When you find the person you want to spend the rest of your life with and you’re ready for that long-term commitment, the next step is usually marriage. Celebrating this big moment is always better with your close friends and family, but planning a wedding that can accommodate everyone can quickly become overwhelming and stressful thanks to the pricey fees imposed by venues and service providers.

From food and drinks to decorations and music, and, of course, the dress, wedding costs can easily escalate out of control quickly. In fact, a 2022 survey from The Knot found that the average wedding in the U.S. costs $28,000.

Many brides and grooms get so wrapped up in planning their dream celebration that they end up charging expenses and purchases they can’t afford and start their life together in debt. Although credit card debt could lead to a lot of chaos, using these plastic payment methods wisely can actually help couples earn valuable rewards to cut wedding and honeymoon expenses.

Here are five ways to utilize your credit card wisely when planning your big day.

1. Beware of Additional Service Charges

You may be tempted to charge every wedding-related expense on your credit card to earn points and other rewards. Or perhaps you just don’t have the cash on hand to cover the costs in advance, and a credit card seems like the only solution to make your dream celebration a reality.

However, it’s important to know that many service providers such as photographers, wedding coordinators, and videographers will impose a credit card transaction fee on the bride and groom. This means that whatever you’re paying for comes with an additional premium and makes it that much more expensive.

Many wedding vendors charge a credit card transaction fee in addition to the cost of the service provided. Pay with cash or a check to avoid this fee.

If you want to use a credit card because you just don’t have the cash to cover all the expenses, then you really need to reevaluate your wedding budget and priorities. Perhaps scaling back on the number of guests you’re planning to invite or opting for less expensive alternatives, such as a DJ over a live band, can help reduce wedding costs and prevent you from taking on unnecessary debt.

For those who are going to spend the money anyway, consider taking out a personal loan instead. Personal loans offer lower interest rates compared to credit cards, and since you get a fixed amount of money, it will prevent you from overspending and taking on even more impulsive debt.

2. Take Advantage of Signup Bonuses

Opening a new credit card that offers an impressive signup bonus, such as 50,000 airlines miles, can be used strategically for those planning a honeymoon.

When it comes to wedding-related purchases in which a transaction fee is not imposed on the cardholder, such as for clothing and shoe purchases, car rentals, or hotel bookings, taking advantage of new cardholder bonus rewards can really pay off.

When it comes to wedding-related purchases in which a transaction fee is not imposed on the cardholder, such as for clothing and shoe purchases, car rentals, or hotel bookings, taking advantage of new cardholder bonus rewards can really pay off.

If you are planning to use a card to cover this amount in wedding expenses anyway, opening a new card to get the signup bonus can help offset other costs, such as flights or accommodation for your upcoming honeymoon.

Just make sure that when using a credit card to earn rewards you pay off the balance in full every month or before the 0% APR introductory offer expires. Otherwise, you will have to pay interest on what you’ve charged, which basically voids the points or miles you earn.

3. Activate Bonus Rewards

Credit card companies commonly offer reward programs that provide miles, points, or cash back for everyday purchases, but some may offer bonus rewards in rotating categories that can charge monthly or quarterly.

For example, the Chase Freedom Flex℠ card offers cardholders top-tier cash back on up to a set purchase in combined purchases in bonus categories each quarter when activated, as well as tiered rewards earned on set categories.

Meanwhile, other cards like the Bank of America® Customized Cash Rewards Credit Card now offer members the option to choose their preferred bonus category in which they can earn 3% back on purchases. Bonus category options include gas stations, online shopping, dining, travel, drug stores, or home improvement and furnishings.

Taking advantage of bonus categories is a great way to boost your reward earnings when planning your big day. Keep in mind, many credit card companies require you to activate the bonus rewards, so make sure to log into your account and opt-in to start earning the extra points, miles, or cash back.

4. Stockpile Points to Offset Travel Costs

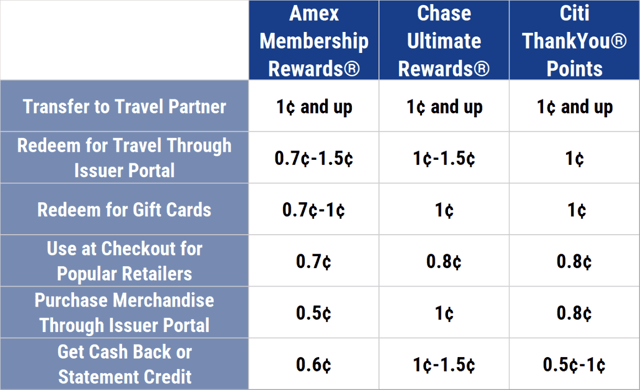

You may be tempted to redeem whatever credit card points you’ve already earned toward retail gift cards to help pay for various wedding purchases, but, in most cases, you’re better off holding on to those rewards.

In fact, travel rewards are often the most valuable redemption option, especially when using a credit card that offers airline miles or hotel points.

Your best bet is to stockpile rewards during your entire wedding planning process — or from the moment you know you’re going to get married — to help cover other big expenditures, such as flights for your far-off honeymoon that you may otherwise not be able to afford.

Redeeming points and miles for travel often returns the highest value.

Planning your reward redemption wisely allows you to get the best value from your points and miles and can help reduce the stress of planning your big day!

5. Gift Miles as Thank You’s

If you’re planning to have a bridal party, you may be eyeing different thank you gifts to hand out. After all, your bridesmaids and groomsmen really go out of their way to help make your day extra special.

Instead of passing along another “thing,” consider gifting miles to help cover travel expenses for your big day or allow them to take an exotic trip. Since many credit card companies will actually charge you fees for transferring miles, you may be better off booking flights with your rewards in the person’s name.

Otherwise, you can use cash back rewards to find the perfect trinket that says thank you in a big way and doesn’t add to your increasing wedding expenses.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Cards for Wedding Expenses ([updated_month_year]) 12 Best Credit Cards for Wedding Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/weddings.png?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year]) How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/how-to-use-a-credit-card-1.jpg?width=158&height=120&fit=crop)

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![9 Ways to Make Money Using Credit Cards ([updated_month_year]) 9 Ways to Make Money Using Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Ways-to-Make-Money-Using-Credit-Cards--1.jpg?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)