Bank of America’s flagship cash back cards are like two peas in a pod. One pea dispenses the same amount of cash back on all eligible purchases, and the other offers tiered rewards you can control. Except for how the cards distribute their cash back, nary a difference separates one from the other.

Both cards are terrific choices for Bank of America customers who prefer cash back to points. Indeed, these cards have enough broad appeal to attract folks who bank elsewhere.

1. The Bank of America® Unlimited Cash Rewards credit card Offers Flat Rewards On Every Purchase

The Bank of America® Unlimited Cash Rewards credit card pays the same cash reward rate on all eligible purchases. The rewards are unlimited and never expire while the account remains open.

Bank of America® Unlimited Cash Rewards credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The rewards rate is pretty much the industry standard for unlimited cards, but a few of its competitors offer 2% cash back. This card is suitable for everyday purchases since it doesn’t favor any merchant categories.

As with its Customized sibling, the Bank of America® Unlimited Cash Rewards credit card is a Visa Signature card. As such, it offers the automatic benefits available to all Signature cards and a minimum starting credit limit of $5,000.

2. The Bank of America® Customized Cash Rewards credit card Offers Tiered Rewards You Control

Check out the Bank of America® Customized Cash Rewards credit card if you want a measure of control over your cash back rewards.

This card’s premium rewards tier, 3%, applies to your choice among the following merchant categories: gas (the default), online shopping, dining, travel, drug stores, or home improvement/furnishings. You can change categories once per calendar month on the Bank of America website or mobile app.

Bank of America® Customized Cash Rewards credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Bank of America is a CardRates advertiser.

You earn the card’s middle rewards tier, 2%, on purchases at grocery stores and wholesale clubs. But this tier excludes superstores and smaller stores (such as drug and convenience stores) that sell groceries and other products.

Rewards are limited to the first $2,500 of combined net purchases made each calendar quarter. All other eligible purchases earn an unlimited 1% cash back.

3. These Two Visa Signature Cards Share Most Features

Back to the peapod: These two reviewed Bank of America cash back cards offer the following identical features.

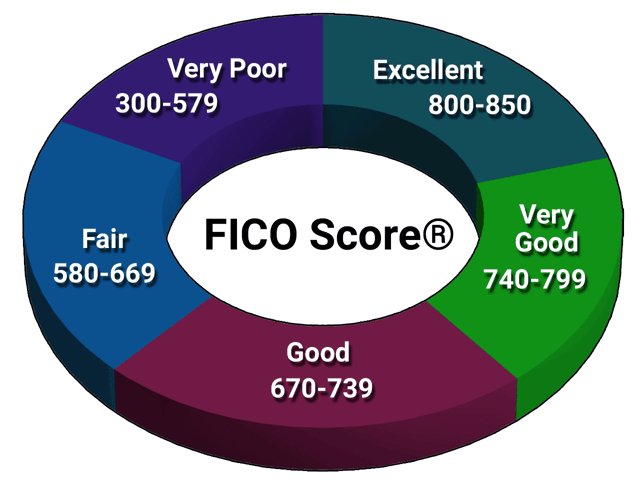

Credit Requirements

You must have a good to excellent personal credit score to obtain these cash back cards. This requirement translates into a minimum FICO credit score of 670 within the 300 to 850 scoring range.

With the average US FICO score hovering around 714, it appears that most American consumers can qualify for these Bank of America cards.

Credit Limit

These two cash back cards carry the Visa Signature logo, meaning their minimum credit limits are $5,000. You may qualify for a much higher limit depending on your financial status and credit history. Online forums mention a maximum credit limit of $99,900 for Bank of America credit cards.

Signup Bonus

These two cards usually offer a signup bonus. Although the details may change from time to time, the general scheme is to award new cardmembers a cash back bonus in exchange for a set amount of spending on purchases that post within the introductory period, typically 90 days.

Introductory 0% APR

Both of these cards offers new cardmembers a 0% intro APR on purchases and balance transfers. Only balance transfers you make in the first 60 days after account opening take advantage of the 0% offer.

After the promotional period ends, you’ll pay the cards’ regular APR on any remaining balances. Each balance transfer incurs a 3% transaction fee.

Regular APR

The APR you receive depends on your creditworthiness when you open the account. The cards’ terms and conditions specify the APR range that the credit card issuer uses to assign your interest rate. APRs vary with the market and are based on the prime rate.

If you fail to pay at least the minimum amount due by the deadline, the cards will apply a penalty APR indefinitely.

Annual Fee

Neither card charges an annual fee.

Other Card Fees

These cash back cards’ few fees result from the following:

- Balance transfer transactions

- Cash advances

- Foreign transactions

- Late payments

The first late payment carries a lower fee than fees for subsequent late payments that occur within six billing cycles of the first fee. The fee will not exceed the total minimum amount due. The bank will not assess the late fee if your balance is $100 or less on the due date.

Reward Redemption

You can redeem cash rewards for a statement credit, check, or deposit made directly into a Bank of America checking or savings account. You can also receive a credit to a qualifying Cash Management account or 529 account with Merrill Lynch.

You can request redemptions at any time; some redemptions may be subject to a minimum amount, such as $25.

As long as your account remains open and in good standing, cash rewards do not expire. If you or the bank close the card account, you will forfeit unredeemed cash rewards unless specifically authorized by the bank.

Preferred Rewards

Cardmembers get a 25%-75% rewards bonus with the Bank of America Preferred Rewards Program. Enrollees earn benefits based on their Bank of America and Merrill Lynch account balances.

