Asking the question, “What is the easiest credit card to get?” is a bit like asking, “What’s the best diet to lose weight?” Both questions will return a huge number of responses, most of which will be starkly different — and few of which will be the right advice for everyone.

Instead, the easiest credit card for any given consumer to get will vary based on each individual’s specific credit profile and personal needs. For example, the easiest credit card to get as a student will be very different from the easiest credit card to get when you have bad credit.

In this article, we’ll look at the potentially easiest cards to get for those with fair credit and bad credit, as well as secured cards, student cards, and store credit cards.

Fair Credit | Student | Secured | Bad Credit | Retail

Easy Credit Cards to Get With Fair Credit

Whether you’re building your credit for the first time or rebuilding credit after a few mistakes, most consumers will have fair credit at some point in their lives. While the options aren’t quite as limited with fair credit as they would be if your credit score were lower, they’re not the bells-and-whistles cards you’d get with better credit, either.

In general, the easiest cards to get with fair credit will be the bare-bones starter cards; the ones without annual fees can be great for building credit, though, if you’re able to pay an annual fee, you can also likely find a card with purchase rewards. Just make sure the rewards are worth the fee before applying.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

+See More Cards for Fair Credit

Easy Student Cards to Get Approved For

Although obtaining a credit card without a credit history can be difficult, students tend to have an edge here; many issuers offer student cards specifically designed to help young people establish and build their credit profiles.

These cards have flexible credit requirements that allow for the limited credit history typical of a college student. This allows applicants to obtain a student credit card with lower fees and better perks than they may otherwise qualify for without a credit history.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

+See More Student Credit Cards

Easy Secured Cards to Get Approved For

Secured credit cards are by far the easiest type of credit card to obtain, particularly if you have a poor or limited credit history. That’s because secured credit cards require a cash deposit that acts as collateral for the account, meaning the credit card issuer doesn’t have to risk its own money to approve your credit line.

With less risk, issuers are more willing to be flexible about credit scores and income, often offering better rates, lower fees, and higher credit limits than other cards for the same credit demographic. What’s more, your secured credit card deposit is fully refundable when you close your account with a $0 balance.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

+See More Secured Credit Cards

Easy Credit Cards to Get With Bad Credit

While the exact scores that qualify as bad vary based on the specific scoring model, typically, a credit score that falls below 600 will land you in the bad credit score category. At this point, most mainstream credit card companies will be wary of offering you an unsecured credit card, limiting your choices quite a bit.

That said, options still exist, particularly if you’re willing to put up with a few limitations. For instance, if you want an unsecured card, a pricey subprime card or a closed-loop store card will be your options.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

- Earn 1% cash back rewards on payments made to your First Access Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Bad Credit

|

+See More Cards for Bad Credit

Easy Retail Cards to Get Approved For

A frequently recommended route for finding easy-to-get credit cards is to go with a store credit card. Most major retailers now offer their own co-branded cards, many of which offer purchase rewards or store discounts.

At the same time, many store credit cards are closed-loop, meaning they can only be used to make purchases with the specific brand that co-issued the card. This also applies to the rewards you earn with these cards — they can typically only be used toward branded purchases.

13. Target RedCard

The Target RedCard is a solid option for Target shoppers, and reports indicated consumers with scores as low as 580 have been approved for the card. Unlike typical rewards cards, you’ll earn 5% off at the register instead of earning cash back to be later redeemed.

- Get 5% off your total purchase at checkout for eligible in-store or online Target purchases

- Receive exclusive deals & discounts

- Pay no annual fee

Keep in mind that the discount does not apply to prescriptions or over-the-counter items located behind the pharmacy counter, Target Optical™ eye exams, gift card purchases, or certain restaurant merchants in store (though the discount was recently extended to newer stores with a Starbucks).

14. Amazon.com Store Card

The Amazon Store Card is reported to be fairly easy to obtain for a variety of credit types. You’ll get the best value out of this card if you’re also an Amazon Prime member, as Prime members earn cash back at a higher rate on Amazon.com and Whole Foods purchases.

- Receive special financing on eligible Amazon.com orders of $149 or more made with your card

- Amazon Prime members also get 5% cash back at Amazon.com

- Pay no annual card fee (Prime fee may apply)

Watch out for this card’s special financing offers; while they seem like a good deal, they use deferred interest, which means you’ll need to pay off every last financed cent or else you’ll be on the hook for interest on the entire financed amount.

15. Old Navy Credit Card

The Old Navy Credit Card offers rewards at Old Navy stores and online, as well as with other Gap Inc.-brand stores. It takes 500 points to earn a $5 Reward.

- Earn 5X points per dollar on purchases at Old Navy and other Gap Inc.-brand purchases

- Reach Navyist status by earning 5,000 points

- Pay no annual fee

One thing to keep in mind with this card is that rewards are capped at $250 per billing cycle. Rewards earned beyond the monthly cap will be rolled over into the next billing cycle.

How Do You Choose a Credit Card?

If you’re on the hunt for a card that’s easy to get, chances are you are dealing with some credit issues that make approval questionable with most prime issuers. As such, choosing a card may come down more to what’s available than what you really want out of your card.

That being said, even in the limited- and bad-credit card markets, you’ll likely have some options. Here are a few things to investigate when comparing credit cards:

- Application/Processing Fees: Some cards, especially cards from subprime issuers, may charge a fee simply to apply for the card or to open the account.

- Annual Fees: Some cards can be worth the annual fee, but others won’t be — do the math before you apply.

- Maintenance Fees: Many subprime cards will charge monthly maintenance fees on top of the annual fee.

- Grace Period: Most cards should provide a grace period on interest for new purchases of at least 21 days; check the terms and conditions to be sure.

