A signup bonus, also called a welcome bonus, is a marketing tactic credit card issuers use to attract new customers. Customers benefit by getting a windfall of credit card rewards by meeting the terms of the bonus. A win-win if you happen to be in the market for a new card to add to your wallet.

You’ll need good credit — a credit score above 670 — to qualify for most credit cards with signup bonuses. If that describes you, read on for our top recommended cards with signup bonuses of at least $200.

-

Navigate This Article:

Best Cards With $200+ Signup Bonuses

You really can’t go wrong with any of these cards, but what you’ll want to pay attention to aside from the signup bonus is the APR, rewards, and 0% APR promotions. Best of all, none of these cards charge an annual fee.

Best Overall

This card is one of my personal favorites. I extracted the most value from this card when I owned the Chase Sapphire Reserve® card; I would transfer the rewards from this card to my Sapphire card in the mobile app and then use my Chase Ultimate Rewards points for travel purchases. But this card stands strong on its own, which is why I still carry it even after closing my Reserve account.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

Best For Selective Rewards

The following card lets you choose the purchases that earn the most rewards, which is a nice feature most people can appreciate. But if you’d rather not have to stay on top of changing your rewards in the Bank of America app or website to fit your purchases, a flat-rate rewards card that pays the same percentage of cash back or points on everything you buy may be a better choice.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Best For Flat-Rate Rewards

This no-fuss-no-muss option pays the same rewards rate on everything you buy, though travel accommodations made through Capital One Travel pay more. You’ll also enjoy 0% APR promotions and a signup bonus with a low spending requirement. But if you’re unsure whether you qualify for this card, there’s also the Capital One QuicksilverOne Cash Rewards Credit Card for people with fair credit, but it doesn’t offer a signup bonus or 0% promotions.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

Best For Big Spenders

This card doesn’t offer the typical signup bonus you’ll get three or so months after opening an account. Discover lets you use the card for 12 months and earn rewards as you normally would, then the bank will match all the rewards you’ve earned at the end of your first year. Because there’s no limit to the amount the bank will match, we recommend this card for big spenders or those who need to finance a particularly large purchase.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

Best For Travel With No Annual Fee

This is another flat-rate rewards card, but it pays points you can redeem for eligible travel purchases (or cash, whichever you prefer). All Bank of America cards come with expansive security features, including a $0 Liability Guarantee, Balance Connect for overdraft protection, account alerts, and contactless chip technology. Of course, better travel cards with lounge access and Global Entry or TSA Precheck credits exist, but they charge high annual fees.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Best For Fixed Monthly Expenses

This card is similar to the Bank of America cash back card above in that it lets you choose which spending category earns the most rewards. But this card caps its highest reward rate to $500 spent per month. So to extract the most value from this card, choose a purchase category that you spend about $500 monthly on, such as groceries, gas, or dining out. You could save $25 per month doing this, or $300 a year!

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

Best For Dining Rewards

This card doesn’t limit its purchase rewards, meaning you can dine out as often as you like without worrying about spending caps. And if you like to order in, take note of the Uber Eats promotion running through 2024. That’s an immediate 10% savings on everything you have delivered by Uber credited to your Capital One rewards balance.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

Known Signup Bonus Restrictions By Issuer

Each credit card issuer has its own rules regarding signup bonuses and the terms you need to meet to qualify for one. Here are a few known restrictions among big issuers:

American Express: You can only earn one welcome bonus per card in your lifetime. If you opened a Platinum Card, closed it, waited a few years, and decided to reapply, you will not qualify for another welcome bonus. But you would if you applied for a different American Express card you’ve never owned. Coincidentally, Amex will let you know during your application whether you qualify for the welcome bonus.

Bank of America: Bank of America doesn’t limit the number of bonuses you can earn, but it does impose a time frame in which you can qualify for a second signup bonus. You will not qualify for a signup bonus if you apply for the same card you closed less than 24 months ago. But if it’s been more than two years, you can reapply and be eligible to receive another signup bonus.

Barclays: This bank has the same rules as Bank of America. You can qualify for multiple bonuses on the same card, but only if the account has been closed for at least 24 months before reapplying.

