Ready for some statistics? The US average yearly income as of the first quarter of 2023 was $56,940. The annual median income was $75,143 for two-person households, while four-person families collected a yearly median income of $105,901.

We at CardRates.com are interested in the relationship between salary and credit cards from the consumer and card issuer viewpoints. This article explores how credit card companies use salary information to design their offerings and approve applicants.

We also consider how consumer credit card choices relate to income, credit scores, and debt, and recommend the top credit cards for households with salaries of $50,000, $75,000, and $100,000 based on the cards’ annual fees.

These recommendations are informal — everyone can apply for any card regardless of income. However you choose, we’re confident that the reviewed cards are top-quality and provide excellent value.

Credit Cards For $50k Salaries

Your local cost of living colors how you view a $50,000 salary. But for many, this salary level requires careful budgeting, which makes a no-annual-fee credit card a sensible choice. The following cards charge no yearly fees yet deliver excellent rewards and benefits.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

Chase Freedom Unlimited® offers multiple reward tiers on eligible purchases without an annual fee. You earn the highest bonus rate when you book travel through Chase. You can redeem your reward points for cash back, statement credits, gift cards, travel, or purchases through Pay with Points.

The card provides $0 liability protection, extended warranties, auto rental collision damage waiver, trip insurance, and eligible purchase protection. This may be the best credit card with no annual fee.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card lets you choose your top cash back bonus category. The card limits rewards at the top earning rates to a set amount in combined quarterly purchases.

This card is eligible for the bank’s Preferred Rewards program, which can increase your reward rates by as much as 75%. Its introductory 0% balance transfer and purchase promotions last longer than most.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card offers generous rewards yet charges a relatively low APR on purchases and balance transfers. Although the card charges for late and returned payments, there isn’t an annual fee or penalty APR.

You can freely access your FICO credit score online, via the mobile app, or on your monthly statement. The card’s Freeze it® feature lets you instantly switch your account on or off. Virtually all US merchants that accept credit cards welcome those with the Discover logo.

Credit Cards For $75k Salaries

Many consumers with $75k salaries want more benefits from their credit cards and may be willing to pay an annual fee of up to $100 to get them. The following cards deliver the goods.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card offers more perks than its Freedom Unlimited sibling yet manages to keep its annual fee below $100. Its Ultimate Rewards points are 25% more valuable when you redeem them through Chase for travel accommodations.

You also get baggage/trip delay insurance, 1:1 point transfers to travel partners, an annual credit for hotel stays you book through Chase, a generous signup bonus, and no foreign transaction fees.

- Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don’t expire as long as your account remains open.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Premium Rewards® credit card appeals to consumers who want travel benefits and top rewards. You earn a signup bonus when you spend the required amount on purchases during the first 90 days following account opening.

This card does not charge foreign transaction fees. You also get travel statement credits to reimburse you for airline incidentals and TSA PreCheck® and Global Entry fees.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card is a cost-efficient travel credit card that provides travel accident insurance, auto rental collision damage coverage, and 24-hour travel assistance services. You also get extended warranty protection and special access to entertainment, dining, and sporting events.

You can cash in your reward miles or redeem them to book travel reservations via the Capital One Rewards Center. You can also use your rewards to buy gift cards, pay for PayPal and Amazon.com purchases, or transfer them to a travel partner’s loyalty program.

Credit Cards For $100k Salaries

At this salary level, you may feel flush enough to pay for a high-priced credit card. To varying extents, the following cards pay for their steep annual fees with handsome rewards and benefits.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Chase Sapphire Reserve® may be the best credit card for travel, with plentiful benefits and special promotions. For example, the card gives you access to thousands of airport lounges worldwide. The card’s Chase Ultimate Rewards points are worth 50% more when you redeem them for travel, or you can use your points to shop through Chase online at more than 400 popular stores.

As a cardmember, you get exclusive access to select events, including cooking classes with world-famous master chefs, online charity auctions, and film festivals. You can contact a Chase customer service specialist or a Visa Infinite Concierge representative anytime you need personalized assistance.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

Capital One Venture X Rewards Credit Card cardholders earn an impressive signup bonus as well as unlimited miles on every purchase.

The card provides generous bonus miles on flights, hotels, and car rentals you book through the Capital One Travel portal. You can transfer your reward points to more than a dozen travel partner programs.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Black Card™ offers competitive reward redemption rates, a long list of travel perks, and an introductory balance transfer promotion.

