Business credit card sign-up bonuses are a great way to earn cash and rewards points for doing nothing more than using your credit card. These bonus rewards pay out when you meet certain spending thresholds within the first few months after activating your new account.

But not all sign-up bonuses are equal. Some pay rewards in points and others in cash, and some cards offer 0% financing for a period to help you finance large purchases interest-free. And that same large purchase will help you achieve your sign-up bonus — a win-win!

We’ve compiled our list of the best business credit card sign-up bonuses to help your company get a leg up on the competition. Read on to see the best cards or skip ahead to the FAQs.

Best Business Credit Card Sign-Up Bonuses

Business credit card issuers change their sign-up bonus offers regularly to adapt to the marketplace and competition. Keep in mind that each card may provide a different form of welcome bonus.

For example, some cash back cards offer a one-time cash bonus for reaching the spending threshold, whereas a points or miles card will award a lump sum of those rewards. Other cards skip the traditional rewards and will offer a gift card or financing deal in place of bonus cash, points, or miles.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card from Chase charges an annual fee for membership, but that’s a small price to pay for the industry’s best sign-up bonus. Although the welcome bonus amount regularly changes, the bonus always lets you choose whether you want cash back or bonus points.

Points tend to have a greater return, as they cost the bank less to issue. With points, you can jump into Chase’s rewards portal and select from many different reward options that suit your business needs.

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Business Platinum Card® Account.

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% - 28.49% Pay Over Time

|

$695

|

Excellent

|

The The Business Platinum Card® is a premier charge card for successful businesses. While its sign-up bonus regularly changes, you can almost always score at least 60,000 Amex Membership Rewards points if you meet the spending minimum within the first three months of account opening.

This card is especially valuable for business travelers who spend a lot of time in airports. It comes with access to Centurion Lounges and a bevy of exclusive travel perks and insurance coverage.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

Chase’s Ink Business Unlimited® Credit Card offers cash back or points for every eligible purchase. The minimum required to earn the signup bonus is very attainable for most business owners.

And just like all Chase business credit cards, you can request free employee cards for your company. Any spending on those cards will count toward your quest to earn the large sign-up bonus. They’ll also earn you rewards over the life of your account.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

Chase continues its dominance over the business credit card market with the Ink Business Cash® Credit Card. This card is very similar to its Ink Business Unlimited® sibling listed above. They tend to have the same sign-up bonus, but offer different ongoing rewards to cardholders.

While Unlimited® allows you to convert your rewards to either cash back or Chase Ultimate Rewards points, the Cash® card stays true to its name by offering a tremendous cash back reward rate that includes a bonus category with elevated return rates.

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

Although the Capital One Spark Miles for Business typically ranks below its Spark Cash sibling on our top overall list, it betters the Cash card in terms of sign-up bonus. This is usually the case when comparing miles and points cards to cash cards, as banks can offer a greater number of points and miles since it’s easier on their bottom line.

You can redeem your miles to cover all or part of a previous travel purchase. You can also choose to transfer your miles to more than 10 leading airline loyalty programs to help you earn future discounted flights.

6. Capital One Spark Cash for Business

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

The Capital One Spark Cash for Business is one of our favorite business credit cards. While this card stays ahead of the pack on rewards, flexibility, and reliability, its cash bonus isn’t quite as lucrative as the trio of Chase cards above.

But this card still provides a generous cash bonus for meeting an attainable spending threshold. And even after your sign-up period ends, you’re left with one of the best cards in the industry. That’s a win-win in our books.

7. Business Advantage Customized Cash Rewards credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Business Advantage Customized Cash Rewards credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Business Advantage Customized Cash Rewards credit card offers a solid statement credit bonus when you surpass a fairly small spending threshold during your first three months with the card. Along the way, you’ll earn a high cash back rewards rate and may qualify for an interest-free intro bonus financing period after activating your new card.

Just remember that the signup bonus pays out as a statement credit and not as cash. That means that your bonus will apply to your card’s current balance and erase part of your credit card debt. If you have no balance on your card after qualifying, the bonus will remain as a credit on your account.

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% - 24.49% (Variable)

|

$0

|

Excellent

|

The Capital One Spark Cash Select for Excellent Credit is the bank’s entry-level business credit card. This means that you’ll earn a slightly lesser rate of cash back and the signup bonus may not be as large as that of other Capital One business cards. But that doesn’t make this card any less of a winner.

You shouldn’t have any trouble qualifying for this signup bonus — and you’ll also earn business credit as you use your card to help support your growing operation. Over time, you can leverage your responsible behavior to move to another business credit card.

