If you are an entrepreneur, the best cash back credit cards for business are like having a partner who lets you make all of the decisions and reap all of the rewards.

Adding a cash back credit card to your wallet can help you recoup some money from all of the inevitable charges that make up your day-to-day operations. And, depending on how much you spend, the cash back you earn can go a long way toward boosting your bottom line.

What’s more, a cash back business credit card can help you develop a business line of credit. In a world where access to capital sinks so many young businesses, this is a lifeline you don’t want to go without.

Best Overall | Instant Redemption | Choose Your Earnings | Flat-Rate | Amazon/AWS | Bulk Purchases | Bad Credit

Best “Overall” Cash Back Card for Business

The Ink Business Cash® Credit Card from Chase is the sister card to the Ink Business Preferred® Credit Card.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

If you don’t want to worry about juggling points and comparing redemption values — and you simply want a card that rewards you with cash back for every qualifying purchase — this is the card for you. Employee cards come at no additional cost, and zero liability protection means you won’t be liable for unauthorized charges made with your account.

Best “Instant Redemption” Cash Back Card for Business

The Blue Business Cash™ Card handles cash back a little differently than do typical cash back credit cards for business. Instead of allowing you to redeem your cash back for a check or direct deposit into a linked checking account, American Express automatically applies any cash back rewards you earn with this card to your statement.

- Earn a $250 statement credit after you spend $3,000 in purchases on your Card in your first 3 months.

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement.

- Buy above your credit limit with Expanded Buying Power. Make business purchases over your credit limit with no penalty or enrollments, and still earn cash back on those purchases. Terms apply.

- 0% introductory APR on purchases for 12 months from the date of account opening, then a variable APR applies

- Get an application decision in as little as 30 seconds

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

18.49% - 26.49% Variable

|

$0

|

Good/Excellent

|

If that is acceptable to you, this card can help you rack up cash back rewards to eat away at your current balance before any interest applies to the charge. It is still a substantial savings opportunity despite the different format. This card is ideal if you think you may forget to redeem your rewards or just don’t want to deal with it.

Best “Choose Your Earnings” Cash Back Card for Business

The Bank of America Business Advantage Customized Cash Rewards credit card offers unlimited cash back rewards and lets you choose one of six categories to earn your top rewards rate.

3. Business Advantage Customized Cash Rewards credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Business Advantage Customized Cash Rewards credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

This card also typically offers a cash back welcome bonus offer with a promotional period during which you can enjoy interest-free financing as a new cardholder. That is a big deal if you own a business and need to make a large purchase in the near future.

Best “Flat-Rate” Cash Back Card for Business

The Ink Business Unlimited® Credit Card from Chase is one of the best entry-level business credit cards on the market thanks to its unlimited cash back earnings and lucrative offers for new cardholders.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

This is a no-fuss card that earns a flat-rate on all purchases, so you don’t have to worry about using the card at certain places to get the most bang for your buck. Employee cards come at no additional cost, and you won’t be held responsible for unauthorized charges made with your card.

Best “Amazon” Cash Back Card for Business

The Amazon Business Prime Card and a Prime membership can make your combined purchases at Amazon.com, AWS, Amazon Business, and Whole Foods Market even more lucrative.

- Welcome Offer: Receive a $125 Amazon.com gift card upon approval

- 5% Back or 90 Days Terms on U.S. purchases at Amazon Business, AWS, Amazon.com, and Whole Foods Market with an eligible Prime membership on the first $120,000 in purchases each calendar year, 1% Back thereafter

- 2% Back on U.S. purchases at restaurants, gas stations, and wireless phone services purchased directly from service providers

- 1% Back on all other eligible purchases

- Expense management tools to help you track and organize expenses

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% - 27.49% Variable

|

$0

|

Good/Excellent

|

Even if you opt not to link a Prime membership to your card, you can still earn a generous cash back rate on purchases through Amazon or any other business you transact with. This is the ideal choice for business owners who rely on Amazon to run their business.

Best “Bulk Purchases” Cash Back Card for Business

The Costco Anywhere Visa® Business Card by Citi can supercharge your cash back earnings on everyday purchases for your business. If you rely on bulk purchases to run your business, this is the card for you.

6. Costco Anywhere Visa® Business Card by Citi

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Citi is a CardRates advertiser.

There’s no annual fee with your paid Costco membership, but its rewards are a bit limiting in that your cash back will be provided as an annual credit card reward certificate once your February billing statement closes. This certificate is only redeemable for cash or merchandise at Costco.

