Being a parent is hard; being a single parent is one of the most challenging tasks anyone could ever undertake. And, as any single parent will tell you, a little extra help now and then is always welcome.

Often, that help comes in the form of a piece of plastic you can rely on when finances are tight. But identifying the best credit cards for single parents is not always easy.

Choosing a credit card should be based on your own unique needs, financial circumstances, and lifestyle. How you typically use a credit card will determine what type of card you should consider.

Overall

0% APR | Balance Transfer | Cash Back | Groceries & Dining | Gas | Credit-Building

Best Overall Card for Single Parents

With all you have to worry about as a single parent, you don’t need the added stress that comes from juggling multiple credit cards. But if you choose to carry a single card, that card had better be able to perform multiple functions.

Here’s our choice for the best overall card for single parents who value time and convenience, but still want the most from just one card.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card is a great card for anyone looking to eliminate the confusion of carrying multiple credit cards. Plus, it comes with a friendly introductory rate on balance transfers and purchases that can help you get your budget back on track. There’s also a ton of features that Discover offers to cardholders, like free FICO credit scores on your statement, a feature that allows users to have an on/off switch if you misplace your card, contactless tap to pay, and more.

You’ll also find fewer fees with the Discover it® card than with similar cards. Discover also has a 100% U.S.-based customer service team that is available 24/7.

Best 0% APR Card for Single Parents

A credit card should do more than just help make purchases convenient. That’s why 0% cards are so popular — they save you money on interest, can help you consolidate other card debt, and can help you pay down existing balances faster.

While there are plenty of 0% cards out there, our top choice is the Chase Freedom Unlimited® for single parents looking to save.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Sure, the Chase Freedom Unlimited® offers a 0% introductory rate on purchases after account opening, but it also offers so much more. First is the fact that this card comes with no annual fee.

Next is the unlimited cash back rewards on every purchase with rewards that never expire. You may also qualify for a cash signup bonus after spending a minimum amount in the first three months of opening your account.

The Chase Freedom Unlimited® is available to those with good to excellent credit, meaning a score of at least 670 or higher. If accepted, you can expect card features that include fraud protection and alerts, purchase protection, extended warranty, and the convenience of contactless payments.

Best Balance Transfer Card for Single Parents

Balance transfer credit cards are one of the most effective ways to pay down debt fast while avoiding additional interest charges. They let you consolidate monthly payments onto one card and can help you get a better handle on your budget.

When transferring balances from higher interest cards to a balance transfer card, the interest you were paying can instead go toward reducing your balance.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The card comes with an industry-leading intro rate on balance transfers. You can transfer balances from multiple cards within a set time frame of account opening to take advantage of this extraordinary offer.

A small balance transfer fee may apply, but remember that this is a one-time fee. When used as part of an overall debt-reduction strategy, a balance transfer card can help lower your debt faster by putting what had been interest payments directly toward your principal.

Best Cash Back Card for Single Parents

When it comes to credit card reward programs, nothing says simplicity like cash back. These rewards are easy to redeem, easy to transfer, and easy to see exactly how much you’ve earned.

As a single parent, eliminating complexity is priority number one, so a simple credit card reward plan that’s easy to use should be right up your alley.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card lets you earn bonus cash back in rotating categories each quarter. These are places you regularly visit, including gas stations, grocery stores, restaurants, and even wholesale clubs, up to the quarterly maximum.

Plus, your cash back rewards never expire, and you can redeem them at any time and in any amount.

Best Grocery and Dining Card for Single Parents

Food expenses make up a significant portion of a single parent’s monthly budget. Why not earn extra cash back for those purchases?

A rewards card that’s specially designed for dining and entertainment lets you take full advantage of your food spending by offering higher-than-average rewards in this common expense category. The Capital One SavorOne Cash Rewards Credit Card is a premier credit card for anyone who regularly spends on food and entertainment.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

There’s no annual fee for the Capital One SavorOne Cash Rewards Credit Card, and new cardmembers can earn a one-time cash bonus for spending a minimum amount within the first three months. New cardholders can also expect a low introductory rate on purchases.

Applicants should have good to excellent credit, meaning a FICO score of around 670 or higher.

Best Gas Card for Single Parents

Gas purchases are unavoidable for most of us. So, getting rewarded for using your card at the pump is a big perk for single parents.

Finding a card that offers big cash back rewards for gas purchases, plus cash back at other places you use your card, is especially nice. Here’s our top gas card recommendation.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Cash Rewards Credit Card is a unique card in that it offers 3% cash back rewards in a category you choose. The rewards are set to the gas category by default, but you have an opportunity to choose a different category each month.

As a gas card, it lets you earn the maximum 3% cash back at gas stations, marinas, fuel dealers, and even wholesale clubs with pay at the pump. You’ll additionally earn 2% back at grocery stores and wholesale clubs, plus 1% back on all other purchases.

Note that 2% and 3% cash back applies to the first $2,500 in combined purchases each quarter. A good to excellent credit score is required, and new cardholders may be eligible for a one-time cash bonus after making a minimum amount in purchases within the first 90 days.

Best Credit-Building Card for Single Parents

Finding the right credit card can be especially tough for single parents who don’t have stellar credit. You need a card that can help in an emergency, is accepted anywhere, and will help you rebuild your credit.

That often means a secured card; one that requires a security deposit, but also reports to the three major credit bureaus so you can begin to establish a good payment history. As a credit-building card, the Capital One Platinum Secured Credit Card is among the best around.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

A security deposit is required, of course, and you must have a valid bank account in your name to qualify. Depending on your credit history, you will be required to deposit $49, $99, or $200 into an account, and, in return, you’ll get an initial credit line of $200 on your card.

