Changes to the prepaid card industry over the last decade have left many consumers wondering, “Where can I get a prepaid Visa Card?”

Prepaid debit cards that work on the Visa network are easy to obtain online through each card issuer’s website or in retail stores nationwide. They’re free to sign up for online, but you’ll be charged a small fee to purchase a prepaid card in-store.

With so many card options available — each with varying fees and perks — you may need some help whittling down your options to find the best prepaid Visa card offerings on the market. That’s where we can help.

-

Navigate This Article:

You Can Sign Up For Prepaid Visa Cards Online

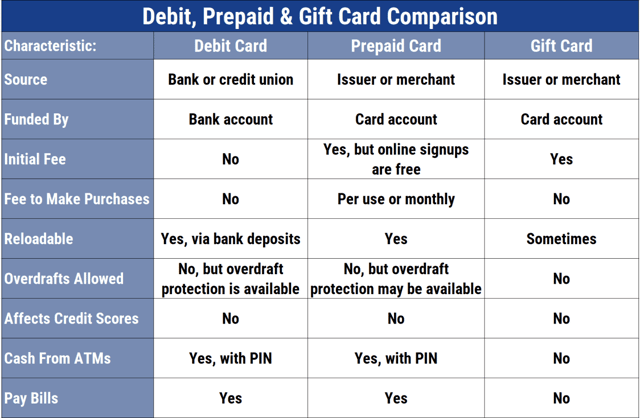

The cards below are different from a Visa gift card, and despite having the popular network logo, these aren’t prepaid credit card products. These work like a Visa debit card that you get from a bank or credit union.

You can sign up for these cards through the financial institution that issues them by following the links to each card below. You then deposit money into your new card account to make purchases at any location that accepts Visa.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

You can deposit money into your NetSpend® Visa® Prepaid Card account at more than 130,000 locations nationwide or by accepting direct deposit of your paycheck or government benefits checks.

Your direct deposit could lower or eliminate your monthly fee, which makes this card more affordable than most on the market. The issuer’s NetSpend Mobile App helps you record your every transaction, and cash reloads can guide you to the nearest Moneypass ATM when you need quick cash.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Up-to $9.95 monthly

|

Not applicable

|

You don’t have to worry about your credit score with the NetSpend® Visa® Prepaid Card. This reloadable card doesn’t require a credit check for approval nor does it charge overdraft fees since you can’t spend any more money than what’s loaded into your account.

And as with its sibling card listed above, you can still enjoy free direct deposit and access to thousands of locations around the country to manage cash reloads. Visa’s zero liability policy also means you won’t be on the hook for unauthorized transactions.

- Manage and control your money on one convenient reloadable prepaid card

- Get paid up to 2 days faster with direct deposit

- No-fee cash withdrawals of up to $100 at ACE with regular Direct Deposits

- When you use your card for everyday purchases, you can earn offers to redeem for cash back rewards at select retailers.

- Choose from 3 card designs

- As a cardholder, you can open a Tiered Optional Savings Account. Balances up to $1,000.00 currently earn up to 5.00% annual percentage yield. No minimum balance required.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

Your credit history won’t affect your eligibility for the ACE Elite™ Visa® Prepaid Debit Card. This card makes it easy to conduct everyday purchases or pay bills using your linked card account that you can reload at any of the more than 900 Ace Cash Express locations throughout the U.S.

You can also withdraw up to $100 per day from your account with no transaction fee at any ACE location. And with Payback Rewards, you can earn valuable offers that save you money on the items you purchase the most.

What Is a Prepaid Visa Card?

A prepaid Visa card is different from a Visa gift card or a secured credit card in many ways. Unlike a gift card, your prepaid Visa card will link to an online account that allows you to continually add money that you can spend using your card.

These cards will also allow you to accept direct deposits of your paychecks or government benefits checks. On the other hand, a prepaid gift card is typically a one-use product that expires once you’ve spent the money loaded into the card account.

But a prepaid card is not a credit card. It is not connected to a revolving line of credit, and you cannot spend more than the amount of money you have loaded into your card account.

These cards work like a Visa debit card that you’d receive from a bank or credit union. But instead of depositing your money with a single financial institution, you’re placing it with the bank that issues your card.

And just like a bank-issued debit card, you can use your prepaid Visa card at the register or online to make purchases or pay bills. You can also take advantage of a free ATM withdrawal network and receive a personalized card with your name on it. Some cards offer rewards for your everyday purchases.

In many ways, a Visa prepaid card allows you to maintain a bank account without dealing with a bank. And since these cards do not tie to a credit account, you won’t have to worry about a credit check that uses your credit history or credit score against you.