Best “Bad Credit” Cash Back Card for Business

The Wells Fargo Business Secured Credit Card is a great choice for entrepreneurs with low credit scores and/or a nonexistent business credit history. It’s one of the few secured business cards on the market, and you’ll have your choice of flat-rate cash back rewards or points with this card.

7. Wells Fargo Business Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

This card also has one of the highest secured credit limits we’ve seen, so if you have the money to put down to secure the credit line, you can access a sizable credit limit for all your business purchasing needs.

How Can You Earn Cash Back on a Business Credit Card?

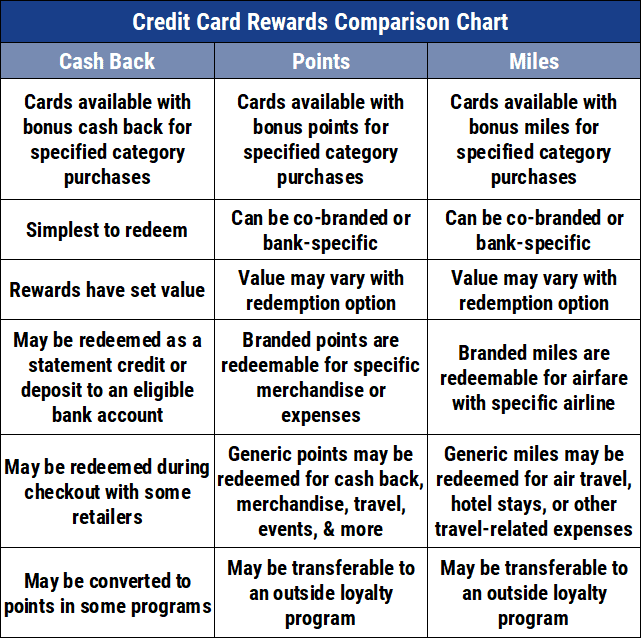

Rewards credit cards have exploded in popularity over the last decade and have become the preferred form of plastic for both individuals and businesses. In terms of cash back, the rewards work the same for consumer cards as they do for business credit cards.

With a cash back business credit card, you receive a set percentage of cash back for qualifying purchases. You can let the cash back you earn accrue in your account or redeem it whenever you choose.

Your redemption options will vary based on your credit card. Most cash back cards let you choose to have your earnings deposited into a linked bank account, have a paper check mailed, or apply your earnings as a statement credit to help cover your current balance.

Some cards, such as the Blue Business Cash™ Card, only allow you to apply your cash back rewards as statement credits.

The amount of cash back you earn will also depend on your chosen credit card. Some cards, such as the Ink Business Unlimited® Credit Card pay a flat-rate percentage of cash back for any qualifying purchase you charge to the card. Others may offer tiered categories that pay higher rewards for specific purchases.

For example, a card may offer 4% cash back at gas stations, 3% at restaurants and grocery stores, 2% at drug stores, and 1% on all other purchases. This system encourages cardholders to use their card to make everyday purchases.

Using the percentages above, a $100 purchase at a grocery store would yield $3 in cash back. Spending $40 to fill up your car with gas would earn you $1.60 in cash back. A $200 online purchase would yield $2 in cash back.

While these numbers may not seem like much, they definitely add up over time. Let’s say you fill your gas tank up once a week. In one year, those $40 purchases would net just over $83 in cash back — enough to cover two weeks’ worth of gas. And if your card doesn’t charge an annual fee, this is quite literally two free tanks of gas you earned just for using your card.

Of course, this example assumes you’re paying your balance off each month and avoiding expensive interest charges that eat away at any rewards you earn.

In 2019, the average American household spent nearly $10,000 on food for the year. If you were to use the hypothetical credit card above, those purchases would earn you $300 in cash back.

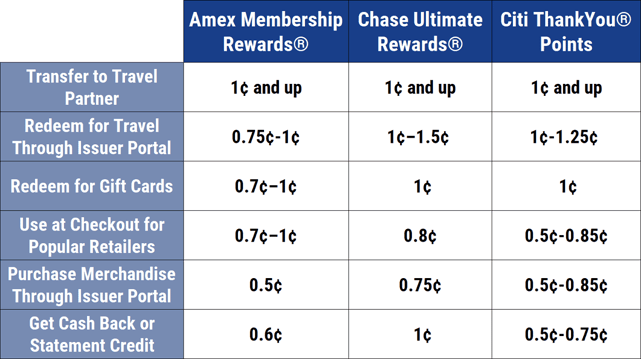

Some credit cards offer points that can be redeemed for cash back. These programs, such as the popular Chase Ultimate Reward program, let you redeem for cash back or use your points toward several other redemption options. This is why points are often referred to as being flexible — cardholders generally have far more options for redeeming their rewards, including using them to pay for merchandise, gift cards, or to access exclusive experiences.

