Perhaps your credit card bills are beginning to pile up, and staying ahead of the payments each month is becoming a struggle. You may be wondering, “Can you pay a credit card with a credit card?” Keep reading to learn more about this common quandary.

Whenever a member of my social group starts thinking about getting their first tattoo, they turn to Alan, our group’s resident expert with over two dozen of his own. Alan, well used to such queries, always gives the same advice: Be careful what you start because tattoos are like potato chips — it’s hard to stop with just one.

In an amusing bit of coincidence, Alan’s advice to rookie tattoo enthusiasts is much the same as the advice I give to those friends who ask me about credit cards. Namely, that it’s often extremely tempting to collect more than one — especially for those who want to get serious about earning credit card travel rewards. As such, one of the first questions they always have (with visions of easy miles in their heads) is, “Can I pay my credit card bill with another credit card?”

Short Answer: No, You Can’t Pay One Card with Another

While it’s not what anyone wants to hear, the fact of the matter is that most issuers simply don’t allow you to plug in the number from Credit Card B to pay the bill for Credit Card A. There are two main reasons behind this restriction, both more or less what you’d expect (i.e., about money).

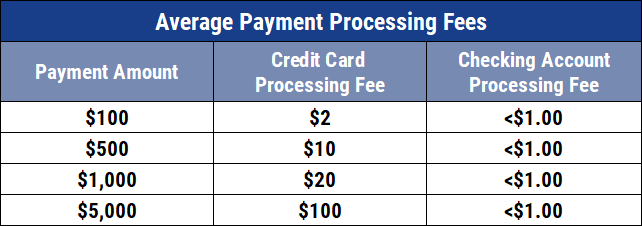

The first reason is based on the same gripe just about any company has with credit cards: the fees. On an average credit card transaction, credit card processing fees are about 2% of the transaction total. For a $1,000 payment, the merchant would need to pay a whopping $20 to have the transaction processed. A checking account transfer, on the other hand, can usually be completed for less than $1. The table below illustrates the problem with credit card processing fees.

The second reason for the restriction is exactly the reason many people want to use one credit card to pay another credit card bill: rewards. If consumers were allowed to make a large purchase on one credit card, rack up rewards, then earn more rewards on a separate card from paying the bill for the first one — well, the credit card issuers would quickly start hemorrhaging money through their rewards programs.

Long Answer: You May Be Able to Indirectly Pay Your Bill

For those who need to pay a credit card bill with a different card for financial reasons, there may be some indirect methods of making your payment. Keep in mind that each method will have its own shortcomings, however, so make sure you think it through (and crunch the numbers) before choosing a path.

1. By Making a Balance Transfer

Depending on the balance of the credit card that needs to be paid, the best option may be to perform a balance transfer. In this method, the balance from Card A is transferred to a new card, Card B, effectively “paying” Card A by eliminating its balance. (Before anyone gets too excited, there are no extra rewards here, either. Balance transfers are not eligible for any rewards points or cash back. This is true even if the credit card to which the balance is transferred offers rewards on regular purchases.)

The real appeal behind performing a balance transfer is the potential to decrease the interest rate you are paying on your balance. In an ideal balance transfer, the interest rate of the new credit card will be (significantly) less than the interest rate of the first card. And, as every credit card holder should know, a lower interest rate means lower payments.

Indeed, the best balance transfer credit cards will actually do more than lower your interest rate — they will terminate it, at least for a time. All of our top-rated picks for balance transfer credit cards offer introductory 0% APR periods, some up to 21 months, giving you more than a year and a half with an interest-free (and, thus, worry-free) balance.

Additional Disclosure: Citi is a CardRates advertiser. Additional Disclosure: Citi is a CardRates advertiser. Additional Disclosure: Bank of America is a CardRates advertiser. Additional Disclosure: Bank of America is a CardRates advertiser.

