Finding the best prepaid debit cards for teens and parents can help your children expand their financial know-how while learning valuable lessons in responsibility.

A good prepaid debit card can help your teen learn how to budget, meet his or her savings goals, spend wisely, and lessen the danger of carrying around cash. Even better, the cards listed below make it easy for you to deposit allowance money or add a few extra dollars to your child’s account when they need it.

Best Overall | More Cards | FAQs

Best Overall Prepaid Debit Cards For Teens & Parents

The Greenlight – Debit Card For Kids calls itself the money app for families that want to raise kids with strong financial literacy. With your account, you can access tools that teach your child or teen about savings and allow him or her to start investing with as little as $1 — and no trading fees.

- Greenlight is a debit card for kids, managed by parents

- Parents set flexible controls and receive real-time alerts while kids monitor their balances, set goals, and learn how to manage money

- Feel secure knowing Greenlight blocks unsafe spending categories

- Receive Mastercard’s Zero Liability Protection

- Upload a photo of your choice to create a unique custom card

- Debit cards are FDIC-insured up to $250,000

- Easily turn your Greenlight card on or off and receive real-time spending notifications

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

See Pricing

|

Not applicable

|

You can also send money to your child’s Greenlight – Debit Card For Kids account in a matter of seconds from your desktop or phone. The card comes with a host of valuable features to help parents manage their kids’ finances and is Apple Pay and Google Pay compatible.

The card costs about $5 to $10 a month per family to use, depending on the plan you choose. All ATM withdrawals are free, and kids of all ages qualify for this card.

The BusyKid Visa® Prepaid Spend Debit Card lets kids earn, save, donate, and spend as they please. Or, as their parents please because it gives parents full account control. The card pairs with an app that lets parents assign chores and pay an allowance that becomes available to spend with their teen debit card.

It’s a Visa debit card that can be used everwhere Visa debit is accepted. It charges a monthly fee starting at $3.99/mo, but annual plans save 20%.

- Great for families who wish to store money on multiple prepaid cards linked together

- No risk of debt, overdraft, or hidden fees

- Retain parental visibility and control while empowering kids of all ages

- Separate funds into multiple purpose-driven accounts

- Alert parents and children about card activity and the remaining balance in real time

- A paid FamZoo subscription entitles you to use all of the active prepaid cards in your FamZoo family for as long as your subscription remains active. Adding family members and adding cards does not impact your subscription fee.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

See Pricing

|

Not applicable

|

The FamZoo Prepaid Mastercard can aggregate multiple family accounts into one and give each family member access to his or her own card. As the head of household and the main account holder, you can monitor spending, set spending limits, and distribute funds however you like to each FamZoo card connected to your account.

You’ll need to pay a single subscription fee that activates each FamZoo prepaid card in your family. Each FamZoo card will remain active for as long as you keep your subscription.

More Prepaid Debits Cards to Consider

A prepaid debit card is not a credit card. Instead of relying on a personal line of credit, these cards work similarly to your bank or credit union debit card and only allow you to spend up to the amount of money you have deposited in your account.

That means your teen will learn to stick to a budget and only spend as much money as he or she has saved. It also means that you don’t have to worry about your child racking up debt from a credit card that can ruin your credit history.

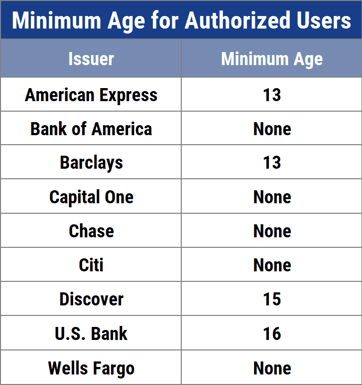

The following cards all require authorized users to be at least 13 years old to qualify.

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

Brinks has protected financial institutions for generations — and now the Brink’s Armored™ Account can do the same for your teen’s spending. This card charges a variable monthly fee that is waived if you receive regular qualifying direct deposits into your account. You can also manage your account balance and activity through the card’s robust mobile application.