But points usually yield the least value for cash back, whereas you would get a boost in value for your points if you redeemed them for travel or whatever other promotion the bank has going on at the time.

All said, if you want some variety in your rewards, a points card is the way to go. But if you’re only interested in cash back, you are better served with a card that only offers cash back. These cards typically have a higher rate of return than a card that allows you to redeem your points for cash.

What is the Best Cash Back Business Credit Card?

This question requires a two-part answer because you can earn cash back with a business credit card in two ways — points or traditional cash back.

With a points card, you can redeem your earned rewards for cash back or a host of other valuable discounts or merchandise. A traditional cash back card specializes in cash back — and typically at a higher rate than a points card.

If you only want cash back, you can’t go wrong with the Ink Business Cash® Credit Card from Chase.

This card has special bonus categories that can help you earn far above the industry average in cash back. Even if your average purchase does not fall in a bonus category, you can still earn slightly more than the industry average for those purchases.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

On top of the rewards earnings, cardholders can also take advantage of employee card offers as well as business monitoring and protection that guard your operation against fraud while offering purchase protection, personalized account alerts, and other benefits — all with no annual fee.

Consider the Ink Business Cash® Credit Card‘s sister card — the Ink Business Preferred® Credit Card — if you’re interested in earnings points.

This card has ranked as our highest-rated business credit card for some time because of its ability to rack up rewards points in a hurry. These points can net you cash back, but you can also redeem them for amazing travel discounts, gift cards, merchandise, and other perks.

When it’s time to redeem your points, you will find that you can get up to 25% more value when you redeem them for various travel accommodations. That makes this card a winner if your business has you on the move regularly. You can also benefit from free employee cards and the same business monitoring and protection services offered through the Ink Cash card.

What is the Best Credit Card for Small Business?

Every entrepreneur knows how important working capital is to operations. Business expenses add up quickly, and cutting costs is a skill that every business owner needs to master.

If you’re already paying hefty prices for technology, office supply store purchases, rent, and utilities — why add another expense in the form of a credit card that charges an annual fee?

The best credit card for a small business is one that offers lucrative rewards with no annual fee — and our favorite is the same card mentioned above, the Ink Business Cash® Credit Card from Chase.

Thanks to bonus categories, this card offers huge potential cash back earnings and a generous unlimited rewards rate on all other eligible net purchases. Cardholders also gain access to Ink Insider and its plethora of discounts and bonus rewards opportunities that rotate regularly.

This includes an Avis Corporate Rewards Program membership to help you earn free rental reward days. Your card also unlocks savings on Avis rentals and free one-car-class upgrades, among other perks and discounts with Avis.

Business owners can also enjoy free employee card printing with set spending guidelines for each card. This means you can give specific employees access to your full credit line or limit each employee to a specific spending limit or charge type.

And as your company grows, you can potentially graduate to another Chase credit card, such as the Ink Business Preferred® Credit Card that offers rewards points with greater redemption options for a small annual fee.

How Do I Apply for a Business Credit Card?

The process of applying for a business credit card is very similar to that of applying for a consumer credit card. You can click the links to any of the cards above to begin the application process.

Since these are business credit cards, you will need to run a business to qualify. Thankfully, banks are pretty flexible with their definition of a business. If you cut lawns on the weekend, tutor kids after school, or resell items you buy at garage sales, you can likely qualify as a business.

If you own a small business that does not have its own credit history, the bank will rely on your personal credit history to make an application decision. This line of credit will be tied to your name, though. That means any late payments or defaults will damage your personal credit history as well as your business credit profile.

You will need to supply some specific information to apply for a business credit card, including:

- Your business name. If you freelance or have a sole proprietorship, enter your name.

- Your business address and phone number. Wherever your business is located, including your home address if you work from home. You can also supply work and/or personal phone numbers.

- Industry type and company structure. This is the industry your business falls under and whether you have a corporation, partnership, sole proprietorship, or other company structure.

- Years in business. It’s okay to put zero here if you’re a new business.

- Number of employees. If you are the only employee, enter one.

- Annual business revenue. This is your total annual business revenue and not your business profit. Be honest with this number as some banks may require you to provide documentation to verify it.

- Estimated monthly spend. Enter the average monthly business expenses you plan to charge to your card.

- Tax identification number. This is either your employer identification number (EIN) or Social Security number (SSN). You may have to provide both if the application will use your personal credit history for approval.

