If you’re planning to get a new credit card, you may as well seek out the best credit card sign-up bonuses. Many of the reward credit cards for consumers with average and better credit offer a sign-up bonus, so you have a wide variety of candidates from which to choose. We’ve organized our review by bonus amounts, which directly correlate to the amount of spending required to earn the bonus.

While you may come for the bonus, you’ll stay for the card’s overall benefits. We suggest you look upon the sign-up bonus as just one factor when selecting new rewards credit cards. In the long run, it’s the total package of rewards and perks that determine whether a card will figure prominently in your wallet or collect dust on a shelf.

- $200+ Bonus For Consumers

- $500+ Bonus For Consumers

- $500+ Bonus For Businesses

- Frequently Asked Questions

$200-$300 Credit Card Sign-Up Bonuses For Consumers

These cards offer modest sign-up bonuses in return for a moderate amount of spending on purchases during the first three months following account opening. All offer nice rewards and benefits that make them desirable well beyond their sign-up bonus offers.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card offers a variety of perks beyond the sign-up bonus, including instant purchase notifications, a generous extended warranty program, and travel accident insurance. You can accept your rewards as cash, use them with the online Capital One Shopping tool or to purchase items from Amazon or via PayPal. As with all Capital One cards, you can access Eno for virtual card numbers that protect you against account theft.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

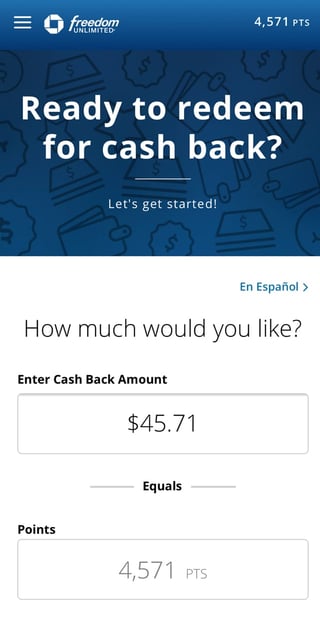

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Points earned on the Chase Freedom Unlimited® can be easily redeemed for cash, travel, gift cards, and purchases made through the Pay with Points feature or directly from merchants. If you also own a Chase Sapphire card, you can upgrade your ultimate reward points to get extra value when redeemed for travel via the Chase Travel site. The card provides $0 liability protection and frequently offers special promotions with partners like Lyft and DoorDash.

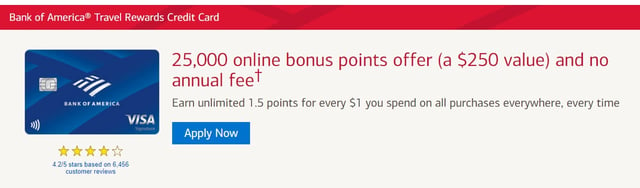

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Travel Rewards credit card is a solid card offering flat-rate points that can be redeemed for statement credits to pay for eligible travel purchases. It currently offers a 0% Intro APR for 15 billing cycles for purchases in addition to the generous sign-up bonus. You can add this card to your mobile device and shop in-store or in-app using Apple Pay, Google Pay, or Samsung Pay.

4. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

If you prefer quarterly rotating bonus category rewards (subject to limits on bonus combined purchases), the Chase Freedom Flex℠ card is available with mostly the same perks you get from the Chase Freedom Unlimited®. You’re eligible for the signup bonus if you do not have this card and have not received a new card membership bonus for this card in the past 24 months. Card benefits include $0 liability protection, free credit score reporting, and point upgrades if you also own a Chase Sapphire card.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card is a travel credit card that comes with $0 fraud liability, integrates with a mobile app, and provides automatic security alerts. You earn airline mile rewards redeemable for travel purchases, including flights, rental cars, hotels, and vacation rentals. If you prefer, you can cash in your miles, use them to buy gift cards, transfer them to a travel partner, or make purchases at Amazon.com or with PayPal.