Capital One: Capital One has no known issuer restrictions regarding welcome bonuses. But there’s some fine print in most of its cards that states, “The bonus may not be available for existing or previous account holders.” This suggests you may not be eligible for a second bonus, though several unconfirmed reports are circulating of cardholders achieving a second bonus without issue.

Chase: You can generally get a second signup bonus if it’s been 24 months since you earned the last bonus. But its pair of Sapphire cards require a 48-month waiting period. And that applies to both cards — if you had a Reserve card and want to open the Preferred, you won’t qualify unless 48 months have passed since you earned the bonus on your Reserve.

Citi: You must wait at least 24 to 48 months from either opening or closing a card before you can qualify to earn a second signup bonus for the same or similar card. If you opened a card and canceled it before 24 months had passed, the 24-month clock would begin from the day of cancellation. Its co-branded American Airlines cards have a 48-month restriction.

Discover: While there are no known signup bonus restrictions, you cannot have more than two Discover cards at any time, and your first card must be open for at least one year before you can qualify to open a second.

U.S. Bank: No known restrictions.

Wells Fargo: You must wait at least 16 months before you can qualify for another welcome bonus from Wells Fargo. Personal and business cards are separate, so you could technically achieve two signup bonuses within those 16 months.

What is a Signup Bonus and How Does it Work?

A signup bonus is a promotion credit card issuers — including banks, credit unions, and other small issuers — use to attract new customers. It’s a lump sum payment in the form of credit card rewards that is credited to our rewards balance.

It’s similar to how banks will pay you money to open a new deposit account with them, but signup bonuses require new cardholders to abide by a few rules.

Here are the general steps to get a credit card signup bonus:

- Open a new credit card account. You must meet the issuer’s approval criteria, including age, income, and credit requirements.

- Spend a certain amount within a specified time frame: Signup bonuses typically require you to spend a minimum amount with the card before the issuer will award you a bonus. How much you must spend varies by card, but typical signup bonus terms look like:

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn 25,000 bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

- Keep your account in good standing. If you fail to make a payment before you’ve achieved your signup bonus, the credit card issuer may revoke your signup bonus opportunity in response to your breach of contract. A credit card agreement is a legal contract between you and the issuer, and by failing to make a payment, your account is no longer considered to be in good standing. If you breach the contract, the credit card issuer can change the terms of the agreement as it sees fit.

Follow these guidelines, and you’ll be on your way to earning a rewards bonus worth a couple hundred dollars. Signup bonuses are typically credited soon after you meet the spending requirement.

So for example, if you had to spend $500 to hit the bonus and did so within your first week of having the card, the bonus would appear in your rewards balance typically within a few days or weeks of the transaction. You don’t have to wait until the 90 days or however long the period lasts to receive the bonus.

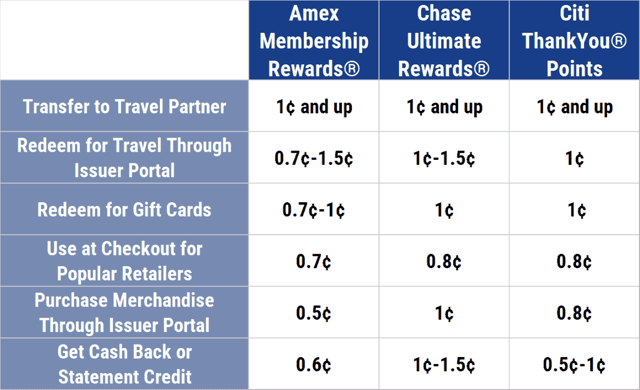

Once you receive the bonus, you can spend it as you please. But different redemption options weigh the value of your rewards differently.

For example, most cards award higher values to rewards redeemed for travel accommodations — hotel stays, flights, car rentals, cruises, etc. — through the issuer’s travel portal. Gift cards are another common way to redeem rewards for higher values.

And all cards allow you to redeem your bonus for cold hard cash. You transfer the dollar value of your rewards to your bank account or apply them as a statement credit to cover your credit card balance.