9. Business Advantage Travel Rewards World Mastercard® credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Business Advantage Travel Rewards World Mastercard® credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Business Advantage Travel Rewards World Mastercard® credit card typically offers the same sign-up bonus as the Business Advantage Cash Rewards credit card listed above. The major difference is that this card’s bonus pays out in statement credits toward a travel purchase. The Cash Rewards card can apply your statement credit toward any purchase.

Both cards also have similar ongoing rewards rates — which makes the cash card more valuable if you’re racking up rewards at a high rate. But if your business has you on the road regularly, you may find more utility with a good travel rewards business credit card like this one.

- Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of card membership

- Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle, including U.S. purchases for advertising in select media (online, TV, radio), U.S. purchases made directly from select technology providers of computer hardware, software, and cloud solutions, and U.S. purchases at gas stations, restaurants, or for shipping. Applies to the first $150,000 in combined purchases from these 2 categories each calendar year.

- Earn 3X Membership Rewards® points on flights and prepaid hotels and prepaid flight + hotel packages booked on AmexTravel.com using your Business Gold Card.

- Earn 1X Membership Rewards® points on other purchases

- $375 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% - 28.49% Pay Over Time

|

$375

|

Excellent

|

The American Express® Business Gold Card awards lucrative Membership Rewards points to every new cardholder who meets the spending requirement within the first three months of card membership.

Given the large spending requirement to earn the bonus, this card is most valuable to business owners who have large monthly expenses they can charge to the card. American Express’s new Pay Over Time feature gives the flexibility to pay the balance over time — with interest — on eligible purchases.

- Earn 65,000 Bonus Miles after spending $6,000 in purchases on your new card in your first 6 months of card membership

- Receive $2,500 Medallion® Qualification Dollars each Medallion Qualification Year and get closer to Status with MQD Headstart.

- Earn 3 Miles on every dollar spent on eligible purchases made directly with Delta and purchases made directly with hotels

- Earn 1.5x miles up to $100,000 of combined eligible purchases per year on transit including rideshares, taxicabs, and more, at U.S. shipping providers, and on single eligible purchases of $5,000 or more

- You can check your first bag for free and save up to $60 on a round-trip Delta flight, plus enjoy early boarding on Delta flights

- Receive Main Cabin 1 Priority Boarding on Delta flights; board early, stow your carry-on bag and settle in sooner

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.99% - 29.99% variable

|

$350

|

N/A

|

The Delta SkyMiles® Platinum Business Card also offers a two-tiered bonus structure that lets you earn Delta SkyMiles® with qualifying purchases and then pile on even more miles if you make a Delta purchase with your card within three months after activation.

You can use your Delta SkyMiles® for free or discounted flights, seat upgrades, in-flight purchases, and more. All cardholders also earn a Status Boost® that gets them closer to Medallion® Qualification Miles.

- Earn 50,000 bonus points after spending $4,000 on purchases in the first 90 days, plus 10,000 bonus points when a purchase is made on an employee card in the first 90 days

- Earn 6X points on eligible JetBlue purchases, plus 2X points at restaurants and office supply stores, 1X points on all other purchases

- Earn 5,000 bonus points every year after your account anniversary

- Receive a 50% savings on eligible inflight purchases of cocktails and food on JetBlue-operated flights

- Enjoy an annual $100 statement credit after purchasing a JetBlue Vacations package with your card

- Free first checked bag for you and up to 3 companions on the same reservation when you use your card to book JetBlue-operated flights.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.99%

|

$99

|

N/A

|

The JetBlue Business Card, issued by Barclays, rewards faithful JetBlue passengers with a glut of bonus points when they make qualifying purchases. You can also earn bonus points on JetBlue purchases as well as charges at restaurants and office supply stores.

This card regularly has a two-tiered sign-up bonus system that allows you to earn points when you reach the spending threshold and another set of points after the first purchase made on an employee card.

What is a Credit Card Sign-Up Bonus?

A credit card sign-up bonus is an incentive that some credit card issuers use to entice consumers to sign up for their credit cards. These programs typically offer a large amount of cash back, bonus points, or bonus miles to any new cardholder who meets specific spending thresholds.

These offers aren’t limited to only business credit cards — consumer cards also offer very lucrative sign-up bonuses.

Not every sign-up bonus pays out in cash. Some cards specialize in travel miles or points that can be just as (or more) valuable as cash. Points rewards, for example, tend to have the most flexibility because you can redeem them for travel discounts, gift cards, merchandise, and other perks. A card issuer may even allow you to convert your points into cash back.

Since you typically redeem your points rewards through the bank’s partners, they cost the issuer less than cash back offers. As a result, you can often earn more points through a sign-up bonus than you would cash back.

