It’s amazing to discover how many ways you can make money using credit cards. We think of credit cards primarily as a convenient alternative to cash when we shop in stores, in apps, and online.

But these nifty plastic rectangles can actually help you earn and save money without creating credit card debt, as long as you pay your full balance each billing cycle and only charge what you can afford.

- Earn a Signup Bonus

- Earn Cash Back

- Convert Points to Cash

- Plan Purchases

- Refer a Friend

- Link a Card to Acorns

- Stooze a 0% APR

- Leverage a Cash Back Program

- Employee Cards

1. Earn a Signup Bonus

Reward credit cards are big business and competition among card issuers is intense. One way the credit card companies attract new cardmembers is through promotional programs that reward your decision to get one card instead of another. A signup bonus is a classic example of a promotion aimed at enticing consumers to apply for a new credit card.

Signup bonuses are rewards a new cardholder earns by spending a required amount on purchases during an introductory period, typically three months from account opening. These rewards can take the form of cash back, reward points, or miles.

For example, a credit card’s signup bonus may earn you 50,000 miles when you spend $1,000 on purchases during the first three months. If you satisfy the required spending, your miles will be added to your account in the following billing cycle. You can redeem your signup bonus rewards the same way you redeem the rewards you earn through regular use of the card.

The following credit cards feature our top-rated signup bonus offers.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

A few caveats apply to earning a credit card signup bonus:

- Credit card issuers usually prohibit consumers from collecting multiple signup bonuses if you already collected one on the same kind of card (or from any card from the issuer) within a specified time period — often two to four years

- Only eligible purchases can help you attain the signup bonus. This rules out purchases of gift cards, money orders, gambling chips, and other ineligible transactions such as a cash advance or balance transfer.

- Some cards offer multiple bonus periods. For example, one such cashback credit card may offer $2,000 when you spend $5,000 on purchases during the first three months and another $3,000 cash back if you spend $10,000 during the first six months.

- Signup bonuses vary in size, depending on factors that include the credit score and credit history required to get the card and the card’s annual fee. Several cards offer signup bonuses without charging an annual fee or any other sort of processing fee.

A signup bonus is usually the fastest way to earn a large sum of money from a credit card.

2. Earn Cash Back and Pay Your Balance Off

Cash back makes for the most versatile rewards card, and one way you can use the rewards earned on your cashback credit card is to apply your earnings as a statement credit to your current credit card debt. This saves you money in two ways:

- You don’t have to fork over your own money to pay off your balance.

- You won’t have to shell out interest on a balance you fail to pay off before the due date.

The following are our recommended cash back cards offering the best rewards.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Cash back cards offer several ways to accumulate rewards:

- Flat rate: You earn an unlimited flat reward rate, usually in the 1% to 2% range, on every eligible purchase. This is the simplest type of cash back reward and doesn’t favor any specific merchant type.

- Tiered: A card with tiered cash back offers two or more flat rates that vary by the merchant type. For example, a card may offer 5% cash back on restaurant dining, 3% on travel and grocery shopping, and 1% on all other everyday purchases. Sometimes, the higher rewards are limited to a set amount spent on purchases during the quarter or year.

- Rotating: For those of you who like variety, this kind of card offers a high reward rate on a different merchant type each quarter. You must activate your reward each quarter to receive the high rate, and that rate may cap eligible purchases for the quarter. All other everyday purchases earn unlimited cash back at the card’s base rate, usually 1%.

Cash back may be rewarded as a statement credit that will automatically reduce your current balance. Alternatively, you can have the cash wired to your checking account or use the cash to purchase gift cards.

Some cards allow you to send cash rewards to other types of accounts besides your checking account, including brokerage and 529 education accounts. A few allow you to make a charitable contribution using your cash back rewards. Many cash back cards give you access to a marketplace sponsored by the credit card company that allows you to purchase goods using your rewards.

Discover credit cards offer their famous Cashback Match to a new cardholder on all cash back you earn during the first year after opening the account. Soon after the one-year anniversary, you’ll receive cash back equal to the sum of all your cash back earned in Year 1.

