Many consumers find the Reddit platform a valuable source of information about credit cards. Reddit’s large community offers diverse opinions on various topics, including how to choose the best credit card for your situation. You can use the subreddit r/CreditCards to add your own comments about credit cards.

To compose this list of Reddit’s top recommendations, we’ve combed through many of the site’s posts for advice about credit cards. We also review each recommended card independently. Any of these credit cards should be a welcome addition to your wallet.

Redditors Recommend These Cards

Reddit commentators often provide detailed information to back up their recommendations. We came across very few instances of the profane or hyperbolic language so prevalent on today’s social media platforms. The following credit cards received favorable comments from Redditors.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card targets consumers who want to control where they earn rewards. You select your top-tier rewards from categories that include online shopping, gas, travel, dining, home improvement/furnishings, and drug stores.

You can revise your category selection monthly or leave your choice in place indefinitely. The card offers good introductory promotions and higher redemption values when you qualify for the Bank of America Preferred Rewards Program.

“If you’ve got > 100k at BoA then it boosts CC [Customized Cash] Cashback by 75%, which for their cards gives 3-5% CB [cash back] depending on what categories you choose for their customized cash card. If you’re looking for a single card it’s probably the best answer, especially if you don’t travel much.”

— Quote: Anomandaris__Rake

“I use the [Customized Cash] ‘online shopping’ category for gas purchases (via the BP [British Petroleum] app), food purchases & pick ups (via the app), and Amazon. It’s great. Plus, there is a built in 2% for grocery stores and wholesale spots. For a no AF [annual fee] card, it’s pretty good… Plus, they’ve been very generous to me with CLIs. [credit limit increases]”

— Quote: MysteriousHedgehog23

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card lets you earn a substantial signup bonus when you spend a set amount on purchases during the first three months following account opening. Your reward points increase in value by 25% when you redeem them for travel through Chase Travel. If you upgrade to the Chase Sapphire Reserve®, the point values increase to 50%.

The card provides an annual hotel credit, and you can transfer your points to airline and hotel partners. Other travel benefits include baggage delay insurance, auto rental collision damage waiver, travel delay reimbursement, trip cancellation/interruption insurance, and emergency assistance service.

“The CSP (Chase Sapphire Preferred® Card) makes the most sense for 2 things…1. transfer points from your CFU (Chase Freedom Unlimited®) to CSP for greater redemption value. 2. Get the SUB [signup bonus].

— Quote: HomerCrew

“I have this card and I transferred 60K points to Hyatt and booked with them four nights at two 5-star hotels in Italy, worth almost $3,200 total. Your 60K points can be stretched a long way!!”

— Quote: Routine-Guard9979

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back has a 0% intro APR on new purchases and balance transfer transactions. The regular interest rates apply once the introductory period ends. The card’s interest rates compete well against those of similar cards.

The Discover it® Cash Back provides several security safeguards, including online privacy protection and the Freeze it® on/off switch. We consider this to be the best credit card for Year-One rewards because of Discover’s Cashback Match.

“What you say implies that anyone can just get a 2% card as their first card, but this isn’t the case. There’s a reason the Discover IT is the standard recommendation for a first card: it’s easy for people with no credit history and low income to get.”

— Quote: philosophers_groove

“I’m a big fan of the Discover card, I see it [as] a long term, forever card as there will always be a quarter that the card will be used for, whereas there are cards I’ve gotten within the last two years that I was super excited for but are now rarely used.”

— Quote: Jesse_berger

- Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don’t expire as long as your account remains open.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Premium Rewards® credit card ranks among the best cards for consumers who want travel benefits and top rewards on eligible purchases. The card offers a signup bonus when you spend the required amount on purchases during the first 90 days after account opening.

The card offers travel statement credits to reimburse you for TSA PreCheck®/Global Entry fees and in-flight incidentals. This premium reward card never charges a foreign transaction fee, and its annual fee is moderate.

“A card for high spending in food delivery & ride-sharing but rewards not centered around travel, for someone with high income. This is honestly perfect for the Bank of America PR [Premium Rewards].”