The four reward tiers vary according to the three-month combined average daily balance:

- Gold Tier ($20K to <$50K): 25% rewards bonus

- Platinum Tier ($50K to <$100K): 50% rewards bonus

- Platinum Honors Tier ($100K to <$1M): 75% rewards bonus

- Diamond Tier ($1M and up): 75% rewards bonus and no international transaction/ATM fees

Enrollees also get a better deal on savings rates, mortgages, banking and brokerage fees, and home equity and auto loans, among other financial products.

While impressive, the most premium rewards require you to maintain $100,000 or more in a Bank of America or Merrill Lynch account. For many, these rates are out of reach.

Bank of America Benefits

Cash back card owners receive the following benefits from Bank of America:

- Technology: These contactless cards allow you to pay quickly and securely with a tap. The cards integrate with digital wallets, allowing you to pay at stores, online, and in apps without taking out your wallet. This technology means that your actual card number doesn’t reside on your devices or appear to merchants. Mobile banking lets you make a card payment, check your available credit, and transfer funds, among other things.

- Alerts: Cardmembers can stay current on their balances and due dates by setting up various text and email alerts at no charge.

- Free FICO Scores: You get access to your free FICO Score every month. You can see the key factors affecting your score, track your score over time, compare it to the national averages, and access Better Money Habits® to learn about maintaining good credit.

- Overdraft Protection: Optional Bank of America Balance Connect® automatically draws cash advances from your credit card to protect against checking account overdrafts. Cash advance interest charges and transaction fees apply.

- Museums on Us: Bank of America gives free general admission to its cardholders at more than 225 museums and cultural centers around the US on the first Saturday and Sunday of each month.

- Paperless Statement Option: You can use paperless credit card statements to increase account security while reducing paper consumption. You can review these online documents to verify you received an anticipated statement credit.

Cards will be mailed with a complete guide to benefits. You can also call 1-800-592-4089 to discuss card benefits.

Visa Signature Benefits

Signature is the middle Visa benefits tier, between Traditional and Infinite. Visa Signature cards may receive the following additional benefits:

- Rental Car Benefits: You receive auto rental collision damage waivers, rental discounts, and complimentary upgrades from participating rental companies

- Concierge: 24/7 complimentary personal assistance with travel, dining reservations, event tickets, gift deliveries, and other unique lifestyle requests

- Roadside Dispatch: This is a pay-per-use roadside assistance program. Available 24/7, roadside dispatch will ask for your location and problem description. The agent will remain on the phone with you while arranging a dispatch to a reliable tow operator or locksmith — you pay a set price per service call.

- $0 Liability Guarantee: This feature covers fraudulent transactions made by others using your account. Accountholders may file claims against posted and settled transactions, subject to verification and dollar limits.

- Lost Luggage Reimbursement: When you use your covered card to purchase an airline or common carrier ticket, you can receive reimbursement for your checked luggage or carry-on baggage and their contents in the event of theft or misdirection by the carrier.

- Trip Delay/Cancellation/Interruption Reimbursement: This benefit can help reimburse the non-refundable cost of your passenger fare for canceled or interrupted travel. Trip delay coverage pays up to $300 when you must cool your heels for more than 12 hours due to a covered hazard.

- Travel and Emergency Assistance: When traveling or working anywhere, your covered Visa Signature card gets you 24/7 access to a multilingual call center. Services include medical referral assistance, emergency transportation, translation, and messaging, prescription and document delivery, legal referral assistance, emergency ticket replacement, and lost luggage locator service.

- Extended Warranty Protection: When you use your covered Visa Signature card for eligible purchases, extended warranty protection will double the term of your qualified manufacturer’s US warranty up to one additional year on warranties of three years or less. The term doubles for warranties of less than one year.

This is only a partial list of Visa Signature benefits. The credit card issuer decides which it will make available, so check with Bank of America for the definitive word.

4. Decide Which Is Best By Calculating Which Card Will Pay You More

Suppose you are a frequent traveler and set your 3% custom reward to travel. You use your Bank of America® Customized Cash Rewards credit card to charge $5,000 in the quarter on the following eligible purchases:

- Travel: $2,000

- Groceries/wholesale clubs: $1,000

- Miscellaneous purchases: $2,000

Your Bank of America® Customized Cash Rewards credit card rewards will be ($2,000 x 3% for travel rewards) + ($500 x 2% for grocery rewards) + ($2,500 x 1% for miscellaneous rewards), or $95.

If you instead opt for Bank of America® Unlimited Cash Rewards credit card, your reward is $5,000 x 1.5%, or $75.

It’s easy to conclude that the Customized card offers better rewards, but wait. Suppose you didn’t travel during the quarter and spent that $2,000 on miscellaneous purchases instead. The Customized rewards would be: ($1,000 x 2%) + ($4,000 x 1%), or $60, assuming you didn’t juggle your favored category.

The best cash back card is contingent on your actual spending for the quarter and how frequently you change your favored merchant category.

The Bottom Line

Your choice between the Bank of America® Unlimited Cash Rewards credit card and the Bank of America® Customized Cash Rewards credit card hinges on how you like your cash rewards. You’ll favor the Unlimited card if you want a flat rewards rate on all eligible purchases.

The Customized card is the choice for consumers who want tiered rewards they can control. Both cards are excellent selections for Bank of America customers. If you are one, explore the bank’s Preferred Rewards Program to get the most value from your credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Facts About the Shopping Cart Trick for Credit Cards ([updated_month_year]) 5 Facts About the Shopping Cart Trick for Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/carttrick.png?width=158&height=120&fit=crop)

![6 Facts: How to Transfer Money From One Credit Card to Another ([updated_month_year]) 6 Facts: How to Transfer Money From One Credit Card to Another ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/transfer--1.png?width=158&height=120&fit=crop)

![5 Best Bank of America Cash Back Credit Cards ([updated_month_year]) 5 Best Bank of America Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Bank-of-America-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)