It is a World Elite Mastercard that provides special deals from select vendors, discounts on movie tickets, global emergency assistance, and curated experiences in more than 40 cities worldwide. Other benefits include Mastercard ID Theft Protection and cellphone protection.

What Can I Include in My Income Besides My Salary?

Your salary or wages are your regular employment income from your job. You can include a spouse’s salary if you can readily access it. Salary is the most common and easily verifiable source of income, but hardly the only one.

Credit card issuers consider your total income when you apply for a card. This income data helps them set your credit limit and understand your capacity to handle your monthly payment obligations.

Here are some other forms of income and supporting documentation you can include when you apply for a credit card:

- Self-Employment Income: You can include your business income if you’re self-employed or run your own business. You may need documentation to support your income claims, including your tax returns, profit and loss statements, 1040s, and financial institution statements.

- Rental Income: You can include rental income you receive from the properties you own. The required documentation may include lease agreements, rental receipts, and bank statements that show your rental deposits.

- Interest, Dividends, and Capital Gains: This income stems from stocks, bonds, mutual funds, ETFs, and other investments. You can provide statements and 1099s from your brokerage accounts and other relevant documentation.

- Retirement Income: You can include regular income from a pension, annuity, or retirement account when you apply for a credit card. Your documentation may include account and benefit statements.

- Alimony or Child Support: Regular alimony and child support payments are part of your income. You can provide court documentation and bank statements to confirm the amounts.

- Social Security or Disability Income: You should include Social Security benefits, disability payments, and any other government assistance you receive. Each source should be able to provide relevant benefit statements.

- Supplementary Income: This category includes income from freelance work, part-time jobs, and side businesses. You can use invoices and financial institution statements to document your supplementary income.

Despite all temptations, be honest and accurate when you report your income. Otherwise, you may ensnare yourself in legal problems and hurt your credit score.

How Do Credit Card Companies Use Salary Data?

Credit card companies use aggregated salary data to design their offerings. They also use individual salary information to underwrite credit card applications.

Card Offerings

Credit card issuers often set income requirements for their cards. They use salary data to determine an individual’s minimum income level to qualify for a particular card, though these limits aren’t publicized. This practice helps issuers target specific income segments and ensure cardholders can handle the credit limits and fees.

An issuer may focus on cards for a particular salary range or design tiered offerings for different income brackets. Basic cards offer few frills, whereas those for everyday use may provide valuable rewards and benefits.

Unfortunately, consumers with low income and poor credit must contend with expensive unsecured credit cards. These cards charge outrageous fees and high interest rates yet deliver only the most rudimentary benefits.

We recommend subprime consumers get secured cards instead, which have lower costs and better perks than those of their unsecured cousins.

Assuming your credit is good (670+ FICO), you can choose cards based on their cost/benefit tradeoffs. Large credit card companies take distinctive approaches to the good-credit market. For example:

- Discover issues high-quality everyday cards with no annual fees, good perks, and their famous Cashback or Mile-for-Mile Match. It offers cards for all credit types but not necessarily for high-income consumers.

- Most Citibank credit cards charge no annual fee and are a natural choice for the bank’s customers. Its premium Premier card has an annual fee below $100.

- Capital One offers a broad range of card types. Its “One” series (VentureOne, SavorOne, QuicksilverOne) are economical everyday cards that low-income consumers may favor over the issuer’s costlier offerings (i.e., Venture and Venture X).

- Several issuers, including Bank of America, American Express, and Chase Bank, offer premium and elite cards to balance their no-annual-fee offerings. Their cards with triple-digit annual fees aim for well-heeled consumers willing to pay for extra perks.

Premium and elite credit cards provide high-income consumers perks that may include airport lounge access, concierge services, travel benefits, and bonus cash back rewards on luxury purchases. Card issuers tailor these offerings to appeal to individuals with a higher spending capacity.

Salary data can also influence credit card interest rates and fees. Credit card companies may offer lower interest rates or waive specific fees for high-income customers to attract and retain their business.

Conversely, lower-income individuals may have to settle for cards with expenses high enough to offset the issuers’ costs from defaulted accounts.

Marketing

Credit card companies often use summarized salary data to target their offerings to specific markets. Issuers can tailor their marketing strategies and personalize their offers to particular salary brackets by understanding the incomes of potential customers.

