Going to college is more of an expectation these days as companies put more value on potential job applicants who have a degree. Many employers require a degree to even be considered for an entry-level position.

However, the road to graduation doesn’t always result in the best financial outcome. A growing number of students face serious financial burdens thanks to unmanageable student debt and limited employment opportunities that make it difficult to pay down these balances.

How much debt a student takes on depends on several factors, including the type of school, where it is located, and the type of loan. The overall debt load will also be affected by how much family assistance the student receives, scholarships or grants, and the length of time in school.

All said, one thing remains the same: Many young adults graduate neck-deep in debt and find it difficult to get ahead financially after they graduate.

While a college degree has been shown to lead to higher-paying jobs that will offset the financial burden of student debt, poorly managed student loans can hinder reaching major life milestones in the future. Here’s a look at the staggering student debt statistics in America.

1. Total Student Loan Debt Tops $1.6 Trillion

Student loan debt in America has reached a whopping $1.68 trillion, and nearly 45 million Americans carry student loan debt. This number may come as no surprise given the growing cost of attending a four-year college.

In fact, tuition bills have climbed an average of 2.2% per year above and beyond inflation over the last decade, according to the Trends in College Pricing report from The College Board.

The average annual cost to attend a public four-year college is nearly $22,000 for in-state tuition with room and board and other fees. It’s no wonder more students and their parents lean on loans to afford college these days. This may also explain why over one-third of the total student loan debt is still outstanding.

2. About a Third of Student Loan Borrowers Say the Costs of Their Bachelor’s Degree Outweigh Benefits

About one-third of student loan borrowers say they believe the lifetime financial cost of earning a bachelor’s degree outweigh the benefits, according to a study from Pew Research Center. In this same study, college graduates between the ages of 25 and 39 with loans are more likely than graduates without loans to say they are either finding it difficult to get by financially or are just getting by.

Meanwhile, 32% of young college graduates with student loans say they are living comfortably, compared to 51% of college graduates of a similar age who do not carry any outstanding student loan debt.

Although student loan debt can cause strain on a monthly budget, keeping expenses low in the first few years after graduating can allow for bigger monthly payments. The faster you pay down your student loan balance, the faster you can reap the financial gains of earning a college degree.

3. Student Loans are Associated with Higher Income

For those who don’t have cash or scholarships to pay for school, taking on debt may be the only road to better-paying opportunities later. An analysis of the Federal Reserve Board’s Survey on Household Economics by Pew Research Center found that 52% of young college graduates with student loans live in families earning at least $75,000 a year compared with just 18% of those without a bachelor’s degree.

On the flipside, approximately 53% of young adults without a bachelor’s degree earn a household income of less than $40,000, compared with 21% of young college graduates with student loans. This data clearly shows that a college degree is a necessity for achieving career and income growth.

However, this doesn’t mean you have to take on tens of thousands of dollars of debt to make a good salary. Applying for grants or scholarships, choosing an in-state or less expensive school, and living at home to save on room and board are all realistic ways to reduce your debt burden but still achieve similar employment opportunities and pay.

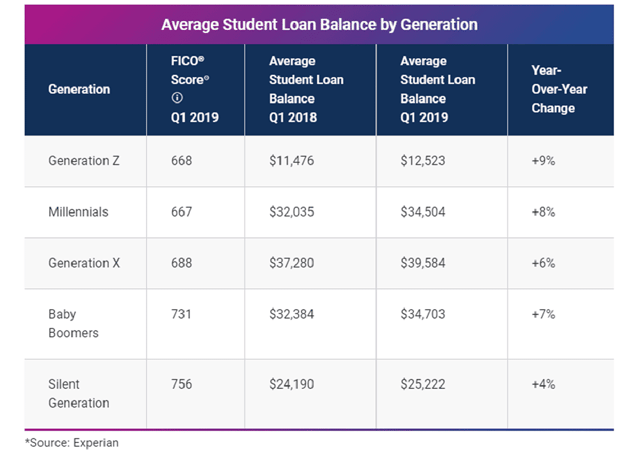

4. Generation X Carries the Highest Student Loan Debt

Millennials may have the highest consumer debt on average, but they come in below other generations when it comes to student loan debt.

