Credit card credit limits can vary from $200 for consumers with bad credit to more than $1 million on super-premium cards for the rich and famous.

In this article, we identify the best credit cards classified within four different credit limit categories. This way, you’ll know the right cards to get no matter what credit limit you qualify for.

Credit Cards Under $1k Limits

The credit cards in this category are aimed at consumers with bad credit or no credit score at all. These cards don’t offer much beyond the basics, but all give you an opportunity to improve your credit score if you pay your bills on time and keep your balances relatively low.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

The Surge® Platinum Mastercard® from Continental Finance offers an initial maximum credit limit of $300 to $750. This really isn’t too bad for a card marketed to consumers with bad credit. Your actual credit limit will depend on your credit score and credit history, and you may be able to get a high credit limit after six months of on-time payments.

If you are at the low end of the FICO score range, this may be your best bet for an unsecured credit card. If you need a higher limit despite a bad credit score, consider getting a secured credit card, in which your cash deposit determines your credit line. A secured card can be a great way to build credit before upgrading to an unsecured card.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 - $125

|

Bad, Fair, or No Credit

|

The Reflex® Platinum Mastercard® is identical to the Surge® Platinum Mastercard® in all ways except its name. Both are offered by Continental Finance. Not surprisingly, the starting credit limit is $300 to $750, with higher limits available after six months of timely payments.

The card reports your payment activity to the three major credit bureaus, giving you the opportunity to raise your credit score. Just pay the monthly bills on time and keep your balance well below your credit limit to start seeing an improvement in your score within six months to a year.

3. Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Yet another card issued by Utah’s Celtic Bank, the Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay has a modest credit limit of $300. It too is aimed at the bad credit market, explicitly including consumers with a prior bankruptcy. You can’t get this card if you previously had an Indigo card charged off for delinquency.

The card doesn’t appear to offer a higher credit limit until a year after opening the account, and the increase is anything but automatic. Some reviewers report the card company telling cardholders that the bank never approves higher limits on this card. It’s, therefore, best to think of the card as a temporary stepping stone for improving your credit score.

Credit Cards With $10k+ Limits

This group of cards is popular for everyday use. The cards have average credit limits below $10,000 but occasionally offer limits above that amount to qualified applicants. These cards are pitched to consumers with good credit scores.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® offers tiered cash back rewards, a signup bonus, and a 0% introductory APR promotion. The average credit limit appears to be in the $3,000 to $4,000 range.

However, one reviewer reports receiving a $24,000 credit limit on this card, and a member of the CardRates team received a $12,000 initial credit limit upon opening this card.

Your exact credit limit will be determined by your credit rating and income. But, in general, the most creditworthy holders of this card can expect a minimum credit limit of $5,000.

5. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

True to its name, the Chase Freedom Flex℠ offers a flexible combination of tiered and quarterly rotating cash back rewards on purchases. In other respects, it mirrors its sibling Chase Freedom Unlimited®, so expect similar credit limits as well.

That puts the average limit in the $3,000 to $4,000 range, $5,000+ for consumers with excellent credit, and a top limit of $15,000 reported by our friends at WalletHub. This card is a good choice if you want to earn high cash back on purchases at restaurants, drugstores, and any of the quarterly rotating merchant categories (activation required).

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

We consider Capital One Quicksilver Cash Rewards Credit Card to be the best cash back card from this issuer for consumers with good credit. The credit limits for this card vary from $1,000 to $10,000 depending on your creditworthiness. It may require one or more increases to reach the $10,000 limit.

One reviewer claimed they received a slightly higher limit of $11,500, which grew from an original limit of $3,000. However, we came across a number of reviewers who combined the credit limits of Quicksilver and another Capital One card to yield limits of $20,000 or more.

Credit Cards With $50k+ Limits

If you have good or excellent credit, this trio of cards should provide you with an ample credit limit. Expect to pay a moderate annual fee on these cards in return for a nice assortment of benefits. These are travel cards that offer rewards in the form of points or miles.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card has a simple, flat reward structure in which points never expire as long as the credit card account remains open. The average credit limit for the card hovers around $10,000, but we have encountered reports of limits in the $30,000 to $50,000 range. Expect a minimum credit limit of $5,000.