For example, they may offer high-income earners exclusive cards with unique benefits, rewards, or services. Doing so helps prevent issuers from spending money on mistargeted marketing.

In other words, a premium credit card issuer may advertise in an upscale lifestyle magazine rather than a survivalist publication.

Issuers can also use salary data to recommend specific offerings when customers explore a website for card options. Credit card companies can suggest cards that fit a potential customer’s financial profile by considering the person’s income.

This strategy helps issuers maximize applicants’ approval chances while steering consumers to more expensive offerings whenever possible.

Card issuers most likely consider income data when they partner with other companies, such as luxury brands or travel providers, to offer co-branded credit cards that appeal to higher-income individuals. These partnerships may use salary data to target customers more likely to buy these promotional offerings.

Card Approvals

Credit card issuers use salary data when an individual applies for a new card or higher credit limit. They collect and verify the individual’s income during the application process.

An applicant’s income impacts the issuer’s decisions in several ways, including:

- Credit Risk: Salary data helps credit card companies evaluate an applicant’s debt capacity. Card issuers gauge an applicant’s financial stability to help estimate the consumer’s default risk. High-income consumers are usually better able to handle debt payments, although this is by no means certain. On the other hand, a consumer’s high debt-to-income (DTI) ratio indicates a significant level of monthly debt payments, which increases the applicant’s default risk.

- Credit limits: Credit card companies want to ensure that the credit limits they grant match a person’s income and capacity to pay. An applicant’s higher income may result in a larger credit limit that allows the cardholder to make bigger purchases.

Credit card companies need to handle salary data responsibly. They must observe the privacy regulations that protect personal information. Additionally, issuers must not discriminate against individuals based on income or other protected characteristics.

How Should My Salary Guide My Credit Card Choices?

Your salary should be one of the factors that guide your credit card choices. Here are some tips on how to choose the right card:

- Satisfy the Income Requirements: Some credit cards have income eligibility requirements that you must meet. These requirements ensure you have enough money to handle the card’s APR, potential fees, and minimum payment amounts. Consider credit cards that match your income level to increase your approval chances for a card that suits your financial circumstances.

- Compare Fees and Interest Rates: Credit cards come with various costs, including annual, late-payment, and balance transfer fees. You must consider whether you make enough money to afford these fees and the card’s interest rate. Due to their stronger finances, higher-income consumers may have access to credit cards with lower fees and interest rates. You should evaluate the costs of different cards and choose one that offers affordable terms.

- Compare Rewards and Benefits: Credit cards offer various rewards programs and benefits, including cash back, travel rewards, and exclusive perks. Before choosing an affordable card, consider its rewards and benefits. The card should fit your budget and support your spending habits. For example, a card that offers travel rewards and benefits may be most suitable if you frequently travel.

- Consider Budgeting and Repayment: Your salary should guide your credit card choices according to your budget and repayment capabilities. Review your income and expenses to see how much you can comfortably afford to pay off each month. You want to choose a credit card that fits your financial situation. Avoid cards that may tempt you to overspend. Also, don’t carry high balances that may challenge your ability to repay.

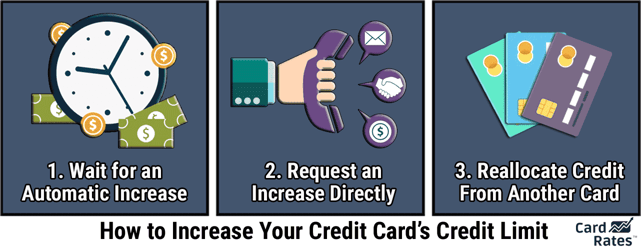

If life smiles upon you with a salary increase, consider whether to ask your card issuer for a higher credit line. But only do so if you’re confident you can handle the extra credit without taking on too much debt.

How Can I Get the Most Value From My Credit Card?

To get the most value from your credit card, consider the following tips:

- Choose the Right Card: Select a credit card that fits your budget and spending habits. You want a card with rewards and benefits that match your lifestyle. For example, if your income is low, consider a cash back card with bonus rewards for groceries, gas, and other necessities you already buy.

