If there were a true national pastime in America, acquiring debt might be it. From car loans to credit cards to student loans and even medical debt, Americans now owe more than at any point in history. In fact, according to the 2018 Planning and Progress Study by Northwestern Mutual, the average American has around $38,000 in personal debt, not including mortgage debt.

If you’re feeling anxious lately about the amount of debt you are carrying, you’re not alone. Short of a huge boost in your income, a life-changing inheritance, or winning the lottery, your financial circumstances will likely be the same tomorrow as they are today. Faced with these bleak facts of life, many indebted consumers are turning to their credit cards as a solution.

But wait, isn’t that the source of all the anxiety to begin with? Actually, when used as part of a comprehensive debt-reduction strategy, credit cards can be an effective way to pay off debt. Read on to learn more about which credit cards are best for helping reduce debt.

Credit Card Debt | Other Types of Debt | FAQs

Best Cards to Pay Off Credit Card Debt

If the idea of using a credit card to pay off credit card debt seems counterintuitive, consider this: A credit card with a long 0% introductory interest rate period lets you direct more of your money toward paying down the principal balance instead of interest. That means you may be able to pay off your debt sooner than you otherwise would.

Here are some of the cards we found that offer long intro-rate periods:

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Best Cards to Pay Off Bills and Other Debts

If you’re looking for a way out from under a pile of bills and other debts, a card with an extended 0% APR period may just be the ticket. Whether we’re talking about student loans, medical bills, a car loan, home equity loan, or any type of personal loan — a chunk of what you pay each month goes toward interest charges.

By using a card with a 0% interest rate on new purchases, you can direct all of the money you pay toward reducing the actual loan balance. Depending on the amount of debt and the strategy you use, you could be debt-free before you know it.

Here are some of the cards we found that can help you implement a solid debt-payoff plan:

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Make sure the card you choose doesn’t charge deffered interest on any outstanding balance once the intro period expires.

Do Balance Transfers Affect Your Credit Score?

A number of factors go into whether and how a balance transfer can affect your credit score. Aside from how credit scores are calculated in general, your personal financial and credit situation will play a role. Consider also your debt repayment strategy and how you implement your balance transfer plan.

If you view a balance transfer as a life preserver or temporary fix, it’s unlikely to help your credit score, since you haven’t addressed the underlying debt problem. On the other hand, if you use the balance transfer as part of a strategy to pay off credit cards and other debt, it can ultimately help improve your score.

Balance transfers actually have two potential effects; the short-term impact on your credit score, and the long-term effect of a well-designed debt repayment plan. Some people experience a short-term hit to their score, followed by an increase as their overall debt amount drops.

Other positive and negative factors that contribute to the impact of a balance transfer on your credit score include:

- Getting a new card can add a hard inquiry to your credit file. This inquiry can cause a temporary small hit to your credit score (temporary negative).

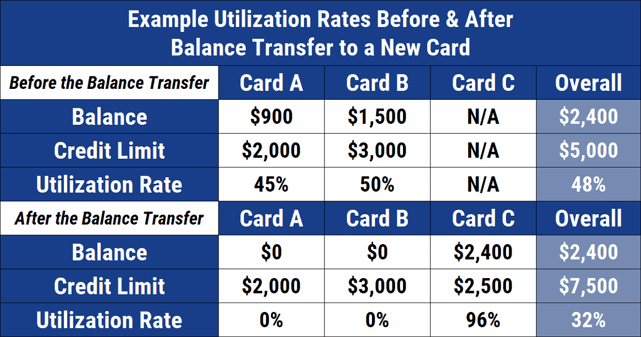

- Your credit utilization represents 30% of your FICO score. If you add a new card with a new line of credit, it can raise your available credit and lower your overall credit utilization ratio across all accounts (positive). However, if you get a balance transfer card with a credit limit of $15,000 and then transfer $12,000 to it, your credit utilization for that card is now 80% (negative).

- As you begin to follow your debt repayment strategy and pay down your balance, this will lower your debt and raise your credit utilization ratio (positive).

- Age of credit accounts is another factor in determining your FICO score, accounting for 15%. Getting a new account will lower the average age of your accounts (negative).

There are some things to remember that can help offset the negative impacts listed above, and enhance the positive. First, after transferring a balance to your new credit card, don’t cancel the old card. That card has an available credit line that counts toward your overall utilization rate and also contributes to a higher average credit age.

Next, keep the utilization of your new account to around 30% or lower. A balance transfer card with a limit of $30,000 should have no more than $9,000 or so transferred to it.

Finally, if your credit score is temporarily impacted to the negative, will a balance transfer put you in a better position down the road? In other words, will a little short-term pain result in a stronger credit score after the effects of a balance transfer (and ultimately lower debt) are realized?

Is Transferring Credit Card Balances a Good Idea?

When used as part of a debt reduction plan, balance transfers to a no-interest credit card can save money, reduce debt, and improve your credit score. If used as a way to buy extra time and extend unhealthy spending habits, a balance transfer can send you into an even deeper debt hole.

The thing to remember is that balance transfers only work if they’re part of an overall strategy to pay off debt. Many of these cards have a regular APR that’s above the industry average after the introductory rate period ends.

It can end up costing you more in the long run if you transfer a balance to one of these cards and don’t pay it off before the 0% period ends.

A good balance transfer strategy involves having a debt repayment plan and sticking to it. Here are some things to remember when devising your plan.