The Citi Double Cash® Card also deserves a mention because it offers 2% cash back on eligible purchases — 1% at the time of purchase and another 1% when you pay your bill.

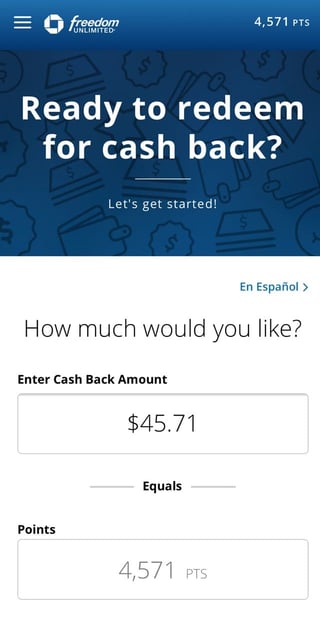

3. Redeem Points For Cash Back

Credit cards designed for travelers frequently offer rewards in the form of points. Typically, you earn one point for each dollar you spend on eligible purchases, and 100 points can be redeemed for $1. Points are often worth less than 100 per dollar when redeemed for non-cash items, such as travel or goods.

Most issuers allow you to convert your rewards points to cash.

Occasionally, points can acquire extra redemption value. For example, Chase Ultimate Reward points earned from purchases made on the Chase Sapphire Reserve® are worth 1.5X their cash back value when you redeem them for travel on the Chase Ultimate Rewards website.

You usually can redeem points for gift cards, and in some cases, the gift card may be worth more than the monetary value of the points. You can see this in some reward credit cards co-branded with a merchant that sells the gift card.

For example, you may be able to redeem 2,000 points (worth $20 cash) from Merchant A’s co-branded rewards credit card and receive a $25 Merchant A gift card — it’s like getting $5 for free.

The value of points may relate, in part, to how much the card costs a merchant to accept. Some brands are reputed to have a larger interchange fee that makes them less acceptable to merchants.

An interchange fee (or processing fee) is how much the merchant must pay to process a credit card transaction.

Points, and indeed all reward types, usually don’t expire as long as you keep the rewards credit card account open. But always confirm this before accepting a card, as a credit card company may expire your rewards if you don’t use the card within a specified period.

Points are a proprietary reward of the card issuer. In some cases, the card company may allow you to transfer points to the rewards programs of partner airlines and/or hotel chains. The best card company deals give you one mile or point in the partner program for each point you transfer.

4. Plan Purchases With the Right Cards

Tiered and rotating reward cards offer varying reward rates, depending on the merchant type. For example, one card may offer 5% on travel purchases, while another gives 5% on grocery store purchases.

By having a variety of cards in your wallet (or e-wallet), you can use the card that gives you the best reward for your current purchase, whether you’re buying an airline ticket or a can of soup. Reward caps complicate the process, which is why you want to plan your card usage in advance.

For example, suppose rotating-reward Card A pays 5% cash back on groceries for this quarter, up to $1,500 in purchases for the quarter, and 1% thereafter. If you are near or over the $1,500 limit, you may use Card B that offers unlimited 3% on grocery purchases, thereby earning an additional 2% over Card A’s 1% base rate.

5. Refer Friends and Family

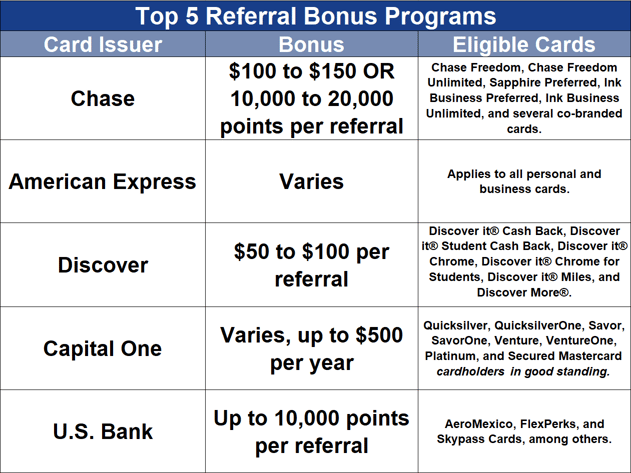

If you sometimes wonder what your friends and family are worth, you can get an objective opinion by referencing the referral bonuses offered by many credit card companies. These are bonuses you earn when you recommend a new cardmember who is subsequently approved for a card.