+See More Balance Transfer Credit Cards

While this may all sound like a sweet deal, there is one catch: the fees. The average credit card will charge between 3% and 5% of the transferred balance for the service. The most notable exception to this catch is the Chase Slate®, which often offers fee-less balance transfers as part of an introductory offer. Unfortunately, you can’t transfer the balance on one Chase credit card to another Chase card, however.

The best way to determine if a credit card is eligible to participate in a balance transfer is to thoroughly read the cardholder agreement (which is a good thing to do either way). The cardholder agreement should also show the balance transfer limit. The amount you can transfer will depend on the terms of agreement of the card receiving the transfer and may be less than the spending limit on the card.

2. By Using a Cash Advance

Using a cash advance is the least recommended of the three methods, but may be a better alternative to not paying a bill at all. The method is a bit twisty, involving multiple steps — and a checking account intermediary.

To start, check your cardholder agreement to find the cash credit line limit; this amount is the maximum amount of cash that can be advanced with that credit card. The amount is likely to be around 10% to 30% of the card’s credit limit.

To receive cash through an ATM, you will need to contact the card issuer and set up an ATM pin. In many cases, this can be done online. Alternatively, you can go to the bank backing the credit card (go to a Chase bank for a Chase credit card) to receive funds. Once you have the cash advance, the next step is to deposit that cash into a checking account. Most banks will make a cash deposit available within 24 hours. Then, simply use the checking account to pay the credit card bill.

Naturally, this method has a catch; technically, a cash advance is a loan — a really, really expensive loan. Not only will you pay a hefty fee for the privilege of withdrawing cash with your credit card (typically $10 or 5% of the advance, whichever is greater), but the balance transfer amount will be subject to a much higher APR than the rest of your balance. Be sure to determine exactly how much that cash advance is going to cost before going through with it.

3. By Redeeming Rewards

While this is probably not the most practical method for the majority of people, there is a way to use the rewards you earn on one credit card to pay some or all of the bill for another card. Similar to the cash advance method, it will involve a checking account.

The first step is to redeem your rewards. If you are redeeming a cash back reward, this is as easy as simply having the credit card issuer deposit the money into your checking account. Most rewards programs that use miles or points will also provide a cash back option.

Once deposited into a checking account, the cash rewards can be used to pay any bill you like, including a credit card. The best part of this method is that you will not have to pay any additional fees and your interest won’t increase.

The Best Method is to Save Before You Buy

Of course, when it comes to credit cards, the best method of all is to simply save the necessary cash before making any purchases. Not only will this save you from having to scramble to avoid paying a bill late, or missing a payment altogether, but will also ensure you don’t end up paying a lot of interest.

One of the most effective methods I’ve learned for saving, especially for big items, is actually based on more of Alan’s sage advice. To begin with, get a slip of paper describing what you want (maybe an ad for that new TV, or, in Alan’s case, the design for a new tattoo) and place it in a jar. Then, every day or week — or just when you can — add money to the jar. That’s it.

Over time, the jar will fill up, and, eventually, you will have saved the money needed for whatever you placed in the jar. When the time comes, if you haven’t changed your mind about what you want — go for it. Charge the purchase for the cash back or travel miles, then pay the bill — in full — with the cash you saved specifically for that purpose. No late fees, no interest payments, and no worry over an unpaid bill. Voila!

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year]) 5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/5-ways-last-try.jpg?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![2 Ways to Check Chase Credit Card Application Status ([updated_month_year]) 2 Ways to Check Chase Credit Card Application Status ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/chase-credit-application-status1-2.png?width=158&height=120&fit=crop)

![How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year]) How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/how-to-use-a-credit-card-1.jpg?width=158&height=120&fit=crop)

![8 Ways to Maximize Credit Card Points ([updated_month_year]) 8 Ways to Maximize Credit Card Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Ways-to-Maximize-Credit-Card-Points.jpg?width=158&height=120&fit=crop)

![9 Ways to Refinance Credit Card Debt ([updated_month_year]) 9 Ways to Refinance Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Ways-to-Refinance-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)