$500+ Credit Card Sign-Up Bonuses For Consumers

If you have excellent credit and a bigger spending budget, these cards will reward you with a more generous sign-up bonus and extensive perks. Some even offer relatively low annual fees.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card offers about 80% of the benefits offered by its bigger sibling, the Chase Sapphire Reserve® travel credit card, for only 20% of the annual fee. Benefits include special promotions as well as many travel-related perks, including baggage delay insurance, $0 foreign transaction fees, trip cancellation and interruption insurance, and auto rental collision damage waiver. You also get $0 liability protection and point transfer to all participating frequent travel programs on a 1 to 1 basis.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Chase Sapphire Reserve® offers generous travel benefits as well as special promotions with partners such as Peloton. The card lets you access hundreds of airport lounges, obtain a companion pass, and Shop through Chase® online at more than 400 popular stores while earning extra rewards on selected deals. You also get exclusive access to special events, including cooking classes with world-famous master chefs, online charity auctions, and film festivals, among other benefits.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card provides many benefits, including 24-hour travel assistance services, travel accident insurance, and auto rental collision damage waiver. There are several ways to redeem your reward miles, including the Capital One Rewards Center where you can book new travel reservations. Redeeming your miles for travel purchases provides the most value, but if you prefer, you can exchange your airline mile rewards for cash (sub $500 value), gift cards, purchases at Amazon.com and PayPal, or miles in a travel partner’s loyalty program.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% - 27.49% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® is an American Express charge card in which the high annual fee is offset by generous bonus point rewards, various statement credit amounts, a companion pass, and special promotions with Uber and other partners. The Amex International Airline Program provides savings on 25 world-class airlines booked through Amex Travel. Other benefits from this American Express card include an online year-end summary of all activity for the year, complimentary additional Gold Card allotments, return protection on each eligible purchase, and account management on the American Express App.

$500+ Credit Card Sign-Up Bonuses for Businesses

Businesses spend more than individuals, which is why it makes sense for issuers of business credit cards to offer larger sign-up bonuses. The following five cards from Chase and Capital One have high cash or point bonus offer arrangements in return for higher spending requirements during the first three months.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card from Chase offers business-oriented awards such as additional employee cards at no extra cost, extended warranty protection, and trip cancellation/interruption insurance. You and your authorized employees receive cell phone protection against damage or theft when you pay the monthly phone bill with the card. The card allows you to transfer rewards points 1:1 to leading frequent travel programs and charges no foreign transaction fees.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Unlimited® Credit Card offers the simplest rewards scheme among the trio of Ink business cards, with one flat cash back rate on all purchases. Benefits include travel and emergency assistance services, auto rental collision damage waiver, and emergency roadside dispatch. You also receive limited purchase protection against purchase damage and theft, and one-year extended warranty protection on each eligible purchase.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card from Chase skews its biggest cash back rewards toward business-related purchases. The card provides employee cards at no extra cost, but it does impose a penalty APR for late and returned payments. As with all Ink Business cards, you can convert your unused credit line into a MyChaseLoanSM fixed-rate, low-APR installment loan without an application, credit check, or fees.

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

The Capital One Spark Miles for Business is Capital One’s top miles card for small businesses, offering several benefits that help your company run. For example, you can download your purchase records in several formats, including QuickBooks, and you can set up AutoPay and recurring transactions. You can also get quarterly and annual custom, itemized spending reports to help you with your budgeting, planning, and taxes.

What is a Credit Card Sign-Up Bonus?

Unless you recently arrived from another planet, you know that credit cards aggressively compete with each other for your business. Each issuer looks for ways to recruit new cardmembers, and one weapon in their arsenal is the credit card sign-up bonus.

The bonus is a promotion open to new cardmembers who will receive extra rewards (such as cash back, points, or miles) for achieving set spending targets after opening the card account. The sign-up bonus is sometimes paired with a 0% intro bonus APR, typically for the first six to 15 months, on purchases and/or balance transfers.

Banks use signup bonuses to entice customers to apply for their credit cards.

The rules for eligibility affect consumers who have already collected a sign-up bonus on the same card and closed the account. The rules may also extend to bonuses collected from other credit cards from the same issuer.

How Does a Credit Card Sign-Up Bonus Work?

The rules are pretty simple: You will receive specified bonus rewards when you spend the required amount in the introductory period (typically three months) following account enrollment. For example, you may receive $300 cash back by spending $2,500 on purchases in the first three months.

Each card establishes its own reward and spending scheme. Typically, higher rewards require more spending. Sometimes the program involves two periods. You can earn an initial bonus in the first period and additional rewards by spending a set amount more in the second.

Each card establishes its own reward and spending scheme. Typically, higher rewards require more spending. Sometimes the program involves two periods. You can earn an initial bonus in the first period and additional rewards by spending a set amount more in the second.

The sign-up bonus is of the same type (cash back, points, miles) as the card’s standard rewards. You can redeem the reward as soon as you receive it, which may be one to two months after the reward period ends. The account must be open and not in default at the time your bonus is posted.

In general, there is a direct relationship between a card’s sign-up bonus, spending requirement, and annual fee.

Cards with no annual fee tend to have smaller sign-up bonuses and lower spending requirements. The reverse is true for cards with high annual fees.

How Do You Hit a Credit Card Minimum Spend?

To hit your credit card’s sign-up bonus minimum spend, just buy, buy, buy till you get there. You must charge the required amount on purchases during the bonus period. You don’t have to pay for the purchases during the period, but you do have to make at least the minimum payments.