— Quote: BucsLegend_TomBrady

“I just want to plug about how amazing [Premium Rewards] is if you have platinum honors with BOA. Up to 2.62% cashback on everything and 3.5% on travel and dining, unlimited, if you got 100k asset[s] with BOA. It’s doable if you roll [a] retirement/brokerage account to Merrill. It’s a fantastic card for people who spend a lot and [don’t] want to spend a lot of time optimiz[ing their] cards. I think this is about as close to the perfect card if you can only have one card for life.”

— Quote: FareastFFL

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card usually offers a signup bonus and a 0% intro APR for new cardmembers. You also get complimentary concierge services, 24-hour travel assistance, and travel accident insurance. You can redeem your rewards for a statement credit, gift card, trips via Capital One Travel, or in several other ways.

The card provides tiered rewards on dining, grocery, streaming, and entertainment expenses, including amusement and theme park purchases. You earn rewards on all eligible purchases without the bother of quarterly rotating categories.

“I think the Capital One SavorOne is a solid card [with] 3% [cash back] on entertainment and streaming services which are rare categories as well as dining and groceries with no [annual fee] great for people who don’t want a lot of cards or deal with rotating categories and spend caps.”

— Quote: d3monX

“I built a relationship [with Capital One] first with a Platinum card > upgraded to Quicksilver (they sent an email offering that) > 6 months later they sent me another email saying that I was pre-approved for Savor One. I was approved with [a] 710 credit score… instant approval btw, and they post cash back right after posting the purchases.”

— Quote: dealsfully

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$250

|

Excellent

|

If you prefer a moderate annual fee (compared to the fee for the American Express Platinum Card), the American Express® Gold Card offers many compelling reasons to own it. You can use the card without a preset spending limit if you pay your entire balance each month. Alternatively, you can spread your payments across multiple months, subject to a credit limit.

Food lovers may hunger for this American Express card because of its generous membership rewards for supermarket and restaurant purchases. You even receive credits for using Grubhub for food delivery. And if you enjoy hotel dining, you can book a stay at The Hotel Collection through American Express Travel to earn an instant bonus.

“I think you’ll naturally consume the $10 credits for Uber/Gruhub, that should drop it down to a $10 net AF [annual fee].”

— Quote: GideonWainright

“My [AMEX] Gold SUB [signup bonus] got me to Europe and back in 2019, and my grocery/food spend did it again in 2022. Cash in on the point transfer promotions to the correct airlines and the $250/yr easily pays for itself (for me). Plus the Uber credit and Grubhub credit. [The] Gold card stays.”

— Quote: PointsPlayer

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

Capital One Venture X Rewards Credit Card provides generous rewards, including bonus rewards for travel accommodations made through the Capital One Travel portal. The card offers a signup bonus to help finance your purchases and travel accident insurance that helps to make your trips more secure.

The card provides 24-hour concierge service through Capital One Travel and doesn’t charge foreign transaction fees. You also get cellphone protection and several credits that offset the cost of the annual fee.

“in its current iteration it essentially pays you to carry it, which no other premium credit card can really claim to do as easily as VX [Venture X].”

— Quote: dolphindiver9

“Card definitely pays for itself. This is a no-brainer straightforward card. Highly recommended for someone who at least travels once a year or stays at a hotel / car rental.”

— Quote: KPGJ02

How Does a Credit Card Work?

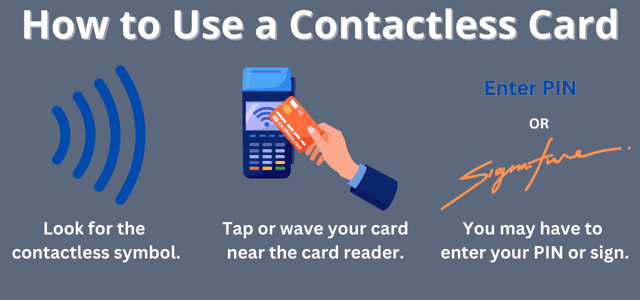

Plastic or metal credit cards are easy to use, and most merchants accept them for purchases. You can tap, swipe or insert your card into a card reader to make a payment.