- Stop or greatly reduce new purchases on your credit cards.

- Choose a balance transfer card with the lowest fees possible — preferably zero.

- Transfer balances with the highest interest rates to your 0% balance transfer card first.

- Don’t close credit card accounts after you’ve transferred the balance to a new card.

- Focus all your financial firepower at paying off this debt before the intro period expires.

- Pay close attention to the 0% intro period and the transfer window to qualify for the promotional rate.

- “Flipping” to a new 0% card after one intro-rate period is over seldom works. Make every attempt to pay off your balance the first time around.

If you transfer a large balance to your new 0% card from one or more cards, you may exceed the recommended 30% utilization rate of that card. That’s okay if it’s a temporary situation and you plan to direct all of your payments toward bringing down this balance. Your credit score may take a hit but will recover once you bring the balance down.

What is the Best Debt-Transfer Credit Card?

The best credit card to transfer debt to is the one that works best for your individual debt circumstances. In other words, there’s no single card that will fit everyone’s financial situation. Here are some things to consider when deciding which balance transfer card to get.

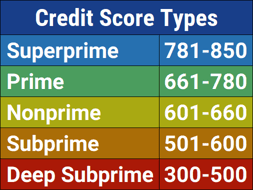

You’ll generally need a prime or superprime credit score to qualify for 0% interest financing.

Know your current credit score. Most 0% introductory rate balance transfer cards require a good to excellent credit score — technically, a minimum score of 680, although a score in the low 700s is a more practical minimum. If your score doesn’t fall into this range, do what you can to improve your credit score before applying for one of these cards.

If your overall goal is to reduce the amount of debt you have, you probably won’t — and shouldn’t — be using the card for regular purchases. That means you don’t need a card with rewards or bonus points. You also want to avoid fees for balance transfers if possible. Two cards that fit this profile are the Chase Slate® and BankAmericard credit cards with $0 transfer fees.

Chances are you’ll need as long as possible to pay off a large amount of credit card or other debt. Look for a card with the longest introductory-rate period, like the Citi Simplicity® Card.

If you have no choice but to continue using your 0% intro-APR card while paying off your debts, then a card that rewards you with cash back may make sense. A few of these cards will even pay you a substantial cash bonus when you spend just a few hundred dollars in the first three months. The Chase Freedom Flex℠ card and the Capital One Quicksilver Cash Rewards Credit Card are two such cards.

Finally, before choosing a balance transfer card, check to see if it allows you to transfer debt from another card issued by the same bank. Many issuers have this restriction, so it could affect which balances you can transfer to your new card.

What is the Best Way to Pay Off Credit Cards Fast?

The fastest way to pay off credit card debt is to focus more of your payment toward the principal and less toward interest. That’s where a 0% intro rate balance transfer card comes in. Even if you pay the same amount each month, your debt will be reduced quicker with a 0% card since the entire amount goes toward the principal amount owed.

The avalanche method prioritizes your debts by interest rate, starting with the highest APR first.

That said, there are two widely accepted techniques for paying off credit cards that you should consider. One is referred to as the debt avalanche method, which focuses on paying off high interest cards first, and the other is the debt snowball method that prioritizes paying off the smallest debts first.

Using a 0% balance transfer card, you can create a hybrid of the debt avalanche method that transfers the balances on high interest credit cards to the new 0% card. This lets you reduce the overall interest you pay and direct more of your money toward principal repayment. Here’s an example of how that might work.

The snowball method prioritizes your debts by balance, starting with the smallest balance first.

Let’s say you have three credit cards with balances of $3,500, $4,000, and $2,200, respectively. We’ll call them Card 1, Card 2, and Card 3.

The interest rates on the cards are 23% on Card 1, 16% on Card 2, and 21% on Card 3.

If you get a 0% balance transfer card with a credit limit of $8,000, it would make the most sense to transfer the balances of Card 1 and Card 3, since they carry the highest interest rates. In this scenario, you would continue to pay on Card 2, but focus most of your repayment efforts on the new card.

This has the effect of paying down debt at the fastest rate since more of your payment efforts are going toward principal and less toward paying interest.

Pay Off Your Credit Balances to Avoid a Debt Cycle

You may wonder how people can get stuck in a cycle of debt, but it’s actually more common than you think. Borrowing is almost unavoidable in our society, between loans for education, loans for home repairs, loans for a new vehicle… you get the point.

Borrowing money is an advance on our future earnings. Borrow too much, and you won’t earn enough to pay it back in a reasonable period. Soon, the interest becomes overwhelming and consumes the majority of your payment efforts.

The way to avoid this, other than simply being conscientious, is to pay off the credit balances you’re carrying now. And as you’ve seen, one way to do that is to use a balance transfer card with a 0% rate.

Of course, as you’ve also read by now, this needs to be part of a clearly defined debt repayment strategy. Create a budget that prioritizes paying off debt. Put as much as you can toward your credit card debt and make your payments more effective by directing more toward principal and less to interest.

When used wisely, a balance transfer card with a 0% introductory rate can be an effective way to pay off high-interest credit cards or loans and break the debt cycle. Just be sure to also address the habits that caused you to amass too much debt in the first place.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)

![How to Pay Off Credit Card Debt ([updated_month_year]) How to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/How-to-Pay-Off-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)

![5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year]) 5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/loans2.jpg?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)