Apparently, you are likely to receive a higher credit limit for this card if you ask for it, but it’s rare to receive an unsolicited credit increase. Capital One allows you to transfer limits among its cards, so if you own another card from this issuer, you can achieve a high limit on one card at the expense of the limit on another.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card is the junior partner in the sparkling Sapphire duo from Chase. We like it because you get 80% of the benefits of the Reserve card for 20% of the annual fee. The card offers a $5,000 minimum and $10,000 average credit limit, but you can get a much higher limit if you have excellent credit.

In fact, the good folks at Credit Karma tell us that 10% of cardholders enjoy a credit limit of above $20,000. A report on Quora mentions a $100,000 limit for this card, but we suspect that’s quite out of the ordinary. Chase is fairly receptive to requests for credit limit increases after a suitable display of creditworthy behavior.

- Earn 90,000 Bonus Miles after you spend $6,000 in purchases on your new card in your first 6 months of ownership

- Earn 15,000 Medallion Qualification Miles after you spend $30,000 in purchases on your card, up to 4 times/year

- Earn 3X miles on Delta purchases made directly with Delta -- all other purchases earn 1 mile per $1

- Complimentary access to The Centurion Lounge and the Delta Sky Club® plus two Delta Sky Club One-Time Guest Passes each year

- Receive a domestic First Class, Delta Comfort+®, or Main Cabin round-trip companion certificate each year upon renewal of your Delta SkyMiles Reserve American Express card

- As a benefit of Card Membership, you can check your first bag free on Delta flights booked with your card. You can save up to $60 on a round-trip Delta flight per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 29.24% (Variable)

|

$550

|

Excellent

|

If you prefer to fly on Delta, consider the Delta SkyMiles® Reserve American Express Card, one of several similar cobranded cards from Amex. Unlike many Amex charge cards with no preset spending limit, this card assigns you a specific credit limit. While the credit card company plays its cards (no pun intended) close to the vest, we have seen reviews placing the credit limit as high as $50,000.

The card offers tiered rewards on purchases in the form of air miles, and you can use your miles to purchase flight tickets directly from Delta.

Credit Cards With $100k+ Limits

You really can’t live the plush life without a credit card sporting a $100k credit limit, or so I’m told. True or not, these three cards fit the bill, offering you the opportunity to buy a tiny home or sports car with just a swipe, insert, or tap.

In case you’re worried about carrying around high-limit cards like these, relax — they all carry fraud protection.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The minimum credit limit on the Chase Sapphire Reserve® is $10,000. The maximum limit is at least the $100,000 of its junior sibling, the Chase Sapphire Preferred® Card, and may be as high as $500,000. The card charges a hefty annual fee, creating a self-selecting population of relatively affluent cardholders, some of whom no doubt need a six-figure credit limit.

While the card is expensive, it’s also value-laden with great rewards and benefits. You earn points that are worth 50% more when you redeem them for travel via Chase. It, as with all Chase cards, is subject to the Chase 5/24 rule that excludes a new credit card from certain existing cardholders.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% - 27.49% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® from American Express has no preset spending limit, so the sky’s the limit on this card. However, as a charge card, Amex expects you to pay your entire credit card debt every month. The card charges a high annual fee to offset its many benefits and rewards.

This charge card offers a Pay Over Time option that lets you stretch out payments over time. If you choose this option, you’ll be given a Pay Over Time Limit (POTL) that functions as a credit limit for financed purchases. The POTL starts as low as $2,500 but values exceeding $100,000 have been reported.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

According to some forum reports, the maximum credit limit on the Bank of America® Customized Cash Rewards credit card is $99,000, just a hair under this category’s $100,000 limit. That’s remarkable given that the card charges no annual fee.

The card offers tiered cash back rewards that allow you to select a merchant category for bonus cash back. If you have a debit or credit account with Bank of America or Merrill, you can earn extra benefits through the Preferred Rewards program.

Which Credit Card Offers the Highest Credit Limit?

Among this group of credit cards, the Chase Sapphire Reserve® is the winner, with a rumored credit limit as high as a half-million dollars. We imagine you’d have to be a multimillionaire to qualify for that kind of limit, but America has more than its share of the filthy rich, so the limit is quite possible.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Whichever card you get, you can increase your chances for a high limit by boosting your FICO credit score into the excellent (800 to 850) range. To do so, you must scrupulously pay all your bills on time and minimize (under, say, 10%) your credit utilization ratio (i.e., CUR is equal to your total credit used divided by your total credit available).

