If you’re like most people, you probably spend a lot of time trying to save up for your next vacation — only to spend a good chunk of your budget simply flying to and from your destination. Thankfully, the best credit cards for free flights can change your entire itinerary.

These cards can provide cardholders with tremendous travel discounts, free accommodations, and a supercharged boost to airline loyalty points or miles. These kinds of perks can get you on your way to your next vacation much faster.

But not every travel card and co-branded airline card operates the same. We’re here to break down the differences so you can optimize your spending power and get the most out of your credit card.

Travel Cards | Airline Cards | FAQs

Best Travel Cards for Free Flights

The cards below can help you earn free flights on your own terms because they aren’t connected to a specific airline or travel provider.

You can use these cards to redeem your earned points or miles to reimburse past travel expenses or decrease the cost of future expenses. In many cases, you can earn free flights or other perks.

And, since you aren’t tied to an airline, you most likely won’t have the same restrictions, blackout dates, or other limitations branded cards can bring.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

With the Capital One Venture Rewards Credit Card, you can earn an unlimited 2X miles on every dollar charged to the card. Those miles never expire and you can redeem them to cover past travel-related expenses.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles card remains one of the most flexible travel cards on the market because it doesn’t force airline restrictions or blackout dates on its cardholders. You simply earn miles for every purchase charged to your card and redeem those rewards to help cover some — or all — of your recent travel-related expenses.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card offers rewards similar to those offered by its Venture sibling, but without the annual fee. With this card, you can earn an unlimited 1.25X miles on every purchase and use those miles to cover a host of travel-related expenses that you charge to the card.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card allows you to earn Chase Ultimate Rewards points that you can redeem for free or discounted flights, rental cars, hotel accommodations, and several other travel-related charges.

And, since points have 25% more value when you redeem them for airfare through the Chase Travel portal, you can likely get that free flight much faster than you think.

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

The Capital One Spark Miles for Business helps ease the financial burden associated with business travel by allowing cardholders to earn miles per dollar on every purchase they make. You can redeem those miles as statement credits or transfer them to more than 10 popular travel loyalty programs.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Don’t let this card’s annual fee scare you off. If you’re looking for free flights, the Chase Sapphire Reserve® has you covered.

Not only will you earn bonus points on travel-related purchases, but all cardholders receive a $300 annual travel credit, a statement credit to reimburse your Global Entry or TSA PreCheck® fees, and access to more than 1,000 premium airport lounges across the globe. That’s how you travel in high style for low cost.

7. Capital One® Spark® Miles Select for Business

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

With the Capital One® Spark® Miles Select for Business, you can get closer to your next free flight by saving your unlimited 1.5X miles earned for every $1 charged to the card. You can redeem those miles to offset the cost of a flight, hotel stay, rental car, or any other travel-related expense.

Once your flight touches down, you can also take advantage of 5X miles earned on hotel and rental car bookings through Capital One Travel.

Best Airline Cards for Free Flights

If you have an airline that you’re loyal to, you may think it’s a no-brainer to add that company’s branded credit card to your wallet. After all, you can maximize loyalty points and earn price breaks, free checked bags, and other valuable add-ons that make your trip easier and less expensive.

Here are our choices for the top airline-branded cards for earning free flights.

8. Delta SkyMiles® Gold Card from American Express

The Delta SkyMiles® Gold Card from American Express lets cardholders take up to $50 off the cost of their flight for every 5,000 rewards miles redeemed. With enough miles, you can pay for your entire flight with the rewards you earn.

And, earning those rewards is easier than ever since you can now accrue 2X miles at restaurants, U.S. supermarkets, and purchases through Delta. Cardholders also receive a free first checked bag and a $100 Delta flight credit when they spend at least $10,000 in purchases in a calendar year.

Additional Disclosure: (The information related to Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Citi® / AAdvantage® Executive World Elite Mastercard® cardholders can earn up to 2X AAdvantage® miles on every purchase they make. Those rewards can help pay for a flight through American Airlines.

Cardholders also receive a free first checked bag, preferred boarding, and a 25% discount on in-flight food and beverage purchases when using their card.

10. UnitedSM Explorer Card

The United Explorer Card from Chase lets cardholders earn up to 2X miles for every $1 charged to the card. And, if you spend at least $3,000 on purchases during your first three months with the card, you’ll get 60,000 bonus miles — which can help pay for your next flight outright.

All cardholders also receive a $100 statement credit every four years for Global Entry or TSA Precheck® fees, as well as 25% back as a statement credit for purchases onboard United-operated flights.

(Non-Monetized. The information related to United Explorer Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

What is the Best Credit Card for Airline Miles?

The cards above can help you earn travel credits for your next flight or give a boost to your frequent-flyer miles account. But not every card packs the same perks.

Here are our choices for the best cards in some popular travel-related categories.

Highest Ongoing Rewards: Capital One Venture Rewards Credit Card

Cardholders earn 2X miles for every $1 spent, which can add up quickly to compensate all, or part, of a travel-related expense. If you save up enough rewards, you can pay for entire flights, hotel stays, rental cars, or other charges that can bog down a trip.

Since Capital One doesn’t partner with a specific airline for its Venture-branded credit cards, you’ll have the freedom to redeem your rewards for any flight at any time.