This initial credit line is automatically eligible for an increase after you make the first five payments on time. A secured credit card from Capital One is different from a prepaid card in that it actually helps you build credit by reporting your payment history to the credit agencies.

It’s a true credit card that you can use anywhere Mastercard is accepted. And, after making payments responsibly for a period, you could be offered one of Capital One’s unsecured cards.

Can I Get a Credit Card in My Child’s Name?

Teaching your child about credit cards and their proper use is a great way to help them build good spending habits. However, opening a credit card in their name is not only improper, but it’s also illegal. Only a person 18 years or older can enter into a legally binding contract, which is what a credit card application is.

There have been instances where family members have used a child’s personal information — including Social Security number and birthdate — to apply for a credit card. But in addition to this being unfair to the child, it’s also credit card fraud.

The scope of the problem of parents or other family members using the identity of a minor to get a credit card is hard to pin down. According to at least one report, more than 1 million kids were impacted by identity theft in a recent study. Many don’t find out about this fraud until they reach an age to apply for credit themselves.

While a minor can be added to the credit card account of a parent as an authorized user in some instances, they can’t legally obtain a credit card until age 18. Parents concerned about the credit status of their minor child or children can legally request a credit report on their behalf.

You can even get a free copy from all three credit bureaus at AnnualCreditReport.com.

Can I Get a Credit Card if I’m Unemployed?

You may think being out of a job would mean you can’t apply for a credit card, but that’s not always the case. Thanks to the Credit Card Act of 2009, any income from other sources such as unemployment benefits or even income from child support can be included in your application.

If you can show income or access to resources and your credit history is decent, you may be approved for a credit card. Remember, though, just because a credit card is being offered doesn’t mean you should accept it.

You don’t need to be employed to get a credit card, but you do need to show a source of income. Child support payments are one such example of an acceptable income.

There are credit cards designed for those with blemishes on their credit, low credit scores, or who are unemployed, and they typically come with a lower credit line and higher APR. These so-called subprime credit cards are also much less lenient when it comes to late payments.

Subprime cards come in a lot of different flavors, many with high activation or processing fees and monthly or annual fees. If you choose to go this route, be sure to shop around for a card that offers the features you want without draining your wallet.

An alternative to settling for a subprime card is to get a cosigner or become an authorized user on someone else’s account. If you are certain you can make the payments responsibly on any charges you incur, ask a friend or family member if they are willing to do this for you.

If you take on this responsibility, remember your actions will impact the credit score of someone else.

Can I Build My Child’s Credit?

The best thing you can do as a parent to help your child build good credit is to talk with them about what credit is and how to use it responsibly. Of course, helping them actually build credit is great too.

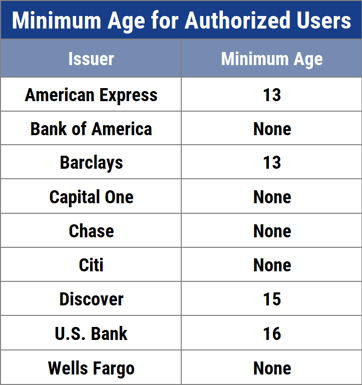

For any parent interested in helping a child establish their own credit profile and begin building a good credit history, there are ways to do this responsibly, and, most importantly, legally. Many card issuers allow minors to be added to an adult’s credit card account as an authorized user.

Call customer service to find out if your card issuer allows for this, as most companies don’t detail it in their terms and conditions. Some credit card companies have a minimum age for authorized users, while others have no age restrictions at all.

Regardless, it’s still on you to ensure they are responsible in their use of credit. Remember, they can spend, but you have to pay. You can also try to take advantage of teachable moments around credit card use to reinforce lessons of responsible spending.

The interesting thing about credit is that it follows you around wherever you go. Your credit profile and history of financial dealings is indelibly linked to your name and Social Security number.

Anyone who has made mistakes involving credit and debt can tell you, it takes a lot to overcome them. Helping your child learn this lesson early is one of the best gifts you can give them.

Choose a Card that Works as Hard as You Do

Single parents have one of the toughest jobs around — raising a child while juggling all of life’s other challenges. The right credit card can help make things a little easier and less stressful, but it’s still a big responsibility.

When choosing among the best credit cards for single parents, make sure the card you decide to apply for fits your lifestyle and spending patterns. The card you choose should work as hard as you do.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Prepaid Debit Cards For Teens & Parents ([updated_month_year]) 9 Best Prepaid Debit Cards For Teens & Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Best-Prepaid-Debit-Cards-For-Teens-Parents.jpg?width=158&height=120&fit=crop)

![5 Credit Card Tips for New Parents ([updated_month_year]) 5 Credit Card Tips for New Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/10/shutterstock_1672923496-1.jpg?width=158&height=120&fit=crop)

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)

![7 Best Secured Credit Cards: No Credit Check ([updated_month_year]) 7 Best Secured Credit Cards: No Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/Best-Secured-Credit-Cards-with-No-Credit-Check.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![7 Same-Day Credit Cards for Poor Credit ([updated_month_year]) 7 Same-Day Credit Cards for Poor Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Same-Day-Credit-Cards-for-Poor-Credit.jpg?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![9 Credit Cards For Very Bad Credit ([updated_month_year]) 9 Credit Cards For Very Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Credit-Cards-For-Very-Bad-Credit.jpg?width=158&height=120&fit=crop)