- Personal information. This could include your home address, monthly rent or mortgage payments, and your total annual income. Include any income you receive — not just proceeds from the business.

If you apply online, most banks can provide a credit decision in a matter of seconds. This may take longer if the bank requires more information from you. This could include proof of income, sales, or clarification on any details you stated in your application.

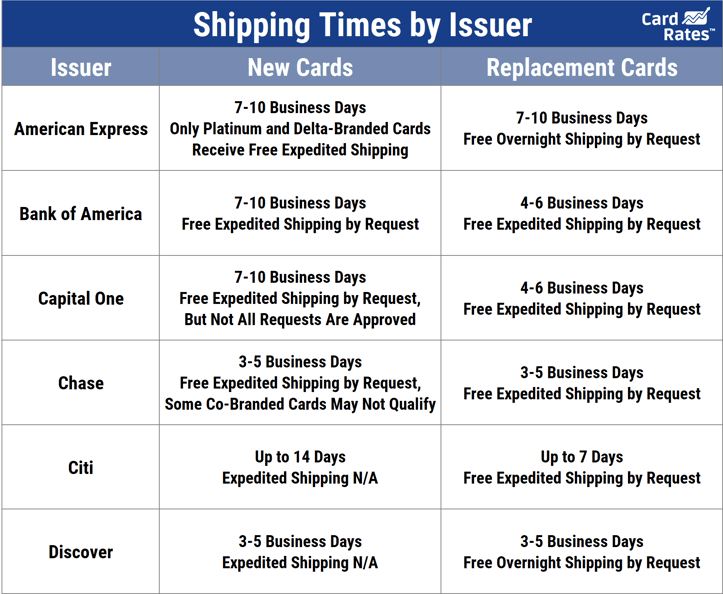

If approved, the bank will provide you with your new card’s credit limit and begin the process of printing and shipping your card. You should receive the card within seven to 10 business days.

Once the card arrives, you can activate it online or over the phone and begin using it right away.

What Credit Score is Needed for a Business Credit Card?

Your personal FICO score ranges between 300 and 850 and has several different tiers on its way to excellent credit.

For most business credit cards, you will need at least a good credit score for approval. That means any score at or above 670.

But even if you have a poor personal credit score, you may still be able to qualify for a business credit card. A secured business credit card may not require a credit check at all for approval. That is because a secured card will require a refundable security deposit for approval.

Think of this deposit as the same sort of security deposit you place on a rental car before you get the keys. If you return the car in the same condition as when you received it, you will get your money back. If you wreck the ride, the rental agency will keep your deposit (plus whatever other charges the damage incurs).

The same goes for a secured business credit card. As long as you cancel your account with no outstanding debts, you will receive your full deposit back.

And the nice part of a secured card is that you essentially get to choose your own credit limit. That is because your spending limit will match the amount of your deposit. Want a $10,000 credit limit? Many secured business cards will allow that — so long as you can ante up a $10,000 deposit when you open your account.

Which Business Card Offers the Best Rewards?

We’ve already told you we like the Ink Business Cash® Credit Card for earning cash back. But if you want options with your rewards, you can’t go wrong with the Ink Business Preferred® Credit Card.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

With your card, you earn and accrue points that you can redeem for a host of rewards options.

Keep in mind that your points have varying values depending on how you redeem them. For example, a single point may have up to 25% more value if you redeem it for travel deals than if you redeem it for cash back.

Chase offers many travel deals to choose from. You can pay for all or part of your airfare, rental car fees, ride-sharing services, hotel or resort stays, cruises, or certain excursions.

Certain airlines also allow you to initiate a 1:1 point transfer to their loyalty programs. This allows you to use your rewards for airfare, seat upgrades, on-board purchases, and more.

Aside from travel, Chase also partners with Apple in its Ultimate Rewards Store. Through this portal, you can purchase Apple products and services using your points.

You can also shop directly on Amazon using your points when you link your card to your Amazon account, purchase one of more than 150 gift card options, gain access to exclusive events and experiences, or redeem your points for cash back. Chase is constantly adding new redemption options to the Ultimate Rewards program, which is why we prefer this points option to any other on the market.

And the Ink Business Preferred® Credit Card makes it easier than ever to earn bonus points for yourself or your business. For starters, this card typically offers a very generous signup bonus that allows you to earn a large number of bonus points if you reach certain spending thresholds within your first three months with the card.