Only purchases count toward the spending requirement, which means the following are excluded:

- Any checks that access your account

- Balance transfers

- Cash advances

- Casino gaming chips

- Fees of any kind, including an annual fee, if applicable

- Foreign currency

- Interest

- Lottery tickets

- Money orders

- Other betting transactions

- Other cash-like transactions

- Racetrack wagers

- Refunds and returns

- Traveler’s checks

- Unauthorized or fraudulent charges

- Wire transfers

Typically, sign-up bonuses appeal to consumers who are contemplating big-ticket purchases. The purchase price of these items can bring you close to the minimum spend amount or even put you over the top. It’s like getting an extra discount on stuff you needed anyway.

What Can the Welcome Bonus Be Redeemed For?

Sign-up bonus rewards take the form of cash back, points, or miles, the same as the card’s regular rewards. There’s no difference in the redemption procedures for the sign-up bonus versus regular rewards.

In either case, your monthly statement or the card’s online account page will tell you your current reward level and may even preview your upcoming rewards for the next billing cycle.

You usually have several options for redeeming your welcome bonus. You may be able to receive the reward as a direct deposit to your checking account or as a check mailed to you. Other ways to redeem your rewards may include a statement credit, deposits to brokerage and 529 education accounts, gift cards, purchases at selected merchants (such as Amazon.com), and even charitable donations.

Reward points and miles can often be transferred to the frequent flyer programs of partner airlines and hotels. Pay attention to the transfer ratio — a 1:1 ratio is best. You also may be able to use cash back to purchase additional points or miles, which comes in handy if you are short of the amount needed to pay for a flight or other travel credit card purchase.

Whatever form your rewards take, it behooves you to maximize your credit card use during the bonus period so you are assured of racking up the required spending. Some tips for accomplishing this include:

- Eschew other ways to pay: Wherever possible, use your new credit card to make purchases during the bonus period, which is usually three months. Don’t pay with a debit card, cash, or checks unless the merchant doesn’t accept your credit card. Also, don’t use other credit cards, even if they have a better reward or bonus offer on a particular purchase.

- Pay your rent with your new credit card. Most landlords don’t directly accept a rent payment via credit card. However, many third-party companies will accept the card payment and then forward cash to the landlord. The fee for this service may range up to 5%, but you’ll only need to do it during the bonus period.

- Check your automatic payments: You may have made autopay arrangements with your local utility, cable provider, cellular network, and other monthly billers. In some of these arrangements, you may have the choice of paying from your checking account or via a credit card. Where possible, switch the autopay to your new credit card, at least for the duration of the bonus period.

- Delay cash advances and balance transfers: During the bonus period, don’t utilize your credit line for anything other than purchases that satisfy the signup bonus spending requirement, something that cash advances and balance transfers do not do. Also, several types of purchases are ineligible for rewards, including money orders, traveler’s checks, lottery tickets, etc., so don’t use your new credit card to pay for these.

- Accelerate big-ticket purchases: If you have any large purchases planned for the next 12 months, see if you can move up the purchase date so it occurs during the three-month signup bonus window. Many folks wait to apply for a new credit card with a large sign-up bonus until they are ready to, say, renovate a kitchen and buy a whole new array of appliances.

- Put group purchases on your card: Going to dinner with seven of your best friends? Volunteer to put the bill on your credit card and have the others reimburse you with cash or checks. Same for tickets to sporting events, plays, concerts, and so forth.

- If you are a business, stock up: The spending requirements are usually much higher for the sign-up bonuses on business credit cards. It’s therefore a good time for your company to purchase all the supplies it will need for the next six to 12 months, plus any other business purchases you can accelerate into the bonus period.

Your ingenuity will be rewarded as you look for ways to satisfy the bonus period spending requirement. However, don’t go overboard — only buy what you can afford to repay.

Do All Cards Offer Sign-Up Bonuses?

Not all credit cards offer sign-up bonuses. This is generally true for cards aimed at consumers with bad credit. Also, certain issuers, including Credit One, do not offer sign-up bonuses on any of its cards.

Student and secured credit cards seldom offer this bonus, although there are exceptions, such as the Bank of America® Travel Rewards credit card for Students and the Wells Fargo Business Secured Credit Card.

Are Points or Cash Back Bonuses More Valuable?

For the most part, bonus points and cash back rewards are equally valuable whether earned through a sign up bonus or regular purchases. However, points (and miles) may be worth more when redeemed for travel.

Several factors determine the value of your rewards:

- Award ratio: This is the ratio of how much you have to spend to earn one unit of reward. The base award ratios shared by most credit cards is 100:1, depending on the type of reward:

- Cash back: The base award ratio is $1.00 in eligible spending earns you $0.01 in cash. Elevated award ratios, usually in the range of 1.5X to 5X, increase the amounts you’re awarded for each dollar spent. For example, if your card awards 5X cash back for grocery store purchases, you’ll earn $0.05 for every dollar spent on grocery store purchases.

