A huge number of credit cards come with amazing rewards programs. Each time you charge a purchase to one, you’ll rack up valuable perks in the form of cash, miles, or points.

Of course, you won’t get any of those rewards without using the card, so it’s time to spend. Here are eight great ways to maximize credit card points and other perks you get from credit card companies.

1. Focus on High-Value Categories

Many credit cards offer higher point values for spending in certain categories or during different quarters of the year. If your card does, modify your charging activity to match it.

For example, if you like to get away from home and travel, you may want to use your Chase Sapphire Reserve® card and purchase travel through Chase when booking hotels and renting cars since it offers 10X points after the first $300 spent on travel purchases annually.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

You’ll also receive 3X points on travel purchases, but only after you earn your $300 annual travel credit. Pay attention to those high reward offerings.

2. Charge Every (Affordable) Expense

Review your budget to determine exactly what you need and want to spend money on each month without going over your income threshold. Make a point of charging as many of those expenses as you can.

Then, use the money in your checking account to pay off the bill.

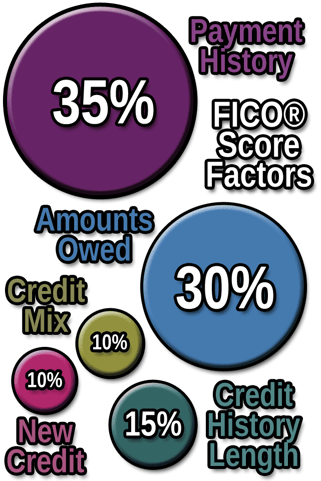

You’ll give your rewards credit card a massive workout, and your repeated on-time credit card payments will be reflected nicely in your credit score. On-time payments are the single most important factor in determining your credit score.

It’s easy to overspend if you’re not keeping track of what you charge, so be sure to keep an eye on your spending to avoid high-interest credit card debt.

3. Put Group Costs on the Card

Let’s say you go out for dinner with a bunch of friends. At the end of the meal, you find that the entire bill is $400, and everyone’s portion is $50.

Take hold of the check and say, “Anyone mind if I get this? You can give me the cash or send your portion to me with an app!” Examples of money transfer apps include Venmo, the Square Cash App, and Zelle.

Assuming they’re in agreement, you get to claim a big pool of points, miles, or cash without going over budget. Just be sure to forward the money they send you to your credit card company without delay.

4. Get the Highest Signup Bonus Possible

Many credit cards offer generous signup bonuses just for opening the account. As long as you spend the required amount within a few months of getting the card, you’ll attain a large sum of bonus miles, points, or cash back.

The Chase Sapphire Preferred®, for instance, currently offers a large sum of points worth a pretty penny when redeemed for travel for meeting the minimum required spending amount within the first three months from account opening.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

If you’ve decided to invest in new furniture or purchase some other costly item (and have the available funds to pay for it all at your disposal), using the card to score that big bonus is smart.

5. Transfer Points to Partner Programs

Nearly all the major credit card issuers will let you transfer the rewards you’ve earned to their travel company partners. The value of those rewards may increase by doing so.

For example, one point may be worth 0.7 cents when redeemed for various travel accommodations on the issuer’s website or travel portal, but if you transfer your points to an airline or hotel loyalty program, you could earn upward of 1 to 2.5 cents per point, sometimes more.

So, if you plan to use your points or miles to cover the price of hotel rooms or flights, consider moving the rewards to the issuer’s partner loyalty programs first. Then, when you cash them in, you’ll get the best deal for your rewards.

6. Automate Your Payments

To make your reward-accumulating life simple without the worry of credit card debt, have your recurring bills, such as insurance, utilities, a cellphone, and gym membership, automatically paid for with a rewards credit card on file.

Then, have your credit card account(s) automatically paid off each month from the cash in your checking account.

The points will add up fast with virtually no effort. Imagine you have a Bank of America® Travel Rewards Credit Card and charge about $1,200 on a monthly basis. That’s roughly $14,400 a year.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Since this card gives an unlimited 1.5 points for every $1 spent, you’ll earn about $217. That’s not a bad deal just for paying your regular monthly bills!

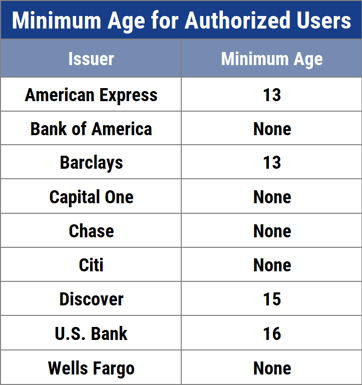

7. Add an Authorized User

Almost all credit card issuers allow primary account holders to add authorized users. If you do add an authorized user, they will have a credit card with their name on it and your permission to use it.

Multiple people paying for all kinds of things with your account will help accumulate more rewards faster. Some cards will even give you bonus points for adding an authorized user when you first get the card.

Multiple people paying for all kinds of things with your account will help accumulate more rewards faster. Some cards will even give you bonus points for adding an authorized user when you first get the card.

The United Explorer Card from Chase, for example, will give you 5,000 miles when you add an authorized user, as long as they make a purchase within the first three months of you opening the account.

Yet, while these piggybackers can help you collect a lot of points, you’ll be responsible for paying the credit card company for all that stuff. Be sure to explain the rules first: no charging unless they can and will give you the money unless otherwise agreed to.

8. Charge Your Rent — Carefully

Chances are strong that your rent is the largest expense you have, so it would be nice to build rewards each time you pay for it. Some landlords or property managers will accept credit cards; however, this is an “only under special circumstances” method of point accumulation.

Merchants are charged an interchange fee of approximately 1.8% per transaction. Your landlord will most likely pass that fee on to you, which will result in the value of your points being significantly eroded.

So, only take advantage of this option when your card offers higher rewards than the added fee you may be charged. When it does, you’ll come out ahead.

Only Charge What You Can Afford to Repay

Remember, the only way to turn a profit with credit card rewards is to keep your balance at zero. Track your spending activity on a daily or weekly basis, and stop charging when you know you’ll have trouble paying the entire amount due.

If you don’t, you’ll roll over debt and interest will be added to the amount you owe. When you’re concentrating on maximizing credit card rewards, it’s easy to get excited and spend more than your checking account can realistically handle.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Credit Cards for Points & Miles ([updated_month_year]) 8 Best Credit Cards for Points & Miles ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/points.png?width=158&height=120&fit=crop)

![9 Credit Cards With the Most Bonus Points ([updated_month_year]) 9 Credit Cards With the Most Bonus Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/09/credit-cards-with-the-most-bonus-points.jpg?width=158&height=120&fit=crop)

![Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year]) Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/refer.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year]) 5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/5-ways-last-try.jpg?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![2 Ways to Check Chase Credit Card Application Status ([updated_month_year]) 2 Ways to Check Chase Credit Card Application Status ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/chase-credit-application-status1-2.png?width=158&height=120&fit=crop)