Modern credit cards have an embedded computer chip and are contactless — they use near-field communication (NFC) technology for fast and secure transactions without physically contacting a card reader.

Contactless transactions require a signature or secret PIN for verification. A PIN provides better protection against credit card theft and fraud.

The issuer imprints your credit card with your name, account number, expiration date, and security number. The card chip contains similar information and can keep track of your current credit balance. The card design includes the name of the card, the issuing bank, and the payment network (i.e., Visa, Mastercard, Discover, or American Express).

Banks and other institutions issue credit cards to consumers as a type of revolving credit facility. The issuers make money by charging interest and fees. Credit cards lend you money every time you use one to make a purchase or take a cash advance.

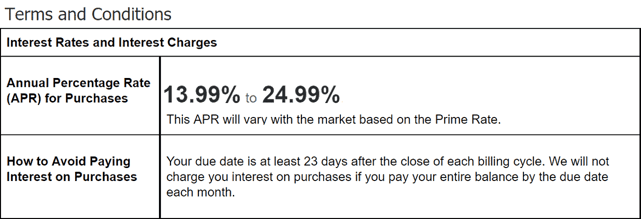

Most credit cards offer a grace period, which is an interval during which you don’t incur interest on your credit card purchases. A grace period begins on the statement date at the end of each billing cycle and continues until your payment is due, typically in 21 to 27 days.

During this interval, you will not incur interest on any purchases you make with the card if you pay your entire balance. The card suspends your grace periods if you carry an unpaid balance past the due date. You must remit the minimum amount (typically about 1% to 3% of your balance) by the due date or face late charges and other penalties.

Without an active grace period, you’ll accrue interest daily on your balance until you repay the entire amount. There are no grace periods on cash advances.

Your card’s daily periodic rate is its annual percentage rate (APR, typically between 10% and 36%) divided by 360 or 365. Your daily interest equals your average daily balance for the month times your daily periodic rate. Your monthly statement shows your interest charges for the period.

Credit cards also impose various charges, including an annual fee and fees for foreign transactions, late payments, cash advances, and balance transfers. These fees are added to any interest charges you run up.

What most people think of when they use the term credit card is an unsecured card. You don’t have to post a deposit to get one. Credit card companies issue these products based on an applicant’s credit score and creditworthiness. You will usually receive better terms, a lower APR, and a higher credit limit if you have a good credit history and score.

Better-quality credit cards provide membership rewards through bonus points, cash back, and airline miles. Many cards offer signup bonuses, typically worth $200 to $1,000, to new cardmembers who spend a set amount on purchases during an initial period (usually 90 days).

Cards may also offer new cardmembers a 0% introductory APR on purchases and/or balance transfer transactions for the first six to 21 months following account opening. These promotions allow savvy cardmembers to save money on purchases.

Credit cards for consumers with good to excellent credit usually provide various benefits, including free travel insurance, credits for travel and hotel stays, purchase protection, extended warranties, and access to special deals. Cards with higher annual fees (i.e., $95 and up) typically offer the most generous rewards and benefits.

Secured cards are for consumers with no credit, limited credit, or bad credit. Your spending limit equals the refundable deposit you must make to get the card. In many cases, secured cards are better deals because they charge less and provide better perks than unsecured cards for consumers with poor credit.

How Do I Apply For a Credit Card?

To obtain a credit card, you can apply directly to various issuers, including American Express, Capital One, Chase, Bank of America, Citibank, and Discover. Each issuer offers credit cards with top-notch perks to applicants with good to excellent credit, and some credit card companies provide options for subprime consumers to help them build credit with responsible use.