You can also earn points for eligible net purchases on travel, shipping, internet, cable, phone, and advertising for your business. In short, this card rewards you with points for taking care of your business. It doesn’t get much better than that for entrepreneurs who want to see their business reach its full potential.

How Do I Get My First Business Credit Card?

A business credit card is something that should be able to grow with your business. That is why getting your first business credit card should always start with one very important step:

- Research: Look at every card you may qualify for and factor in which one works best for your type of business and the spending you do. You do not want to invest in a card that offers bonus cash back for gas station purchases if you rarely visit a gas station. Maybe a card with bonus rewards for office supply store purchases or shipping and advertising charges may be more up your alley. Maybe a card with a good sign up bonus is better for your bottom line.

- Apply: This may seem like a formality, but you can improve your chances of approval if you plan ahead. Have all of your business and personal financial documentation ready and maximize every chance you get to impress the bank. This means adding all of your personal income to your part of the application, which shows that you can repay any debts the business incurs on the card.

- Spend wisely: Getting the card is the first step — maintaining your card account is something that will continue for years to come. Keep your balances low, leverage any bonus cash back or point rewards you accumulate, and pay on time every billing cycle. Doing so will help you earn future credit limit increases and potentially give you access to more affordable financial products from the card issuer and bank.

If you apply online, the bank will likely give you a credit decision within one minute. You will see one of three determinations at that moment: a rejection, an approval, or a pending approval.

A pending approval likely means that the automated underwriting system flagged your account and it needs to be reviewed by a human. That sounds worse than it is. The bank may request further documentation from you to prove your income or the business income. The faster you provide that information, the quicker the bank can make a decision.

If you get the dreaded rejection, the bank must send you an adverse action letter in the mail within seven to 10 business days. This letter will outline its reason for the rejection and possibly provide some tips on how to get approved in the future.

If you are approved, the bank will show you the credit limit of your new card. Some banks will allow you to access your new credit account right away via a temporary card number. Your new business credit card will arrive in the mail within seven to 10 business days.

Once the card is in your hand, you can activate it online or over the phone. At that point, the card is ready to use, and you can begin building business credit.

Is it Worth Getting a Cash Back Credit Card?

It is worth getting a cash back credit card — if you can manage the card responsibly.

With a traditional credit card that has no rewards, you simply pay full price for everything and pay the debt off when it posts to your card account. With a cash back credit card, you get money back for every eligible purchase you charge to the card.

An eligible purchase is typically any new purchase you make. You will not earn cash back for completing a balance transfer or cash advance.

Some cash back rewards cards will charge an annual fee for membership. To make one of these cards worthwhile, you have to charge enough to your card to earn the reward needed to offset the cost of the card.

But not every cash back rewards card will charge an annual fee. With those cards, all of the rewards you earn are like icing on the cake (as long as you’re not paying interest on your purchases).

Most cards allow you to earn an unlimited number of rewards. So if you charge your monthly bills to the card and pay the debt off as soon it posts to your card account, you can get money back for the expenses you have to pay anyway. So, why not maximize your spending power?

But keep in mind that you can only make a cash back rewards card worthwhile if you pay your debt in full each month. Never spend more than you can afford to repay in hopes of racking up cash back rewards.

In the end, your card’s monthly variable APR will be greater than your rewards rate. That means you will pay more in interest than you will earn in cash back, and that is a losing proposition.

But if you keep your balance low and utilize your bonus spending categories and signup bonus opportunities, you can use a cash back rewards credit card to come out ahead.

Another thing to take note of is the ways in which your cash back credit card allows you to redeem your rewards. Just about every credit card company will send you a check or transfer your earnings to a linked checking account or savings account.

Most will also allow you to apply your earnings as a statement credit that helps pay down your current balance. Some cards may set a minimum amount of cash back rewards you must earn before you can redeem them.

The Blue Business Cash™ Card adds an extra wrinkle to the redemption process and will only allow cardholders to redeem their cash back rewards as a statement credit. There is no limit to the number of rewards you can earn, but do not expect to get cash in hand with this Amex offering.

Is it Better to Get Cash Back or Points?

Points offer more flexibility, but cash back offers a higher rate of liquid return.

If you want options as to how to redeem your rewards, a points credit card is the route you should take. This will allow you to maximize your points for the betterment of your business. You can use points to purchase supplies or equipment directly through Amazon or purchase travel accommodations for a business trip or upcoming conference.

Some card issuers even allow you to redeem your points to gain access to exclusive events or experiences that would be a great way to entertain a big client.

If you are a little short on cash at some point, you can also use your bonus points for cash back. When the holidays roll around, your points can net you a diverse selection of gift cards to hand out to employees. The options are vast with this type of card.

