Sometimes, tax payments are due, but the cash isn’t there. Even if you have the cash, you may want to use one of the best credit cards for tax payments to reap a signup bonus.

On the other hand, if you need an extended period to pay, you can choose a card with 0% financing. In either case, you’ll need a new credit card to grab the introductory perks.

Read on to discover the 10 best credit cards for tax payments — one or more may suit you perfectly.

Overall | Signup Bonus | 0% Financing | FAQs

Best Overall Credit Card for Tax Payments

Our top pick has a low purchase threshold to earn the introductory bonus plus a long period of 0% APR on purchases. This is a balanced approach for folks who want to finance their tax payment and earn a bonus as well.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® offers new cardmembers a quite lengthy introductory period of 0% APR on purchases. The introductory signup bonus is yours if you spend the required amount during the first three months after opening the account.

You earn cash back on every purchase made without redemption minimums. All this plus no annual fee and a range of other benefits make this card a great choice for tax payments.

Best Cards for Earning a Signup Bonus on Tax Payments

These cards all offer substantial bonuses to new cardmembers. If you obtain the card within three months of when taxes are due, you can use the tax payment to help you earn the bonus. It’s like a discount on your taxes — not bad!

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card provides an unprecedented way to earn bonus cash back. Rather than offering a quick flat-rate sum as most cards do, Discover offers a unique one-time bonus at the end of your first year. Read more in card terms above.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card offers a one-time mileage bonus to new cardmembers who spend the required amount on purchases in a set time frame after opening the account. You receive unlimited 2X miles on all purchases plus up to a $100 credit for Global Entry or TSA Precheck®.

You can transfer your miles to 12+ travel partners and redeem miles for travel and hotels with no blackout dates.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card offers introductory bonus points when you spend the required amount on purchases during the first three months after opening the account.

It also rewards travelers with 2X points on restaurant dining and travel, plus 1X points on all other purchases. Points are worth 25% more when redeemed for travel through Chase. This is a premium card and it charges an annual fee.

5. Capital One® Savor® Cash Rewards Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

The Capital One® Savor® Cash Rewards Credit Card provides a one-time cash back bonus after new cardmembers spend the specified amount within the first three months from account opening. You earn unlimited cash back rewards of 4% on entertainment and dining, 2% at grocery stores, and 1% on all other purchases.

The categories are not rotating and don’t require activation. The card charges no annual fee for the first year.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles lets you earn an introductory bonus similar to the Discover cash rewards card discussed above. You earn miles on all purchases all while enjoying an introductory APR for new cardholders.

You can redeem your miles for cash or use them to pay for travel purchases with no blackout dates. It also provides benefits like free FICO credit scores and Social Security number alerts.

Best 0% Financing Cards for Tax Payments

If you need time to pay off your tax bill, the following cards all offer at least one year of 0% APR financing. Rather than choking on a big tax bill due all at once, these cards allow you to cut down the size of your tax payments into more digestible monthly chunks.

7. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The Chase Freedom Flex℠ card gives new cardmembers a promotional 0% purchase APR after opening the account. You also can earn a cash back bonus when you spend the required amount during the first three months.

This no-annual-fee card lets you earn top-tier cash back on the first set limit of purchases each quarter for the quarterly-revolving merchant category that you activate. Other set categories also earn elevated, slightly lower cash back, while all other purchases earn 1%.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card has a 0% introductory purchase APR for the first months after opening the account. There is also a one-time cash bonus when you meet the spending requirement on purchases during the first three months.

You earn an unlimited 1.5% cash back on every purchase, every day. The card charges no annual fee, no foreign transaction fees, and your cash back rewards don’t expire as long as the account remains open.

The Capital One SavorOne Cash Rewards Credit Card gives new cardmembers 0% APR for several months on purchases from account opening. It also provides a one-time bonus when you spend the requisite amount during the first three months.

The card offers nice benefits, including virtual card numbers, point redemptions for direct purchases on Amazon.com, and special event access.

The Capital One VentureOne Rewards Credit Card has an introductory APR of 0% for a promotional period. In addition, you can earn bonus miles by spending a set amount on purchases during the first three months.

You can use the miles for travel on any airline without any blackout dates or for any hotel stay. You can also transfer your miles to more than a dozen travel partners. The Capital One VentureOne Rewards Credit Card charges no annual or foreign transaction fees.

Is it Smart to Pay Taxes with a Credit Card?

It can be convenient to use your credit card to pay taxes, but it’s really smart to get a bonus and free financing as well. Your choice of credit card should depend on the primary reason for using the card.

If you are mainly interested in getting rewards, then your card should offer you the maximum reward for your tax payment. For example, if you owe $500 to Uncle Sam, you wouldn’t necessarily choose a card that requires $2,000 in purchases during the first three months to earn the bonus.

Rather, you might want to choose among the several cards that require modest spending, of which the Chase Freedom Unlimited® card comes in first. On the other hand, if you owe several thousand in taxes, a card like the Capital One Venture Rewards Credit Card offers a larger bonus in return for a higher purchase requirement.