- Points (and miles): Once again, the base award ratio of 100:1 equals 1 point for every dollar spent on eligible purchases. A 5X points award ratio means you’ll earn 5 points per dollar spent on qualifying purchases.

- Redemption ratio: This is the value you receive for redeeming rewards. For cash back, this is simply the dollar value in your reward cache. But the value of points and miles depends upon how you redeem them, as described below.

- Expiration: Usually, you keep your cash back and points as long as the account remains open. In other words, you lose any unredeemed rewards when you close the account. Sometimes, mileage rewards may start expiring if you don’t use your rewards card for a certain period of time. On rare occasions, you’ll encounter a cash back card that will automatically redeem your rewards and send them to you when you close the account.

- Minimum redemption: Many cards let you redeem your rewards in any amount with no minimum. However, always check the fine print, as some cards do set a minimum redemption amount and/or limit redemptions to unit amounts, such as multiples of 500 points.

- Annual fee: The value of rewards is diluted by the amount you must spend on the card’s annual fee. For example, if a cash back rewards card has an annual fee of $595, you’d have to earn that much in rewards just to break even. To be fair, cards with high annual fees usually have the most generous sign up bonuses and award ratios.

Ideally, you’d want a card with the most generous award and redemption ratios, and with no early expiration rules, minimum redemption amounts, or annual fees. As noted, the tension between award ratios and annual fees will have to factor into your decision of which credit card best suits your lifestyle.

Beyond higher award ratios, a large annual fee usually buys you many additional benefits, often related to travel credit card expenses that are covered or reimbursed.

Cash Back

Cash back is the most versatile of rewards since you can spend redeemed cash on anything you please. Furthermore, other types of rewards can be converted to cash if you so wish. However, the cash you redeem from a card that specializes in points or miles may be less than the value of those other reward types.

For example, the Chase Sapphire Reserve® is a points card, but you can easily redeem your sign-up bonus in cash. However, the Ultimate Rewards points are worth 1.5X more than their cash value when applied to travel purchases made through the Chase website.

Points

Points are a flexible type of reward because you can use them as is, convert them to cash, or exchange them for miles in a frequent flyer program. Most cards that offer points also offer shopping opportunities to use your points. Prominent examples include Chase Ultimate Rewards, Capital One Rewards, and American Express Membership Rewards.

You can often redeem your points for cash back, but the value is usually less than what you’d get for other redemption options.

At these shopping sites, you can redeem your points for travel, merchandise, and services. Often, the points have extra value when used for specific purchases, As we pointed out earlier, the Chase Sapphire cards are worth 1.25X to 1.50X when used for travel at the Chase rewards site.

One big difference between cash back and points is value. Cash is valued by its denomination — a dollar is a dollar. Points are valued by what they can buy for you, for which there is no universal standard. That’s why it is hard to compare points-based signup bonuses because 100,000 points from Card A may have purchase power equal to 80,000 points from Card B.

Furthermore, the cash value of points from a single card may vary depending on how you redeem them. For example, many cards peg the cash redemption value of a point to one cent — you can cash out 100 points for a dollar. But the same points may be valued differently when redeemed for purchases.

You can get some idea of how the value of points varies by combing through the fine print that accompanies a credit card advertisement. You may have to go two or three links deep to find the information, but it’s in there. Before you spend too much time researching point values, note that card issuers usually add language claiming the right to alter those values without notice.

Miles are usually found in co-branded airline cards and are therefore less versatile than points. That’s because miles are subject to the rules of the co-branded airline’s frequent flyer program. That’s not necessarily a negative if you travel often on the co-branded airline, but otherwise, you would probably want to own at least one other credit card to accumulate non-travel rewards.

What is Credit Card Churning?

Credit card churning occurs when you frequently open and close credit card accounts to earn sign-up bonuses. On the surface, it sounds like a great deal for the ambitious consumer, but don’t get too excited — you must consider several drawbacks. Naturally, the credit card companies frown on churning and try to prevent it.

The practice is simple to execute, at least in theory. You pick a card that offers a nice sign-up bonus but doesn’t charge a high annual fee (which would reduce the incentive for churning the card). You then use the card for the following three months to earn, collect, and redeem the sign-up bonus, after which you close the account sometime within the first year — to avoid paying another annual fee, if applicable.

If it sounds too simple to be true, you’re right. Credit card issuers caught on pretty quickly and instituted rules to make churning much harder.

For example, consider the two Chase Sapphire cards, both of which offer generous sign-up bonuses. Chase allows you the bonus from one of the cards if you don’t currently own either, and if you haven’t received a welcome bonus from either card in the past 48 months.

Issuers have also instituted rules limiting card ownership, such as Chase’s 5/24 Rule, described below.

