The best cash back Visa cards can give you the chance to earn cash rewards for spending. Here’s how they work: Every time you use them to make eligible purchases, you’ll get cash back you can use for just about anything.

You can usually redeem your cash back rewards via statement credit, paper check, or direct deposit. Let’s dive deeper into the best cash back Visa cards out there.

Overall

Consumers | Business | Bad Credit | Students | FAQs

Best Overall Cash Back Visa Card

With the Chase Freedom Unlimited®, you can earn unlimited cash back on every purchase you make. Unlike other cash back cards, you don’t have to target your spending toward specific types of purchases.

Though you do earn higher cash back rates for travel, dining, and drugstore purchases, you’ll still earn cash back on all other spending categories. No matter where you choose to spend, you’ll reap the benefit.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

In addition to its flexible cash back rewards, the Chase Freedom Unlimited® is increasing your rewards rate on everything you buy in the first year of card ownership. Fortunately, you don’t have to pay an annual fee or meet any minimum to redeem your rewards.

More Cash Back Visa Cards For Consumers

We’ve selected another 16 cash back Visa cards for your consideration. CardRates.com gives these cash back credit cards an overall rating of 4.0 or higher out of 5.0.

- Discover one of Citi’s best cash back rewards cards designed exclusively for Costco members

- 4% cash back on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter

- 3% cash back on restaurants and eligible travel purchases

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

- No annual fee with your paid Costco membership and enjoy no foreign transaction fees on purchases

- Receive an annual credit card reward certificate, which is redeemable for cash or merchandise at U.S. Costco warehouses, including Puerto Rico

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% (Variable)

|

$0

|

Excellent

|

Additional Disclosure: Citi is a CardRates advertiser.

You must be a Costco member (minimum yearly fee: $60) to get the no-annual-fee Costco Anywhere Visa® Card by Citi. This cash back credit card provides multiple reward tiers, including bonus cash back rates on Costco and Costco.com purchases.

The “Anywhere” in the card’s title refers to where you can use the card, but you can redeem your cash back only at a Costco store. The card may be your first choice if you are a frequent Costco shopper.

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card lets you earn the most cash back in a category of your choosing each month. You can choose from gas, online shopping, dining, travel, drug stores, or home improvement and furnishings.

This is an optimal choice if you know you’re going to be making a lot of purchases in a specific category one month and are willing to go online and make the switch. If you don’t make a change, the category you previously opted for will continue to roll over to the next month. Some people don’t enjoy dealing with rewards categories and prefer a flat-rate rewards structure, in which case we recommend the Chase Freedom Unlimited® above.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Unlimited Cash Rewards credit card offers unlimited flat-rate rewards that can be worth more than a full percentage point more if you’re a Bank of America Preferred Rewards member. It also comes with generous 0% APR offers for purchases and balance transfers.

You’ll also earn a signup bonus if you satisfy the minimum spending requirement within the first 90 days after opening the account. You can link the card to a Bank of America checking account to cover overdrafts.

- Earn 5% cash back at Aamzon.com and Whole Foods market

- Earn 2% cash back at restaurants, gas stations, and drugstores, 1% back on all other purchases

- Exclusively for customers with an eligible Prime membership

- Get a $100 Amazon Gift Card instantly upon credit card approval

- See your rewards balance during checkout at Amazon.com and easily use rewards to pay for all or part of your purchase — no minimum rewards balance to redeem rewards

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

14.24% – 22.24%

|

$0 (Prime Membership Required)

|

Good/Excellent

|

The Amazon Prime Rewards Visa Signature Card is well-suited for Amazon shoppers with Prime memberships. The card provides a signup bonus that requires no upfront spending and generous cash back on Amazon.com purchases.

The Amazon cash back credit card charges no annual or foreign transaction fees. Surprisingly, this store card provides many travel benefits. You also receive extended warranty protection, purchase protection, and roadside dispatch.