Alternatively, the unique signup bonus available from Discover cards can pay off, no matter how much you owe in taxes. Whether you owe $100 or $10,000, you get bonus rewards that match the rewards you earned during the first 12 months after opening the account.

If you are more interested in free financing, many of the cards reviewed here offer new cardmembers 15 months of 0% APR on purchases. That means you can use get up to three months of free financing for the following tax year if you correctly time the acquisition of your new credit card.

Here’s how that works: You time the card acquisition such that it arrives just before April 15 and then use it to pay this year’s tax payment. Next year on April 15, you’ll still have about three months left in the introductory 0% APR period. That can come in handy when you pay next year’s tax bill.

By the way, you can use your credit card when you establish a monthly payment plan with the IRS. There is a one-time setup fee for this service. Then, you pay an installment each month on the tax you owe.

The IRS will assess interest and possibly penalty charges until your balance is paid. However, if your income is at or below 250% of the poverty line, the IRS can waive your interest and late fees.

What is the Fee for Paying Taxes with Credit?

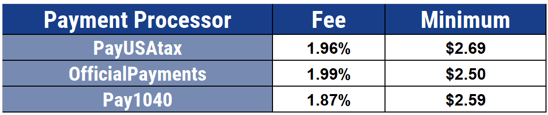

The IRS allows you to pay your taxes with a credit card, but you’ll have to pay a fee to the designated payment processor. All three processors accept Visa, Master Card, Discover, and American Express. Here are your choices:

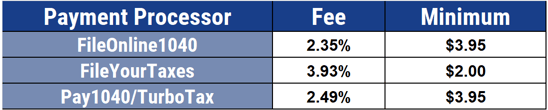

In addition, you can pay by credit card when you e-file your tax return, but the cost is higher. The following table specifies the fee rates and minimum fees for combined e-file/tax payment transactions:

Note that this table also applies to combined e-filing/debit card payments.

Many tax professionals and tax preparation programs besides TurboTax offer combined e-filing and credit card tax payments. If you use one of these, check to see the available options and costs. Note that some tax software programs permit partial payments, but none support multiple payments.

Another benefit of using your credit card for taxes is that, as long as you use it to pay at least $1 of your estimated tax, you receive a free filing extension without having to fill out IRS Form 4868. Note that payment processing fees go to the processor, not the IRS.

If you are paying business taxes, the fee is deductible. Your credit card statement will list the tax payment (as “United States Treasury Tax Payment”) separately from the fee (“Tax Payment Convenience Fee”).

Finally, take note that you cannot use your credit card on the official IRS Direct Pay System.

What Forms of Payment Does the IRS Accept?

While using a credit card is a convenient way to pay your taxes, it’s not your only choice. If you’d like to pay directly from your checking account, you can use the IRS Direct Pay System for free.

Direct Pay accepts Automated Clearing House (ACH) payments from your bank account. You must provide your bank’s routing number and your account number to make an ACH payment.

If you are making a direct federal tax payment for your business, you must instead use the Electronic Federal Tax Payment System.

If your employer took payroll deductions from your paychecks, you may not owe any tax payments when filing your return.

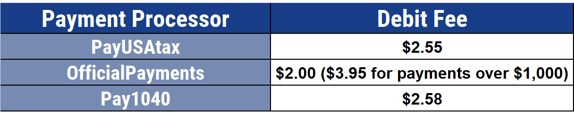

You can also use a debit card to make a tax payment, subject to the following fees:

The IRS will also accept cash at a retail partner location. These locations are in retail stores that participate in the PayNearMe program.

The fee for this service is $3.99 per payment. You can also pay by mail via check or money order made out to The United States Treasury. There is no fee, just the cost of postage, and, if applicable, the fee for a money order.

When you pay by card, you don’t have to send in the IRS Payment Voucher (Form 1040-V). If you want to cancel a credit card tax payment, you must contact the card processor, not the IRS.

Of course, the IRS will refund any overpayment you make, except if you owe money on your tax account. If your payment relieves a tax lien, expect up to a 30-day wait time before you receive your lien release from the IRS.

Get a Little Something Extra When You Pay Taxes

If you are looking for an efficient and rewarding way to pay your taxes, consider credit cards for tax payments. By using a credit card, you could earn a bonus reward, free financing for a set time period, and rewards in the form of cash back, miles, or points.

The 10 cards reviewed here are great choices for getting something extra when you pay your taxes. You can use your credit card to make tax payments online, through a mobile app, or over the phone. If you prefer, you can pay with a debit card, an ACH payment, cash, a check, or money order.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Prepaid Cards For Tax Refunds ([updated_month_year]) 8 Best Prepaid Cards For Tax Refunds ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Prepaid-Cards-For-Tax-Refunds.jpg?width=158&height=120&fit=crop)

![11 Ways to Lower Your Monthly Bill Payments ([updated_month_year]) 11 Ways to Lower Your Monthly Bill Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Ways-to-Lower-Your-Monthly-Bill-Payments.jpg?width=158&height=120&fit=crop)

![7 Best Contactless Credit Cards ([updated_month_year]) 7 Best Contactless Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Contactless-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)