In fact, data from Experian found that Generation X carries the most student loan debt at an average of $39,584 per borrower. That’s over $5,000 more in student loan debt per borrower compared with millennial student loan holders.

Data from Experian shows Generation X has the highest average student loan balances.

Meanwhile, baby boomers have an average of $34,703 in student loan debt — the second-highest student loan balance and just slightly higher than the average owed by millennials. Overall, the national average of student loan debt across all consumers was $35,359 as of the first quarter in 2019, according to the Experian survey.

5. Borrowing Rates are the Highest Among Black College Students

African American students who earned a bachelor’s degree carried the highest median debt across all ethnic groups at $31,000, according to data from the 2015-2016 National Postsecondary Student Aid Survey from the National Center for Education.

Specifically, this group of graduates had the highest borrowing rate at 84%, compared with a 71.2% borrowing rate for Asian students, a 67.6% borrowing rate for white students, and a 44.3% borrowing rate for Hispanic or Latino students during the same academic year.

6. Women Take on More Student Loan Debt than Men

Gender disparities in our society even reach student debt as more females take on loans to earn a degree. Females hold nearly two-thirds of the nation’s nearly $1.6 trillion in student loan debt, amounting to a whopping $929 billion, according to a report from the American Association of University Women.

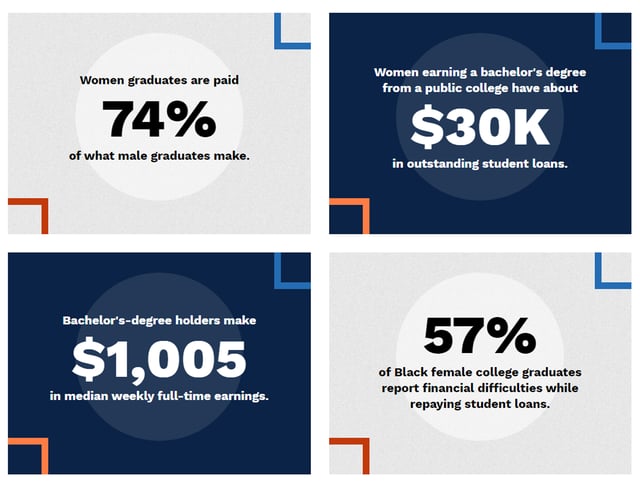

Female graduates owe nearly $22,000 in student debt, on average, compared with $18,880 owed by men. Considering female graduates are paid 74% of what their male peers earn after graduating and entering the workforce, it’s no wonder female graduates take an additional two years to pay off their loans.

Data from the American Association of University Women.

Even more concerning is that Black female borrowers are disproportionately affected by student debt, carrying the highest loan balance upon graduation, with an average of $37,600 in student loan debt.

7. Student Borrowing Needs Rise Exponentially

More Americans rely on student loans to earn a degree as the cost of college increases. Student borrowing has risen exponentially over the last 15 years, according to data from the National Center of Education Statistics.

Statistics show that about 6 in 10 college seniors ages 18 to 24 took out loans for their education during the 2015-2016 school year, which is up from about half in the 1999-2000 school year.