- Unlimited 2% cash back. Every eligible net $1 spent equals 2 Reward Points. No limits on total Reward Points and no restrictive categories.

- Deposit your rewards into any eligible Fidelity account, such as a brokerage account, Cash Management Account, or a 529 college savings plan.

- Explore special offers with the Luxury Hotel Collection and Avis® and Budget®, then enjoy peace of mind with Travel and Emergency Service and Lost Luggage Reimbursement.

- Enjoy 24-hour complimentary service with Visa Signature® Concierge. Get assistance managing your account with real-time alerts and 24/7 cardmember service

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.24% (Variable)

|

$0

|

Good/Excellent

|

The Fidelity® Rewards Visa Signature® Credit Card offers an excellent cash back rate on all eligible net purchases. Cardholders can link this Visa credit card to several of their Fidelity accounts.

The card supports digital wallet use. It has no annual fee, no reward limits, no restrictive categories on everyday purchases, and a reasonable credit line.

- Earn up to 2% Cash Back Rewards when you redeem into an eligible TD Bank Deposit Account

- Bonus Cash Back: Earn $150 Cash Back in the form of a statement credit when you spend $1,000 within the first 90 days after account opening

- Earn unlimited cash back – no rotating categories, no caps or limits as long as your credit card account is open and in good standing

- 0% introductory APR balance transfers for the first 15 billing cycles after account opening, after which a variable APR will apply

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 15 months

|

20.24%, 25.24% or 30.24% (Variable)

|

$0

|

Good/Excellent

|

The TD Double Up℠ Credit Card offers three variable APRs based on your creditworthiness. New cardmembers can earn a statement credit by spending a set amount during the first 90 days of account ownership.

This Visa card pays you bonus cash back when you deposit your rewards into a TD Bank Deposit Account. Benefits include cellphone protection, lost luggage reimbursement, purchase security, and extended warranty protection.

Best Business Cash Back Visa Cards

If you’re in the market for a Visa business card, look no further — the following cards provide lucrative cash back rewards on business purchases.

The Ink Business Unlimited® Credit Card is a business rewards credit card that offers unlimited cash back on all purchases. You can add employees as authorized users and give them cards for no additional fee. Employee spending will also earn cash back, and you can set custom spending limits for each employee if you wish.

One of the most noteworthy perks of this card is its generous signup bonus. You can claim it if you meet the minimum spending requirement in the first three months of opening your account.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card from Chase should be a serious candidate for small business owners. Cardholders can earn a handsome signup bonus plus the card’s top rate for limited cash back on ordinary business expenses — office supplies, internet, cable, and phone.

This card offers lower reward rates for other purchases. You can obtain employee cards at no extra cost.

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won’t expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% – 24.49% (Variable)

|

$0

|

Excellent

|

The Capital One Spark Cash Select for Excellent Credit charges no annual fee and provides unlimited, flat-rate rewards on all eligible purchases. Thanks to its intro APR offer, startups can use this card to finance business purchases for free over a period of time.

You can redeem your cash back rewards in any amount, and your rewards won’t expire for the life of the account. The card doesn’t impose a balance transfer or foreign transaction fee.

11. Capital One Spark Cash Plus

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

The Capital One Spark Cash Plus card has a moderate annual fee, but companies with significant budgets can recoup it by spending a set amount on purchases each year. In addition, you earn a generous, flat cash back rate on all eligible purchases.

Your cash back doesn’t expire while the account remains open. Capital One Spark Cash Plus is a charge card, as it requires full payment each billing cycle to avoid the late fee.

12. Costco Anywhere Visa® Business Card by Citi

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Citi is a CardRates advertiser.

The Costco Anywhere Visa® Business Card by Citi should suit business owners who shop for bulk supplies at Costco. The business credit card version is nearly identical to the one for consumers, except for balance transfers.

You can authorize employees to use the card, as long as each is a Costco member. The Costco business credit card provides Citi Concierge, extended warranty protection, and Citi Quick Lock, which immediately blocks new transactions while allowing recurring transactions to continue without disruption.