This is why signup bonuses are so popular among people who have a big upcoming purchase: They can buy what they need and easily hit the signup bonus spending requirement, maybe even finance it at 0% interest (usually for 12 to 18 months), apply the signup bonus to the statement balance, and save a big chunk of change on whatever they bought.

Which Cards Give You Money For Signing Up?

Most cards for good credit scores offer signup bonuses. Some balance transfer cards with exceptionally long 0% APR promotions, such as 20 or more months, may skip rewards altogether because of the long period of interest-free financing.

We’ve reviewed some of the best credit card signup bonuses available from cards with no annual fees above. But other cards we recommend that offer bigger signup bonuses (and charge annual fees) include:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Capital One Venture Rewards Credit Card

- The Platinum Card®

- American Express® Gold Card

- Blue Cash Preferred® Card

Remember that if you pay an annual fee, you should factor that cost into the signup bonus amount. And most issuers deduct your annual fee upon issuing the card.

So, for example, a card may pay you a $300 signup bonus but charge you a $95 annual fee, thereby reducing the value of your bonus to $205. And the issuer will charge that annual fee again in 12 months, but you won’t have another opportunity to earn a second signup bonus.

Is Getting a Card With a Signup Bonus a Good Idea?

That depends on whether you have to overspend to achieve the bonus. Credit card debt is expensive, and interest rates are high right now due to the Fed’s prime rate increases. If you struggle to repay what you’ve charged, it’s probably not a good idea.

But if you have an upcoming purchase that will meet or exceed the minimum spending requirement, then a card with a signup bonus opportunity can be a good idea. Couple that with a 0% promotional interest rate on new purchases, and it can be a great idea.

Key Takeaways:

We’ve covered a lot in this article, but the main points are:

- Signup bonuses are available on most cards for people with good credit (670+ FICO).

- You must abide by the issuer’s terms to receive the bonus.

- Be mindful of each issuer’s rules regarding signup bonuses.

- Don’t take out a card just for the bonus if it’ll overextend your budget or be difficult to repay.

Many credit card options exist, but remember that the best credit card for you depends on your preferences and spending habits. The APR is also an important consideration, but you can avoid expensive interest charges altogether by paying your balance in full each month.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Bank Signup Bonus Credit Cards: $200 – $750 ([updated_month_year]) 8 Bank Signup Bonus Credit Cards: $200 – $750 ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Bank-Signup-Bonus-Cards.jpg?width=158&height=120&fit=crop)

![7 Best Credit Card Signup Bonuses $200 – $1,250 ([updated_month_year]) 7 Best Credit Card Signup Bonuses $200 – $1,250 ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/Best-Credit-Card-Signup-Bonuses.jpg?width=158&height=120&fit=crop)

![12 Best Credit Card Signup Bonus Offers ([updated_month_year]) 12 Best Credit Card Signup Bonus Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/credit-card-signup-bonus-offers.jpg?width=158&height=120&fit=crop)

![9 Best 0% APR Signup Bonus Credit Cards ([updated_month_year]) 9 Best 0% APR Signup Bonus Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-0-APR-Signup-Bonus-Credit-Cards-3.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year]) 8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/500.png?width=158&height=120&fit=crop)

![8 Business Credit Card Sign-Up Bonuses ($200 to $1250) – [updated_month_year] 8 Business Credit Card Sign-Up Bonuses ($200 to $1250) – [updated_month_year]](https://www.cardrates.com/images/uploads/2021/03/Business-Credit-Card-Sign-Up-Bonuses.jpg?width=158&height=120&fit=crop)

![11 Best Credit Card Sign-Up Bonuses ($200, $300, & $500) – [updated_month_year] 11 Best Credit Card Sign-Up Bonuses ($200, $300, & $500) – [updated_month_year]](https://www.cardrates.com/images/uploads/2021/03/Best-Credit-Card-Sign-Up-Bonuses-2.jpg?width=158&height=120&fit=crop)

![Are Credit Card Signup Bonuses Taxable? ([updated_month_year]) Are Credit Card Signup Bonuses Taxable? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Are-Credit-Card-Signup-Bonuses-Taxable.jpg?width=158&height=120&fit=crop)