- Check Promotions for New Cardmembers: A signup bonus is ideal if you plan a big-ticket purchase. It’s even more helpful when the card couples a signup bonus with a 0% intro APR on purchases for 12 months or more. A card that combines the two promotions can give you a rewards windfall and save you oodles in interest. Also, check for an introductory 0% balance transfer promotion if you want to consolidate your credit card debt.

- Understand the Rewards Program: Familiarize yourself with your card’s rewards program, including how you earn and redeem rewards. You should explore a card’s bonus categories and promotions, if any, that can help you maximize your rewards. Shop strategically with your card to earn the highest rewards.

- Pay Your Balance on Time and in Full: Always pay at least the minimum amount due each month to sidestep late fees. Better yet, avoid an unpaid balance on your credit card whenever possible. Paying your balance in full each month helps you avoid interest charges and maintain good financial standing. This practice ensures that interest payments won’t offset the rewards you earn.

- Utilize Additional Card Benefits: Credit cards often provide additional benefits beyond rewards, including travel insurance, eligible purchase protection, extended warranties, and concierge services. Take advantage of these perks to get the most value from your card.

- Monitor Your Spending: Regularly review your credit card statements to track your spending patterns and identify areas where you can optimize your rewards. Look for any fees or charges you can avoid, such as over-limit, late, and foreign transaction fees. Search for instances of overspending and try to avoid those types of purchases in the future.

- Maintain a Good Credit Score: A good credit score can open doors to more favorable card offers and higher credit limits. Pay your bills on time, keep your credit utilization low, and manage your credit responsibly to maintain and improve your credit score over time.

- Review and Adjust Your Cards Periodically: Evaluate your credit card choices as your financial situation and spending habits change. Regularly assess whether your current credit card still meets your needs. If not, consider a switch to a card with benefits or rewards that better fit your new circumstances.

You may benefit from owning multiple cards with complementary features. For example, you may want a travel card that pays in points or miles and a cash back card with bonus rewards for everyday shopping.

By owning multiple cards, you don’t have to find one card that perfectly meshes with your lifestyle. That card may not exist or may be more expensive than two or more cards that work together to offer the same breadth of features.

Should I Change Credit Cards If My Salary Changes?

Not necessarily — it depends on your specific circumstances. Most importantly, your response to a salary hike will differ from your response to a salary cut.

If your salary increases significantly, you may want to ask your card issuer for a higher credit limit. You can contact the issuer and request an increase on your existing card rather than switching to a new card.

If your card’s issuer doesn’t agree to your request, it may be time for you to apply for a new card, perhaps from a different issuer. You may be able to afford a card with better perks (and a higher annual fee).

A higher income may prompt you to evaluate whether your current credit card’s rewards and benefits still suit your needs. For example, if you now have more disposable income and plan to travel more frequently, you may want to switch to a card that offers better travel rewards and benefits.

Read CardRates.com articles to help you consider your options. We review the best cards for a wide variety of circumstances.

On the other hand, a salary cut may not require a new credit card. Instead, you may want to limit your spending to conform to your new budget. But if your current card saddles you with a high annual fee, you may want to replace it with a highly rated $0 annual fee card. If you do so, redeem or transfer your rewards before you close the account.

Note that you may affect your credit history and credit score when you switch credit cards. Opening a new credit card will result in a hard inquiry on your credit report, which can temporarily impact your credit score.

If you have a long-standing credit history with your current card, keeping the card open may be a good idea because you will maintain your average (and possibly longest) credit account age. FICO bases 15% of your credit score on the ages of your credit accounts, so closing a card could hurt your score.

Get a Credit Card Appropriate For Your Salary

Salaries vary widely and can be volatile. That’s one reason the major issuers offer many different credit cards. Cards are available for just about any set of financial circumstances, whether you earn $25k or $25m.

Our review covers salaries of $50k, $75k, and $100k, which should be relevant to most American workers. Take your time, do your research, and select a credit card that fits your budget and lifestyle.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Cards by Credit Limit: $1k, $10k, $50k, $100k+ ([updated_month_year]) 12 Best Cards by Credit Limit: $1k, $10k, $50k, $100k+ ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1038702583.jpg?width=158&height=120&fit=crop)

![11 Best 100k Bonus Mile Credit Cards ([updated_month_year]) 11 Best 100k Bonus Mile Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-100k-Bonus-Mile-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for No Credit ([updated_month_year]) 9 Best Credit Cards for No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/nocredit.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)