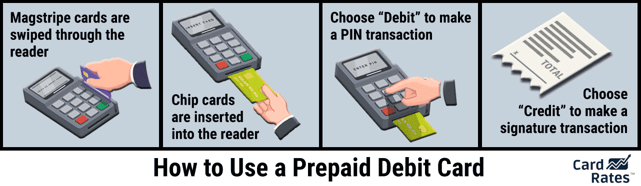

How Does a Prepaid Card Work?

Every prepaid card issuer has different partnerships that make it easy to add money to your card account. This may include visiting a partnered convenience store or grocery store where you can hand money to the cashier and have it instantly added to your card account.

You can also receive money through regular direct deposits of your paychecks or benefits checks. Another benefit is that your deposits may hit your account up to two days sooner than they would through a traditional bank account.

Your card may charge a monthly fee or a per-transaction fee to pay for your account maintenance, though some card issuers will reduce or waive this fee if you meet specific guidelines outlined in your cardholder agreement.

Once you have money in your account, you can use your prepaid Visa card at the register, over the phone, or online to make purchases or pay bills. As with a traditional debit card, the money you spend is automatically deducted from your account. You can spend up to the amount of money you have deposited into your card account.

These cards don’t charge overdraft fees because you cannot overdraft your account. Any transaction that goes over your account limit will be declined unless you have signed up for the optional overdraft protection.

Thanks to the card’s partnership with Visa, you can rest easy knowing that you’re covered by Visa’s zero liability policy that clears you of all responsibility for any unauthorized transactions.

Can a Prepaid Visa Card Help Build My Credit?

Visa prepaid cards are not tied to a credit account, so they cannot help you build or rebuild your credit score. While a prepaid card is a useful financial tool, it is not one that affects your credit history.

Every month, credit card issuers report your credit card payment history and balance to at least one major credit bureau. These bureaus record this information which is then used by credit scoring models to calculate your credit score. Positive data helps your credit score, and negative data lowers it.

Since a prepaid card doesn’t require a monthly payment and doesn’t extend credit, there’s no need to report any data to a credit bureau. When a lender conducts a credit check, it will not see any record of your prepaid card account.

If you’re looking to build credit, consider a secured credit card that won’t disqualify you because of a poor credit score but can help you rebuild your score with responsible behavior. Even better, these cards may not charge an annual fee or monthly fee for membership.

Can I Get a Prepaid Visa Card Without a Credit Check?

Since there’s no credit involved, prepaid Visa cards will process your card application without a credit check.

Just be aware that the card issuer will still require your Social Security number to verify your identity before issuing you a personalized card in your name.

Find the Best Visa Prepaid Card Offers Online

If you’ve made it this far, you no longer have to ask, “Where can I get a prepaid Visa card?” Instead, you’re now armed with the information you need to make an informed decision on which card to sign up for online. Always read the cardholder agreement so you’re fully aware of any fees you’ll be charged.

Just remember that a prepaid Visa card may not be your best option if you’re looking to build credit. While this card is a good choice to have in your financial tool belt if you need a place to store your money or receive direct deposits, it won’t improve your credit score.

Once you’ve established a good routine with your prepaid card, you can consider adding a secured credit card to your wallet to help you build credit. You’ll be well on your way to a better financial future with these two cards.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![How Does a Prepaid Credit Card Work? ([updated_month_year]) How Does a Prepaid Credit Card Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/How-Does-a-Prepaid-Credit-Card-Work.jpg?width=158&height=120&fit=crop)

![8 Types of Prepaid Cards & #1 Card For Each ([updated_month_year]) 8 Types of Prepaid Cards & #1 Card For Each ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Types-of-Prepaid-Cards.jpg?width=158&height=120&fit=crop)

![“Where Can I Get a PayPal Prepaid Card?” ([updated_month_year]) “Where Can I Get a PayPal Prepaid Card?” ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Where-Can-I-Get-a-PayPal-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![How to Use a Prepaid Card Online ([updated_month_year]) How to Use a Prepaid Card Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/How-to-Use-a-Prepaid-Card-Online.jpg?width=158&height=120&fit=crop)

![What Is a Prepaid Card? ([updated_month_year]) What Is a Prepaid Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/What-Is-a-Prepaid-Card_-1.jpg?width=158&height=120&fit=crop)

![7 Virtual Prepaid Card Options ([updated_month_year]) 7 Virtual Prepaid Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Virtual-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![7 Best Reloadable Visa Cards ([updated_month_year]) 7 Best Reloadable Visa Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Reloadable-Visa-Cards.jpg?width=158&height=120&fit=crop)