Best Airline Miles Signup Bonus: Chase Sapphire Reserve®

Chase continually offers some of the best signup bonuses in the credit card industry, but the Chase Sapphire Reserve® may be among its most attractive deals.

New cardholders can earn hefty bonus points after spending a predefined amount on purchases during their first three months with the card. That represents a potential major discount toward your next flight when you redeem the points through the Chase portal.

Best Business Card for Airline Miles: Capital One Spark Miles for Business

Business travel can weigh down your bottom line quickly — but with the Capital One Spark Miles for Business, you can get moving without going into the red.

All cardholders earn 2X miles per $1 on every purchase and a sizeable signup bonus if you meet the criteria as a new cardholder. You can redeem your miles as statement credits to cover previous travel-related expenses or transfer them to more than 10 of the world’s leading travel loyalty programs.

Best for Delta Loyalists: Delta SkyMiles® Gold Card from American Express

Delta is one of the most popular airlines in the world, and the Delta SkyMiles® Gold Card from American Express makes it easy to earn free flights through the carrier.

Cardholders can earn up to 2X points on their purchases and redeem their rewards for flights and onboard purchases through Delta. You’ll also get your first checked bag for free, and a $100 flight credit when you spend at least $10,000 in purchases during a calendar year.

How Can I Travel with a Credit Card for Free?

Travel rewards credit cards have increased in popularity as card issuers have upped the rewards and perks associated with these cards.

With just about all of these cards, you earn either miles or points for every $1 you charge to your card. The number of points you earn will vary by the card type, as will the way you redeem your rewards.

For example, the Capital One Venture Rewards Credit Card and Discover it® Miles card aren’t associated with a specific airline. This means you can redeem your miles for statement credits that essentially erase all, or part, of a recent travel-related expense.

That means you can pay yourself back for a flight, rental car, hotel stay, or other approved expense.

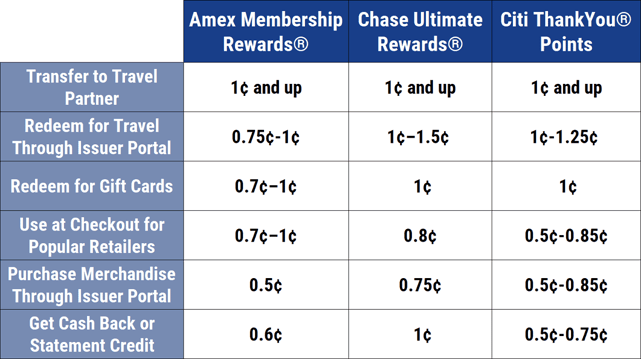

Other cards, such as the Chase Sapphire Preferred® Card, work on a dedicated platform (in this case, Chase Ultimate Rewards®) where you can redeem your rewards for anything you’d like. Options range from flights to electronics, cash back, and gift cards.

Rewards points have varying values, based on what you redeem them for. As an example, you will get more value when you redeem your points for travel accommodations than if you opt for cash back.

Every card allows you to redeem your rewards online through the issuer’s website or via the card’s mobile application. In most cases, the redemption process takes a matter of minutes and you can use your rewards instantly.

Is it Worth Getting an Airline Credit Card?

This depends on how frequently you fly and whether you have a preferred airline.

Regardless of how often you find yourself in the friendly skies, a travel rewards credit card makes a great addition to any wallet.

A non-branded card will allow you to redeem your rewards not only for flights, but for hotel stays, rental cars, ride-sharing services, and other travel-related expenses. This allows you to use your rewards even if you aren’t flying.

An airline-branded card, though, may limit how you use your rewards. Not only are you stuck with flights only through the specific carrier listed on the card, but you may also face blackout dates and other restrictions.

Still, you can find good utility with one of these cards if you’re loyal to a specific airline. That’s because the cards often provide other perks — such as a free checked bag and discounts on in-flight food, beverage, and WiFi purchases.

That savings can add up if you live a jet-set lifestyle — be it for business or pleasure.

Fly the Friendly Skies for Free

Flying can be an enjoyable experience. Paying for the flight? Not so much.

If you often find yourself blowing a good chunk of your travel budget on getting to and from your preferred destination, you should consider one of the best credit cards for free flights. Not only will these cards help you save money on your travel-related expenses, but they can also help you earn enough rewards to fly for free. It doesn’t get much better than that.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Get Free Flights With Credit Cards ([updated_month_year]) How to Get Free Flights With Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Get-Free-Flights-With-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Free Hotel Stays ([updated_month_year]) 7 Best Credit Cards for Free Hotel Stays ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Free-Hotel-Stays-Feat.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![12 Credit Cards that Offer Free Checked Bags ([updated_month_year]) 12 Credit Cards that Offer Free Checked Bags ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-that-Offer-Free-Checked-Bags.jpg?width=158&height=120&fit=crop)

![8 Free Prepaid Credit Cards ([updated_month_year]) 8 Free Prepaid Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Free-Prepaid-Credit-Cards.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Free Car Rentals ([updated_month_year]) 8 Best Credit Cards For Free Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Credit-Cards-For-Free-Car-Rentals--1.jpg?width=158&height=120&fit=crop)

![12 Free Prepaid Debit Cards ([updated_month_year]) 12 Free Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Free-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)