Credit card churning is the practice of frequently opening new card accounts to obtain the signup bonuses and canceling the cards before the annual fees hit.

Another weapon issuers sometimes use is to rescind points earned by churning. In the extreme, the issuer may close your credit card account, and also any checking or savings account you have at the issuing bank.

The issuers’ protective reactions to churning may have slowed the practice, but it still exists — you just need to be more organized about it. A hard-core churner runs the game like a business, keeping track of each issuer’s rules and planning in advance which cards to apply for and when to do so. Often, churners wait to pounce on special sign-up bonuses occasionally offered by card issuers.

Beyond the question of whether card churning is ethical, is it worth the time and energy? Before you decide, consider the major drawbacks:

- Issuers may shut down your card account and possibly other accounts at the issuing bank.

- Issuers may take back rewards you earned by gaming the system.

- Churning can hurt your credit scores and make it harder to get a substantial loan (such as an auto loan).

- You may find yourself spending enough on annual fees, interest, and unnecessary purchases to make churning a less desirable practice. For example, if a card requires a large amount of spending to earn the bonus, you may have to spread out the payments over time. Unless the card also offers a 0% intro bonus APR for a new card membership, you’ll have to pay interest on the carried balances, interest that will cut into your net rewards.

- If you’re not careful, you may find yourself with more debt than you can handle.

- Churning is almost impossible if you have bad credit since the cards available to you probably don’t offer sign-up bonuses.

- Churning may not be worth it in terms of the amount of the reward you reap for the effort and time you sow. If you make just one mistake, you conceivably could wipe out the value of rewards earned.

Churning can hurt your credit in a few ways beyond the impact caused by opening a new credit card, discussed below.

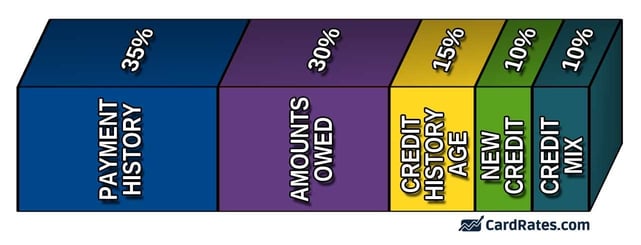

The churning practice of opening and closing accounts tends to reduce the average age of your credit accounts. In the FICO scoring system, the length of your credit history accounts for 15% of your overall score — you are rewarded for having a long history, as it tells a good story about your experience handling credit.

FICO looks at three factors when evaluating the length of your credit history:

- The age of open accounts, including the oldest account, newest account, and the average age of all accounts.

- The age of each specific account.

- The amount of time since each account was used.

All of the items are on the standard credit reports issued by the major bureaus (Equifax, Experian, and TransUnion). When you open a new account and then close it sometime in the first year, you will be likely shortening your account ages and hurting your score.

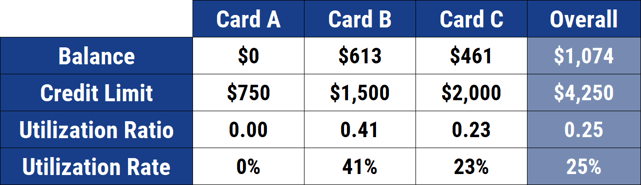

Another problem with churning is that it may increase your credit utilization rate (or CUR, equal to credit used divided by total credit available) with respect to your credit cards. The credit used is the total outstanding balance on your credit cards. Credit available is equal to the sum of your credit card credit lines.

Generally, a CUR above 30% will hurt your score, whereas your score will do better if your CUR drops below 20%. The problem with churning, especially aggressive churning, is that you may not be able to pay off your purchases in the next billing cycle, thereby increasing your credit used relative to your available credit. Your CUR will suffer and so will your credit since it accounts for 30% of your FICO score.

Bear in mind that CUR involves credit cards only and excludes other types of revolving accounts (such as home equity lines of credit). Also, to keep a low CUR, you need to pay your balance before your statement date, which occurs about three weeks before the payment due date. By making the payment earlier, you ensure that the amount owed will always be reported as zero to the major credit bureaus.

Does Opening a New Credit Card Affect Your Credit Score?

Opening a credit card account almost certainly will hurt your credit score. Usually, the impact is on the order of five to 10 points and lasts for a year before it dissipates. The damage derives from the hard inquiry (or hard pull) a credit card issuer will perform when considering your application for a new card.

Credit inquiries are requests for information from your credit reports. The requests are recorded in your credit reports, but their visibility and impact differ by whether the inquiry is hard or soft:

- Soft inquiry: A soft pull is a check of your credit that does not involve opening a new account. Common reasons for a soft inquiry include checks performed by potential employers, existing creditors, lenders looking to prequalify you for a loan offer, collection agencies, and occasions when you check your own personal credit. Soft inquiries do not hurt your credit score, and they are visible only to you. They remain on your report for 12 to 24 months, depending on how the credit bureau operates.