Interestingly, your income is not a direct factor figuring into your FICO score. CUR is the closest proxy to income for calculating your score, on the assumption that, if you can afford to keep your CUR low, then you have enough money to be considered creditworthy. But we don’t rule out a high income as a factor that credit card companies consider when determining your credit limit.

In addition, your credit history will probably have to go back seven years or longer and be free of blemishes. You should check your three credit reports (from Experian, Equifax, and TransUnion) for any mistakes and correct them yourself or through a credit repair company. You can get free copies of your credit reports from AnnualCreditReport.com.

Let’s address the elephant in the room, namely the Centurion® Card from American Express, a.k.a. the Black Card. Reportedly only a few thousand of this no-preset-spending-limit (NPSL) charge card have been issued — by invitation only — to multimillionaires and mega-celebrities. It will cost you five figures just to get the card and you purportedly must spend at least a quarter-million per year on purchases just to qualify.

Unless you’re reading this for the outstanding writing, we assume that folks who qualify for the Black Card don’t spend a lot of time reading credit card comparison reviews. Hmm, pity.

What is the Average Credit Limit on a Credit Card?

The average credit limit in 2021 was $12,945, according to credit bureau TransUnion. The median credit limit was $5,394. Of course, these figures vary by factors such as age, location, income, and credit score.

| 2020 | 2021 | Change | |

| Average Credit Limit | $30,817 | $30,233 | -$584 (-1.9%) |

| Average Balance | $5,315 | $5,221 | -$94 (-2.1%) |

| Average Credit Utilization | 25% | 25% | 0% |

The average total credit limit (limit on all credit cards combined) was $30,233, according to 2021 Experian data. That total is down 1.9% from 2020.

Is the Credit Card Limit Monthly?

Credit card limits are cumulative, applying to the total (not monthly) amount you spend on your credit card. Each monthly payment cycle requires you to make at least the minimum payment. Your monthly payments help pay down your credit balances, leaving more available credit between your current balance and credit limit.

However, available credit is quite dynamic since it falls whenever you make a purchase and rises when you make a payment. Since many cardholders pay their cards more frequently than once per billing cycle, their available credit can bounce around from day to day.

If you always pay your entire balance every cycle, then your available credit will return to its maximum credit limit.

Virtually every credit card has a characteristic grace period (usually around three weeks), which is the time between the close of the billing cycle and the payment due date for that cycle. If you pay off your entire statement balance on or before the due date, you may still have a balance due to post-statement purchases.

However, most credit cards support online payments at any time, meaning you can clear your current card balance whenever you want and reestablish your maximum available credit.

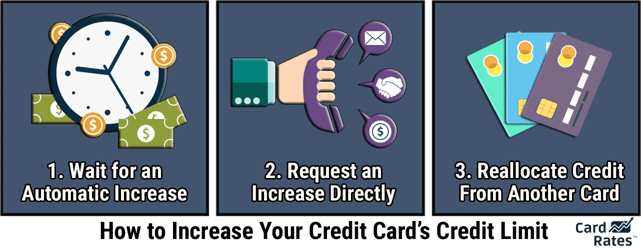

You can increase your available credit in a couple of ways. First, you can request a higher credit limit on your card.

If you have a good score and haven’t applied for a higher limit in the last year, you may have a good chance of success. By definition, a higher credit limit gives you more available credit.

Another way to increase your overall available credit is to apply for another credit card. Your overall available credit is the sum of all your credit limits minus the sum of all your card balances. By getting a new credit card, you receive a credit line increase, and your overall available credit grows.

Note that available credit is a dollar-and-cents expression of your credit utilization ratio. For example, suppose the sum of your credit card limits is $20,000, and the sum of your balances is $5,000. Your CUR is $5,000 divided by $20,000, or 25%, and your available credit is $20,000 minus your $5,000 credit card balance, or $15,000.

As you can see, your overall available credit is equal to (overall credit limit x (100% – CUR)). In this example, your overall available credit of $15,000 is equal to ($20,000 x (100% – 25%)). The bottom line is that your credit score benefits from a lower CUR and higher overall available credit.