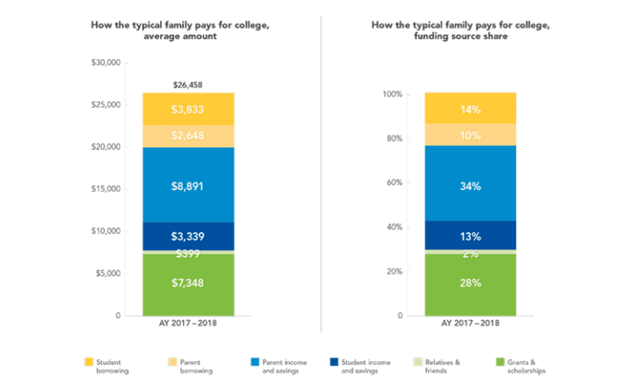

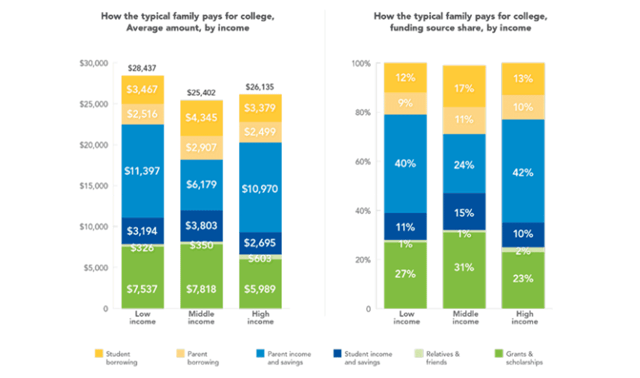

8. Parents Are the Sole Student Loan Borrower in 14% of Families

When you think of student loans, you usually only think of college kids borrowing money. But in many cases, it is both students and parents who take out loans.

The 2018 How America Pays for College study from Sallie Mae found that 53% of families borrowed money in the 2017-18 school year to help pay for undergraduate education.

Among those who took out student loans, 14% were borrowed solely by parents, and 7% were borrowed by both the student and parents.

9. An Estimated 1 Million Borrowers Default on Student Loans Each Year

Keeping up with student loan payments is critical for maintaining a healthy credit file and avoiding late fees and penalties. Unfortunately, many graduates find it hard to manage payments and end up defaulting. This is when a borrower has not made a payment toward their education debt in 270 days, which triggers the account to be sent to a third-party collection agency.

Some 250,000 student loan borrowers default on payments every quarter, according to the Underwater on Student Debt research report by the Urban Institute. That comes to a total of 1 million borrowers who default on their loans each year.

Meanwhile, nearly 40% of all borrowers are expected to default on their student loans by 2023, according to U.S. Department of Education data.

10. More than Half of Families Used Scholarships to Pay College Bills

Student loans aren’t your only option when it comes to paying for college. Scholarships, grants, and several other programs can help supplement your tuition expenses.

According to the 2018 Sallie Mae report, 57% of families used scholarships to pay some portion of college expenses in 2017. Scholarships represent the single most-used resource to pay for an undergraduate’s education. The average total award among those who used one or more scholarships was $7,760.

Scholarship money paid for 17% of college costs in the 2017-18 school year. More interestingly, colleges award three times the amount of scholarship money, on average, than other sources combined.

The reality is that many students would not be able to afford college without these scholarships, or they’d be on the hook for a larger loan bill.

11. About 20% of Student Loan Borrowers Go into Default

Student loan repayments usually go into effect a couple of months after graduation, depending on your loan provider and terms, and missing payments can be detrimental to your overall financial health. Yet, some 20% of borrowers, including students and parents who took out a loan during the 2015-18 school year, were reportedly in default as reported by the U.S. Department of Education.

Defaulting on a loan is defined as having gone at least 270 days without a payment. The same report found that millions of student loan borrowers are behind on payments and that 1 million loans go into default each year.

12. Most Student Loans in Default Have Balances of Less than $5,000

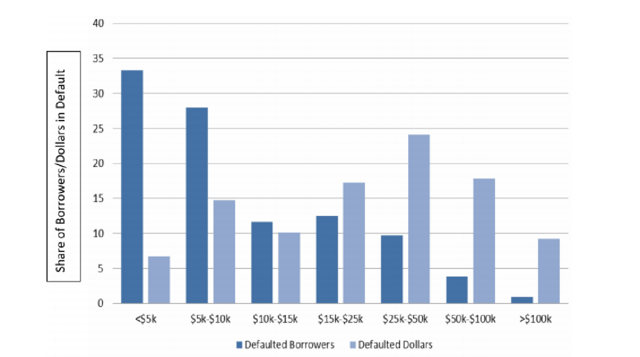

Although this may seem counterintuitive, a study published in Economics of Education Review found that roughly 60% of borrowers in default owe less than $10,000 — and most of them owe less than $5,000.