But if you don’t want to juggle varying point values and redemption options, or you simply want to earn a flat rate of cash back for every purchase you make, you can’t go wrong with a cash back credit card.

If cash back is your only desire, you will almost always earn a higher rewards rate through a dedicated cash back credit card than you would with a points rewards credit card.

Points rewards cards have different values for different redemption options. You will typically find that travel rewards give you maximum point value. If you don’t travel much, this may not be worth it to you.

And since banks are not too keen on giving away money, you will often find that cash back offers the least value for your points. That is why you should stick to a dedicated cash back rewards card.

And while you are shopping for the best cash back credit cards for business, seek out a card that offers bonus categories you will use regularly.

For example, a card may offer 3% cash back at gas stations and 1% on everything else. If you do not spend much money at gas stations, that may not be the card for you. But a card that offers 5% back on office supply store purchases and 2% everywhere else may be your best bet if you are constantly running out of paper, ink, and other office supplies.

What Business Credit Card Gives the Highest Credit Limit?

The line of Ink Business credit cards from Chase typically offer the highest starting spending limit for new cardholders — and the competition isn’t really close.

Reviews show that the minimum starting credit limit for the Ink Business Preferred® Credit Card is approximately $5,000 — but reviews show many applicants receiving a spending limit of $21,000, $25,000, $34,000, and even $56,000.

While some of these numbers may not be that common, they are not completely out of the ordinary.

Keep in mind that not just anybody can qualify for these cards. The reason Chase can grant such high spending limits to new cardholders is that it is very picky with which applications it approves.

You will need an average personal credit score of no lower than 660 for consideration. To get a higher spending limit, though, you will need a better credit score and a few more impressive numbers on your application.

Along with your credit score, Chase also wants to see that you have a successful business history. A startup of just a few months old may not qualify for a very large credit limit. In addition, Chase wants to know that you can repay any debt you accrue. If the bank is going to extend a large amount of potential debt to you, it wants to see that your business is very profitable.

It doesn’t hurt to have a personal relationship with Chase as well. In the reviews linked above from consumers who received high initial credit limits, you will find that most had a long-standing personal or business bank account with Chase before applying.

Surprisingly, some of these successful applicants submitted a cold application — meaning they were not prompted to apply by an email or mailer. This shows that you may still receive a very high initial credit limit even if Chase does not approach you first.

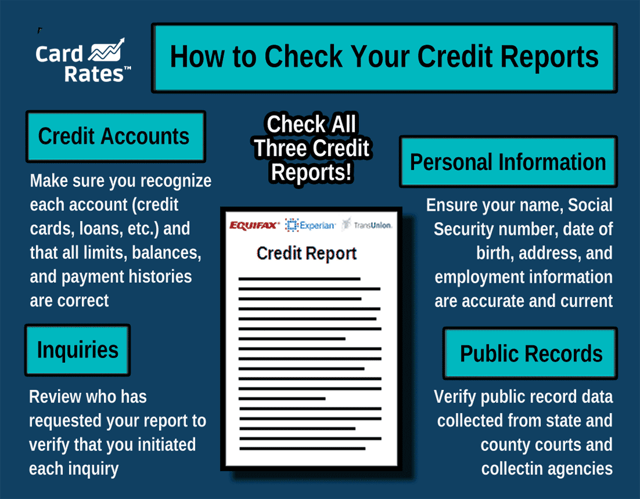

Before you make the leap and apply for a Chase card with dreams of a large spending limit, be sure to know exactly what is on your credit report. This may mean pulling your free annual credit report to get a peek at where you stand.

While this report will not show your actual credit score (several other sources offer free credit scores), it will break down all of the information used to calculate that score. If you see recent negative items, you may want to hold off on your application until you can rebuild a positive history.

Patience is the key when searching for a business credit card with a high limit. No bank is in a hurry to extend credit to a business that will not take its time and do things right.

Is it Hard to Get a Business Credit Card?

Many people think you have to own a major corporation to obtain a business credit card. The fact is that qualifying for a business credit card is no harder than qualifying for a personal credit card.

That’s because most banks will use your personal credit history in place of your business credit history if your operation is new or otherwise doesn’t have a credit history.

And banks have a very loose interpretation of the term business. If you occasionally sell things at a flea market or you are an eBay flipper, you will likely qualify as a business owner in most bank’s eyes.

While a bank will want to see that your business is growing and making money, it will not completely disqualify you if you are not rolling in the dough quite yet. Most business credit cards are designed for small business owners and entrepreneurs who are still putting in the work to get to the profit.

