Finding a great deal feels good — and not just for your pocketbook. Knowing you scored sweet savings can also have a physiological response that just plain makes you happy.

Even something as seemingly banal as finding an awesome credit card deal can get the dopamine flowing. Which is good news because there’s no end to the deals that can be had in the modern credit card marketplace.

Indeed, whether you want a lucrative signup bonus or a year without interest fees, you can find a credit card deal designed to satiate your appetite for savings. Of course, as ever, don’t let a good deal derail you — make sure you know the potential impacts of opening new cards before you start applying.

Overall | Cash Bonus | Points/Miles Bonus | 0% Purchases | 0% Balance Transfers | Travel | Airline | Hotel | Student | Secured | Business

Top Overall Card Deals

Finding the right credit card is a very individualized, subjective process that depends on your needs, wants, and qualifications. The best card for you will likely vary from what is the best card for your neighbor.

Similarly, any one credit card deal — or even three deals — won’t be the best deal for every consumer. That said, our top picks for the overall best credit card deals include cards with remarkable signup bonuses, great purchase rewards, and low or no fees to eat into your earnings.

Additional Disclosure: Citi is a CardRates advertiser.

This card is one of the best deals on the market for cash back lovers. Though there’s no signup bonus, you’ll enjoy the highest flat-rate cash back return — 1% when you buy and another 1% when you pay — for a whopping 2% on everything. No rotating categories or spending caps to worry about.

With this zero annual fee card, cardholders will receive unlimited cash back on each and every purchase made. Cash back rewards do not expire as long as the account is open, and there is no minimum to redeem. New cardholders will also enjoy an intro-APR offer on purchases as well as a signup bonus if the requirements are met.

While this card’s Unlimited Cashback Match can be quite valuable, it’s the ongoing cash back rewards that help make the card a great deal. Simply activate your bonus category from a rotating set of options each quarter to earn the higher rewards rate — all other purchases earn 1% back. Keep in mind bonus category rewards are subject to a quarterly purchase limit.

Top Card Deals for a Cash Back Signup Bonus

Often, when people talk about a great credit card deal, they’re referring to the signup bonus. This makes sense, of course — who doesn’t love a big pile of cash back?

Happily, the cash back market is packed full of solid signup bonus offers that can put hundreds of dollars in your (metaphorical) pocket. And, because they’re cash back, you know that redeeming the rewards from your awesome deal can be as simple as point, click, statement credit.

The signup bonus for this card simply screams “Deal!” Not only do you get a big lump sum of cash back for meeting the spending requirement in the first 90 days, but you won’t be charged an annual fee.

Discover has a relatively unique signup bonus. Rather than offering a quick flat-rate sum, Discover offers cardholders a one-time bonus at the end of the first year that is top in the industry. This card is an excellent choice for those seeking cash back rewards. With a low APR and friendly introductory terms, it’s geared to those who want the benefits of a robust rewards program without breaking the bank on interest payments and fees.

This card has an attainable cash signup bonus when you meet the minimum spending requirement. You’ll also earn lucrative rewards on dining and entertainment purchases, among other popular spending categories.

Top Card Deals for a Points or Miles Signup Bonus

Points and miles credit cards are the go-to of many serious rewards aficionados thanks to their flexibility — and, of course, the ability to travel for free with the right rewards. And while it may take a little more work to get top value out of points or miles than it does to redeem your cash back, cardholders looking for a deal know it can be well worth the time.

Most of the best points and miles signup bonuses will come from the pricier cards, but you don’t need a $500 Platinum card to score a sweet signup bonus credit card deal. Our picks not only have good signup bonus offers, but they also provide value beyond their bonus.

New cardholders will enjoy friendly introductory terms as well as robust travel rewards and an unlimited match of all the Miles you’ve earned at the end of your first year. This card will earn you miles for every dollar spent on all purchases. Spend wisely, and you could save up enough rewards to pay for your next dream vacation.

