You’ve paid all your bills on time, kept your balances low, applied for and opened new credit only when you really needed to, and tackled your debt. Your hard work has paid off because you now have a high credit score you couldn’t be prouder of.

So, how can you reap the benefits of a high credit score? Easy! You can take advantage of the best credit cards for high credit scores and the awesome perks they offer.

Whether you’d like simple cash back or miles you can use for upcoming travel plans, plenty of options are available to you.

Best Overall

Cash Back | Travel | Dining | No Annual Fee | 0% Interest | Balance Transfers | FAQs

Best “Overall” Cards for High Credit Scores

With an excellent credit score, you can qualify for some exciting credit card offers that simply aren’t an option to those with lower credit scores. First and foremost, you can expect lower APRs and higher credit lines so you can buy what you want when you want without worrying about paying high interest fees or having your card declined because you’ve reached your credit limit.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

You may also enjoy introductory bonuses, airport lounge access, trip delay and cancellation protection, high rewards earning rates, and so much more. If you’ve put in the time and dedication it takes to build an excellent credit score, these best overall cards for high credit scores can certainly reward you.

Best “Cash Back” Card for High Credit Scores

The Chase Freedom Unlimited® offers an easy-to-understand rewards program that allows you to earn cash back on everything you buy. With this card, you don’t have to target your spending toward a specific type of purchase because you’ll earn bonus cash back rewards on some of the most common spending categoies and a flat-rate on everything else.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Another great perk of the Chase Freedom Unlimited® card is its 0% introductory APR offer on purchases. You won’t be charged an annual fee, and your rewards won’t expire as long as your account remains open.

Best “Travel Rewards” Card for High Credit Scores

If you choose the Chase Sapphire Reserve® card, you can earn bonus points after you meet the minimum spending requirement in the first three months from the date you open the card.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Each year you are a Chase Sapphire Reserve® cardholder, you’ll get a $300 travel credit you can use toward a variety of purchases including flights, hotel stays, tolls, UberEats purchases, parking garages, and more. This is quite the perk, as other cards aren’t as flexible and limit their travel credit to purchases with a specific airline or hotel.

Best “Dining Rewards” Card for High Credit Scores

The American Express® Gold Card can be the ideal card if you love going out to eat. You’ll earn 4x points at restaurants and grocery stores, so all your food purchases will earn industry-leading rewards.

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$250

|

Excellent

|

You’ll also get monthly statement credits good toward different food delivery services and other participating partners to make this card even more appealing for foodies. That credit alone is worth almost half the annual fee.

Best “No Annual Fee” Card for High Credit Scores

If you take full advantage of a card’s perks, paying an annual fee is no big deal. The Discover it® Cash Back card is great, however, because it offers a plethora of benefits without the fee. It’s a bonus category card that can give you the opportunity to earn bonus cash back in rotating quarterly merchants that you activate.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card is an excellent choice for those seeking serious cash back rewards. With a low APR and friendly introductory terms, it’s also attractive to those who want the benefits of a robust rewards program without steep interest payments.

Best “0% Interest” Card for High Credit Scores

By signing up for the Citi® Diamond Preferred® Card, you can lock in an industry-leading 0% introductory period. This can give you plenty of time to pay off large purchases and save big on interest.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

Fortunately, this card does not come with an annual fee, so you can keep it for as long as you’d like without having to dish out any money. It also offers some awesome travel perks like trip cancellation and interruption insurance, free travel and emergency service, worldwide rental car coverage, and Citi Entertainment concierge services.

Best “Balance Transfer” Card for High Credit Scores

The Discover it® Balance Transfer card can be a good option if you’re looking for a card with a longer balance transfer offer as well as a cash back incentive so you can use it long after you’ve paid down your balance. You’ll enjoy a long introductory APR period on transfers and a modest period for new purchases with the Discover it® Balance Transfer card.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Cardholders also enjoy free FICO credit scores, so you can keep track of your high credit score while you pay down your balance.

FAQs About Credit Cards for High Credit Scores

If you’re new to credit cards for high credit scores, you likely have some questions, which we will answer below.