Best Bad Credit Cash Back Visa Cards

If you have a poor credit score and want to earn cash back, fear not — the following two cards are solid options for subprime applicants. One is a secured card with more generous rewards, the other is an unsecured card that doesn’t require a security deposit for approval.

13. Bank of America® Customized Cash Rewards Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Bank of America® Customized Cash Rewards Secured Credit Card offers generous cash back rewards that you can redeem at any time. You can collect your rewards with a statement credit, a check, or a direct deposit into your Bank of America checking or savings account.

Another way to redeem your cash back is through contributions to a qualifying Merrill brokerage or 529 account. Benefits include an award-winning mobile app, free FICO scores, and seamless integration with digital wallets.

14. Revvi Card

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair

|

The Revvi Card offers cash back on payments made to your card. The initial credit limit is minimal, as to be expected with a poor credit score. But you can increase your credit limit over a period of one year with responsible use.

While other credit-building cards require a security deposit and match your credit limit to your deposit, this card does not. An initial program free is required.

Best Student Cash Back Visa Cards

The following cards are comparable to cards for good credit but are made for young adults with no credit history. They offer rewards, student-centric perks, fair APRs, and charge no annual fees.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students offers a 0% intro APR for new purchases and balance transfer transactions. You get to choose your bonus cash back spending category.

You’ll also earn a signup bonus if you satisfy the minimum spending requirement within the first 90 days after opening the account. You can link the card to a Bank of America checking account to cover overdrafts.

16. Chase Freedom® Student credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Chase Freedom® Student credit card pays you Ultimate Reward points that you can quickly convert to cash. Alternatively, you can redeem your points for statement credits, gift cards, merchandise, experiences, or Amazon.com purchases.

This student credit card also provides extended warranties, purchase protection, and trip cancellation insurance. You can access your credit score for free via Chase Credit Journey.

What Is Visa?

Although you see the Visa logo on hundreds of credit cards, the company does not issue any of them. Instead, Visa makes money by processing payments. It earns various fees from merchants every time you charge a purchase on a Visa card. That’s great for Visa shareholders, but for merchants, not so much.

Visa and Mastercard are the two payment processing networks that don’t issue credit cards. The other two major processing networks — American Express and Discover — produce their own financial products, including credit and debit cards.

Visa started in 1958 when it partnered with Bank of America to offer regular shoppers their first modern credit card. The company, then called BankAmericard, launched the country’s first debit card in 1975.

A year later, it changed its name to Visa, and in 2008, it became a public company through a giant initial public offering. Today, Visa is the largest credit card network. The Visa logo on your credit card assures acceptance in more than 200 countries worldwide.

How Do I Get a Visa Card?

Credit card issuers have the final say on how consumers obtain their products, but the procedures are relatively uniform throughout the industry. With more than 335 Visa credit cards available, finding one to fit your needs is not hard.

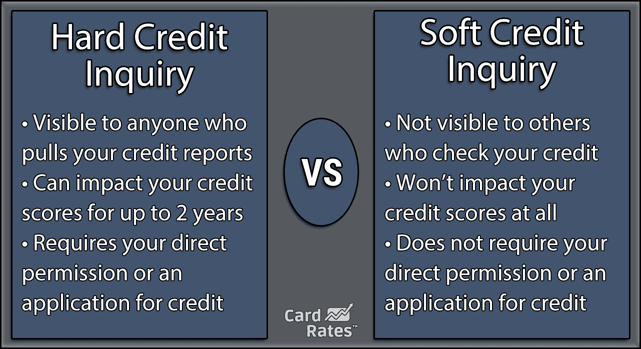

When the card issuer receives an application, it will probably do a hard credit pull that may cause your score to drop a few points. Hard inquiries remain on your credit reports for two years.

Upon approval, expect your card to arrive in the mail over the next two weeks. You can then acknowledge receipt online or over the phone, remove any stickers, and start shopping.