Roughly 60% of borrowers in default owe less than $10,000. Source: Adam Looney and Constantine Yannelis in the August 2019 issue of Economics of Education Review.

This is likely due to the fact that students who do not complete degrees tend to have lower debt levels than college graduates, but they also have lower earnings, which makes repayment more difficult.

13. Graduates from Low-Income Families are 5X More Likely to Default

A 2018 Student Debt report from The Institute for College Access & Success found that graduates from lower-income families are five times more likely to default on their loans than their peers from higher-income families.

Meanwhile, this report also found that 21% of Black college graduates defaulted within 12 years of entering college.

14. Nearly Half of Student Loan Debt is for Graduate School

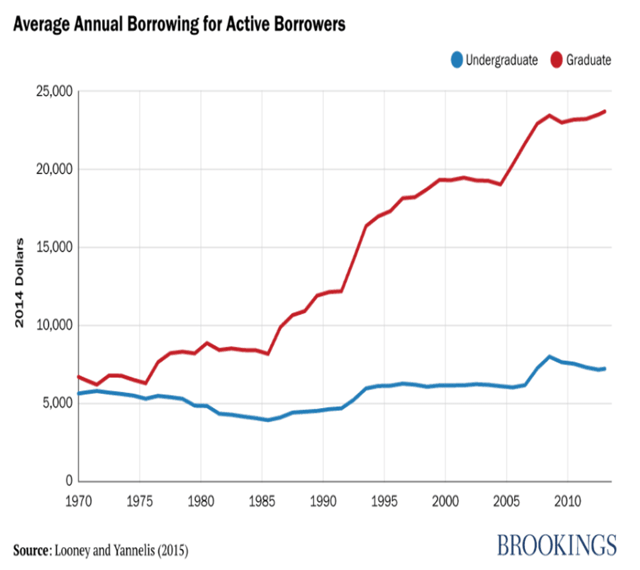

Earning a higher degree often comes with more lucrative jobs and higher earnings, but it also comes with a higher debt bill.

It may come as no surprise that graduate students have the highest average student loan balances.

Brookings.edu reported that graduate school student loan debt accounts for nearly half of all outstanding student loan debt, and approximately 24% of all student loan debt is held by borrowers without a bachelor’s degree.

15. The Average Student Loan Interest Rate Hovers Around 5.8%

A 2017 report by New America found that the average student loan interest rate among all households with student debt was 5.8%, which included both federal and private student loans. This means a student or parent who borrows $30,000 and takes 10 years to pay off the balance will pay approximately $9,600 in interest charges.

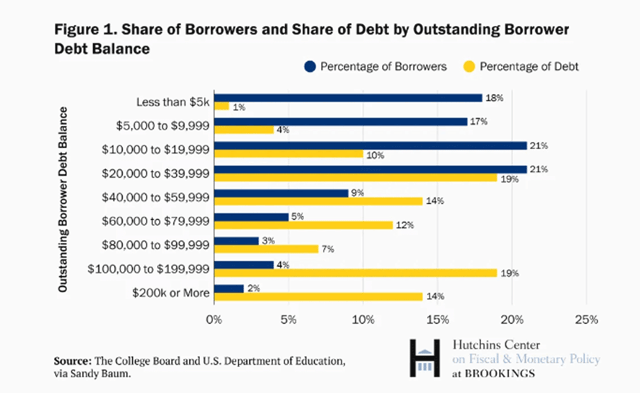

16. Loans of Over $100,000 Account for a Small Percentage of Borrowers

With so many student loans going into default every year, you’d think the number of people carrying significant balances would be much higher. However, a report from the Hutchins Center on Fiscal and Monetary Policy at Brookings found that only 6% of student loan borrowers owe more than $100,000, and 2% owe more than $200,000.

On the other hand, 18% of those who took out student loans owe less than $5,000 in debt.

17. Students Take Out $30,000 Just for Living Expenses

Paying for college tuition and books aren’t the only school expenses students struggle with. Many don’t have money to pay for basic living costs, including food, transportation, or shelter.