- Hard inquiries: These are inquiries made in relation to opening a new credit account or loan and must be authorized by you in advance. The fine print in credit card agreements discloses that you are providing tacit authorization for a hard pull whenever you apply for a card. Because hard inquiries may indicate some degree of financial distress, they hurt your credit score to a minor degree (five to 10 points).

The source and date of each hard inquiry are visible to anyone who accesses your credit report. It remains on your report for two years, but only hurts your score for the first year. Hard inquiries comprise 10% of your credit score.

Hard credit inquiries are clustered together when you are rate shopping, say for a new mortgage. In other words, multiple inquiries made within a 14- to 45-day window for the same type of account are counted as a single inquiry. This feature lets you nail down the best deal without crippling your credit score.

What Are the Best Credit Cards For 2021?

We’ve created a comprehensive listing of the year’s best credit cards. You can peruse it to find the leading cards in various categories.

This article describes the cards with the best sign-up bonuses, so if that’s what you’re looking for, you found it!

What is a 5/24 Rule?

The Chase 5/24 Rule caps the number of credit cards you can own when you apply for a new Chase card. The rule is shorthand for the following limit: You cannot have opened more than 5 new credit accounts in the previous 24 months and still qualify.

Remarkably, the 5-account limit covers all creditors, not just Chase. This is one way that Chase combats card churning, which means the Rule will stop new applicants in their tracks even if they have excellent credit.

There is a chance you can get Chase to make an exception to the Rule if you contact the bank’s reconsideration line at 888-270-2127 (personal cards) or 800-453-9719 (business cards) and thrash it out with a customer rep. You may have a winnable case if you are only an authorized user on one or more of the five cards.

Chase is by no means the only issuer that limits card ownership. For example, Citibank’s 8/65/95 Rule states that:

- You must wait 8 days to apply for a second card after applying for another Citi card.

- You must wait 65 days before applying for a third Citi card.

- You must wait 95 days before applying for a second Citi business card.

The limits apply to Citibank credit cards only.

Capital One’s limit is simple: You can own no more than two of its credit cards at the same time.

American Express enforces its 4/4 Rule limiting you to four each of its credit cards and charge cards. This rule doesn’t apply to authorized users.

All of these rules help to make card churning harder to accomplish. Clever or patient churners can probably work around the rules, but they’ll have to put some effort into it. It would seem that ownership limits may be more effective against casual churners rather than the seasoned pros.

Are Signup Bonuses Taxable?

Under normal circumstances, no credit rewards, including sign-up bonuses, have to be included in your taxable income when filing taxes. The reason is that you have to first spend money on purchases to get the reward, which allows the rewards to be treated as nontaxable discounts or rebates.

One exception involves credit cards that give you a signup bonus even if you don’t use the card to make any purchases. Since you haven’t bought anything, the bonus can’t be considered a rebate, making the income taxable. The Amazon Prime Rewards Visa Signature Card is an example of such a card because it gives you an instant Amazon gift card.

Don’t worry, though — you only have to declare instant bonuses when they exceed $600. That’s the threshold for issuers to send out Form 1099-MISC, notifying you and the IRS about a taxable bonus. The Amazon gift card amount is below the $600 limit, so your CPA is likely to ignore the bonus.

In the unlikely event you receive a 1099-MISC form declaring your bonus reward, you’re safer including the amount in your annual taxable income. It’s a much better solution than suffering through an audit or penalty for underreporting income.

Can I Get a Sign-Up Bonus with Bad Credit?

Very few credit cards that offer a sign-up bonus are designed for consumers with bad or thin credit. The Wells Fargo Business Secured Credit Card is a rare example of a secured card with a sign-up bonus. If you are a student, the Bank of America® Travel Rewards credit card for Students is one of the few cards of its kind with a sign-up bonus.

Given the slim pickings, the best way to get into the action is to improve your credit score so you can qualify for the higher-quality cards that offer sign-up bonuses. Let’s review a few ways to boost your FICO score:

Fix Your Credit Reports

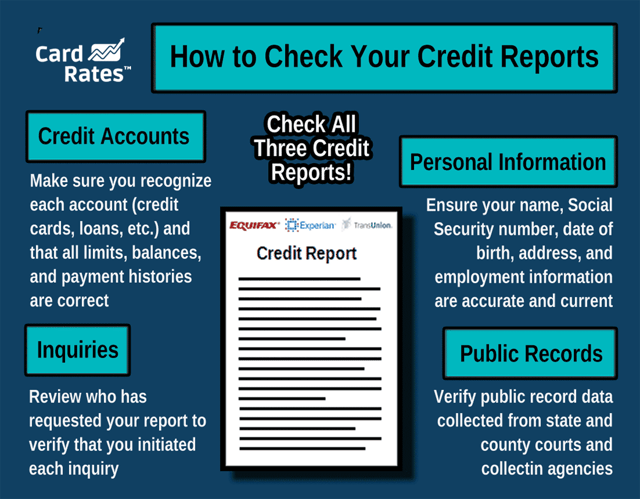

Your credit reports are chock-full of information about your life, including where you live, your job history, how much debt you owe, and whether you pay your bills on time. Regarding your usage of credit cards, every month the credit bureaus receive updates from card issuers, merchants, and others regarding your spending and payment activity.