Visa credit cards come in two types: secured and unsecured. Secured credit cards require you put down a cash deposit equal to your credit line. These cards are for folks with poor, limited, or no credit who have trouble getting an unsecured card.

Secured credit cards allow issuers to reduce their losses when cardowners don’t pay their bills. Through timely payments, consumers can use these cards to build their credit.

Unsecured cards do not accept security deposits. Issuers approve or reject applicants based on their creditworthiness.

Visa cards are available for any type of credit, from subprime to excellent. As with their secured cousins, unsecured cards allow you to build credit by making timely payments and keeping your debt levels low.

What Are the Different Types of Visa Credit Cards?

Credit cards bearing the Visa logo come in three tiers: Traditional, Signature, and Infinite. Each level provides a different set of benefits. You usually have to pay an annual fee to break into the upper tiers.

Visa and the issuer contribute benefits to a credit card, but the issuer has the final say. Therefore, you may not receive all the benefits from a Visa tier — check the credit card agreement to confirm the card’s perks.

Visa Traditional

The entry-level Visa tier is called Traditional, and it comes with basic protections and modest access to various experiences. Here are the Traditional benefits available to you:

- Access to emergency cash

- Collision damage waiver on rental cars

- Emergency card replacement

- Roadside dispatch

- Special offers and discounts

- Zero liability protection

Look for special deals on food, shopping, wine, entertainment, and sports.

Visa Signature

Better Visa cards occupy the Signature tier. These cards provide the Traditional card’s benefits plus many more:

- Airline fee credits

- Airport lounge access

- Baggage delay insurance

- Cellphone protection

- Concierge service

- Emergency evacuation

- Emergency medical and dental insurance

- Extended warranties

- Global Entry / TSA Precheck statement credit

- Guest status at the Visa Luxury Hotel Collection

- Hotel theft protection

- Lost luggage reimbursement

- Price protection

- Purchase security

- Rental car service discounts

- Return protection

- Travel accident insurance

- Travel and emergency assistance service

- Trip cancellation and interruption insurance

- Trip delay reimbursement

Some Visa Signature cards provide discounts at Sonoma County wineries and Troon golf courses.

Visa Infinite

Visa Infinite augments Traditional and Signature benefits with better return protection and a shorter waiting period to collect trip delay reimbursement.

What Are the Different Kinds of Visa Interest Rates?

A critical credit card feature is the ability to stretch payments over multiple billing cycles. Doing so lets you afford purchases that would otherwise bust your budget. It also creates unpaid balances.

Credit card companies charge interest on balances resulting from:

- Purchases not paid before the end of the grace period

- Cash advances

- Balance transfers

Most credit cards have an interest-free grace period on purchases, extending from the end of the card’s billing cycle to the payment due date. The card will not charge you interest if you pay your entire balance by the due date.

If present, the grace period must be at least 21 days. Some cards do not have a grace period and charge you interest on purchases immediately.

Cash advances and balance transfers never have grace periods.

Credit cards use the annual percentage rate (APR) to express the interest rates they impose. The card issuer divides the APR by 365 to get a daily periodic rate (DPR). It applies your DPR each day to your balance subject to interest, resulting in daily compounding.

The cardholder agreement specifies the card’s different APRs. Cards usually set their APRs to a set amount, or margin, above the current Prime Rate. The margin may vary among the card’s different APRs. Since the Prime Rate can change over time, card APRs are variable.

Cards often specify a range of APRs for purchases. Your actual APR depends on your creditworthiness.

The Penalty APR is optional. Cards may impose it if you miss a payment. It is usually the highest APR, often fixed at 29.99% or more. Credit cards can’t charge an APR above 36%.

Which Visa Cash Back Card Has the Highest Credit Limit?

Chase Sapphire Preferred® Card and Chase Sapphire Reserve® reportedly have credit limits as high as $500,000. But although these cards often mention cash back in their ads, they actually offer reward points that you can easily convert into cash.

