When traveling abroad, there’s so much to pack. I always bring my favorite headphones, a guidebook, and of course, my passport. I also never leave behind my travel credit card.

The right travel credit card helps me access extra travel perks and benefits and earn points that I can redeem for future trips. But finding the right card can be tricky, especially if you’ve never had a travel card before. Read below to find the best travel credit cards Reddit users love.

Redditors Love These Travel Cards

There are dozens of card options to consider if you’re traveling abroad. Here are some of Reddit’s top picks for travel credit cards.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card welcomes new cardholders with bonus Ultimate Rewards points after spending a moderate amount in the first three months. These bonus points may even be enough to earn a free domestic round-trip flight.

When you redeem Chase Ultimate Reward points for travel, they will be worth 25% more than if you redeem them for merchandise or gift cards. There are no foreign transaction fees.

Reddit user codece said, “Chase Sapphire Preferred is pretty good start if you want to earn mileage points that can be redeemed within the Chase ecosystem of travel partners. It’s a $95 AF (Annual Fee) card; you probably don’t need to spend that on a card, but on this card at least the benefits might help offset the AF.”

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® card is like the Preferred’s older, more sophisticated sibling. The Chase Sapphire Reserve® has one of the highest annual fees among all travel credit cards, but points are worth 50% more when redeemed for travel in the Chase portal.

There is also a significant annual travel credit. If you spend a certain amount or more on flights, hotels, or other travel-related purchases, some of that money will be refunded on your statement. This annual benefit can help take the sting out of the large annual fee.

“I think most people will pass bc [because] of the $550 annual fee, but for me it’s more than worth it,” said Reddit user Heterochromio.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

The Capital One Venture X Rewards Credit Card is Capital One’s premier travel credit card, offering the largest signup bonus among all Capital One cards. Cardholders also receive a free membership to TSA PreCheck or Global Entry and access to more than 1,000 airport lounges.

This card has a sizable annual fee, but it is mitigated by the travel statement credit. There are no foreign transaction fees.

Reddit user rousinglight said, “Very easy to get your AF back, and gives you Priority Pass as well as credits to Global Entry [or] TSA PreCheck. 2X back on everything plus very high multipliers on hotels and flights. Sign up bonus is lucrative as well.”

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® from American Express is one of the most popular travel credit cards among Redditors. There is a significant signup bonus, usually between 80,000 and 150,000 points, which American Express gives customers six months to earn. Cardholders will earn the most points on flights and prepaid hotel stays booked with the card.

This card has a hefty annual fee, the highest on this list. But cardholders can earn an annual statement credit when spending a certain amount on hotels and airlines. Users can also use more than 1,400 special airport lounges and get a free CLEAR Plus membership to help them get through airport security lines faster.

Reddit user Tornadog01 said, “If you use all of the credits, then its [sic] essentially a no fee card that gives you 4.6% cashback on hotels & flights.”

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months – that’s a $200 cash redemption value

- Earn unlimited 3x points on travel, transit, gas, dining, streaming services, and phone plans – all other purchases earn 1x point

- Redeem your rewards for travel, gift cards, PayPal purchases, or as a statement credit for eligible purchases

- Get up to $600 cellphone protection when you pay your monthly cellphone bill with your eligible Wells Fargo card (subject to a $25 deductible), terms apply

- Auto rental collision damage waiver covers theft, damage, valid loss-of-use charges imposed and substantiated by the rental company, administrative fees, and reasonable and customary towing charges to the nearest qualified repair facility, terms apply

- $0 Annual fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

20.24%, 25.24% or 29.99% Variable APR

|

$0

|

Good, Excellent

|

Additional Disclosure: (The information related to Wells Fargo Autograph℠ Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

If you’re looking for a travel card that doesn’t come with an annual fee, the Wells Fargo Autograph℠ Card is your best bet. It’s one of the only cards mentioned several times by Redditors looking to get travel perks without paying an annual fee.

The Wells Fargo Autograph℠ Card still comes with a modest signup bonus as well as the ability to earn extra points on travel, restaurants, gas, and transportation, among other categories. They even offer a special APR offer for new purchases. Wells Fargo points can be redeemed for hotel stays, flights, and car rentals.

Reddit user petty0p said the card has, “good point earn[ings] and comes w/ some rental car protection and no international transaction fees.”

What Credit Score Do I Need For a Travel Credit Card?

Most travel credit cards have relatively high credit score requirements. While card issuers usually do not state the exact score required, some sources say the minimum is around 670. You’ll likely have a harder time qualifying for a travel card if your score doesn’t hit that threshold.

If you apply and are rejected for a travel credit card, you can work on improving your credit score by making payments on time, keeping a low balance on your cards, and not opening new accounts.

Should I Listen to Reddit’s Advice About Travel Credit Cards?

Redditors may provide good suggestions for travel credit cards, but they can’t tell you what kind of card fits you best.

For example, if you don’t travel frequently, then the Wells Fargo Autograph℠ Card may be the most appropriate selection because it doesn’t come with an annual fee and still offers a number of travel perks.

The choice also depends on where you’re flying from and whether your home airport has any major airline hubs. If it does, you may be better off opening a card associated with that particular airline instead of a general travel credit card. Choosing a credit card is a personal decision that no one else can make for you.

Should I Close My Current Travel Card and Open a New One That Redditors Like?

Closing your current travel card can potentially hurt your credit score, especially if the card is one of the oldest in your credit history. When you close an old card, the average age of your credit accounts will decrease. This makes up 15% of your credit score.

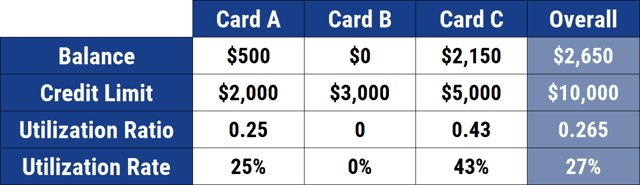

Also, closing an existing card can increase your credit utilization percentage, which is a part of the credit scoring metric that makes up 30% of your credit score. Your credit utilization percentage is your current card balance divided by your total credit limit.

Before closing a card, calculate your current credit card utilization percentage and see how it will change if you close your card. Unless the card has an annual fee, there’s usually little reason to cancel it.

Rely on More Than Reddit to Choose Your Next Travel Card

If you’re trying to find the best travel credit cards, Reddit can be an excellent starting point. There are plenty of knowledgeable users and helpful forums to browse.

But you should also do your own research to figure out what you need in a card and which cards include those features and benefits. Make sure you always understand the annual fee, APR range, and any other applicable fees before making a decision.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards Reddit Users Recommend ([updated_month_year]) 7 Best Credit Cards Reddit Users Recommend ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-Reddit.jpg?width=158&height=120&fit=crop)

![7 Best Cash Back Cards Redditors Love ([updated_month_year]) 7 Best Cash Back Cards Redditors Love ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Cash-Back-Cards-Reddit-Users-Love.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Authorized Users ([updated_month_year]) 5 Best Credit Cards for Authorized Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Authorized-Users.jpg?width=158&height=120&fit=crop)

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Travel Rewards Credit Cards ([updated_month_year]) 7 Best Travel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/best-travel-credit-cards.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for International Travel ([updated_month_year]) 12 Best Credit Cards for International Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/credit-cards-for-international-travel-feat.jpg?width=158&height=120&fit=crop)

![8 Best Travel Credit Cards for Students ([updated_month_year]) 8 Best Travel Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Travel-Credit-Cards-for-Students-1.jpg?width=158&height=120&fit=crop)