And since this isn’t a credit card, you can get a unique card for your teen or add his or her name as an authorized user on your card account. It’s a great money management tool from a company that’s managed money for a very long time.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

You likely already know PayPal as the internet’s leading way to make payments, but the company also has a PayPal Prepaid Mastercard® that links directly to your PayPal account. The card allows you to spend the money in your account at any retailer or service provider that accepts Mastercard.

On top of the convenience, you can also earn cash back from your spending, receive direct deposits, or add money to your PayPal card account quickly.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The NetSpend® Visa® Prepaid Card is a long-time leader in the prepaid debit card business because it allows those who don’t have a bank account to get access to all of the features you’d expect from a bank or credit union. That includes direct deposit, account alerts to your mobile device, and full account access through your desktop or mobile device.

You will be charged a monthly fee that varies based on your account balance and whether you choose to receive regular direct deposits into your card account.

- Enjoy FREE withdrawals at over 37,000 MoneyPass® ATM locations nationwide.

- Get access to your money up to 2 days faster with early Direct Deposit

- No monthly fee when you direct deposit $500 or more within a statement period

- Use Online Bill Pay to help you save time and help you avoid late fees. Terms apply.

- Check your balance and recent transactions, pay bills on the go, get SMS text alerts, and send money to family or friends who have a Serve Account

- No credit check, no hidden fees

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

The Serve® American Express® Prepaid Debit Account provides a full-service savings account and charges no ATM fee at thousands of locations around the U.S. This is a tremendous teen debit card because it offers a mobile application with multiple tools for tracking your spending and meeting your savings goals.

And as a reloadable prepaid card, you can add money to your child’s account easily online or for a small fee in person at one of many MoneyPass ATM locations around the country.

- A reloadable prepaid debit account that can be used anywhere American Express® cards are accepted

- Get your paycheck up to 2 days faster with free direct deposit

- Shop with added confidence and Purchase Protection, which can help protect eligible purchases made with the card against accidental damage and theft for up to 120 days from the date of purchase

- Get free ATM access at over 38,000 MoneyPass® ATM locations. It's free to add cash to your account at Family Dollar locations and free to transfer money to other Bluebird Accountholders.

- With Roadside Assistance, you can call us in case of emergency for coordination and assistance services to help you get on your way

- Pay no monthly fees or foreign transaction fees

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

The Bluebird® American Express® Prepaid Debit Account has many perks you’d expect from an American Express credit card, but without the credit score requirements for approval. The Bluebird card also gives cardholders free ATM access at thousands of partner locations, along with purchase protection and roadside assistance.

What makes the Bluebird card even more valuable is that it doesn’t charge a monthly fee or foreign transaction fee to eat away at your teen’s savings. This is truly a traditional MoneyPass ATM card without the red tape and expensive fee structure.

- Mango is a safe and convenient way to manage and access your money when and where you need it

- The Mango Card is a prepaid card account and there are no hidden fees or interest charges. See your Cardholder Agreement for fees and details.

- You can use your Mango Card everywhere debit Mastercard is accepted

- Manage your account anywhere you are. Securely check your balance, transaction history, and send money to friends and family.

- Once you activate and load your Mango Card, you can open a Savings Account with as little as $25 and get up to 6.00% Annual Percentage Yield with up to 6 transfers out each month

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

Adding The Mango Prepaid Mastercard® to your teen’s wallet also makes him or her eligible for a valuable Mango Savings Account that has a very competitive interest yield and a low minimum balance requirement. That’s a great way to improve financial literacy and maintain a spending limit on your teen’s bank account.

The Mango mobile application can link your card and savings account and give your teen access to tools that make it easy to send and receive money quickly, with funds available on the prepaid card instantly. All of this with no monthly fee, activation fee, or annual fee. Your spending limit will always match your current account balance.

What is a Prepaid Debit Card?

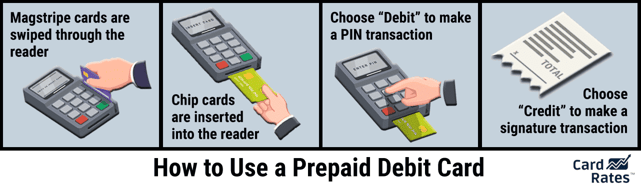

A prepaid debit card is very similar to a traditional Visa debit card or Mastercard debit card that you may receive from your bank or credit union. These cards have no assigned credit line, so you can only spend up to the amount of money you have deposited into your linked reloadable prepaid card account.