A far lower credit limit is available for mere mortals. The Chase Freedom siblings reportedly offer credit limits of up to $24,000. Once again, these cash back cards denominate rewards in points.

What Are the Differences Between Visa and Mastercard?

Mastercard is Visa’s biggest rival. It is the second-largest payment network, and it also doesn’t issue any of its own credit cards.

Both brands offer basically the same benefits, although Mastercard uses four credit card tiers instead of three: Standard, Platinum, World, and World Elite.

As with Visa’s credit card tiers, those for Mastercard add more benefits as you rise above the basic card. The top tier, World Elite, applies to the best (and most expensive) Mastercard credit cards. It adds Fandango discounts and World Elite Concierge to the already impressive list of World Mastercard benefits.

What Are the Differences Between Visa and American Express?

American Express is an issuer of credit, prepaid, and charge cards as well as a payment network. Visa is the world’s largest payment network but does not directly issue cards.

Amex maintains three card categories: travel and dining cards, points cards for everyday spending, and cash back cards. Each type has three different benefit levels. For example, Amex offers Green, Gold, and Platinum versions of its travel and dining cards. Each one has its own set of rewards and benefits.

American Express issues credit cards and charge cards. The latter have no prescribed spending limits and do not charge interest — you must pay your entire bill each month — unless you opt for Amex’s Pay Over Time plan.

What Other Types of Cards Does Visa Offer?

Visa’s product line extends beyond credit cards. It also offers:

- Bank debit cards: These cards link to your bank account, allowing you to spend money already on deposit. They do not extend credit and do not charge interest.

- Prepaid reloadable debit cards: You don’t link these debit cards to a bank account. Instead, you deposit cash into the card’s account, which funds purchases. You can reload money whenever you want, usually for a fee. Other fees apply, such as monthly or pay-as-you-go usage fees, ATM charges, etc.

- Gift cards: These are non-reloadable debit cards. They are a simple way to give a gift to someone who can use the card to pay for purchases.

Visa has other payment products and services, including commercial, mobile, and money transfer offerings.

What Are the Advantages of Owning a Visa Credit Card?

Merchants accept Visa credit cards around the world. The Visa logo gives credibility to any credit card, even those from obscure banks.

All Visa credit cards provide basic features, such as zero liability protection and rental car collision damage waiver. Higher-tier Visa cards pack many benefits that supplement those from the card issuer.

With a Visa credit card, you can shop conveniently and securely. You may be able to earn rewards for your spending on purchases.

Finally, you can build credit because most Visa credit card issuers report your payments to the three major credit bureaus. If you pay your bills on time and keep your debt levels low, you can raise your credit score and become eligible for higher-quality credit cards.

Which is Better, Cash Back or Rewards Points?

While some credit cards offer cash back rewards, others come with rewards points. The better of the two really depends on your lifestyle and personal preferences.

If you don’t travel much and prefer earning cash rewards for your purchases, cash back cards may make more sense. Cash back cards are easy to understand and often available without annual fees.

If you travel frequently and want to save money on travel-related expenses, like airfare and lodging, rewards points may be the way to go. Keep in mind that if you go with a rewards points credit card, however, it may be difficult to decipher the point systems.

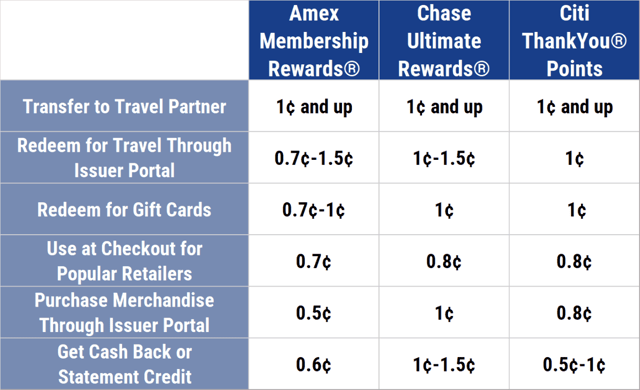

You’ll have to do some math to figure out how you can make the most of your points. It’s also important to note that points can fluctuate in value.