The signup bonus with this card has a lot of potential value, especially given how easy it is to get outsized value from Ultimate Rewards® points. The annual hotel credit and various perks pay for the annual fee of this top-recommended card.

Right off the bat, this card helps pay for its pricey annual fee with an easy-to-get signup bonus. It’s also a high-rate rewards card, offering up to 4X points per dollar spent.

Cardholders can even enjoy an annual airline fee credit and a dining credit good at select restaurants. (Note that Amex bonuses tend to vary a lot by link, so if you don’t see the right signup bonus, try an incognito browser window.)

Top Card Deals with 0% Intro-APR on New Purchases

An important part of making any big purchase is figuring out how you’re going to pay for it — especially if you don’t happen to have the cash on hand already. Credit cards can be a good way to make a big purchase for many reasons, including the convenience, security, and purchase rewards, but the high interest rates make them less desirable for anything that needs to be paid off over time.

Or do they? If you have good credit, a card with an introductory 0% APR deal can be a boon for any big buy. With some of the top 0% APR deals, you can enjoy zero-interest purchases for well over a year, giving you plenty of time to pay off your balance without being buried under interest fees.

Cash back and more than a year of interest-free purchases? Yes, please! With the rewards you’ll earn from this card, Capital One is literally paying you to use this card. But be sure to have your balance paid off before the interest-free period ends.

For some, a great 0% APR deal on new purchases doesn’t stop at a long promotional period; this card not only has a competitive 0% APR term, but it also offers cash back on every purchase — rewards that you can earn while still enjoying 0% APR on those purchases. Even better, the card has no annual fee to weigh down your savings.

This card is a deal on nearly every front, providing a long introductory APR offer on new purchases, cash back on every purchase, and bonus cash back in categories that rotate each activated quarter subject to a purchase limit.

Top Card Deals with 0% Intro-APR on Balance Transfers

With a little planning and some smart credit card use, you can leverage 0% APR deals on new purchases to avoid paying interest on your big buys. But, what about the credit card debt you’ve already got — and the high interest fees it’s likely accruing? That’s where balance transfer deals come in.

A good balance transfer interest rate deal will offer more than a year of 0% on your transferred balances, as well as providing a low or even a waived balance transfer fee and no annual cardholder fee. It doesn’t hurt if the card also offers a little something extra — like purchase rewards — to give it some long-term value.

As far as balance transfer deals go, this card is a solid contender, offering a lengthy introductory APR term on your transferred balances (transfer fee applies). You’ll also earn cash back rewards on your purchases — but not your transferred balances.

Additional Disclosure: Citi is a CardRates advertiser.

This Citi card has one of the longest 0% periods available, though a balance transfer fee does apply to each transfer you make. This card is a solid contender for anyone who needs to pay off some high-interest debt.

This card is currently not available. Additional Disclosure: The information related to BankAmericard® credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.15. BankAmericard® credit card

Only a few cards from major banks pair a long 0% intro APR on both new purchases and balance transfers — but this is one of them. The no-annual-fee card offers a 0% APR for transfers made within the first 60 days, a deal that likely makes up for the lack of purchase rewards or other perks.

Top Deals for Travel Cards

If you’ve ever heard or read a story of a savvy cardholder using credit card deals to score free flights and hotel stays, then you’re likely thinking, “How can I do that, too?” The answer is actually pretty simple: get the right card deal and start spending.

The main trick to getting a good deal with a travel rewards card is to make sure you know where you’re going before you pick a card. Each travel rewards program will have its own sweet spots, so know the ins and outs of your points or miles program before you start accruing its rewards.

Perched atop many a list of best travel rewards cards, this pick has a lot more going for it than just a valuable signup bonus — though it does have that, too. What makes this card such a good deal for travel (beyond that bonus) is its high-rate rewards on travel and dining purchases, the $300 annual travel credit, and the cardholder perks like airport lounge access and primary rental car insurance.