All that information funnels into the FICO scoring system as interpreted by each of the three major bureaus — Equifax, Experian, and TransUnion. The result is that your score is updated each month to reflect your financial activity. Unfortunately, inaccurate negative information sometimes falls into the hopper and drives down your credit score.

You can repair your credit score by removing mistakes from your credit reports. By law, the credit bureaus must allow you to dispute items on your credit report. If your challenge is accepted, the disputed items are removed, and your score should see an immediate improvement.

There are two ways to fix your credit reports. The first is to do it yourself, which entails the following steps:

- Order copies of your credit reports: You can get free copies at AnnualCreditReport.com, the only federally authorized source of free credit reports.

- Inspect for errors: Comb through each credit report and note anything suspicious, including accounts you don’t recognize, hard inquiries you didn’t authorize, and account balance that seem wrong.

- Dispute inaccurate information: The three credit bureaus have specific website pages that allow you to challenge bad information. Enter a separate dispute for each error you find, explaining why you think it’s wrong and including any evidence that bolsters your argument.

- Track progress: It can take up to a month for a credit bureau to investigate a dispute and come to a judgment. The bureau may have to interact with the provider of the disputed information as part of the investigation. You should receive a formal statement explaining what action the bureau will take to resolve the problem.

- Appeal adverse decisions: If your challenge was denied but you still think you’re correct, you can issue an appeal and include any additional information to bolster your case. Even if your dispute is ultimately denied, you can add a note to your credit report explaining your side of the story. While this won’t help your score, it will give creditors a more balanced view that may help you win approval for a loan or credit card.

If you successfully remove derogatory data from your credit reports, you should see your credit score rise within a month or two. Check with the credit bureau if you still don’t see the improvement after two months have elapsed.

The DIY method essentially costs no money, but it will require time and energy to execute. If you’d rather have help, consider hiring a credit repair company. These are professional services with expertise in disputing information on your credit reports. They usually operate by submitting a set number of challenges each month for as long as you subscribe to their service.

Typically, these companies work on a monthly subscription basis, with rates ranging from about $79 to $150 per month. Subscriptions commonly run for six months, but you can extend the service or cancel it early. The credit repair services can’t guarantee success, but we judge the ones we review to be ethical and effective.

Pay Your Bills on Time

Now that you’ve cleaned up old problems, you can concentrate on preventing new ones. The most important way to improve your credit is to pay your bills on time. By keeping your payments up to date, you avoid all the score-killing consequences of missed payments: collections, charge-offs, repossessions, garnishments, foreclosure, and bankruptcy.

Your credit history accounts for 35% of your credit score, the biggest single factor in the FICO scheme. Therefore, making timely payments is an essential part of your campaign to raise your credit score.

Sometimes, the problem is as simple as not being organized. You can combat this in a few ways:

- Establish a monthly budget with reminders to pay your recurring bills on set dates. Personal finance software is a good tool for scheduling payments and making them on time.

- Set up autopay. Many billers provide for autopay from your checking account or another source. Autopay kicks in when you don’t make the payment yourself. You can usually set parameters to pay all of the bill each month or to limit the payment to a set amount.

- Consolidate your debts so you have to remember only one monthly payment. If your debt is confined to credit cards, you can execute a set of balance transfer transactions, preferably using a 0% introductory APR. As an alternative, you can use a personal loan to consolidate your debts and then pay it off in fixed monthly installments.

A much harder problem to fix is not being able to afford timely payments. Consider these actions to help you meet your financial obligations:

- Take advantage of your credit card’s grace period, the time between the end of the billing period (also known as the statement date) and the payment due date. In most cases, the grace period is 21 to 25 days in length, during which time you don’t incur interest on your current balance (if you started the period with a zero balance). The extra three weeks may be enough to scrape together the money you need for at least the minimum payment.

- Speaking of minimum payments, you can resort to these if it’s all you can afford. The problem is that you’ll now be paying interest on your remaining balance until it is fully repaid. Besides being more expensive, paying the minimum each month may require years to pay off the balance.

- Consolidation can reduce your monthly payments if you can get a lower APR and/or longer repayment term.