The same goes for travel miles, where different cards may treat the redemption process in different ways. Some cards, such as those issued by Chase, allow you to redeem your rewards directly with travel providers to pay for all, or part, of a future travel expense.

So if you have a big business trip coming up, you could use your accrued miles to pay for your flight. But since these rewards work only through certain partners, you may be limited to using specific airline providers and may be subject to blackout dates.

Other cards treat miles rewards as a statement credit. Capital One’s cards, for instance, allow you to cash in your miles to cover all or part of a previous travel purchase. With this method, you can purchase a flight and then use your miles to cover the cost after the trip.

And since you don’t have to worry about traveling with partner carriers, you won’t have to worry about any restrictions when redeeming your rewards. In many ways, this form of travel miles is similar to cash back — but with the stipulation that you can only use the cash back on travel purchases.

Sign-up bonuses change frequently. Banks constantly monitor the marketplace — and their competition — to see which offers are available. That means an offer may change to reflect a shift in market demand.

Once you sign up for a card, you’re locked into that signup bonus. Once your sign-up bonus period ends, you typically can’t qualify for another signup bonus using that card account.

Aside from the traditional sign-up bonus, some card issuers may allow you to earn bonus cash back, points, or miles at any time by referring a friend or family member to the card. This referral bonus pays out when someone uses your link or referral code and is approved for a new account.

This is an especially valuable program because it allows you to earn a bonus without meeting spending thresholds or being a new cardholder.

How Do I Qualify For a Business Credit Card?

Just like consumer credit cards, each business credit card has varying standards for approval. Some cards are designed only for businesses (or consumers) who have excellent credit (740+ credit score). Other cards will consider your application if you have good credit (670 or higher).

Before you apply for any business credit card, check the card’s disclosure document, or read the info box related to the card above to get an idea of what credit score you need to qualify. You may also find that business credit cards vary in their definitions of the term business.

Most cards will allow you to apply even if you have a small side hustle business, such as selling items on eBay or Etsy. You may also qualify if you have a small business cutting neighbors’ lawns. You don’t need to be the CEO of a major corporation to qualify for a business credit card.

Even small side hustles, like mowing lawns or selling things on eBay, can make you eligible to apply for a business credit card.

If you have a small business with little credit history, the bank will almost always require that you provide a personal guarantee for the line of credit. That means using your personal credit history to qualify for the card. If the business ever defaults on the debt, you will be personally responsible to repay the total amount due.

If you’re required to provide a personal guarantee, the card issuer will request your Social Security number or ITIN number. In many ways, the remainder of the process is similar to that of applying for a personal credit card.

Many banks can provide near-instant credit decisions. Depending on your business information, the bank may need a few days to study your sales numbers to decide whether you qualify for a card.

If the business is approved for a credit card on its own, the monthly payment and balance info will report to each credit bureau only under the business name. There will be no reflection of the account on your personal credit profile.

If you must provide a personal guarantee, the account will report under your name. The bank will decide whether it also reports under the business name. In this case, the business is really just an authorized user, but that shouldn’t stop you from earning a credit history for the business itself.

How Do I Get My First Business Credit Card?

A business credit card application is almost identical to a personal credit card application. The main difference is that you’ll have to provide your business’s information as well as your personal credit information.

The bank needs all of this data to provide a personal guarantee for your account. This means that you’re personally responsible for any debt the business accrues.

Approximately 37% of businesses use a personal guarantee for business financing. If you’re in this boat, you’re in good company.

During the application process, you’ll have to provide information that can include:

- The legal name of your business

- Your business contact information

- Industry type

- Business Entity or Legal Structure

- Number of employees and time in business

- Federal Tax ID (EIN)

- Annual Business Revenue and Estimated Monthly Spend

- Total Annual Income

- Legal Name, Contact Information, and Social Security Number

- Personal Credit History (for personal guarantee)

Similar to consumer cards, the bank you apply to can likely provide a credit decision within one minute or less.

If you’re approved, the bank will invite you to create a profile to manage your credit card account. You’ll also receive other key details of your account, including your credit limit and payment due dates.

The bank will then print your card and send it to you. You will typically receive the card within seven to 10 business days.

If you aren’t approved, you can attempt to contact the card issuer and ask for a reconsideration. If that does not work, you will receive an adverse action notice in the mail within seven to 10 business days that will outline the bank’s reasons for denying your credit request.

What Are the Best Business Credit Cards For Travel?

Travel credit cards are popular among both consumers and business owners because they can lower (or completely eliminate) the rising cost of travel. This can include airfare, hotel stays, rental cars, ridesharing services, or other expenses.

To name the best business credit cards for travel, you must first understand the two main types of travel cards.