This card’s signup bonus alone makes it a pretty solid deal, but the unlimited 2X miles per dollar on every purchase and affordable annual fee really seal the, well, deal. This card allows you to use the miles you earn to erase previous travel purchases at a flat rate, but you can also get more value by transferring your miles to a partner loyalty program to redeem for branded travel.

If you have visions of big signup bonuses when you think about travel credit card deals, then this card could be your winner. What’s more, this card will earn you miles for every dollar spent on all purchases. Another plus to this card is there are no blackout dates — fly any airline, stay at any hotel.

Top Deals for Co-Branded Airline Cards

Whether it’s the great service, snazzy uniforms, or limited selection of your home airport, many of us have that one airline that we prefer above all others. If you have a specific airline that you call your own, then an airline co-branded credit card can represent an amazing deal.

While flexible points and miles cards offer more versatility, co-branded airline cards often come with unique perks like free checked bags or preferred boarding. And, of course, the signup bonuses from our favorite cards can get you flying for free in no time.

- Earn 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

- Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants

- Earn 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases

- Earn a $125 American Airlines Flight Discount after you spend $20,000 or more in purchases during your cardmembership year and renew your card

- No foreign transaction fees

- First checked bag is free on domestic American Airlines itineraries for you and up to four companions traveling with you on the same reservation

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.99% (Variable)

|

$99, waived for first 12 months

|

Excellent, Good

|

Additional Disclosure: (The information related to Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

This card comes with a good-sized signup bonus that is more than enough to get you flying for free as soon as it hits your account. The card also earns double miles on American Airlines purchases, as well as double miles at U.S. restaurants and gas stations.

Cardholders also get a free checked bag on domestic American Airlines itineraries, preferred boarding at the gate, and discounts on in-flight purchases when they use their card.

20. Alaska Airlines Visa® Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Alaska Airlines Visa® Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

This card not only comes with an easily obtained signup bonus — albeit somewhat small — it also comes with an Alaska Airlines Companion Fare, which allows you to buy one ticket and get the second for just taxes and fees.

Cardholders also get a new Companion Fare each year after their anniversary, as well as useful perks like a free check bag on Alaska flights and triple miles on Alaska Airlines purchases. Even if you don’t fly Alaska regularly, its miles can often be used toward flights with any of the airline’s partners.

21. JetBlue Card

- Earn 10,000 bonus points after spending $1,000 on purchases in the first 90 days

- Earn 3X points on eligible JetBlue purchases, 2X points at restaurants and grocery stores, and 1X points on all other purchases

- Enjoy 50% inflight savings on cocktails and food purchases

- 0% introductory APR for the first 12 billing cycles following each balance transfer that posts to your account within 45 days of account opening (transfer fee applies), then a variable APR applies

- No foreign transaction fees, no blackout dates, and points never expire

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 12 billing cycles

|

21.24% - 29.99%

|

$0

|

Good

|

This card offers a signup bonus, no blackout dates, 50% in-flight savings, and no foreign transaction fees. This card makes for a great travel companion.

Top Deals for Co-Branded Hotel Cards

In a world that seems to place little value on customer loyalty, many major hotel brands are still doing it right with comprehensive loyalty programs that make staying with your favorite brand a real treat. If you have a hotel brand that you look for whenever you travel, you can unlock a great deal by getting a hotel co-branded credit card.

The value of a co-branded card starts with the signup bonus — often enough for several free nights — but it doesn’t end there. Our top hotel card deals offer great extras like elite hotel status, free upgrades, and in-room perks that can make your stay that much more enjoyable.

22. Hilton Honors Ascend Card

The Hilton Honors Ascend Card has a huge signup bonus that can be turned into at least a few nights at most Hilton properties, as well as offering one of the highest earnings rate on branded buys with 12X points per dollar for Hilton purchases.