That said, you may not have a very good chance of approval if your personal credit score is poor and your business is barely hanging on. It’s the same with a personal credit card — you need income to show that you can successfully handle any debt you accumulate.

You will have an opportunity to enter your own personal details during the business credit card application process. This may include any income you have beyond the business. If you still maintain your regular 9-to-5 job or you have other sources of income, you can increase your odds of approval because the bank will see that you have a backup source of income to repay your debt.

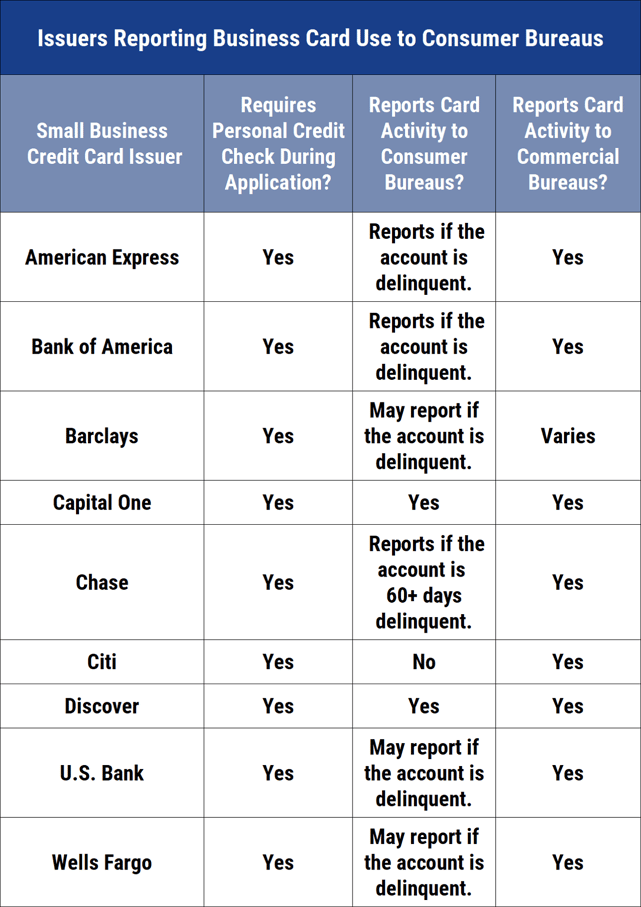

Just remember that any business credit card that attaches to your personal credit will also report to each credit bureau under your name. That means that late payments or defaults can wreak havoc on your personal credit score.

On the flipside, responsible behavior will improve your credit standing and can work to get you future card upgrades or credit limit increases.

What Credit Score Do I Need for a Chase Business Credit Card?

According to our research, the minimum credit score that Chase will consider for a business credit card is approximately 660. This is not a set number, though, and reaching that number will not guarantee your approval.

But your credit score is not the sole determining factor in your credit card eligibility. If anything, it is simply a key that can get you through the door. You may need to show that your business has a history of being profitable and that you are responsible with both your personal and small business credit.

Banks want to see a total package from an applicant. After all, any credit card assigned to you is essentially an investment in your business. A bank only wants to make winning investments, so it is up to you to show the bank that you are a good bet.

You can start by checking with the credit cards issued by any bank you have a working relationship with. These banks can easily access your account history and see if you have regular income — hopefully with less going out than coming in. You can also leverage a long, successful business relationship with the bank when negotiating for a new card or spending limit.

While most people fixate on their credit score when it comes time to apply for a new card, you should consider all of the other things a lender will want to examine before investing in you.

What is the Easiest Business Credit Card to Get Approved For?

Just like in the consumer credit card sector, a secured business credit card is the easiest for any applicant to obtain.

A secured credit card will require a refundable security deposit for approval. Your credit limit will almost always match the amount of your deposit. For example, a $5,000 security deposit will net you a $5,000 credit limit.

Most secured business credit cards will have a minimum and maximum security deposit allowed for approval. The Wells Fargo Business Secured Credit Card, for example, accepts deposits of $500 to $25,000.

Since your security deposit backs your account against default, you may not even have to undergo a credit check for account approval. If the bank does require a credit check, it will likely not fret over your low credit score. Instead, it will look to make sure you are not in the midst of bankruptcy proceedings or have any outstanding tax debts to federal, state, or country collectors.

If you meet those requirements and can cover the cost of your security deposit, chances are you will be approved for a secured business credit card.

Keep in mind that your deposit does not take the place of your payment. The bank will store your deposit securely until you cancel your account. You will still have to repay any charges to place on the card.