According to an Urban Institute analysis conducted using the National Postsecondary Student Aid Study, 22% of students at public universities and colleges borrow at least $30,000 to finance their living expenses.

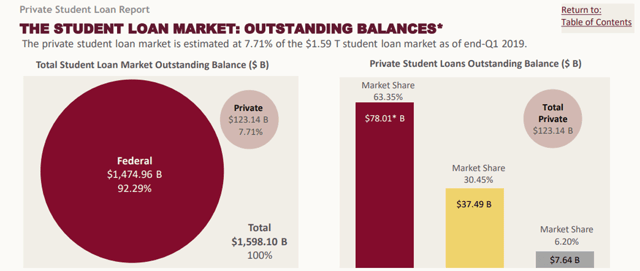

18. Federal Loans Account for 92% of Student Loans

Students have a few options when it comes to borrowing for college, including both federal and private student loans. An estimated 92% of student loans are federal (not private) loans, according to the MeasureOne Private Student Loan Report.

More than 92% of student loans are federal student loans issued by the U.S. Department of Education.

This is good news for these borrowers because interest rates are lower on federal loans than they are on private student loans and come with better repayment terms.

19. Average Student Loan Payments Run $393 Per Month

With the average student loan payment hovering at around $393 per month, as reported by the U.S. Federal Reserve, it’s no surprise many recent graduates struggle to pay their bills. Payscale found that college graduates with up to five years of experience earn less than $50,000 per year, on average.

This suggests that college graduates are spending around 10% of their earnings on student loan payments, which could be hindering their ability to reach other major life milestones.

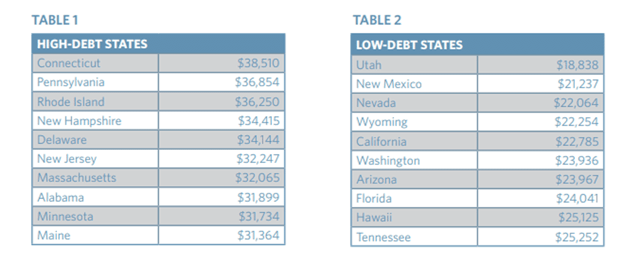

20. Student Loan Debt Varies Widely by State

Where a student chooses to attend college can greatly affect his or her debt balance. The same 2018 Student Debt report from The Institute for College Access & Success also found that student loan debt from four-year college varies widely from state to state.

2017 state averages for the amount of debt at graduation ranged from a low of $18,850 in Utah to a high of $38,500 in Connecticut, according to the report. Overall, states with the highest debt among college graduates were concentrated in the Northeast and low-debt states were mainly in the West.

Students in Connecticut have the highest average outstanding student loan balances while students in Utah owe the least, on average.

The high cost of living in places like New York, New Jersey, and parts of Massachusetts can contribute to higher debt levels, as students often rely on loans to pay for living costs as well as tuition.

21. More than 8 Million Borrowers Use Income-Driven Repayment Plans

Income-driven repayment plans offered to some federal student loan borrowers help graduates maintain lower monthly payments. Borrowers can request to limit monthly payments to a certain percentage of their income — typically between 10% to 20% — through this program, which can potentially forgive the remaining balance after a certain term.

More than 8 million federal student loan borrowers are currently on an income-driven repayment plan.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![21 Startling Credit Card Data Breach Statistics ([current_year]) 21 Startling Credit Card Data Breach Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Credit-Card-Data-Breach-Statistics.jpg?width=158&height=120&fit=crop)

![11 Surprising Teen Credit Card Statistics ([current_year]) 11 Surprising Teen Credit Card Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Teen-Credit-Card-Statistics.jpg?width=158&height=120&fit=crop)

![18 Revealing Credit Card Ownership Statistics ([current_year]) 18 Revealing Credit Card Ownership Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Revealing-Credit-Card-Ownership-Statistics.jpg?width=158&height=120&fit=crop)

![25 Shocking Credit Card Processing Statistics ([current_year]) 25 Shocking Credit Card Processing Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/11/Credit-Card-Processing-Statistics.jpg?width=158&height=120&fit=crop)