-

-

- Earn 12X Hilton Honors™ points per dollar for Hilton purchases

- Earn 6X points for purchases at US restaurants, supermarkets, and gas stations

- Pay $95 annual fee

-

Carrying this card unlocks complimentary Gold status with Hilton — a tier that includes free breakfast at many properties — and spending $15,000 on the card in a calendar year grants users a free Weekend Night Rewards from Hilton. This card also makes getting to the hotel a little nicer with 10 free Priority Pass lounge visits each year once enrolled.

23. IHG® Rewards Club Premier Credit Card

The IHG® Rewards Club Premier Credit Card has a fairly large signup bonus easily worth a couple of free nights, and the card earns a solid 10X points per dollar on IHG purchases, making it great for brand loyalists.

-

-

- Earn 10X points per $1 on IHG® hotel purchases made directly with IHG®

- Earn 2X points per $1 on gas, groceries, and dining

- Pay $89 annual fee

-

Although users have to pay an annual fee, cardholders do receive a yearly free night award after their account anniversary. Cardholders also get complimentary Platinum Elite status and a fourth night free on rewards stays of at least four nights.

(Non-Monetized. The information related to IHG® Rewards Club Premier Credit Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

24. Marriott Bonvoy Boundless Card

The Marriott Bonvoy Boundless Card is a solid hotel card for Marriott fans, offering a competitive signup bonus and an annual free night award worth up to 35,000 points that can pay for the annual fee when used wisely.

-

-

- Earn 6X Marriott Bonvoy points per dollar spent at eligible Marriott Bonvoy properties

- Earn 2X on all other purchases

- Pay $95 annual fee

-

Cardholders receive automatic Silver Elite Status with Marriott Bonvoy and can earn Gold Status by spending $35,000 on purchases each account year. Users can also enjoy free premium in-room wifi and an annual free night award after the account anniversary.

(Non-Monetized. The information related to Marriott Bonvoy Boundless Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

Top Deals for Student Cards

Although college students may be somewhat notorious for being broke and bad with money, your college years are actually a good time to start learning about and building credit. And this is in no small part due to the fact that college attendees can be eligible for student credit cards, which offer some of the best deals for first-time cardholders and credit users.

The best student credit card deals will include the trifecta: a solid signup bonus, no annual fee, and competitive purchase rewards. Just remember that purchase rewards won’t make up for interest fees, so be sure to pay your new card in full every month.

This card has all the bells and whistles you could ask for in a student card, including a great signup bonus deal and cash back rewards. Moreover, this card also has a few extras perfect for credit builders, including a friendly introductory APR on new purchases and free FICO credit scores each month.

This card is a solid option for students who like to eat out and/or have a lengthy drive to class. This card has a low APR, no annual fee, no late fee for your first late payment, and other generous perks for those new to building credit.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

This card lets users choose their own 3% cash back bonus category, as well as providing 2% cash back at grocery stores and wholesale clubs.

Users can select a new bonus category each month or let their chosen category continue unchanged. Earnings on bonus rewards purchases are capped at $2,500 in combined category purchases each quarter.

Top Deals for Secured Cards

When you’re a consumer with poor credit, credit card deals are few and far between. This is especially true if all you’re looking at are unsecured credit cards, as few major issuers are fighting for subprime business. However, you’re not out of options for a decent credit card deal even if you have bad credit — at least, not so long as you’re willing to make a deposit.

Secured credit cards can be a phenomenal way to build credit without breaking the bank with piles of fees. Our top secured credit card deals have no or low annual fee, reasonable minimum deposit requirements, and may even offer purchase rewards or a partially secured credit line.

This is a newer offering from Capital One that offers cash back rewards, even for those who are rebuilding their credit. There’s no annual fee and you’ll be considered for a higher credit line after six months of responsible credit usage.

If you’re interested in a secured credit card but aren’t so sure about a giant deposit, this card might be a good deal. Qualified applicants can put down as little as $49 for a $200 credit line, and making the first six payments on time can unlock a higher limit. Plus, Capital One will periodically review the account to see if you qualify for an upgrade to an unsecured account.