You will receive a full refund of your deposit when you cancel your account or are upgraded to an unsecured card, as long as you are in good standing with no debt owed to the bank.

What is the Difference Between a Personal and Business Credit Card?

There is no difference between a business credit card and a personal credit card when making a purchase. Both cards access the same credit card networks and work in the same ways. The differences begin in the application process and continue in how the card is branded.

During the application process, you will need to supply your business information to the bank. The bank or card issuer will want to know what kind of business you run, how long the business has existed, and the income generated from your business.

If your business does not have its own credit history, the bank will likely lean on your personal credit history for approval. Consider yourself the cosigner for your business. If the business fails to repay its debt, the card issuer will come knocking on your door for the money.

If approved, you will receive your card in the mail in between seven and 10 business days. You will notice that the card will have the name of your business printed on the front along with your name. That is because the card will effectively tie to the business first and you second.

Having your name on the card shows that you are the only authorized user for that card. You can often have employee cards printed for your credit account that have specific employees’ names printed under the business name on the front of the card.

A personal credit card only cares about your personal credit score and income to make sure you can repay any debts you incur. The bank will give a closer look at your business when examining a business credit card application to make sure your company is a good investment.

You may also find that a consumer credit card has a rewards structure that provides cash back or points for the things that most individuals need. This could mean bonus cash back for grocery store and gas station purchases.

With a business credit card, you may see a rewards structure that gives bonus cash back or bonus points for combined purchases at office supply stores or on internet or wireless data plans. Some cards even give extra rewards when you charge your shipping or advertising costs to your card.

Do Business Credit Cards Affect Personal Credit?

If the bank that issued your card requires your personal credit information for approval, then the debt will report to each major credit bureau under your name and the business name.

In this case, any negative or positive reporting will affect your business credit and personal credit at the same time.

If the bank only uses your business credit history for approval, then your personal credit history will not reflect any business credit card activity. Banks require personal credit information when your business is too young to generate a credit history or if the business credit history is not sufficient for card qualification.

This, in essence, makes you a cosigner or guarantor for the card. The bank wants to see that you have sufficient income aside from the business to cover any debt the business may not be able to cover on its own.

Just as it would with any other credit card or loan, your bank will report your payment history and balance to at least one of the three major credit reporting bureaus each month. If your balance is high, it can affect your personal credit utilization rate.

As long as you make on-time payments each billing cycle, you should continue to build a good business and personal credit history.

The bank may also take your personal credit into consideration when you request a card upgrade or credit limit increase.

Many small business owners use their personal credit to help their business develop its own credit rating. This may continue for several years until the business has a long track record of success.

Make sure your personal credit history is in order before you apply for a business credit card so you will be prepared for any further information the bank may request during the application process.

The Best Cash Back Credit Cards for Business Can Help Grow Your Company and Business Credit History

Cash is king — even in the world of credit. That is why so many consumers and business owners flock to cash back credit cards for their reward of choice.

After all, getting cash back is like getting a rebate for every purchase you make. And getting money back is never a bad thing.

But before you pull the trigger on one of these cash back credit cards for business, be certain that you are not better served with the flexibility of points rewards. Although you may not earn as much cash back with one of these rewards structures, you could still have a larger number of reward options at your disposal when it comes time to redeem your earnings.

You can’t go wrong with either option, but once you choose one path, you can’t go back — unless you sign up for an entirely new business credit card.

You should also consider the fees associated with any card option. Annual fees, foreign transaction fees, interest rates, and late fees, among others, can accumulate quickly and eat away at your bottom line if you don’t earn enough rewards to recoup the cost. But if you choose your business credit card carefully, you could end up with a business partner for life.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Best 2% Cash Back Business Credit Cards ([updated_month_year]) 6 Best 2% Cash Back Business Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/2bus.png?width=158&height=120&fit=crop)

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![Financing a Business Using Credit Cards ([updated_month_year]) Financing a Business Using Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Financing-Business-Using-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Best Business Credit Cards for New Businesses ([updated_month_year]) 7 Best Business Credit Cards for New Businesses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/newbus2--1.png?width=158&height=120&fit=crop)

![12 Best Business Credit Cards for Travel ([updated_month_year]) 12 Best Business Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/business-credit-cards-for-travel-feature.jpg?width=158&height=120&fit=crop)

![8 Best Business Credit Cards for Startups ([updated_month_year]) 8 Best Business Credit Cards for Startups ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/Best-Business-Credit-Cards-for-Startups-Feat.jpg?width=158&height=120&fit=crop)

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)