So, your points may be worth more or less, depending on what you redeem them for. Below we compare three popular points programs and their respective point redemption values.

You can use rewards points to buy a variety of products from the card issuer’s catalog. However, if you go this route, you’ll likely get less value for your points. In most cases, using them for travel purchases is the smarter move because it provides the highest value.

Take Chase cards, for example. Points cards such as the Chase Sapphire Preferred® and Chase Sapphire Reserve® offer 25% to 50% more value when redeemed for travel through the Chase Ultimate Rewards® portal.

Similar to cash back cards, points cards come with some advantages. First off, they typically offer larger signup bonuses. Secondly, rewards points cards can give you travel benefits, such as free checked bags or airport lounge access.

So, you may personally prefer to save a little on each purchase via cash back rewards, but if free hotel stays and flights excite you, travel rewards via a points card may be the better option for you.

Why Do Credit Cards Offer Cash Back?

Credit card companies, just like all businesses, are on a mission to make money. Rewards, including cash back, are ultimately profitable for banks because they help them lure in new customers.

Banks still come out ahead on their rewards payouts because most credit cards that offer cash back have certain rules and regulations. For example, many impose spending restrictions and caps.

Since most people don’t take the time to read the fine print, here’s what typically happens: They sign up for credit cards and believe that cash back rewards programs are more lucrative than they actually are.

It’s not uncommon for cardholders to spend more than they can afford to hit a signup bonus and rack up interest charges on the unpaid balance. Essentially, the goal of cash back rewards programs is to offer consumers an incentive to use their credit cards instead of cash or debit cards.

And, when they do, they often help credit card companies increase their profits.

In addition, credit card companies charge merchants a fee for accepting their cards as payment. If you pay a merchant $100, for example, they may only pocket $97 because they’ll owe the credit card company a 3% fee.

Cash back cards also make money through annual fees. Sometimes, people pay an annual fee and don’t earn enough cash back rewards to make it worth it. For this reason, it’s important to do the math and make sure the potential rewards outweigh the fee.

If you’re selective in the cash back reward card you go with and are aware of the fine print, you can benefit from it. Just make sure you don’t spend more than you can afford and pay your balance in full each month. Otherwise, the interest charges you pay will outweigh any rewards you earn every time.

Earn Cash Back “Everywhere You Want to Be”

Consider more than just the rewards rates when you shop for the best cash back Visa cards. Look into annual fees, redemption flexibility, signup bonuses, and introductory and ongoing APRs.

Also, think about your spending habits and try to choose a card that complements them well. If you can’t decide on one, you can always get a few and use each card strategically. Some issuers allow you to combine rewards from two or more of its cards, as is the case with select Chase credit cards, which can provide maximum value when done right.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![7 Best Reloadable Visa Cards ([updated_month_year]) 7 Best Reloadable Visa Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Reloadable-Visa-Cards.jpg?width=158&height=120&fit=crop)

![8 Best Visa Signature Cards ([updated_month_year]) 8 Best Visa Signature Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/10/Visa-Signature-Cards.jpg?width=158&height=120&fit=crop)

![8 Visa Credit Cards For Bad Credit ([updated_month_year]) 8 Visa Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Visa-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year]) Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/vs.png?width=158&height=120&fit=crop)

![Is the Chase Freedom a Visa or Mastercard? ([updated_month_year]) Is the Chase Freedom a Visa or Mastercard? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/chasevisa.png?width=158&height=120&fit=crop)

![Where Can I Get a Prepaid Visa Card? ([updated_month_year]) Where Can I Get a Prepaid Visa Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Where-Can-I-Get-a-Prepaid-Visa-Card.jpg?width=158&height=120&fit=crop)