This secured card is a great deal for users who can meet the reasonable minimum deposit amount, as it offers highly competitive purchase rewards for a card that’s open to poor-credit consumers. Discover will periodically check your account for upgrade eligibility to an unsecured card.

Top Deals for Business Cards

The world of business credit cards gets bigger every year as more and more issuers jump into the game. That growth is great for business owners who can reap the benefits of increased competition — including some pretty remarkable deals for new cardholders.

Most of the major banks these days have a smattering of business card options, so business owners have a lot of variety from which to choose. That said, many of the best business card deals come from a handful of banks that also happen to offer some of the best consumer credit card deals.

This card earns flat-rate cash back on every purchase, but it also comes with a sizeable signup bonus for business owners who can meet the minimum spending requirement. There’s no annual fee and a low APR for those who qualify.

This Capital One card is for the business traveler who doesn’t want to deal with spending categories or travel restrictions. This card makes it easy to earn and redeem rewards, and you can transfer miles to 15+ loyalty programs for even more potential value.

Nearly everything about this card is a deal — excepting the annual fee, but even that isn’t too bad considering the high rate at which you can earn rewards. The signup bonus alone is worth quite a hefty sum if you can meet the spending requirement (which is high but not outside the realm of reasonable). Plus, employee cards are free and have customizable spending limits.

How Do You Pick the Best Credit Card Deal?

When looking for a new credit card, it’s easy to get overwhelmed by the sheer volume of options — and it seems like they all have sort of deal or gimmick. But, how to select the best deal?

Is a 30,000-point bonus better than $250 in cash back? Should you get the card with the higher bonus, or should you go for the card with the waived annual fee? And how much should the signup bonus influence your choice — aren’t the purchase rewards important, too?

In the end, the best deal will be the one that actually fits your needs, not necessarily the deal that offers the most valuable bonus. That’s because a deal is only a deal if you actually use it to its full extent. For example, it doesn’t matter how many miles you could earn with that co-branded card’s signup bonus if you never fly that airline.

Before you start looking for a new credit card, you need a clear idea of what you really want out of that card. Are you looking for a way to earn rewards on your most common purchases, or something in particular? Do you need a 0% APR offer for an upcoming purchase, or do you simply want to churn a big signup bonus?

Once you know what the card should do, you can put together a short list of options that suit your main purpose before you start looking at anything else. From there, you’ll have to crunch the numbers to figure out which deal offers the best value.

In some cases, a larger signup bonus may make up for a higher annual fee — but, other times, the reverse may be true. Think about how you’ll realistically use the card to get an idea of what kind of rewards and benefits you’ll earn along the way.

For example, cards with the highest rewards rates tend to charge annual fees, but you can often find a similar card with no fee and a slightly lower earnings rate. The amount you need to spend to make up a 1% difference in earnings may be enough to turn a good deal into a poor investment.

Similarly, if it’s likely you won’t spend enough for the big signup bonus, then you may be better off with a card that has a smaller bonus but also a spending requirement you can actually meet. On the other hand, if you know you have a large purchase coming up that could easily meet the spending requirement, you may want to consider a card with a larger signup bonus even if it has an annual fee.

Do Credit Card Deals Change?

Simultaneously a pro and a con of credit card deals is the fact that they tend to change — and they typically change often. Many card issuers change up the signup bonuses and introductory offers of their credit cards at least a few times a year, with some cards seeing near monthly rotations in the bonuses that are available.

But the changes don’t stop with the new cardholder deals. Issuers are not shy about changing, updating, overhauling, or outright eliminating entire credit card products, often with only a few months’ notice.

These changes can be positive — the revamped Amex Gold Card was met with enthusiasm by many credit card rewards enthusiasts — but they can also be negative (like the massive devaluation of the Starwood Preferred Guest Amex card after the Marriott and Starwood merger).