What Are the Best Credit Cards for People with Excellent Credit?

Having excellent credit, defined as a FICO Score above 740 or a VantageScore above 780, makes you eligible for a number of credit cards. If you’re looking for a straightforward rewards program and cash back on every purchase you make, the Chase Freedom Unlimited® can be the perfect fit.

For the ultimate travel rewards card, you’ll likely appreciate the Chase Sapphire Reserve® Card, with which you can earn a $300 travel credit every year to use toward a wide range of travel-related purchases. If you find yourself frequenting various restaurants, the Capital One® Savor® Cash Rewards Credit Card will reward you with an unlimited 4% cash back on all dining and entertainment purchases. (Information for this card not reviewed by or provided by Capital One.)

The Discover it® Cash Back is a solid choice if you don’t mind rotating categories. For a 0% interest credit card, the Citi® Diamond Preferred Card® is a great pick.

With the Discover it® Balance Transfer, you can enjoy the best of both worlds: a longer balance transfer offer and cash back incentives.

How Many Credit Cards Do People with Excellent Credit Have?

Everyone is different and has their own unique preferences and money management strategies, so there is no one definitive answer to this question. While you may be better off with three or four credit cards, one credit card may make more sense for someone else with excellent credit.

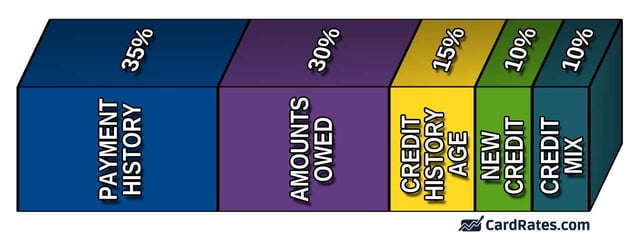

Having a mix of credit accounts is factored into an excellent credit rating, so having a few credit cards isn’t a bad thing, as long as you use them responsibly. With a number of credit cards at your disposal, you can earn the maximum rewards on every purchase you make.

Your credit mix accounts for 10% of your FICO Score.

For example, you may want to use the Capital One® Savor® Cash Rewards Credit Card every time you eat out and get the most bang for your buck on restaurant purchases, and the Discover it® Balance Transfer to pay off your new kitchen renovation. (Information for this card not reviewed by or provided by Capital One.)

Of course, you don’t want to have too many credit cards, as it can be easier for you to forget to pay a bill or charge up too much debt.

What is the Toughest Credit Card to Get?

Some cards can be difficult to get even if you have stellar credit. Take for example the Centurion Card – better known as the American Express “Black Card”. It is so prestigious that you have to be invited to use it.

The Black Card, easily one of the most difficult cards to get, is an invitation-only offering from Amex.

Although American Express hasn’t officially published the requirements of this card, the word is you must be a high earner who has spent and paid off between $350,000 and $500,000 across all your American Express accounts in a calendar year.

Once you’re approved, you have to pay a $7,500 initiation fee and a $2,500 annual fee to take advantage of perks, such as hotel elite status, airport lounge access, international arrival service, and best of all, no spending limit.

Don’t worry if you don’t get invited to apply for a Black Card any time soon — plenty of other credit cards, including those listed above, can reward you handsomely for your good financial habits.

Excellent Credit Opens a World of Financial Opportunities

Looking for a new credit card is exciting when you have a high credit score. Not only are your chances of approval increased, but you’ll also pay the lowest APRs and receive the best perks only available to the few Americans with an excellent credit rating.

The best credit cards for high credit scores can give you the chance to earn cash, save on travel, make big purchases with ease, and thrive financially.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For Scores Under 600 ([updated_month_year]) 7 Credit Cards For Scores Under 600 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Scores-Under-600.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for High Spenders ([updated_month_year]) 12 Best Credit Cards for High Spenders ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Spenders-Feat.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year]) 7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_232260670.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year]) 4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/charts.png?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title'] Review: Credit Scores, Limits & Rewards ([updated_month_year]) [card_field card_choice='22068' field_choice='title'] Review: Credit Scores, Limits & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-2.jpg?width=158&height=120&fit=crop)