Here is a summary of the top five referral bonus programs:

The remaining large issuers offer no referral bonuses.

6. Link a Credit Card to Acorns

The Acorns app provides a great introduction to investing, offering a set of exchange-traded fund (ETF) portfolios ranging from conservative to aggressive.

Acorns rounds-up purchases made with your card and invests the difference.

You can link your credit card(s) to Acorns and use the Round-Ups feature to round your purchases up to the nearest dollar.

The rounded amounts are deposited into your Acorns Spend account. Whenever you’ve rounded up at least $5, Acorns will move the money from Spends to one of its diversified portfolios (that you select in advance).

If you want to invest faster, you can set a Round-Ups multiplier to skim 2x, 3x, or 10x of the rounded amount. You can also set whether to round up $0 or $1 when your purchase is a whole-dollar amount.

Acorns says that its average Round-Ups user invests more than $30 per month with this feature. The cost of this service is $1 per month, though the fee is waived for college students.

Of course, the investment portfolios you join may have their own fees.

7. Stooze a 0% Intro APR

Stoozing is a practice in which you take advantage of a credit card’s 0% introductory APR on purchases (this doesn’t include cash advance or balance transfer transactions) made during the promotional period, often 12 to 18 months.

If executed properly, stoozing allows you to earn interest income on essentially no-cost borrowings — a form of credit card arbitrage. This practice of credit card arbitrage began in the U.K. and has migrated to our shores and is available to you.

Here’s how stoozing is done:

- Obtain an appropriate credit card: The card must offer a 0% intro APR on purchases for 15 to 18 months (or more) after account opening. Normally, you’ll need a good-to-excellent credit score and credit history to get the best introductory offer. You’ll also need a credit limit sufficiently high to accommodate your shopping habits.

- Open a high-yield savings account: Online banks and credit unions are good candidates to offer the right savings or money market account, which should feature no minimum balance, no minimum deposit, and no monthly fees, if possible. The account should be insured by the FDIC or a similar third-party. Look for the account with the highest annual percentage yield — an APY of around 1.5% to 2% is pretty good nowadays.

- Spend using your credit card: We’re not suggesting you go out and buy a diamond tiara with your rewards card — just use it for all your normal monthly spending. Don’t use cash or a debit card unless you have to.

- Send money to your savings account: Each week, deposit an amount of money into your savings account equal to the money you spent on your credit card during the week. You can go online to verify the amount of your credit card spending. Some savings accounts limit the number of deposits per month, but a weekly schedule should be fine.

- Make your credit card minimum payment: Each month, make the minimum payment on your credit card bill and let your balance balloon. Don’t fret, you are protected by the 0% intro interest rate when you make a minimum credit card payment. Be careful to pay your credit card bill on time, lest you forfeit your introductory rate and send the whole scheme crashing down in flames.

- Watch the calendar: Set reminders well in advance for the end of the introductory period. When the period is about to end, you must….

- Pay down your credit card balance: Use the money in your savings account to make a credit card payment that wipes out your entire credit card balance, and make sure to do it before the promotional period terminates. Whatever remains in the savings account is the interest you earned. Although it may not be a huge amount, hey — it’s free money and all yours.

If you like stoozing, you can always repeat the exercise by getting a new credit card featuring an appropriate 0% intro APR promotion. If you have the necessary organizational skills, discipline, and spending budget, you just may find stoozing addictive.

The following cards will serve both rookie and experienced stoozers well:

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Keep the following tips in mind:

- Be picky when choosing the right credit card and the right savings account. The ideal card will have a promotional period of 18 or more months and charge no annual fee (and foreign transaction fee). The savings account should require little or no initial deposit. If it offers a high-APY promotion on new accounts, look for a promotion that lasts at least as long as the credit card’s introductory period.