That’s not to say that you need to sign up for a certain credit card as soon as you stumble upon a deal. Getting a new credit card is a financial decision, and it should engender the full consideration that such a decision is due. However, it does mean that you shouldn’t dawdle too long if you spot a deal that seems like it may not last.

How Do You Earn a Signup Bonus?

Although maximizing purchase rewards is certainly the key to getting long-term value out of your credit cards — well, that and paying in full and on time every month, of course — it often takes a lucrative signup bonus to feel like you got a really stellar deal on your new card.

And that’s perfectly understandable when you know that a good signup bonus can easily be worth $500 or more — much more, in fact, when you make smart redemptions with a giant pile of transferable points and miles. But, signup bonuses aren’t all roses and sunshine for everyone, especially cardholders who bite off more of a spending requirement than their budgets can chew.

Basically, the typical signup bonus is earned by meeting a set spending requirement within a certain period of time. The standard signup bonus will give you 90 days to meet the spending requirement, though some bonuses will give you six months, and others (mostly from Barclays) only require making a single purchase.

For most deals, only net new purchases count toward the requirement, so making a return can impact your eligibility — even after you earn the bonus. Similarly, the only transactions that usually count will be purchases; balance transfers and cash advances won’t contribute to the spending requirement.

A more recent change in how some signup bonus offers is the growing use of tiered bonuses. Instead of earning a flat bonus amount for reaching a set spending level, tiered bonuses have multiple bonus rates for different levels of spend.

For example, a tiered signup bonus might require you to spend $3,000 in the first 90 days to earn 20,000 points, then require you to spend additional $3,000 in the first six months to earn another 10,000 points. Tiered bonuses are designed to thwart bonus churners and encourage cardholders to continue using a card after the initial payoff.

Given that an average signup bonus can have a minimum spending requirement in the thousands of dollars — or in the tens of thousands, for some top-tier cards — it’s easy to get caught up in the need to spend, spend, spend so you can earn the bonus.

Unfortunately, that rush to meet the requirement can get you into trouble if you don’t have the funds to pay for those purchases. And if you wind up with a balance you can’t pay in full, interest fees are soon to follow. While a really high-value signup bonus can make up for a little bit of interest, few bonuses will be worth accumulating debt you can’t repay.

How Do Introductory 0% APR Deals Work?

When evaluating credit card deals, it’s easy to see the immediate value in a typical signup bonus; a big pile of cash back, points, or miles has an obvious monetary equivalent in our minds. However, for those cardholders who need to carry a balance on their credit card, an introductory 0% APR deal can actually hold as much — if not more — value than a rewards-based bonus.

That’s because most credit cards come with two-digit interest rates that can turn even modest balances into money hogs. Quality introductory 0% APR deals can offer more than a year of interest-free financing, making it much more affordable to take your time paying down your debt.

For example, consider Exemplar Edmund, who has an upcoming $2,000 purchase that will take him one year to pay off. If Edmund puts the purchase on a credit card with a 21% APR, he’ll wind up paying more than $230 in interest fees during the year it takes to pay off his purchase. If Edmund instead uses a card with an introductory 0% APR deal, he’ll save that $230 and can put it toward his balance.

Along those same lines, intro-APR deals for balance transfers can save someone with a large balance a significant amount of money — even when you include the typical 3% to 5% balance transfer fee.