One form of these cards allows you to use your accrued points or miles to reduce or completely cover the cost of a future trip. Chase, for example, allows you to redeem your points through the Chase Ultimate Rewards portal for airfare, hotel stays, rental cars, or other necessities.

The bank converts your points into cash and uses it to book and pay for your travel accommodations through its partners. This is a convenient way to lower the cost of a business trip. But since you can only book through the card’s partners, you may find yourself limited in which carriers you can use.

Other cards allow you to redeem your miles for a statement credit to wipe out recent travel purchases. Capital One, for example, converts your earned miles to cash and applies it to your card’s current balance to pay for qualified travel expenses.

A benefit of this method is that you don’t have to worry about carrier limitations or other travel restrictions. And since the definition of travel expense is fairly broad, you should have no problem using your miles to cover your expenses.

If you travel internationally with your business travel credit card, you also want to consider a card with no foreign transaction fee. This fee charges a percentage of every transaction you make in a currency other than your own and is intended to cover the cost of converting the currency.

In terms of the best business credit cards for travel that allow you to pay for future trips, you should consider:

- Ink Business Preferred® Credit Card

- The Business Platinum Card®

- Delta SkyMiles® Platinum Business Card

For cards that allow you to use your rewards to cover past trips, consider:

- Capital One Spark Miles for Business

- Business Advantage Travel Rewards World Mastercard® credit card

Another perk of travel credit cards is that they often have higher rewards rates than those for cash back cards. This is because the card issuer pays less for the travel deals through partners. This allows the bank to save money — and pay higher rewards rates — compared with dishing out cash for every cardholder.

What Are the Best Cash Back Business Credit Cards?

Cash is king — even in the credit card world. With a good cash back business credit card, you can essentially earn a rebate for every qualifying purchase you make.

The amount of cash back you earn will depend on the card you qualify for. Some cards may provide a flat-rate of cash back — such as 1.5% back on every purchase you make using the card. That means you’ll earn $1.50 back for every $100 you charge to the card.

Other cards may provide a bonus category in which you can earn increased cash back. This may mean that you’ll earn 5% at restaurants and gas stations, 3% at office supply stores, and 1% on all other purchases. The categories and amounts you receive will vary by card.

The best flat-rate cash back business credit cards include:

If categories are more your thing, check out:

- Ink Business Cash® Credit Card

- Business Advantage Customized Cash Rewards credit card

Keep in mind that some category-based rewards cards will limit how much bonus cash back you can earn in that category. This may mean you’ll earn 5% back on grocery store purchases with a maximum of $5,000 in purchases allowed each quarter.

No matter what kind of cash back card you go for, you’ll find that the redemption process is similar. In most cases, you can redeem your cash back through the card’s mobile application or website. When you do this, you’ll likely see at least two or three redemption options. These typically include:

- Cash deposited directly into your linked checking account or savings account

- A paper check mailed to your address (this may come with a processing fee)

- A statement credit that will apply your earnings to your current balance

You may also be able to redeem travel miles or bonus points for cash back using certain credit cards.

Most cash back business credit card options that offer a welcome bonus will still allow you to earn cash back while you’re working toward your bonus spending threshold. That means you’re earning in two different ways during your first few months with the card.

And as you save up your cash back, you should never have to worry about your rewards disappearing. Just about every major bank won’t let your rewards expire as long as your account remains open and in good standing.

What Happens If You Don’t Qualify For a Sign-Up Bonus?

Each credit card signup bonus has a well-defined expiration date. For example, a card may offer a large amount of cash back that pays out after you charge at least $5,000 in qualifying purchases during your first three months with the card.

The clock starts ticking as soon as you activate your new card account. Whether you have three months or six months to meet the spending threshold, you can’t extend your timeline beyond that. If you don’t spend enough to meet the requirement during the time frame, you simply won’t receive the sign-up bonus.

And since a sign-up bonus is limited to new cardholders, there’s no way to restart the clock with a new bonus opportunity.

You only have a few months to spend the required amount to earn the bonus.

Not qualifying for a sign-up bonus won’t impact your interest rate, credit limit, or other important card account details. You’ll still get the same terms and conditions you received when you applied for the card.

If the card also comes with an intro APR deal that gives you interest-free financing, that deal will still remain in place for as long as the bank guarantees it. So if your sign-up bonus expires after three months, but your intro APR deal lasts six months, you’ll still enjoy interest-free financing even if you don’t qualify for the sign-up bonus.

The same goes for a 0% balance transfer deal or any other special financing packages.

If a sign-up bonus is very important to you, you can attempt to qualify for a new card under the same — or a different — issuer and try again. Just remember that every new credit card application brings with it a hard inquiry that can have negative impacts on your credit score over time.

