No matter the time of year, it always seems like there’s an occasion around the corner that requires a gift. Whether you’re shopping for the holidays, a birthday, graduation, or any other special moment, few items meet a recipient’s needs more than a gift card. That’s why we’ve assembled this list of the best credit cards for buying gift cards.

You can accumulate and maximize your credit card rewards if you’re strategic about where and when you buy your gift cards, which is like a gift for you, too. Read on to see which cards are best used where when it comes to buying gift cards.

Best Overall

Cash Back | Miles | Business | Student | Retail

Best Overall Card for Buying Gift Cards

The Discover it® Cash Back credit card remains one of the kings of cash back. That’s because it offers a great daily incentive to use your card — including bonus cash back in quarterly categories that include gas stations, grocery stores, and restaurants — all places that traditionally sell gift cards.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Note that all quarterly bonus categories require activation, but Discover will send you a reminder email when it’s time to do so. Your rewards will never expire as long as the account remains open.

Best Cash Back Cards for Buying Gift Cards

Although the Discover it® Cash Back card tops this list, there are still several strong cash back card options that can boost your bottom line if you’re a regular gift card purchaser. And if you take advantage of quarterly categories, you can supercharge your earnings in a hurry.

2. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

You won’t pay an annual fee with the Chase Freedom Flex℠ card. But you will earn bonus cash back (on up to a set amount in combined purchases) in quarterly bonus categories. Nearly all the bonus categories include retailers that sell gift cards — meaning you can earn a decent chunk of cash back for your gift card purchases.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

With the Bank of America® Cash Rewards Credit Card, you can earn 3% cash back in the category of your choice — which includes gas, online shopping, dining, travel, drug stores, or home improvement and furnishings. By choosing a retail option where you can purchase gift cards, you can tip the scales in your favor and get 3% back on all your gift card purchases.

4. American Express Everyday® Preferred Card

With the Amex EveryDay® Preferred Credit Card, you’ll earn 2X points on gas station purchases and 3X points on grocery store purchases of up to $6,000 total per year. Both options typically sell gift cards, which count toward your cash back earnings. But the savings don’t end there.

- 3X points at U.S. supermarkets, 2X points at U.S. gas stations, 1X points on everything else

- Earn 50% extra points when you use your card 30 or more times on purchases within a billing period

- $95 annual fee

Amex offers a 50% boost in points when you use your card 30 times or more on purchases within a billing period. If you’re a regular swiper and you buy your gift cards at a grocery store, you can essentially earn 4.5X points per $1 on those purchases.

5. American Express Blue Cash Preferred® Card

The Blue Cash Preferred® Card pays out a whopping 6% cash back at U.S. supermarkets on up to $6,000 in purchases each year. Cardholders also receive 6% cash back on purchases from select U.S. streaming subscriptions and 3% on U.S. gas station and transit spending.

- 0% intro APR on purchases and balance transfers for 12 months

- Make anyone age 13 or older an authorized user and earn cash back for their purchases

- $95 annual fee

With the industry-leading 6% cash back at U.S. supermarkets, you’ll essentially save $6 for every $100 you spend, including gift card purchases. All purchases made outside of the bonus categories earn an unlimited 1% cash back.

Best Miles Card for Buying Gift Cards

Gift cards give recipients the liberty to choose the gift they want. With the Discover it® Miles card, you have a choice of your own: how you will spend the miles you’ll earn for every $1 you charge to the card.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

You can redeem your miles as statement credits to cover a wide array of travel-related expenses. That can get you to your next trip much faster.

Best Business Card for Buying Gift Cards

Gift cards are a great way to show appreciation for your employees. With the Ink Business Cash® Credit Card from Chase, you can purchase gift cards at a local office supply chain store — which usually sell a wide array of gift cards — and earn 5% cash back.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

If your local office supply store doesn’t have a gift card rack, you can opt to make your purchases at a gas station or restaurant — which offers a bonus of 2% cash back on your first $25,000 in combined purchases each year.

Best Student Card for Buying Gift Cards

With the Discover it® Student Cash Back card, you’ll earn bonus cash back in quarterly activated categories (up to the quarterly purchase maximum) that include gas stations, grocery stores, and restaurants, most of which sell gift cards.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

This card also has great security features like fraud alerts and the ability to freeze and unfreeze your card in the event it is lost or stolen. These benefits paired with a low fee structure make this card a great pick for any student.

Best Retail Cards for Buying Gift Cards

Most major retail locations offer their own gift cards. A few places also sell gift cards for other establishments.

With the two cards listed below, you can earn rewards for your gift card purchases without limiting which cards you buy for your friends, loved ones, or employees.

9. Amazon Prime Rewards Visa Signature® Card

Let’s face it — in this day and age, who doesn’t shop at Amazon? The e-tailer makes it easy to buy just about anything you want with discounted prices and lightning-fast shipping. An Amazon gift card is pretty much a golden ticket to anything the recipient may want. And, with the Amazon Prime Rewards Visa Signature® Card, you can earn 3% cash back on your Amazon.com purchases — and 5% if you’re an Amazon Prime member.

- Earn 3% back on Amazon.com and Whole Foods purchases; Prime Members earn 5% back

- Earn 2% cash back at restaurants, gas stations, and drugstores

- Pay no annual card fee, Prime fee applies

You can also earn an unlimited 2% cash back at restaurants, gas stations, and drugstores — which all typically sell gift cards. Whichever option you choose, you can earn a nice bonus for giving a gift.