- Make big purchases upfront. Front-loading large deposits maximizes the compounding of your savings account interest. In addition, your credit card may offer a sign-up bonus for the first three months that will save you additional money.

- Stay organized. Choose a consistent time each week to tally your credit card purchases and dispatch your savings account deposit. This little scheme will only work if you milk it to the hilt, which means you can’t afford to miss a week or omit a purchase. This is especially true if you are a bold stoozer, running two or more cards at the same time.

- Secured credit card: Stoozing may seem especially appropriate for a secured credit card because it offsets the lack of interest paid on the deposit you must make. However, for this to work, you’ll need a substantial credit limit. Perhaps it’s best to replace a secured card with an unsecured one first so you can get a higher credit limit.

Interest on a savings account is pretty punk right now, so you may not find stoozing overly compelling. But if you believe that inflation will someday return, you can look forward to higher APYs that will increase the size of your stoozing jackpot. You can begin now and by the time interest rates start climbing higher, you’ll be a seasoned pro.

8. Combine Card Purchases With a Cash Back Program

Wait — why are those people in the TV ad insanely smiling? Ah, it’s because they are earning cash back on their shopping through Rakuten, SavingStar, Swagbucks, BeFrugal, Ibotta, RebatesMe, etc. These sites curate offers from hundreds of stores and online retailers that bring you up to 40% cash back on selected purchases.

The beauty of these cash back programs is that they supplement the credit card rewards you earn from charging the purchases. It’s not difficult — the typical scenario is as easy as 1-2-3:

- Load the app onto your phone and use it to find a store offering the product you want to purchase.

- Shop as you normally would and earn the indicated cash back.

- Collect your cash back via an electronic funds transfer or a check.

These cash back sites are free to use — merchants finance the operation directly. We know some folks who wouldn’t think of shopping without starting at a cash back site. If you have a coupon-clipping compulsion, these sites will save you some work and offer you more choices.

9. Give Your Employees Their Own Cards

It’s good to be the boss, especially when you can earn rewards on purchases made by employees. That’s exactly how many business credit cards work. Business owners distribute these cards to employees that have spending authority and then collect all the credit card rewards.

Most business credit cards allow you to designate employees as authorized users, entitling them to a copy of the business credit card. Where the cards differ is how many free copies you can get, ranging from zero to unlimited. The following top-rated business cards all offer free employee cards:

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

- 0% Intro APR for the first 12 months; 21.24% - 29.24% variable APR after that

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

21.24% - 29.24% (Variable)

|

$0

|

Good

|

When you hand an employee their own business credit card, they can use it to shop for items needed by the company, including office supplies, office furniture, computers, and hundreds of other items. Depending on the arrangements the owner makes, an employee may have charging privileges equal to the primary account holder or subject to individual spending limits.

Business owners are, by default, the authorizing agent for employees who receive their own company card. An owner may be able to designate additional managers to be authorizing agents and allow them to set spending limits for employees within their sphere.

The beauty of this arrangement is that all the rewards earned from business purchases made by the owner and by employees using the card belong to the owner. Depending on the size of your company and its shopping needs, this arrangement may shower the owner with rewards at an accelerated clip.

Imagine the rewards an owner can earn when deciding to open a new office and filling it with equipment, furniture, supplies, and all sorts of other items purchased on the company credit card.

Before selecting their primary business credit card, owners should read all the card’s disclosures, including the section on employee cards. Choosing a business card requires evaluating a number of features, from interest rate to annual fees to no foreign transaction fee. As most top business cards offer free employee cards, this feature will probably not be decisive when an owner mulls which card to get.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year]) How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/how-to-use-a-credit-card-1.jpg?width=158&height=120&fit=crop)

![5 Wise Ways to Use Credit When Planning a Wedding ([updated_month_year]) 5 Wise Ways to Use Credit When Planning a Wedding ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/wise-ways-to-use-credit-when-planning-a-wedding-feat.jpg?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)