Today’s credit card marketplace is brimming with options for rewards. And consumers will have no difficulty finding a credit card that doesn’t charge an annual fee. But finding a no-annual-fee credit card with rewards is an extra special treat.

Many credit card issuers tack on fees or higher interest rates to offset the cost of the rewards they pay to cardholders. By leveraging a card with no fee that still pays rewards, you can earn money for spending money. Who doesn’t want that?

Our list of the best rewards cards that charge no annual fee also features hotel and travel rewards options, as well as business credit cards and options for consumers who have bad credit, so you aren’t just limited to cash back or points.

Overall

Cash Back | Travel | Business | Bad Credit

Best Overall Rewards Card with No Annual Fee

With the Chase Freedom Unlimited® card, you can earn cash back rewards on every purchase that never expires or caps out. And, not only will you never pay an annual fee to use this card, but you can also take advantage of the 0% APR introductory period that Chase often offers with this card.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

If the rewards, lack of annual fees, and the 0% introductory APR period weren’t enough, this card also has a cash signup bonus after you meet the minimum spending requirement on purchases during the first three months of activating your card. Most people can hit that mark simply by charging a few of their monthly bills to the card and then paying them off after the charges post to their account.

Best Cash Back Rewards Cards with No Annual Fee

Cash is still king in the financial world, and cash back cards are among the most popular rewards a credit card issuer can offer. These cards allow you to earn a percentage of each purchase back in the form of cash or a statement credit.

When you combine that with a no-fee card, like those below, you’re maximizing your savings and cutting the cost of the items you purchase.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card is one of the most popular cash back cards on the market — thanks, in part, to its quarterly bonus categories and unique rewards offer in the first year of account membership.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card pays out an unlimited 3% cash back on dining, entertainment purchases, and grocery stores as well as 1% on all other purchases. The card also offers a promotional 0% APR introductory period with no annual fee or foreign transaction charges.

4. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

With the Chase Freedom Flex℠ card, you can take advantage of a 0% APR introductory period while earning up to top cash back in quarterly category spending. Thanks to the Credit Journey℠ program, you’ll also receive a free weekly credit score update.

Best Travel Rewards Cards with No Annual Fee

Just about everyone loves to travel, but few people enjoy the costs associated with taking a trip. Airfare, rental cars, taxis, hotels, and other expenses add up and can take away from your entertainment or souvenir budget.

The list below includes the best travel rewards credit cards with no annual fee. With one or more of these cards in your pocket, you can earn credits that pay for all, or part, of those pesky expenses that keep most people glued to their couch.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles card pays rewards miles for every $1 spent and comes with Discover’s unique year-end bonus after the first year as a cardholder. This card is great for people who have a big trip planned in the future because it allows you to save your miles over time and use them all at once to pay for a big portion of your vacation.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card doesn’t limit how you use your earned miles. No blackout dates or restrictions apply because you redeem your miles earned on each $1 spent as a statement credit that reimburses all or part of a travel-related expense.

This allows you to travel any way you want without having to read the fine print to make sure your purchases qualify for reimbursement.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

You can earn an unlimited 1.5X points for every $1 you charge to your Bank of America® Travel Rewards Credit Card. Points act the same as miles and you can redeem them as statement credits to pay for flights, hotels, vacation packages, cruises, rental cars, and baggage fees.

Best Business Rewards Cards with No Annual Fee

No matter the size of your business, you’re probably accustomed to paying fees for just about everything you need. You can avoid at least one of those fees by signing up for one of the cards below.

These business credit cards offer rewards that match the needs of most entrepreneurs — without tacking on an annual fee for the privilege.

The Ink Business Unlimited® Credit Card pays flat-rate cash back on every purchase you make, so you never have to worry about which purchases earn the most rewards. There’s no limit to the amount of cash back you can earn, even though you’ll never have to pay an annual fee.

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% - 24.49% (Variable)

|

$0

|

Excellent

|

With the Capital One Spark Cash Select for Excellent Credit, you can earn cash back on all purchases and a one-time cash bonus when you charge enough to the card within three months after opening your account. The free employee cards also earn cash back that you can use to help fund your business operations.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

You can earn as much as 5% cash back with the Ink Business Cash® Credit Card and still take advantage of a 0% introductory APR offer. You can also obtain employee cards at no extra charge and earn bonus cash back if you meet the spending requirement within your first three months after card activation.

Best Bad-Credit Rewards Card with No Annual Fee

Secured credit cards often come with high fees and no rewards, but the Discover it® Secured Credit Card bucks both trends by offering cash back rewards on all purchases.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

As with most secured credit cards, Discover requires a refundable cash deposit to open your account. The amount of your deposit will equal your credit limit.

The card issuer reports your payment history to the credit reporting bureaus, which can improve your credit score and help you graduate to one of Discover’s many unsecured credit cards.

Why Would Anyone Pay an Annual Fee for a Credit Card?

Fees aren’t fun — and they certainly aren’t for everyone — but, in some cases, an annual fee can unlock some serious benefits. Many fees can also pay for themselves if you take advantage of the abundant rewards these cards offer.

