Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Credit reports and credit scores are tools credit card issuers use to predict the risk of doing business with an applicant or existing cardmember. It’s standard operating procedure for credit card companies to review your credit information when applying for a new account.

As an existing cardholder, your credit card company may also periodically — usually once a month — review your credit report and credit score. This is to verify your risk level hasn’t dramatically increased since you’re continuously borrowing money from the same account.

Because credit card issuers (and others) may use your credit report and score to make decisions about doing business with you, it’s important to understand what companies see when they check your credit reports.

Your credit reports come from Equifax, TransUnion, and Experian, the so-called Big Three credit bureaus. It may surprise you to learn that the details a credit card issuer looks at during a credit inquiry may differ from the information you see when you review your own credit reports.

Your Personal Information

When you apply for a new credit card account, one of the first boxes a card issuer needs to check is to confirm that your application is legitimate. To accomplish this task (and rule out the possibility of credit card fraud), the card issuer will use software to verify that the details on your application match the personally identifiable information (PII) on your credit report/s.

The personally identifiable information on your credit report may include the following details:

- Name

- Address

- Social Security Number

- Date of Birth

- Employment Information

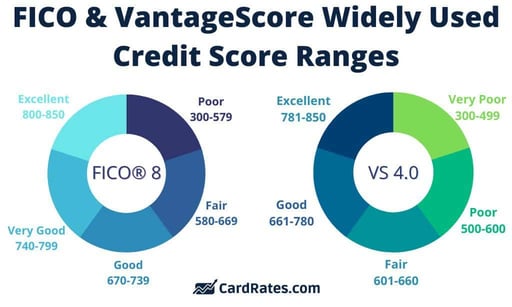

Credit card issuers, lenders, credit bureaus, and others can use these details to identify you. But PII does not and has never factored into the calculation of your FICO® Scores or your VantageScore credit scores.

Even though PII doesn’t impact your credit scores, it’s important to watch out for incorrect personal details in this particular section of your credit reports. Incorrect names, addresses, and other PII errors could indicate that you’ve been the victim of identity theft or have other erroneous information on your credit reports.

Your Credit Score(s)

Your credit scores aren’t technically part of your credit report. They’re a separate, ancillary product sold with your credit reports, like the leather interior of a newly purchased car. But credit card issuers can and do pay the extra cost for a score or scores to help predict how likely you are to pay your credit obligations on time.

You likely won’t qualify for the new account if your credit scores aren’t high enough to satisfy a card issuer’s minimum requirements. And, if you’re an existing account holder and your credit scores drop too low, there’s a chance your current card issuer could also take punitive action.

In severe cases, your card issuer may lower your credit limit or even close your account due to the increase in your level of credit risk.

Reg Flags In Your Credit History

Unsecured credit cards are a high-risk form of credit mainly because there’s nothing to secure your spending, such as a car or home. Having said that, you typically don’t need perfect (or even good) credit to qualify for a new credit card account. But you will want to avoid having red flags on your reports that may disqualify you for a particular credit card you have your heart set on opening.

A credit card issuer may look for these red flags in your credit history when you apply for a new account. These red flags vary depending on the credit card company and the type of credit card you’re applying for. Subprime and secured credit cards, for example, tend to be easier to qualify for when compared with premium rewards credit cards.

Here are a few examples of negative credit items that could cause problems on a credit card application.

- Late Payments: Recent late payments, especially on other revolving credit card accounts, could make it difficult to qualify for certain credit cards. Too many delinquencies can also cause trouble with current credit cards — even if those late payments occurred on unrelated accounts.

- Collection Accounts: Accounts from third-party debt collectors can also be problematic when you apply for a new credit card account. And card issuers willing to approve you despite the presence of collection accounts on your credit report may charge you higher interest rates. This is called risk-based pricing, and it’s how card issuers subsidize the risk of doing business with consumers who have bruised credit reports.

- Bankruptcies: Having a bankruptcy on your credit report could disqualify you from being approved for financing with certain credit card companies, especially if you previously had an account with the card issuer and discharged some of the debt you owed it. Some card issuers are willing to work with those who have filed bankruptcy in the past. But don’t expect the best deals while you have a bankruptcy on your credit reports.

How Much Revolving Credit You Have

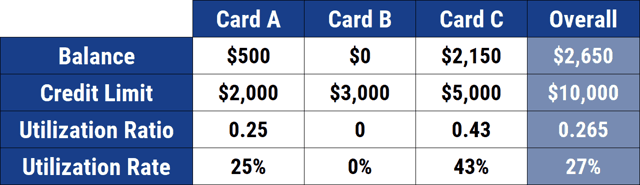

Another detail a credit card issuer may consider when it reviews your credit reports is your revolving utilization ratio (a.k.a. your credit card utilization ratio). Credit card utilization describes the relationship between credit card limits and balances, expressed as a percentage.

As you use your available credit card limits, your balances grow and so does your utilization ratio. This increase in your utilization ratio can cause your credit scores to decline. Lowering your revolving utilization ratio by paying down credit card debt is one of the few actionable ways you can quickly improve your credit scores, often in just a few weeks.

If your credit reports show a high utilization ratio on other credit cards, a credit card company may hesitate to approve your application for a new account. This may be especially true if you have maxed out the credit limits on other accounts with the same card issuer from which you’re seeking additional financing.

Recent Hard Credit Inquiries

The number of times you have applied for new credit in the past 12 months is another detail a credit card issuer may examine when it checks your credit report. Seeking too much credit in a short period indicates greater credit risk.

According to FICO, the company that invented credit scoring, people with six or more hard credit inquiries are statistically up to eight times more likely to declare bankruptcy compared with consumers with no inquiries on their credit reports. This is why inquiries are considered by scoring systems — there’s a correlation between inquiries and credit risk.

Next Steps

Once you understand what card issuers look for during a credit check, you can try to prepare for your next credit application. It’s easy and free to access copies of your three credit reports from AnnualCreditReport.com.

After you download your free annual credit reports, you can review them for errors and dispute any you discover with the three credit bureaus. From there, work to identify any positive actions that can help you improve your credit, such as paying every bill by the due date and maintaining respectable amounts of credit card debt.

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![2 Ways to Check Chase Credit Card Application Status ([updated_month_year]) 2 Ways to Check Chase Credit Card Application Status ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/chase-credit-application-status1-2.png?width=158&height=120&fit=crop)