Whether you’re newlyweds or have several anniversaries under your belt, the best credit cards for married couples can strengthen your family’s financial future.

By adding your spouse as an authorized user on your credit account (or vice versa), you can share in a joint credit line that reports to every major credit bureau and improves both of your credit scores with responsible use. You can also earn joint rewards or work together toward earning a sign up bonus.

And with both names on the card account, you’ll never have to worry about someone being without an emergency credit line. That can provide great peace of mind in a world that often requires quick access to funds.

Best Overall | Cash Back | Miles | Points | Business | Bad Credit | FAQs

Best “Overall” Card For Married Couples

The Discover it® Cash Back card makes it easy to add your spouse as an authorized user. All you’ll need to do is submit a short form with your spouse’s first and last name, address, date of birth, and Social Security number. If approved, Discover will mail your spouse their own card with his or her name on it.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Once activated, you can both share in the joint credit account and earn unlimited cash back on all of your eligible purchases. Discover cards are accepted at 99% of places across the county that take credit cards, and you’ll get to choose from several unique card designs.

Best “Cash Back” Card For Married Couples

You can easily add your spouse as an authorized user on your Capital One Quicksilver Cash Rewards Credit Card by submitting the new user’s personal information on the Manage Users page of the bank’s website or mobile application.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

With this card, you can earn unlimited cash back on every purchase that either of you makes. That can add up to some serious savings if you pay your balance in full each month to avoid interest charges.

Best “Air Miles” Card For Married Couples

Just like the Capital One Quicksilver Cash Rewards Credit Card listed above, you can add your spouse as an authorized user on your Capital One Venture Rewards Credit Card by visiting the Manage Users link when you log onto the Capital One website or mobile application.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

Together, you can save for your next family vacation by earning unlimited miles on every purchase that either of you makes. You can redeem those miles to cover the cost of travel expenses you’ve already purchased with the card.

Best “Rewards Points” Cards For Married Couples

To add your spouse as an authorized user on your Chase Sapphire Preferred® Card, start by visiting the Accounts tab on your Chase account page. Through the drop-down menu, choose “Account Services” and then “Add an authorized user.” There, you can create a unique username and password for the user and set the user’s level of card access — none, view only, or transact.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

As joint cardholders, you’ll both accrue credit card rewards for every purchase you make. These are some of the most valuable rewards in the industry, and every Chase Ultimate Rewards point you earn can be redeemed for a host of options — including travel deals, merchandise, gift cards, cash back, or a statement credit.

Best “Business” Card For Married Couples

Whether you’re a solopreneur or you’re running a family business, you can add your spouse as an authorized user of your Capital One Spark Cash for Business card by visiting the “Manage Users” tab within your account portal.

5. Capital One Spark Cash for Business

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

And since all card users earn credit card rewards, you’ll earn cash back even faster. All users receive a unique card with their name on it so you can manage business spending for each user.

Best “Bad Credit” Card For Married Couples

The Capital One Platinum Secured Credit Card allows cardholders to add an authorized user by visiting the “Manage Users” tab in your online account portal or through the bank’s mobile application. Once added, you’ll both have access to the card’s credit line, and the account history will be reported to every major credit bureau for both of you.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

This is a rare secured credit card that may not require a full security deposit that matches your card’s credit limit. Instead, Capital One will base the amount of your deposit on your credit history. That makes this card one of the most affordable tools to rebuild your credit score.

Can Married Couples Get Credit Cards Together?

Credit cards typically don’t allow more than one primary cardholder per application. The card must be under one person’s name, but that doesn’t mean the card account must only have one user.

You can add your spouse as an authorized user during the application process or at any time after you’ve activated your account. This gives your spouse access to the card’s full credit line and their own card in his or her name.

An authorized user’s spending also counts toward earning rewards points or cash rewards through a cashback card. All spending will also help you earn any potential sign up bonus or welcome bonus. Plus, the card’s balance and payment history will be reported under both of your names to each credit bureau, which means you’ll both improve your credit history with responsible behavior.