If you’re getting close to the expiration date on your sign-up bonus and you still haven’t charged enough purchases to qualify, consider the cost of qualifying before you go on a spending spree.

While many sign-up bonuses provide tremendous cash back, bonus points, or miles earnings potential, these offers lose their value if you go into debt to qualify for them. Interest charges alone can wipe out your welcome bonus earnings.

Can You Earn More Than One Sign-Up Bonus?

Banks only allow you to earn one sign-up bonus per credit card. And if you don’t meet the spending requirement within the allotted period, you don’t get the bonus.

There’s no second chance or new sign-up bonus you can aim for. It’s a one-time deal with nothing offered or promised after that — other than your standard credit card terms.

Some cards offer different forms of bonuses you can earn at any time, even years after you’ve activated your account. The most common is a referral bonus that many card issuers give out when you refer someone to sign up for the card. This is usually a set amount of money that’s paid out as rewards once the referred person is approved for the new card.

In some cases, a bank will pay a referral bonus to both the referrer and the person referred. Just about every bank runs a refer-a-friend program, with varying rewards depending on which bank you choose.

Chase, Citi, American Express, Capital One, Discover, and several other large banks maintain popular referral programs that allow you to spread the word and earn some cash at the same time.

Some cards, typically business credit cards, also offer cardholders a second, smaller sign-up bonus opportunity if they add card features or perfor certain actions. The JetBlue Business Card, for example, provides a second stash of bonus miles when an employee makes their first purchase using an employee card.

While the second bonus amount is never as large as the first sign-up bonus, they usually offer a generous bonus amount for an easily attainable task.

What is the Easiest Business Credit Card to Get?

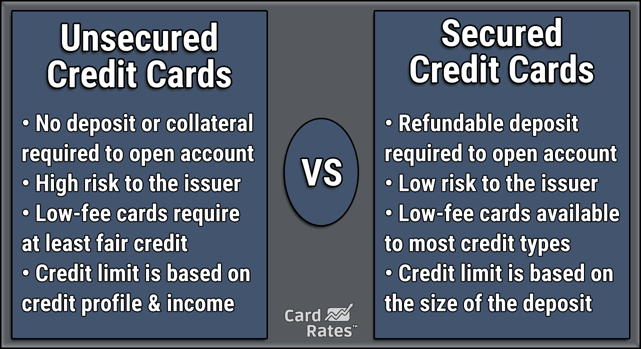

The easiest business credit card to qualify for is the Wells Fargo Business Secured Credit Card. This card requires a refundable security deposit for approval. While the upfront cost may be greater than with a traditional unsecured business credit card, you’ll find that you can almost always qualify for this card — regardless of your personal or business credit history — as long as you can provide the deposit money.

The amount of your deposit will typically match your business card’s credit limit. For example, a $3,000 deposit will net you a card with a $3,000 limit.

This Wells Fargo card allows for deposits as small as $500 and as large as $25,000. You can also earn cash back or Go Far Rewards Points with the card and get up to 10 employee cards for free without paying an annual fee.

The card is easier to obtain because your deposit serves as security in case you default on your account. Wells Fargo will hold your deposit funds in a savings account and refund them in full when you close your account — as long as the account is in good standing and has no balance owed.

This deposit does not act as a payment for your account. You’ll still need to make monthly payments to cover any charges you authorize to the account.

Despite its secured status, you can still use your secured business card in any way that you’d use an unsecured card. These cards can make online or in-person purchases, you can pay bills over the phone, rent a car or hotel room, or set up recurring payments to a vendor or service provider.

Secured cards are a popular way for consumers to build their credit history and get access to a credit card when they otherwise may not qualify.

Banks like them because they remove the risk from otherwise risky applicants. The bank will report all of your payment and balance history to each major credit reporting bureau, which helps you build both personal and business credit.

(The information related to the Wells Fargo Business Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Can I Get a Business Credit Card For My LLC?

Yes, you can get a business credit card for your Limited Liability Corporation (LLC). Every business credit card will ask you the legal structure of your business. This can include an LLC, a sole proprietorship, a corporation, a partnership, or a nonprofit.

The structure won’t affect your card application. It’s simply a way to categorize your business during the application process.

There’s a false narrative that you must be the CEO of a major corporation to qualify for a business credit card. Many consumers apply and receive approval for a business credit card for small side hustles, like selling things online or flipping items on Craigslist.

There’s no set rule as to the type of business you must run to qualify for a business credit card — though some banks may have higher standards than others.

For example, when you apply for a Chase business credit card, the bank will factor in whether you have a previous working business relationship with the institution. Having a Chase business checking account or savings account isn’t a requirement for applicants, but it does help your case if you’re applying for one of the bank’s sought-after business cards.