How is a Credit Card Credit Limit Calculated?

Typically, a creditor has already determined your credit limit when it approves your application for a card. There is a natural tension in the process, as both you and the issuer will want to give you the largest credit limit possible, but the issuer is also concerned that you have sufficient income to repay your credit card on time.

If the credit card company sets the credit limit too high, it risks that you’ll overextend yourself and won’t be able to make the card’s minimum payments.

The four basic factors issuers use to set your credit limit are your credit score, credit history, credit capacity, and past interactions with the issuer. Issuers get much of the data for these factors from the credit reports maintained by the three major credit bureaus, the information you supply on your application, and their own records.

1. Credit Score

Your credit score ranges from 300 (worst) to 850 (best) on the FICO scale. Other credit score systems are available, but FICO is the most popular. Each credit bureau issues you a credit score based on the information it stores in its database.

Since that information may vary among the three bureaus, you won’t necessarily have the same score from all three. Issuers typically prefer one bureau, but that preference may vary geographically.

There is a direct correlation between credit scores and the average credit card limit, so the best way to get a credit line increase is to improve your credit score.

Credit scores impact your credit limit in two ways:

- Choice of credit card: Your credit score helps determine whether your card application will be approved by the issuer. Although not officially published, each card has a lower limit of an acceptable credit score. If your score is below that limit, chances are you won’t be approved for the card.

- Limit range: If the issuer determines that you satisfy its minimum credit score requirement for the card, it will use internal algorithms to formulate an initial credit limit. Your credit score is a primary input to those algorithms, which is one reason why credit limits vary by individual cardholder.

Credit score can also play an important role when you ask for a credit limit increase. You’ll certainly improve your chances of a credit increase if your score shows a significant rise since you first opened the account.

2. Credit History

It’s true that credit bureaus reference your credit history when calculating your credit score. But when an issuer evaluates marginal cases in which some human thought goes into the decision to approve a card and set its limit, that human may also reference your credit history for important clues.

The reason behind this is that there are infinite ways to arrive at a given credit score. The FICO scheme uses five factors:

- Payment history (35% of score): Late payments hurt your credit score, as do collections, write-offs, bankruptcies, and other negative events. Always pay your bills on time, and you’ll be rewarded with a good credit score.

- Amounts owed (30%): Your credit utilization ratio (i.e., credit used divided by your credit available) is an important factor. CURs above 30% can hurt your score, so it makes sense to pay down your credit card balances before applying for a new card.

- Length of credit history (15%): A long history helps your credit score, especially if it is free from negative items. A credit history of seven years or longer helps produce higher scores.

- Credit mix (10%): The credit scoring models factor in your mix of revolving credit and installment loans in your credit history. This is a minor factor, so don’t go opening new accounts just to bump up your score, as it probably won’t make much difference.

- New credit (10%): This factor is measured by the number of hard inquiries registered against your credit report within a given period. Several inquiries within a short period may be interpreted as an indication of financial distress and can hurt your credit score. Therefore, don’t apply for multiple cards at the same time — limit applications to once every six months or so.

Given these factors, it’s easy to see multiple scenarios that would lead a credit bureau algorithm to spit out the same exact credit score for two different applicants with widely differing information.

For example, a consumer who experienced a collection six years ago may receive the same score as a person who’s missed a few payments in the last year. If that score is marginal, the card issuer may take the time to review the credit reports of the two applicants. You’ll know that’s happening when you don’t get an instant decision on your application.

It’s quite possible that one application will be approved and the other declined, based on the judgment of the individual doing the review. Or if both are approved, they may receive very different credit limits.

3. Capacity for Credit

The FICO scoring system doesn’t incorporate data regarding your income and expenses, but an issuer may find such data very useful when determining your credit limit.

One important metric is your debt-to-income ratio (DTI). An issuer may set an upper limit on DTI and reject your application or reduce your high credit limit if your DTI is too high, even if your credit score is satisfactory.

4. Past Interactions with Issuers

Issuers have elephantine memory. They will remember if you defaulted on your credit card 12 years ago, even though credit bureaus delete the negative mark on your credit reports after seven years. The issuer may penalize you for negative interactions by reducing your credit limit or rejecting your application.