Both the primary cardholder and authorized user will also have access to other card benefits, including airport lounge access, credit monitoring, identity theft protection, and FICO score updates. Both users will pay the same interest rate on any accrued credit card debt.

Married couples can get credit cards together by applying for a joint account through select issuers or by adding one spouse as an authorized user to the account.

If the card charges an annual fee, you’ll only have to pay the fee once for the credit card account to remain open, though some premium rewards cards, such as The Platinum Card®, charge an additional fee for authorized users.

Every credit card issuer has a different process for adding an authorized user. In most cases, you can add your spouse easily through a link on the credit card company’s website or mobile application. After you submit your spouse’s personal identifying information, the bank will either confirm or deny your request.

A bank may deny a request to add an authorized user if the new user has a bad history with the card issuer or a pending bankruptcy case.

Just remember that the primary cardholder is responsible for any credit card debt accrued by the authorized user. The debt will fall on the primary account holder’s shoulders if the authorized user refuses to pay his or her share of the joint credit card account balance.

What is an Authorized User?

An authorized user is someone added to the card by the primary cardholder giving the authorized user access to the credit line and full range of features provided by the credit card issuer. You may add an authorized user if you want to maintain a joint credit card account or if you have good credit and want to help the authorized user improve his or her credit score.

You can add an authorized user to an unsecured card or a secured card, and that user will receive his or her own card with their name on it. Whenever the card is used, the charge will be deducted from the card’s available balance. The card will still only require one monthly payment for the shared balance.

Your credit card company will report the account history to the credit bureaus, which will then appear as a tradeline on each of your credit reports. This can help cardholders improve their credit score as long as they make timely payments and maintain a low balance.

Many married couples choose to add the spouse with the lower credit score as the authorized user on the account to give both partners access to credit while working to earn a good credit score for both users. You can maximize your rewards potential because spending by both users will earn credit card rewards.

Can You Improve Your Credit as an Authorized User?

As an authorized user, you can improve your credit score if the account you’re attached to has a positive payment history and a low balance. On the other hand, you can also hurt your credit score if the primary cardholder submits late payments or if either of you runs up a high balance.

Every month, each credit card company reports every secured card or unsecured card’s account balance and payment history to at least one credit bureau. The three major credit bureaus are TransUnion, Equifax, and Experian.

The bureaus add the report information to your personal credit history and use it to calculate your credit score. As you’d expect, positive data will improve your score and negative data will hurt it.

The credit card issuer will report the account information for both the primary cardholder and any authorized users on the account. If you have recent negative data on your credit file, the addition of positive data will help to push past reports further down your credit history.

Your credit score focuses on recent data more so than older information. The more positive data you can add to your credit report, the higher your credit score will climb. Your account information will continue to be reported every month for as long as you’re an authorized user on the account.

Your credit score may vary month to month based on your credit card balance and activity on any other credit or loan accounts listed on your credit report.

What is a Joint Credit Account?

A joint credit card account is different from an authorized user account because, with a joint account, both users maintain full responsibility for the card balance.

A credit card company rarely pursues an authorized user for unpaid credit card debt. Instead, the primary cardholder is solely responsible for all accrued debt — although all card users will reap the credit score benefits — or damage — from the account.

With a joint account, both users share equal responsibility for the debt and the account maintenance. In the case of a default, the credit card issuer can pursue both users to collect payment. Both users will also share any legal responsibilities in the case of a default.

Bank of America and Wells Fargo allow joint credit card applications, but you need to have a joint bank account with the institution to qualify for a joint credit card account.

With a joint account, either user can add a new authorized user, approve transactions, and redeem rewards, whereas an authorized user may have limited account access. The primary cardholder can set limits and restrictions on what an authorized user can do on some cards. That’s not the case with a joint account.

Can a Spouse Use My Credit Card When I’m Not There?

Someone cannot legally use your credit card when you’re not present if their name is not on the card or the account. Even if you give permission for the person to take your card and use it, this is still considered an unauthorized transaction, and the occurrence may force you to forfeit your account.