10. Target REDcard

Target not only sells its own gift cards, but the stores also typically have a large display of gift cards to other establishments, services, and entertainment options. With the Target REDcard, you can instantly get 5% off your purchase at the register without ever paying an annual fee.

- Save an extra 5% at Target and Target.com with early access to special products and promotions

- Free 2-day shipping on Target.com purchases plus extended returns

- No annual fee

Target also sends out regular deals and coupons to cardholders via its mobile application that can increase your savings even further, especially when you combine it with the 5% savings.

Do You Earn Rewards for Buying Gift Cards?

Yes, you can earn rewards with most of your gift card purchases. You should earn at least the basic 1% cash back or 1 point per $1 spent, unless your card pays more for purchases with specific retailers that sell gift cards.

Many grocery stores and other retail establishments once banned the purchase of most gift cards using a credit card. That’s because many scammers would use stolen credit card numbers to purchase prepaid gift cards that would give them access to untraceable cash — even after the stolen card was shut down by the issuing bank.

EMV technology has enabled retailers to accept credit cards for gift card purchases, which means you can use your card to earn rewards on those purchases.

When that happened, the retailer that sold the gift card was responsible for the fraudulent purchase. To limit their liability, most establishments simply banned the purchase of all gift cards using credit cards.

But card transactions are now more secure thanks to EMV chip technology. To get retailers to adopt the equipment needed to read the chips, banks took away the retailer liability for any fraudulent purchases made with an EMV chip card.

That’s when most retailers began allowing credit card purchases for gift cards. That also means you can now earn rewards for your purchases. And, depending on the card you use, you can earn as much as a staggering 10% cash back on your gift card buys.

Some credit card issuers, such as Chase, also allow you to accrue rewards points on every purchase you can then redeem for gift cards. Doing so will basically cover your gift-giving obligations without actually costing you money out of pocket.

What Gift Cards Can I Buy with a Credit Card?

So many establishments sell gift cards that your options are nearly limitless. You can use your credit card to purchase various gift cards for retail, online, or entertainment options at grocery stores, gas stations, drug and convenience stores, and even office supply stores.

Choosing the right place to buy your gift card will play a major part in how much cash back you get for the purchase. For example, a card that offers 5% cash back at office supply stores, such as the Ink Business Cash® Credit Card from Chase, may not seem like a great gift-giving tool. But if you look at the wide array of gift cards available at these retailers — places that include Office Depot and Staples — you’ll find hundreds of options to meet any recipients’ wants or needs.

Some of these retailers even allow you to purchase gift cards online, using your credit card, with the gift automatically delivered via email to the recipient.

Most gift card transactions are processed like credit card transactions. A third-party company handles the transaction and forwards the money to the retailer when the recipient makes a purchase.

That streamlining makes it easy for major retailers to set up large displays that offer dozens of different gift card options. And these retailers often allow you to use your credit card when you make a purchase — including when you buy a gift card.

That’s why you can buy just about any available gift card using a credit card and earn rewards for the transaction.

How Can I Redeem Rewards for Gift Cards?

The only thing better than getting a gift card as a gift is buying a gift card without actually using any money out of pocket. With the right rewards credit card, you can do just that.

Many points rewards credit cards — such as the popular cards issued by Chase and American Express — allow you to earn and collect points for every dollar you charge to your card. You can typically redeem your points through a card-issuer portal that gives you options that include travel discounts, cash back, merchandise, entertainment options, and, yes, gift cards.

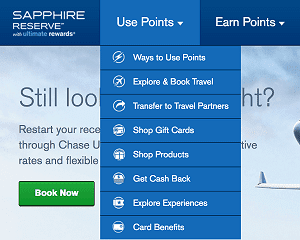

You can redeem your points for gift cards through the Chase Ultimate Rewards portal.

You have access to hundreds of gift card options in the Chase Ultimate Rewards portal, with occasional sales that make gift cards even less expensive. The redemptions typically come with straightforward rates.

For example, 2,500 points can net you a $25 gift card.

Many retailers will lower the price of their $25 gift cards during sales to 2,250. And, since gift card redemptions come out to approximately 1 cent per point — and some Chase cards offer between 3X and 5X points per $1 spent — it doesn’t take much to earn a gift card.

You can also redeem your points for instant cash during checkout at Amazon.com with select Discover, Chase, and American Express cards.

When you link your rewards credit card to your Amazon account, your current rewards total will show up during checkout as a payment option. By simply checking the box, your rewards will transfer to cash and your total charge will decrease by the number of points you redeem.

You can use this option to purchase gift cards (and not just Amazon gift cards) or any of the other millions of items Amazon offers.

Be Rewarded for Your Gift-Giving

Everyone enjoys a good gift — and no gift gives the recipient more freedom than a gift card. With a prepaid gift card, your friend, loved one, or an employee can choose to purchase whatever their heart desires.

And with one of the best credit cards for buying gift cards, you can give a gift and get your own present, thanks to your cash back, points, or miles earnings that make being generous easier than ever before.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards for Buying a Car ([updated_month_year]) 7 Best Credit Cards for Buying a Car ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-for-Buying-a-Car-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Money Orders ([updated_month_year]) 7 Best Credit Cards for Buying Money Orders ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Buying-Money-Orders-Feat.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards After Buying a House ([updated_month_year]) 12 Best Credit Cards After Buying a House ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Best-Credit-Cards-After-Buying-a-House.jpg?width=158&height=120&fit=crop)

![3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year]) 3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/carbuy--1.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)