

You may also select and apply for a new, high-limit card online. Here are the resources you’ll need to increase your limit:

Call or Login Online | Choose a New Card | 6 Tips from Experts

1. By phone, call 1-800-955-7070 and choose “More Options” to hear the credit increase option.

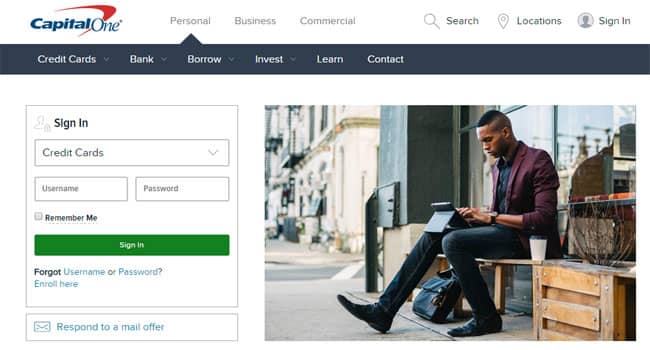

2. To do it online, log in to your account and click the “Services” tab.

You will receive an answer to your request within two to three business days.

If you don’t have an online account yet, click “Enroll here” beneath the “Sign In” button. You’ll need your credit card number and security code, date of birth, and social security number. Visit the Capital One Credit Line Increase FAQs page for more information.

Depending on the Capital One credit card you currently hold, you may already be at your maximum credit limit. In this case, the best way to get a better limit from Capital One may be to go with a new card, perhaps one marketed toward a better credit score demographic. Here are some of our favorite Capital One card offers.

EXPERT'S RATING

★★★★★

4.9

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

EXPERT'S RATING

★★★★★

4.9

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

EXPERT'S RATING

★★★★★

4.9

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

EXPERT'S RATING

★★★★★

4.8

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

EXPERT'S RATING

★★★★★

4.8

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$395

|

Excellent

|

+ See more Capital One credit card offers

Requesting an increase can be kind of nerve-wracking if you’re not sure you’ll be approved. If you decide to contact Capital One to request an increase, we recommend you read this article before doing so:

- 6 Expert Tips for Increasing Your Credit Limit

This article provides six useful tips for increasing your chances of approval and will guide you through the process. You’ll learn what to expect, what you’ll need to have ready, and how to answer the credit analyst’s questions.

Photo credits: capitalone.com

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Tips: How to Increase Chase Credit Limit ([updated_month_year]) 6 Tips: How to Increase Chase Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Chase-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Discover Credit Limit ([updated_month_year]) 6 Tips: How to Increase Discover Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/09/DiscoverCreditLimit--1.jpg?width=158&height=120&fit=crop)

![6 Tips to Increase Your Credit Limit Today ([updated_month_year]) 6 Tips to Increase Your Credit Limit Today ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Credit-Limit-Increase-4.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Citi Credit Limit ([updated_month_year]) 6 Tips: How to Increase Citi Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/Citi-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![3 Tips: Credit Card Limit Increases Without Asking ([updated_month_year]) 3 Tips: Credit Card Limit Increases Without Asking ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Limit-Increase-without-Asking-Feat--1.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)