Also, many card issuers have strict limits on how many card accounts (of theirs or overall) you own or have opened in a set time frame. Chase’s 5/24 rule is well known, limiting you to five new credit accounts within the past 24 months. Other issuers have their own rules to limit new applications.

What is the Highest Credit Limit for Chase Freedom?

Chase currently issues two Freedom cards. Our research found that the Chase Freedom Unlimited® card’s highest documented credit limit is $24,000.

This is not to say that higher limits haven’t or won’t be issued, but rather that this is the highest limit mentioned in online forums and blogs.

In a similar vein, we found a reference to a $15,000 credit limit for the Chase Freedom Flex℠. You may be able to grab a higher limit, and, if you do, we invite you to brag about it on any of the credit card forums.

What is a Good Credit Limit for a First Credit Card?

Equifax estimates that the average credit limit on first credit cards is between $2,000 and $2,500. Because it’s a starter card, the chances are that applicants have little or no credit history and often apply for a cobranded retail store credit card or a credit card from an issuer specializing in bad credit.

Therefore, any credit limit above the $2,500 mark should be considered a good one.

The three cards in this review for bad or scant credit are the Surge® Platinum Mastercard®, Reflex® Platinum Mastercard®, and the Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay. These cards have credit limits in the $300 to $750 range.

If one of these is your first card, you will be doing well to get a limit near or at the top of their ranges. If you can earn an appreciably higher limit on any of these cards, we recommend you trade them in for better cards.

How Can I Get a Credit Card with a $10,000 Limit?

The $10k+ category in this review encompasses cards that accept cardholders with good credit or better. That translates roughly into a FICO score of at least 670. To get above the $10k credit limit, you’d probably need a score of above 750.

Your best bet is to secure one of the cards in this category and then work toward a higher credit limit. That requires you to pay your bills on time, keep your credit utilization ratio below 30%, and fix any problems with your three credit reports.

Over time, you may be able to bump up your credit limit until it reaches $10k or higher.

Is There a Credit Card With No Credit Limit?

Strictly speaking, the answer is no. Cards with no preset spending limit (NPSL) are available from American Express, but they are charge cards, not credit cards.

Charge cards do not allow you to carry balances over multiple billing cycles — you must pay your credit card bill in full each month.

In our review of The Platinum Card® in this article, we point out that it is a NPSL charge card. But you can convert it to a credit card by enrolling in the Amex Pay Over Time option, a way to carry balances over multiple billing cycles.

If you think this is a sneaky way to get a NPSL credit card, think again. Amex imposes a Pay Over Time limit when you choose this option, effectively limiting your credit. This setup is true for the other Amex charge cards as well.

Credit Card Credit Limits Vary by Card & Credit Score

It’s evident that credit card credit limits depend on cardholder credit scores, and each card caters to a particular credit profile and a minimum acceptable credit score. Not only do credit limits rise with credit scores, so do their variability. That is, credit cards for consumers with excellent credit have limits that vary to a much larger extent than do cards for folks with below-average credit.

You can request credit limit increases from time to time, but first, take steps to improve your credit score. It’s really quite simple — pay your credit card bill on time, pay off your balances, and fix your credit reports. As your score rises, you can apply for better cards with higher limits, until you’ve amassed enough available credit to satisfy your lifestyle.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Credit Cards For $50k, $75k & $100k Salaries ([updated_month_year]) 9 Credit Cards For $50k, $75k & $100k Salaries ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Credit-Cards-For-50k-75k-and-100k-Salaries.jpg?width=158&height=120&fit=crop)

![11 Best 100k Bonus Mile Credit Cards ([updated_month_year]) 11 Best 100k Bonus Mile Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-100k-Bonus-Mile-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)

![16 High Limit Credit Cards for Excellent Credit ([updated_month_year]) 16 High Limit Credit Cards for Excellent Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/highlimitcover.jpg?width=158&height=120&fit=crop)

![$1,000+ Limit Credit Cards For Bad Credit ([updated_month_year]) $1,000+ Limit Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/1000-Limit-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![$2,000 Limit Credit Cards For Fair Credit ([updated_month_year]) $2,000 Limit Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/2000-Limit-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![8 Best $500-$1000 Limit Credit Cards ([updated_month_year]) 8 Best $500-$1000 Limit Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-500-1000-Limit-Credit-Cards.jpg?width=158&height=120&fit=crop)