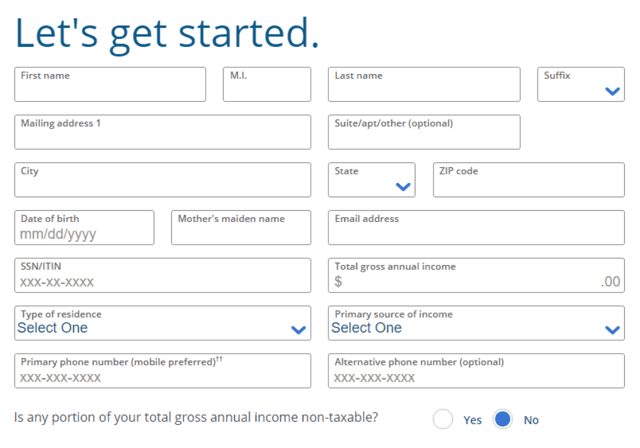

You can apply for a credit card by submitting your application online, by mail, or over the phone. You must be a US citizen and 18 or older to be eligible for a credit card.

To apply, you’ll need to provide basic information, including your name, contact details, current address, and specific financial data about your income, bank account, housing costs, and debts. Further, you’ll need to supply security information, including your Social Security number, date of birth, and perhaps your mother’s maiden name.

When you apply for a card, you authorize the issuer to do a hard pull of your credit, which may have a small impact on your credit score.

Submitting your application online tends to be the most common method because you can easily compare multiple offers to find the right card for you. You can use our offer tables as a shortcut by clicking the “Apply Now” button to go to each card’s official application site.

How Can I Use a Credit Card to Build Credit?

Credit card issuers report your account activity monthly to at least one major credit bureau (TransUnion, Experian, or Equifax). The information they supply includes the card’s account number, age, balance, and credit limit.

Each credit bureau collects this data, records it in its vast database, and uses it to calculate your credit score.

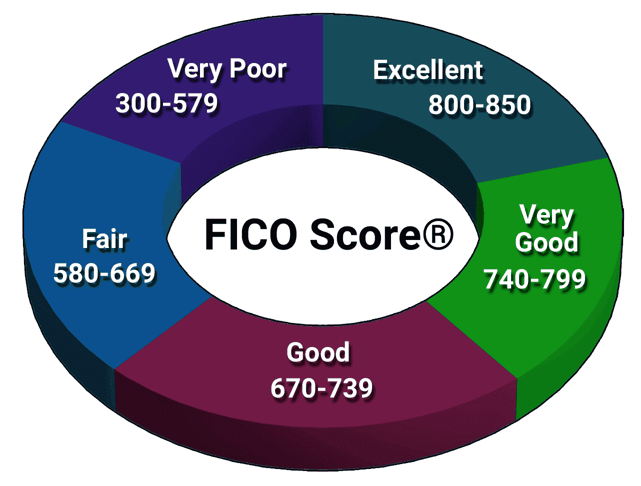

FICO scores range from 300 (worst credit) to 850 (best credit). Scores below 600 are poor and can limit your access to credit cards and loans. You can build credit by following these suggestions:

- Make Purchases: To build credit, you must use your credit card to make purchases. Your purchase activity creates the data the card sends to the credit bureaus each month.

- Pay Your Bills on Time: Your payment history comprises 35% of your credit score, the single most significant factor. Timely payments help raise your score, whereas late payments can send your score plunging. You must pay at least the minimum amount due each month, as listed on your credit card statement, along with the payment due date.

- Keep Your Balance Low: Your credit utilization ratio (i.e., the credit card credit you currently use divided by your credit limit) is another crucial score factor. A lower CUR helps your score, and you should aim for as low a ratio as possible. A good rule of thumb is below 10%.

- Don’t Close Old Credit Cards: Older accounts help prove you can manage your credit over the long term. Keep old accounts open to generate a positive impact on your FICO score.

- Fix Your Credit Reports: You can get your credit reports for free from AnnualCreditReport.com. Review each credit report and dispute any inaccurate, obsolete, or unverifiable information by contacting the credit bureaus directly. Alternatively, you can hire a credit repair agency to do the work for you. Your credit will improve if you remove derogatory information from a credit report.

Consider contacting a credit counseling agency if you have trouble paying your credit card bills on time.