- Request a hardship accommodation from your creditors. Helpful outcomes can include lower minimum payments, reduced interest rates, deferred payments, waived late fees, and more. While not granted automatically, many creditors prefer hardship accommodations to defaults and may be willing to negotiate with you.

- Seek debt settlement, in which lenders and creditors forgive part of your debt. Unless you have some financial expertise, you may do well by hiring a debt relief company to negotiate on your behalf. Typically, the process is for you to send money to the debt relief company each month that the company then distributes to your creditors in an agreed-to manner.

- You can petition for bankruptcy if all else fails. In Chapter 7 bankruptcy, your assets are sold off and your debts are completely dismissed. In Chapter 13, you keep your assets and agree to repay your debts according to a structured plan that lasts three to five years.

Many of these steps will hurt your credit score and remain on your credit report, sometimes for up to 10 years. But don’t despair, your score can begin to recover within a couple of years if you exhibit creditworthy behavior.

Reduce Your Debt

A time-tested way to improve your credit score is to pay down your existing debt without going into new debt. That’s not necessarily easy to do if you have a tight budget, so consider ways to increase your income and/or reduce your spending.

The amount of your debt accounts for 30% of your credit score, as we mentioned earlier in our discussion of the credit utilization ratio. You can reduce your CUR by paying down your card balances and/or increasing your credit limits (without using the new credit!).

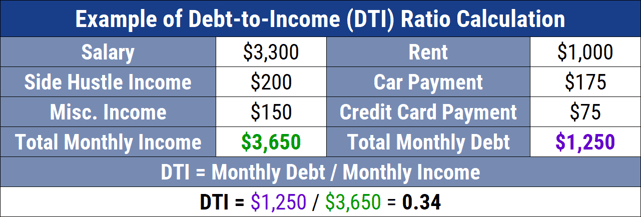

Another important metric is your debt-to-income (DTI) ratio, which most lenders want to be below 36% before they will approve a loan. Mortgage lenders are a little less strict, requiring a DTI below 43%.

As you pay off credit cards, do not take any steps to close the accounts. The FICO scoring system rewards you for long-standing accounts — the average age of credit history makes up 15% of your credit score. Use your old credit cards once a year so the credit bureaus don’t close the accounts.

Other Steps to Improve Your Credit

Here are additional steps you can take to strengthen your credit scores:

- Do not apply for new credit, which accounts for 10% of your FICO score. As discussed earlier, new credit applications that require hard pulls can reduce your score by 5% to 10% each for up to one year.

- Increase your credit mix, which makes up another 10% of your credit score. FICO rates it as positive if you have experience juggling different types of loans and credit accounts.

- Sign up for Experian Boost or one of its competitors. These products can raise your credit score by reporting your utility, phone, and cable payments to the credit bureaus.

As your credit score improves, you’ll be able to access credit cards with increasingly valuable sign-up bonuses. Consider it just one of the many reasons to aim for a high credit score.

Compare the Best Credit Card Sign-Up Bonuses Online

The credit cards in this review offer the best sign-up bonuses currently available. You can get more information and apply for any of these cards by clicking the Apply Now link. Always take the time to read the fine print accompanying any credit card offer — you’ll get the most value from your cards while avoiding unpleasant surprises.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Business Credit Card Sign-Up Bonuses ($200 to $1250) – [updated_month_year] 8 Business Credit Card Sign-Up Bonuses ($200 to $1250) – [updated_month_year]](https://www.cardrates.com/images/uploads/2021/03/Business-Credit-Card-Sign-Up-Bonuses.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year]) 8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/500.png?width=158&height=120&fit=crop)

![7 Best Credit Card Signup Bonuses $200 – $1,250 ([updated_month_year]) 7 Best Credit Card Signup Bonuses $200 – $1,250 ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/Best-Credit-Card-Signup-Bonuses.jpg?width=158&height=120&fit=crop)

![How to Sign Up For a Credit Card: Expert Guide ([updated_month_year]) How to Sign Up For a Credit Card: Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/signup2.png?width=158&height=120&fit=crop)

![8 Bank Signup Bonus Credit Cards: $200 – $750 ([updated_month_year]) 8 Bank Signup Bonus Credit Cards: $200 – $750 ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Bank-Signup-Bonus-Cards.jpg?width=158&height=120&fit=crop)

![7 Best $200 Signup Bonus Credit Cards ([updated_month_year]) 7 Best $200 Signup Bonus Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Best-200-Signup-Bonus-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Credit Card Bonuses For Bad Credit ([updated_month_year]) 7 Credit Card Bonuses For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Credit-Card-Bonuses-for-Bad-Credit-Feat.jpg?width=158&height=120&fit=crop)

![Are Credit Card Signup Bonuses Taxable? ([updated_month_year]) Are Credit Card Signup Bonuses Taxable? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Are-Credit-Card-Signup-Bonuses-Taxable.jpg?width=158&height=120&fit=crop)