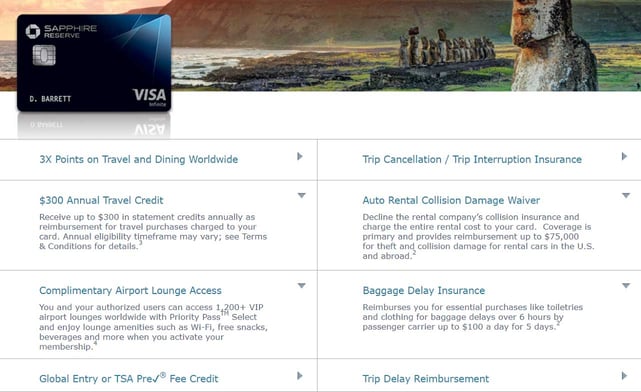

Take the Chase Sapphire Reserve® as an example. The $550 annual fee on this card likely seems outrageous to most people, but to understand the card’s appeal, you have to look at what you get for the money.

As a cardholder, you’ll receive a $300 annual travel credit that reimburses you for airfare costs, hotel stays, or other travel-related charges. You’ll also receive access to over 1,000 Priority Pass™ airport lounges, a $100 application fee credit for Global Entry or TSA PreCheck®, and several other money-saving perks.

You’ll also earn 3X points on travel and dining purchases. New cardholders also receive a generous signup bonus.

Cards that charge annual fees, such as the Chase Sapphire Reserve®, often come with premium rewards and perks many consumers find valuable.

So, as you can see, these cards aren’t meant for people on a tight budget. But if you travel often and make many charges to your card, the annual fee can pay for itself with the money-saving features and other perks.

Other cards may offer higher-than-average cash back yields, annual perks (such as reimbursement for TSA Precheck or Global Entry fees), or access to better rewards redemption rates that make them more beneficial to many consumers.

How Can I Get My Credit Card’s Annual Fee Waived?

In most cases, the only way to avoid an annual fee is to sign up for a credit card that doesn’t charge an annual fee in the first place.

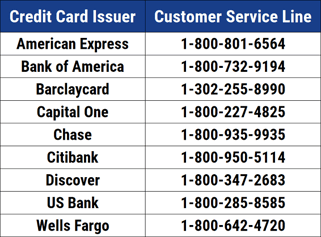

Very rarely will a credit card issuer simply waive a fee because you request it. That doesn’t mean it will hurt you to contact your card issuer and ask — but don’t expect a positive response.

Having your annual fee waived may be as simple as calling customer service and asking.

Some people have found success when asking if they threaten (nicely) to cancel their account, if they leverage their long-term loyalty to the card issuer as a reason for waiving the charge, or if they downgrade their account to a new card in the issuer’s portfolio that doesn’t charge an annual fee.

Requests may be denied because the annual fees most cards charge cover many of the expenses the bank incurs when it pays out rewards and other perks. That’s why you can often find additional charges associated with many cards that yield higher rewards, such as higher APRs.

But the cards listed above truly offer no annual fees or other hidden charges. Many even offer introductory periods of 0% interest, which provides fee-free financing for a set period.

Some cards will also allow you to use your accrued rewards to cover your annual fee. In some cases, you can simply transfer the rewards over and erase the fee. In other instances, you may have to redeem your cash back and use the funds to pay the fee.

Should I Cancel a Credit Card with an Annual Fee?

In most cases, we advise against canceling a credit card because of the impact it can have on your credit score. It’s understandable, though, that you may want to avoid paying an annual fee on a card you don’t use much.

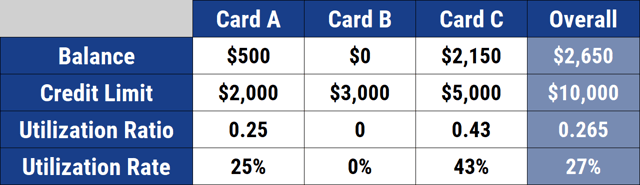

Credit scoring agencies factor credit utilization into their calculations to determine your credit score. You can find your current utilization by dividing your current total balance by your overall credit limit.

For example, a card with a $2,000 credit limit and a $1,000 current balance has a 50% utilization rate. Lenders want to see low utilization on your credit cards. The more credit you use, the more financial trouble you appear to be in.

Your utilization ratio accounts for 30% of your FICO credit score. Any slight shift to that number can impact your score — for better or worse — pretty quickly.

When you cancel a card that has low utilization, you erase that available credit from your credit report. That instantly increases your current utilization and can decrease your credit score.

But you likely don’t want to pay a hefty annual fee just to preserve some points on your credit score. In this case, you can call your credit issuer and inquire about switching your card to an offering that doesn’t charge an annual fee.

By doing so, you may preserve your available credit and avoid the fee. You’ll also maintain the card in case of an emergency.

You Don’t Have to Pay to Earn Great Rewards

People typically earn rewards for a service or a job well done, so you shouldn’t have to pay for rewards if you don’t want to. With one of these no-annual-fee credit cards with rewards, you can earn perks without having to negate the rewards with an annual fee.

And these cards won’t limit you only to cash back — you have your choice of travel rewards, business benefits, or even unheard of rewards from a secured card. So, even with bad credit, you can get rewarded for the money you spend.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year]) 14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Rewards-Credit-Cards-with-No-Annual-Fee-Feat.jpg?width=158&height=120&fit=crop)

![8 Best No Annual Fee Credit Cards ([updated_month_year]) 8 Best No Annual Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/annualfee.png?width=158&height=120&fit=crop)

![13 Best No-Annual-Fee Credit Cards ([updated_month_year]) 13 Best No-Annual-Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/best-no-annual-fee-credit-cards.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![7 Best Student Credit Cards With No Annual Fee ([updated_month_year]) 7 Best Student Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Student-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year]) 5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Air-Miles-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)