A person cannot legally use a credit card that isn’t in their name, even if their spouse gave them permission to do so.

To avoid this potentially costly mistake, add your spouse as an authorized user on the account. Your spouse will receive his or her own printed credit card that grants access to the credit account and its features.

What Happens to My Credit Card When I Get Married?

Your credit card account will not change when you’re married. The only thing you’ll need to report to your credit card issuer is a possible name change that comes from your nuptials.

When you apply for a credit card, the bank approves or denies your application based on your personal credit history, income, and current debt load. When you get married, the bank assumes your income will remain the same and will not alter your credit account in any way.

If there’s no name change involved with the marriage, you don’t need to report your status update to your issuing bank. But you can opt to add your new spouse as an authorized user to your credit account.

In some cases, particularly with Bank of America or Wells Fargo, you may be able to add your spouse as a joint user. This should not change your interest rate or annual fee, but you will both share responsibility for the card account and the credit card debt you accrue.

Adding your spouse as a joint account owner may lead to a higher credit limit, a card upgrade, or other additional perks if you and your spouse both have a good stream of income and good credit.

Just keep in mind that not every bank allows joint accounts. If yours doesn’t, your only other option is to add your spouse as an authorized user.

Will Adding an Authorized User Hurt My Credit Score?

Adding an authorized user to your credit card account will only hurt your credit score if the user initiates several new charges that give you a high account balance.

The act of adding a new user will not impact your credit score or even reflect on your credit report.

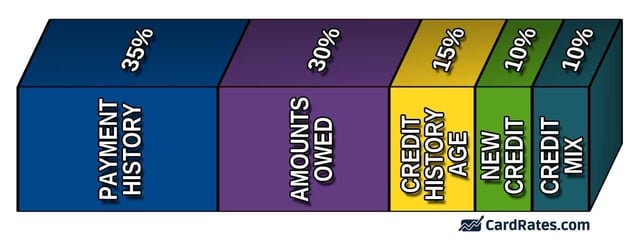

Approximately 30% of your FICO credit score is based on your current debts. The higher your debt, the lower your credit score. If your authorized user charges additional debt, be it through new purchases or a balance transfer, you may see a drop in your credit score if the debt isn’t repaid soon.

Even with an authorized user, your credit card account will still only require one monthly payment. As the primary cardholder, you’re solely responsible for making that payment. If the authorized user does not contribute to the payment to cover his or her share of the debt, you’ll still have to make the payment to avoid taking a hit to your credit score.

Even with an authorized user, your credit card account will still only require one monthly payment. As the primary cardholder, you’re solely responsible for making that payment. If the authorized user does not contribute to the payment to cover his or her share of the debt, you’ll still have to make the payment to avoid taking a hit to your credit score.

It’s important to have an in-depth conversation with anyone you’re considering adding as an authorized user before you make the move. Setting clear ground rules may help avoid expensive and relationship-damaging occurrences.

Research the Best Credit Cards For Married Couples

Adding an authorized user to your credit card account is a great way to share your credit line, while giving a spouse or other family member access to valuable credit card perks, such as airport lounge access, credit monitoring, identity theft protection, or FICO score updates.

And the best credit cards for married couples, listed above, can help you earn cash back, bonus points, travel miles, or simply help your spouse improve his or her credit score. Applying for one of these cards takes less than five minutes, and you can add an authorized user while you apply.

If approved, you’ll both receive your cards in the mail within seven to 10 business days, and can begin working together to pay for wedding expenses, home repairs, or that vacation you’ve always dreamed of.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards for Single Parents ([updated_month_year]) 7 Best Credit Cards for Single Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Single-Parents.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Families ([updated_month_year]) 9 Best Credit Cards For Families ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Credit-Cards-For-Families.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Prepaid Debit Cards For Teens & Parents ([updated_month_year]) 9 Best Prepaid Debit Cards For Teens & Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Best-Prepaid-Debit-Cards-For-Teens-Parents.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)