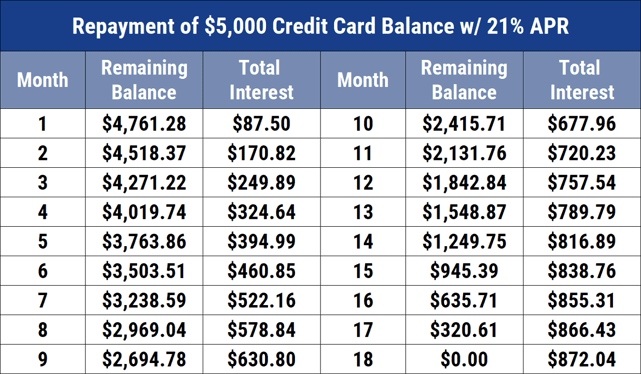

To see the math, let’s look at Edmund again. Say Edmund racked up a $5,000 balance on his 21% APR credit card. Assuming Edmund pays off the balance in 18 months, he’ll have paid over $870 in interest fees.

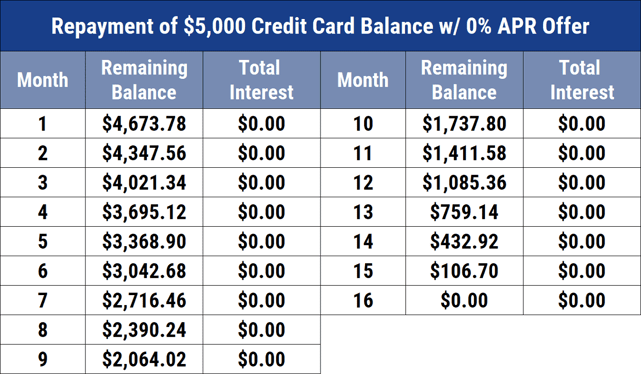

If Edmund instead transferred that balance to a card with a 0% APR deal with a 3% balance transfer fee, he’ll save more than $720 dollars (the $870 in interest minus the $150 transfer fee). Better yet, if Edmund puts that $720 toward his debt, he’ll pay off his balance in just 16 months — two months sooner than if he were paying high interest fees on his balance.

Of course, it’s important to remember that having a 0% interest rate isn’t the same thing as having a $0 monthly payment. Even with an introductory 0% APR deal, you’ll still need to make at least the minimum required payment before your due date each month to avoid late fees and potential credit damage.

Ideally, however, you’ll use the interest fee savings to make more than the minimum payment, thus paying down your debt faster. This not only gets you debt-free quicker — freeing up your debt payments for other uses — but it also helps ensure you don’t have a balance remaining when your promotional interest rate expires.

Be Sure to Read the Fine Print of Any Deal

The thrill of a good deal can turn an everyday event into something much more satisfying. Even a mundane credit card application can be exciting when you know you’re going to score a sweet signup bonus or valuable interest rate offer.

But don’t let the hope of a deal override your common sense. Read the fine print of any credit card deal — before you apply — so you know where any pitfalls may lie.

And don’t forget to crunch the numbers; what may seem like a good deal on the surface may not actually be a good deal for you. Few signup bonuses or other credit card deals will be worth taking on debt you can’t easily repay. Similarly, accumulating credit cards with annual fees can get expensive quickly, so take all of the costs into consideration when looking for a new card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Deals on Credit Card Interest Rates ([updated_month_year]) 9 Best Deals on Credit Card Interest Rates ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/INTEREST.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Walmart Credit Card: Bad Credit OK? ([updated_month_year]) Walmart Credit Card: Bad Credit OK? ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Walmart-Credit-Card.jpg?width=158&height=120&fit=crop)

![5 Credit Score Ranges for Credit Card Approval ([updated_month_year]) 5 Credit Score Ranges for Credit Card Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Credit-Score-Ranges-for-Credit-Card-Approval-Feat.jpg?width=158&height=120&fit=crop)

![How to Apply For a Credit Card With Bad Credit ([updated_month_year]) How to Apply For a Credit Card With Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/How-to-Apply-For-a-Credit-Card-With-Bad-Credit.jpg?width=158&height=120&fit=crop)

![The 1 Discover Credit Card For Bad Credit ([updated_month_year]) The 1 Discover Credit Card For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Discover-Credit-Card-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year]) Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/08/Which-Credit-Card-Companies-Provide-the-Best-Credit-Cards-2.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)