- Interest Rates: If you ever carry a balance, you should know what it’ll cost you. Check the new purchase, balance transfer, cash advance, and penalty APRs before applying.

- Purchase Rewards: Even consumers with bad credit can find cards with purchase rewards, but make sure the rewards are worth any annual fees.

- Cardholder Benefits: Most credit cards come with additional cardholder benefits that can include things like extended warranty coverage and purchase protection.

In the end, if you’re only looking for a card to build your credit so you can apply for better and more valuable cards in the future, then you don’t need a card with a lot of bells and whistles. Simply choose the least expensive option and use it responsibly for six months or so, then graduate to a better card.

How Do You Build Credit with a Credit Card?

For many folks, a credit card is simply a convenient way to make purchases in-store and online — and, perhaps, a way to earn some rewards while they’re at it. But, when used responsibly, credit cards can be a great tool for building credit for consumers with poor or limited credit histories (and anyone else, too).

Credit bureaus keep a record of your card account, including your total credit limit, balance, when the card account was opened, and whether you paid on time.

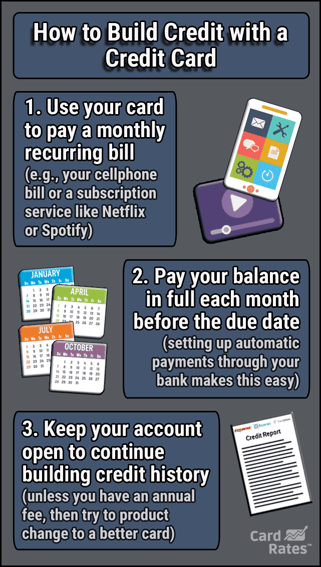

The basics of building credit with a credit card consist of just using the card to make your normal purchases, then paying the balance in full and — most importantly — on time every month. If you pay in full each month, you typically won’t be charged interest, and the positive payment history will boost your score.

At the very least, make the minimum required payment (but, ideally, more) before the due date each month. While not the best strategy for saving money, it will build your payment history.

If your sole credit card goal is to build credit, then you can take this method and set it on autopilot. Essentially, all you need to do is use the card to automatically pay a monthly recurring charge, such as a streaming service or your cellphone bill.

Then, set up automatic payments for the card through your bank account so that the bill is paid each month without you needing to do a thing. Automatic payments mean you won’t have to worry about making late payments, as the bank makes the transaction for you each month. (Of course, you’ll still want to double-check your accounts to ensure nothing went wrong with the payment.)

What is Credit Card Pre-Approval or Pre-Qualification?

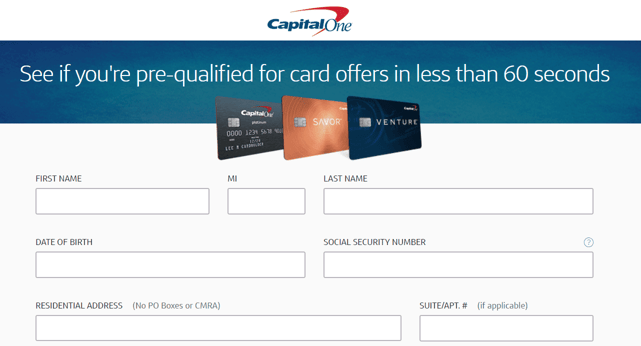

Given that any credit card can be easy to get if your credit is good enough, it’s sometimes hard to tell which cards are actually attainable. Pre-approved or pre-qualified credit card offers can be an easy way to get an idea as to whether you’ll be approved for a certain card before you apply — and before the hard inquiry hits your credit reports.

Many issuers will let you check for pre-approval offers to get an idea of your approval chances.

Pre-approval or pre-qualification is a credit card issuer’s way of getting an idea of your qualifications without going through a full hard credit inquiry. Instead, pre-qualification uses a soft credit pull that won’t hurt your credit scores.

At the same time, because pre-approval applications don’t look at your credit report as deeply as a regular application, being pre-approved for a credit card offer doesn’t guarantee you’ll be accepted when you apply.

Other factors, including your income and your history with the bank, can impact your chances of being approved.

Credit Cards Don’t Have to Be Hard to Get

In today’s digital economy, credit cards are a big part of how millions of Americans make purchases. But some folks have a harder time than their neighbors when it comes to getting new credit cards. Consumers with poor or limited credit histories can find getting a new card to be a challenging experience.

The easiest credit card to get will depend on your specific creditworthiness, so knowing where you stand can go a long way in finding the right card. You can get a free copy of each of your credit reports once per year through AnnualCreditReport.com.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Easiest Credit Cards to Get Approved For ([updated_month_year]) 6 Easiest Credit Cards to Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Easiest-Credit-Cards-to-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year]) 8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Approval-Cards-For-Fair-Bad-Credit.jpg?width=158&height=120&fit=crop)

![6 Easiest Chase Cards to Get ([updated_month_year]) 6 Easiest Chase Cards to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/easy2--1.png?width=158&height=120&fit=crop)

![#1 Easiest Capital One Card to Get ([updated_month_year]) #1 Easiest Capital One Card to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Easiest-Capital-One-Card-to-Get.jpg?width=158&height=120&fit=crop)

![7 Easiest Balance Transfer Cards to Get ([updated_month_year]) 7 Easiest Balance Transfer Cards to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Easiest-Balance-Transfer-Cards-to-Get.jpg?width=158&height=120&fit=crop)

![11 Easiest Online Loans ([updated_month_year]) 11 Easiest Online Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/07/shutterstock_443859163.jpg?width=158&height=120&fit=crop)

![11 Easiest Loans To Get Approved For ([updated_month_year]) 11 Easiest Loans To Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Loans-To-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)