What Is the Single Biggest Credit Card Trap?

Minimum payments are the single biggest trap facing credit card owners. The issuers usually set the minimum payment amount at 1% to 3% of your balance. You must pay this amount by the monthly due date to avoid late charges.

Paying the minimum may occasionally be necessary, but doing so regularly can force you into a debt spiral.

As we detailed earlier, you incur interest daily on balances you haven’t paid before the end of the monthly grace period. Credit card interest compounds daily, meaning you will pay interest on interest. This situation can cause your unpaid balance to grow exponentially.

The longer you pay only the minimum, the longer you repay your balance. In some cases, the repayment period may last years or even decades. In addition, your credit utilization ratio will skyrocket and harm your credit score.

Finally, large unpaid balances leave less credit available for new purchases or emergencies.

Mounting credit card interest can be insidious. Ignoring the problem can lead to defaults and bankruptcy.

What Is the 5/24 Credit Card Rule?

Some credit card companies limit how many cards you can own. The Chase 5/24 Rule is the most infamous policy limiting card ownership. If you’ve opened five or more new bank card accounts (credit or charge cards from any issuer) in the last 24 months, Chase will most likely reject your application for a new Chase credit card even if you otherwise qualify.

Once the 24-month period has elapsed, you can apply for additional Chase credit cards.

Chase is not alone in limiting credit card ownership. Discover and Capital One won’t let you own more than two of their cards. American Express limits ownership to five cards.

Bank of America follows the 2/3/4 Rule, which allows you to get:

- Two new cards in 30 days

- Three new cards in 12 months

- Four new cards in 24 months

The rule applies to Bank of America cards only.

Citi limits card applications as follows:

- You can only apply for one card (personal or business) every eight days and no more than two cards in a 65-day window

- You can only apply for one business card every 90 days

Wells Fargo includes the following verbiage in their credit card terms and conditions:

“You may not qualify for an additional Wells Fargo credit card if you have opened a Wells Fargo credit card in the last six months.”

There is no indication that Wells Fargo has an overall limit on credit card ownership. The same is true for Barclays.

Is Reddit a Trustworthy Social Site?

A study by the American Press Institute found that Reddit ranked second (behind Linkedin) in trustworthiness, with 22% of respondents saying they “trust news a great deal/a lot” on the Reddit platform.

The amount of trust you invest in Reddit may depend on several factors, including the following:

- User Anonymity: You don’t have to reveal your identity to leave a comment on Reddit. Perhaps this frees some contributors from concerns about reprisals. But it also frees some folks to post inaccurate or malicious information. Signed opinions should carry the most weight.

- Diverse Opinions: You can read a wide variety of opinions on Reddit. Getting a broad range of viewpoints is good, but you may not be able to distinguish which ideas are the most informed and factual.

- Moderation Quality: A good moderator can maintain a high quality of content. But each subreddit has its own moderators, which can lead to uneven quality.

- Fact-Checking: It’s helpful when Reddit users fact-check each other. But there is no assurance that the information you rely upon has received any verification, so misinformation can easily slip through.

- Potential Bias and Manipulation: Any social media platform may have manipulators and trolls pushing a particular agenda. They can be sneaky, so you have to keep on your toes.

In summary, it’s fair to say the quality of the information you find on Reddit can range from solid to hot air. But as the statistics show, people trust Reddit more than they do most other social sites.

Always Fact-Check Reddit Recommendations

Reddit offers thousands of opinions about credit cards and is a helpful resource for consumers looking to select their next card. Prudence dictates that you always confirm the information from Reddit by checking with additional sources, including legitimate review websites, including CardRates.com.

The ultimate method to fact-check Reddit recommendations is to read the published terms and conditions of any credit card you contemplate acquiring.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Travel Credit Cards Reddit Users Love ([updated_month_year]) 5 Best Travel Credit Cards Reddit Users Love ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Travel-Credit-Cards-Reddit.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Authorized Users ([updated_month_year]) 5 Best Credit Cards for Authorized Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Authorized-Users.jpg?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)