Without a revolving credit line, you don’t have to worry about a credit score or credit history check for approval. On the other hand, your prepaid debit card will not help you build a credit history.

A prepaid debit card can help your teen learn to budget, create savings goals, and stretch his or her allowance as far as possible — all essential life lessons not taught in school.

You can sign your teen up for an individual account in his or her name or add your child as an authorized user on an existing account. The cards listed above give your teen access to account tools that make it easy to track spending and check balances with just a few taps on the card’s mobile application.

You can use the card online, over the phone, or in-person to make purchases or take advantage of the card’s ATM withdrawal capabilities to get access to instant cash. Parents can also send money to their child’s account in a matter of seconds — ensuring that your son or daughter will never be without money when it’s needed.

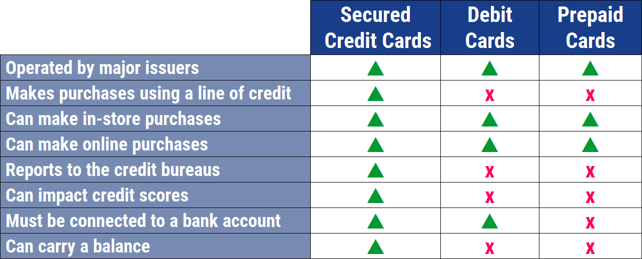

And unlike a secured credit card, you don’t need to place a refundable deposit or deal with a credit check to set up your account. In most cases, a low required card balance makes these cards ideal for depositing allowance, birthday money, or other occasional funds.

The card issuer will also allow cardholders to receive direct deposit funds into the card account — which puts money in your hands up to two days faster than if you were to receive a paper check in the mail.

While this isn’t a checking account, you can still earn an interest yield on your savings that exceeds the national savings account average.

Can You Build Credit With a Prepaid Card?

You cannot build your credit history with a prepaid card. That’s because you’re not borrowing money.

You fund your own purchases with a debit card, whereas the issuing bank of a credit card funds them for you, and you repay the card issuer. Your credit history is a record of how you manage that credit line and any other loans you have, specifically whether you repay what you borrow.

Prepaid cards only allow you to spend up to the amount of money you have in your account, similar to a debit card. You’ll have no associated credit line, and your account history won’t appear on your credit report.

Prepaid cards only allow you to spend up to the amount of money you have in your account, similar to a debit card. You’ll have no associated credit line, and your account history won’t appear on your credit report.

If you want to help your teen develop a credit score before reaching adulthood, consider adding them as an authorized user on a secured credit card. These cards require a refundable security deposit for approval, but your deposit will typically match your card’s credit line.

For example, a $300 deposit will yield a $300 credit line. This allows you to budget your teen’s spending and provide a revolving line of credit that the card issuer reports to each credit bureau.

If your child has no previous credit history, a secured card — either a Visa card or a Mastercard — should help them generate an initial credit score within three to six months after signing up.

Is a Prepaid Card the Same as a Secured Credit Card?

A prepaid card and a secured credit card are two different financial products. The most significant difference between the two is that a prepaid card only allows you to spend the amount of money you have in your account. In contrast, a secured card gives you access to a line of credit after you provide an upfront refundable security deposit.

You’ll open your prepaid debit card by depositing money into a linked account, similar to a savings account.

Let’s say you initially deposit $200. Your card will allow you to spend up to $200, and each charge is deducted from that total. As you add money to your reloadable account, you can use those funds to make more purchases.

With a secured credit card, you place a refundable security deposit at the time of application. You can choose the amount of your deposit — with most card issuers accepting deposits of between $200 and $4,000.

Every time you use your secured credit card to make a purchase, you’ll have to submit a payment to reimburse the debt. The deposit is not a payment.

But if you cancel your account with a $0 balance, the card issuer will refund your original deposit. If you still have a balance on your card account, the issuer will subtract that amount from your deposit and refund the remainder.