Banks would never eliminate LLCs from business credit card consideration — because it would rule out a majority of U.S. businesses. For tax purposes, the U.S. government considers an LLC as a sole proprietorship — which accounts for 86.6% of all small businesses in the country.

If you run an LLC, you’re in good company. And you can rest assured that just about every bank is ready to consider your business credit card application when you’re ready to apply.

What is the Best Business Credit Card For a New Business?

The best business credit card for your new business will depend on your personal credit history, but we like the Capital One Spark Cash for Business. This card considers applications from consumers who have good credit (potentially as low as a 680 credit score) and offers a valuable flat-rate cash back option on every purchase.

Capital One Spark Cash for Business

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

Banks will require any new business owner to provide a personal guarantee for any credit card issued to the business. This means that you will take personal responsibility for any debt incurred using the card. You will need to provide your personal Social Security number during the application process and the line of credit will report to your credit history.

If you have very good or excellent credit (a score of at least 720), you can also consider the Ink Business Preferred® Credit Card. This card offers bonus point earnings that you can use for a variety of redemption options. And since you’re working with Chase, you’ll set your business up for many excellent financial products in the future.

You can never go wrong when you build a positive business relationship with Capital One or Chase. Both banks offer a tremendous array of financial products that can help your business — including a checking account and savings account option, as well as various credit cards, auto loans, and personal loan products.

What Credit Score Is Needed For a Business Credit Card?

Business credit cards are available for just about every personal credit score. The most lucrative cards, though, will require a credit score of at least 680. Some issuers won’t consider your application until you’re at 700 or above.

Much like consumer credit cards, you’ll find that your options expand as your personal credit score improves. You should anticipate paying out a security deposit if you have fair or poor credit. Your sign-up bonus and rewards options will really start to pick up once your credit score is above 700.

- Fair credit or worse (669 and lower): Without good credit, you’ll likely have to start with a secured business credit card that requires a refundable deposit that matches your card limit. The choices aren’t plentiful in this arena, but you can consider the Wells Fargo Business Secured Credit Card or the BBVA Secured Visa® Business Credit Card

- Good credit (between 670 and 739): Bank of America offers a pair of starter business credit cards that require good credit with the Business Advantage Travel Rewards World Mastercard® credit card and the Business Advantage Customized Cash Rewards credit card. Once you hit the top end of good credit — around 720 — you’ll start to qualify for cards in the next section.

- Excellent credit (740 or greater): Those who have top-shelf credit can likely qualify for just about any card they choose, including all of the sought-after Chase Ink cards. Those, and the Capital One line of Spark cards, start to consider applicants who have a credit score of around 720. But it doesn’t hurt to have excellent credit before applying.

It’s easy to get swept up with the idea of the best business credit card sign-up bonuses and all of the rewards these cards can offer. But don’t let your eyes sell you on something that your budget can’t yet handle. There’s nothing wrong with starting smaller and working your way up.

Just like starting a business, you can’t expect big returns overnight. If your credit score isn’t ready for the big time, work on the things that you need to improve to get your personal — and business — credit ready for the spotlight.

How Can I Get a Business Credit Card Without Using My Personal Credit?

The only way to qualify for a business credit card without using your personal credit history is to build enough business credit to qualify without a personal guarantee.

Building business credit is a lot like building personal credit. The issue that most businesses have, though, is getting started. There aren’t any business credit-builder accounts to build business credit like you can your personal credit.

To build business credit, you have to obtain a line of credit from a vendor or supplier. But it can’t just be any vendor. It must be one that reports your dealings to a credit bureau to help you establish a business credit score. This includes:

- Working with vendors and suppliers and always paying on time

- Apply for an EIN that allows you to build business credit

- Separate business and personal expenses

- Incorporate your business to clarify its classification

- Apply for a small business loan or credit card

You can’t build business credit overnight. It’s a much harder task than building personal credit — but it’s not impossible. Take the process slow and don’t be afraid to use your personal credit score to help give your business the nudge it needs in the early stages.

By doing that, you can scale your growth and build a business that is ready for the long term and not just for today.

How Often Can You Earn a Credit Card Sign-Up Bonus?

You can only earn one sign-up bonus per credit card. Even if you do not qualify for the bonus by meeting the spending requirements, you can’t receive a second offer on the same card.

In some cases, you can apply for a new card and attempt to claim another signup bonus. Your ability to do so will depend on the bank that issues your card. Each card issuer has different rules surrounding a sign-up bonus, summarized below.