Since a secured card has a line of credit attached to it, your payment and balance history will be reported to at least one of the three major credit bureaus — which can help the cardholder build a positive credit history. You don’t get this benefit from a prepaid debit card.

Either card makes it easy to budget by setting your spending limits, which avoids taking on debt. There’s no debt at all with a prepaid card since there’s no credit involved.

Can Minors Get a Prepaid Debit Card?

Yes, minors can get a prepaid debit card. Individual card issuers have their own policies regarding the minimum age required to add an unauthorized user. NetSpend, for example, requires minors to be at least 13 to be added as authorized users.

But cards designed specifically for children, including the Greenlight – Debit Card For Kids and FamZoo Prepaid Mastercard, have no minimum age requirements.

Adding your child as an authorized user is a straightforward process that takes minutes to complete online. Your child will receive his or her own card in the mail for use upon card activation.

Which Prepaid Card is Best For Teens?

The best card for your teen will depend on your desired features from the card. If you simply want your child to have access to money without carrying around cash, then a prepaid debit card is the way to go.

If you’re looking to help your teen develop a credit score and begin learning about managing credit, consider a secured credit card with a manageable credit limit. Both will help teach crucial financial literacy and budgeting lessons and give your teen access to funds they can use in person, online, or over the phone.

Both cards have advanced security features that will keep your child’s money safe, including fraud protection and purchase alerts.

Consider your teen’s responsibility level and how often they’ll need the card when choosing a prepaid card. A prepaid debit card is a great way to pay an allowance or give money as a gift. You can’t deposit money onto a secured credit card, which limits its functionality as a tool for distributing cash.

If you want total control over your teen’s account and investment opportunities, we recommend the Greenlight – Debit Card For Kids.

- Greenlight is a debit card for kids, managed by parents

- Parents set flexible controls and receive real-time alerts while kids monitor their balances, set goals, and learn how to manage money

- Feel secure knowing Greenlight blocks unsafe spending categories

- Receive Mastercard’s Zero Liability Protection

- Upload a photo of your choice to create a unique custom card

- Debit cards are FDIC-insured up to $250,000

- Easily turn your Greenlight card on or off and receive real-time spending notifications

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

See Pricing

|

Not applicable

|

If you want your teen to earn interest on their savings, check out The Mango Prepaid Mastercard®. If you already have PayPal accounts and want to consolidate spending, check out the PayPal Prepaid Mastercard®.

Find the Best Prepaid Cards For Teens & Parents

You have a lot to worry about as a parent. A lot of things can go wrong when your teen is away from home, and most of it is out of your control.

Thankfully, the best prepaid cards for teens and parents can make you confident that your kid has enough money when he or she is out on their own. And since schools don’t teach financial literacy lessons, you can leverage the tools that come with these cards to help your teen learn how to set and stick to a budget.

Even though these cards won’t help your teen develop a credit history or credit score, the money management lessons your child will learn can set the foundation for smart future decisions that will help build a solid credit profile.

Just remember that every prepaid debit card issuer charges different fees, such as an overdraft fee, an ATM withdrawal fee, a cash reload fee, or a bank transfer fee. There’s also a potential monthly maintenance fee if your teen keeps a low card balance.

Make sure you and your teen understand all of the potential charges involved before you activate your card. That way, you can avoid any unwanted — and potentially expensive — mistakes.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Cards for Teens ([updated_month_year]) 12 Best Credit Cards for Teens ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/teens.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Single Parents ([updated_month_year]) 7 Best Credit Cards for Single Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Single-Parents.jpg?width=158&height=120&fit=crop)

![5 Credit Card Tips for New Parents ([updated_month_year]) 5 Credit Card Tips for New Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/10/shutterstock_1672923496-1.jpg?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year]) 7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/shutterstock_609135914-edit1.jpg?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year]) 7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Prepaid-Debit-Cards-with-Direct-Deposit--1.jpg?width=158&height=120&fit=crop)

![5 Best Prepaid Debit Cards For Vacations ([updated_month_year]) 5 Best Prepaid Debit Cards For Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Prepaid-Debit-Cards-For-Vacations.jpg?width=158&height=120&fit=crop)

![12 Free Prepaid Debit Cards ([updated_month_year]) 12 Free Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Free-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)