- Chase: You can’t earn a sign-up bonus on a Chase card if you currently hold that card in your wallet or if you earned a sign-up bonus on that exact card in the last 24 to 48 months. To qualify for a bonus on a new card that you already have, you’ll have to downgrade or cancel the old card.

- American Express: Cardholders are eligible for only one sign-up bonus per card in their lifetime. You can’t qualify for another bonus on the same card if you’ve already received one in the past.

- Citi: You can earn multiple bonuses on the same type of card by reapplying for it after your initial bonus period expires. You must wait at least 24 months between applications though.

- Bank of America: No written stipulations will keep you from earning multiple bonuses with different cards. You can even reapply for the same card in time to earn a bonus on the new card.

- Capital One: The only written language that Capital One provides in reference to sign-up bonuses states that “The bonus may not be available for existing or previous account holders.” That typically means it’s at the bank’s discretion whether you can earn multiple bonuses with different cards. Check with the bank before applying.

- Wells Fargo: The position Wells Fargo holds on this question is clearly laid out on its website: “You may not be eligible for introductory annual percentage rates, fees, and/or bonus rewards offers if you opened a Wells Fargo Credit card within the last 15 months from the date of this application and you received introductory APR(s), fees, and/or bonus rewards offers, even if that account is closed and has a $0 balance.”

These rules are all stated on the banks’ websites and are subject to change. If you’re looking to earn a second sign-up bonus with the same bank, contact that bank before applying to make sure you qualify. That way, you won’t waste an inquiry on a card that you may not need.

Can I Get a Business Credit Card With Bad Personal Credit?

You can get a business credit card with bad personal credit, but you may be limited to secured business credit cards, such as the Wells Fargo Business Secured Credit Card. Secured cards require you to place a refundable security deposit that equals the credit limit on your new card.

Wells Fargo Business Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

You can still use this card as you would any other credit card, but since your deposit removes much of the risk from the credit card issuer, you can likely qualify for this card even with bad credit.

Your card issuer will report your payment and balance history to at least one credit bureau. That means you can build a business credit history while also working to improve your personal credit.

Over time, you can leverage your improved credit to qualify for a more lucrative unsecured business credit card with better rewards and a more attractive sign-up bonus. When that happens, you can cancel your secured business credit card and receive a full refund of your deposit — as long as you have no outstanding debts on the card when you cancel it.

(The information related to the Wells Fargo Business Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Can You Use a Business Credit Card For Personal Expenses?

A business card is a form of bank loan extended to your business. How you use that money is up to you — as long as you pay it back.

But you may encounter issues with using your business card for personal expenses when it comes time to file business taxes. Blurring the lines with expenses makes it difficult to differentiate between the two and may be viewed as a conflict of interest by the IRS.

Plus, when you add unnecessary charges to your business credit card, you increase your business debt — which lowers your business credit score and makes it harder to qualify for other financial products.

Keep all of this in mind when using your business credit card. Although it may be easy to just swipe your card and have the business cover a personal expense, it may cause more headaches than it’s worth come tax time.

What Fees Do Business Credit Cards Charge?

Business credit cards charge similar fees as those charged by personal credit cards. There are a few key differences you need to know, though.

The Credit CARD Act of 2009 does not apply to business credit cards. That means your business card won’t have many of the protections afforded to your personal cards. If you make a late payment, for example, the card issuer can permanently boost your APR without warning or repercussion.

And speaking of late payments, they’re treated differently with business cards as well. Most consumer cards cap their late payment fees between $25 and $39 and limit how many of these charges you can incur within a six-month period. There’s no such rule with business cards, which can charge any amount they choose.

Thankfully, many credit card issuers have loosely adopted the CARD Act standards, though they aren’t required to do so.

Aside from those differences, you may also see the following charges on your card statement.

- Annual fee: Some cards don’t charge an annual fee, but many business cards will charge a nominal fee every 12 months to cover the costs of any rewards or perks the bank pays out.

- Late payment fee: Business credit cards aren’t limited in how much they can charge for a late payment fee. Your card issuer won’t randomly change the amounts it charges every month, but you should check your credit card disclosure statement before you apply to understand how much this fee may cost you.

- Balance transfer fee: If you move an existing credit card balance from an old card to your new card, you’ll likely encounter a balance transfer fee. Banks typically charge a percentage of your transferred amount to initiate the request. This isn’t as common with business cards as it is with consumer cards, which may offer a balance transfer promotional rate or intro APR deal.

- Cash advance fee: You’ll see a host of fees when you use your credit card like a debit card to withdraw cash from an ATM machine or at a bank teller’s window. This is known as a cash advance. The amount of your fee will vary depending on your card issuer. A cash advance has no grace period, which means you start accruing interest charges as soon as you receive your cash. A cash advance also comes with a higher interest rate than a regular purchase.

- Over-limit fee: Many credit cards will decline any transaction that brings your balance over your stated credit limit. You’ll also immediately owe the amount you charged over your spending limit.

- Returned payment fee: If your bank declined your payment due to insufficient funds in your bank account, you should expect a fee.

- Foreign transaction fee: You may incur a foreign transaction fee if you initiate a transaction in a currency other than your own. This fee typically equals a percentage of the transaction total.

These fees aren’t standard on every business credit card. Some cards will charge a certain fee and others won’t.

Every bank is required to provide a credit card disclosure statement to applicants before they submit their applications. This digital document will outline all of the card’s fees and charges. Be sure to study this document carefully before you apply to avoid any unpleasant surprises.

Can I Get Business Credit Cards For My Employees?

Most business credit card issuers allow the primary cardholder to request employee cards free of charge. Your bank may limit how many free employee cards you can request.

These cards are usually covered under the primary card account’s annual fee and won’t incur extra charges for use. The primary cardholder can earn rewards from employee spending, and all of their expenses will also count toward your sign-up bonus spending requirement.

Most card issuers provide a limited number of employee cards for free.

Some business cards, such as the JetBlue Business Card, will allow you to earn a secondary sign-up bonus when you complete your first transaction using an employee card.

Many banks also give the main account holder added tools to manage employee cards. This gives them control to set varied spending limits on each card, set a maximum transaction amount, or limit the type of transaction the employee can use the card for.

These tools are a valuable way to keep employee spending in check while still allowing the primary cardholder to earn rewards and give their employees access to company funds.

How Often Can I Apply For a Business Credit Card?

You can apply for a business credit card as often as you like, though each bank has rules as to how often you can qualify for a new card or sign-up bonus.

Chase, for example, has a 5/24 rule that states that, if you have five or more new bank card accounts (credit or charge cards) opened within the last 24 months, you’ll most likely be rejected for a new Chase credit card even if you otherwise qualify.

CitiBank states that you must wait at least 24 months after receiving a sign-up bonus through the bank before you can apply for another card and qualify for a new welcome bonus. That doesn’t mean you can’t add another Citi card to your wallet. You just can’t earn a bonus for that card.

Be sure to check the rules for each card issuer before you apply.

Choose the Card that Best Matches Your Business Spending

There’s a business credit card for just about every business owner out there. Whether you’re into travel rewards, point earnings, or cash back, you can find a card — and a sign-up bonus — that makes it more valuable than ever to insert, tap, or swipe your plastic at the register.

If you have a new business that hasn’t established any credit history, expect to use your personal credit score to provide the guarantee the bank wants to eliminate some of its risk in extending credit to a startup.

But if you’re willing to take that plunge, you can dive into the best business credit card sign-up bonuses that can give you substantial rewards for using your new card. Just be sure to pay your bills on time to avoid interest charges and to avoid going into debt just to qualify for a welcome bonus.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Best Credit Card Sign-Up Bonuses ($200, $300, & $500) – [updated_month_year] 11 Best Credit Card Sign-Up Bonuses ($200, $300, & $500) – [updated_month_year]](https://www.cardrates.com/images/uploads/2021/03/Best-Credit-Card-Sign-Up-Bonuses-2.jpg?width=158&height=120&fit=crop)

![7 Best Credit Card Signup Bonuses $200 – $1,250 ([updated_month_year]) 7 Best Credit Card Signup Bonuses $200 – $1,250 ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/Best-Credit-Card-Signup-Bonuses.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year]) 8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/500.png?width=158&height=120&fit=crop)

![How to Sign Up For a Credit Card: Expert Guide ([updated_month_year]) How to Sign Up For a Credit Card: Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/signup2.png?width=158&height=120&fit=crop)

![8 Bank Signup Bonus Credit Cards: $200 – $750 ([updated_month_year]) 8 Bank Signup Bonus Credit Cards: $200 – $750 ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Bank-Signup-Bonus-Cards.jpg?width=158&height=120&fit=crop)

![7 Best $200 Signup Bonus Credit Cards ([updated_month_year]) 7 Best $200 Signup Bonus Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Best-200-Signup-Bonus-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Credit Card Bonuses For Bad Credit ([updated_month_year]) 7 Credit Card Bonuses For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Credit-Card-Bonuses-for-Bad-Credit-Feat.jpg?width=158&height=120&fit=crop)

![Are Credit Card Signup Bonuses Taxable? ([updated_month_year]) Are Credit Card Signup Bonuses Taxable? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Are-Credit-Card-Signup-Bonuses-Taxable.jpg?width=158&height=120&fit=crop)