Though commonly referred to simply as “Chase” by consumers, Chase Bank — or, formally, JPMorgan Chase & Co. — can trace its lineage all the way back to 1799 New York City, and a savvy water company by the name of The Manhattan Company. Since that time, Chase has continuously expanded, growing as a company and merging with a number of notable banks, to become the largest bank issuer of consumer credit cards in the US.

Part of the reason for the bank’s success in consumer credit is the array of attractive rewards cards and programs, including the Chase Sapphire Preferred® Card, which is frequently recommended as a top travel option. Additionally, the Chase Freedom Flex℠ and Chase Freedom Unlimited® cards are particularly popular as everyday cards, offering solid limits, usable rewards, and a host of additional card benefits.

In the article below, we’ll take a look at the Chase Freedom credit limit and benefits. Pre-qualify online to gain a better idea of whether you will be approved for the card before going through the full application process and getting a hard pull on your credit.

Average Limit | Increase Your Limit | Cash Back Rewards | Card Benefits

Reviews Suggest an Average Limit Around $3,000

When it comes to obtaining a new Chase Freedom Flex℠, you’re likely going to want a credit score in the 700 and up range (“good” to “excellent” credit), but reviews suggest you can still find approval with a lower score. In fact, multiple reviewers were approved with scores in the mid-600s, and one reviewer reported being approved with a score of 644.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.Chase Freedom Flex℠

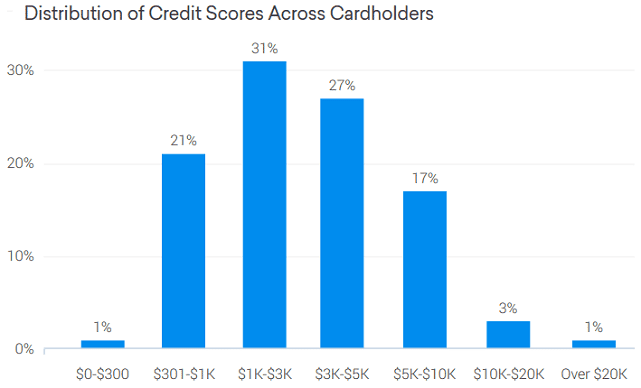

In addition to heavily factoring into your approval odds, your credit will be used — alongside your income and current obligations — to determine your new card’s credit limit. Credit Karma data suggests the Chase Freedom cards seem to typically offer a respectable initial limit averaging around $3,000.

More specifically, about 20% of Chase Freedom Flex℠ cardholders reported limits in the $300 to $1,000 range, and another 20% of users obtained limits above $5,000. In general, it appears the minimum limit to be $300, while the maximum limit is around $20,000, although one reviewer reports receiving an initial $24,000 limit.

This graph from Credit Karma shows users’ reported credit limits.

Of course, those approved for a Chase Freedom Flex℠ despite their low credit scores will likely have to settle for a lower credit limit. In particular, reviewers with scores below 700 when applying were more likely to be approved for below-average credit limits.

According to one reviewer, “Credit Karma gave me good approval odds so I went for it. Application process took all of 30 seconds and I was instantly approved for $2000. CK had my scores at 629 and 661.”

Regular & Responsible Card Use May Lead to Limit Increases

For most credit cards, cardholders have two ways to increase their credit limits. The first is through an automatic increase, which is an unsolicited credit limit increase granted by the issuer. The second is to request a credit limit increase through the issuer’s website or customer service line.

Unfortunately, the Chase Freedom Flex℠ reviews seem to be split on the best way to obtain a credit limit increase. Several reviewers report receiving automatic credit limit increases, particularly in response to regular use and responsible payment behavior. As one reviewer writes, “I’ve had this card about a year. I initially had a $4,500 limit. I began using the card for wedding-related expenses and within 8 months I had a $10,000 limit.”

At the same time, other users complain that Chase is actually stingy with the automatic increases, referencing year-old cards (or more) that have never seen an increase.

In one irritated review, “I was given a limit of $4000.00 which isn’t terrible, but trying to maintain a good utilization ratio on that when you pay for everything with your credit cards is a bit cumbersome. I researched and got the impression that I would just need to wait to get an increase, so I waited… Over a year later and I have yet to receive an increase.”

On the other hand, many reviewers seem to have good success with directly requesting credit limit increases from Chase. While this process does involve a hard credit inquiry, it may be the most effective way to increase your Chase Freedom Flex℠ credit limit.

“When I first got this card my credit score was about 675 I was approved with a credit limit of $1,000 in August of 2014,” said one reviewer. “In April of 2015, I requested an increase on my limit. They asked me how much would I need — I didn’t want to shoot too high, so I said $3,000. Boom! Instant approval. I called them again, asking for another increase, and they asked me the same question. This time, I aimed high and said $7,000. Boom! Instant approval.”

Chase Freedom Flex℠ Users Can Earn Cash Back with Every Purchase

For many cardholders, the best thing about the Chase Freedom Flex℠ and Chase Freedom Unlimited® are the cash back rewards. The rewards also happen to be the main difference between the two cards, coming down to a choice between bonus categories and flat-rate cash back options.

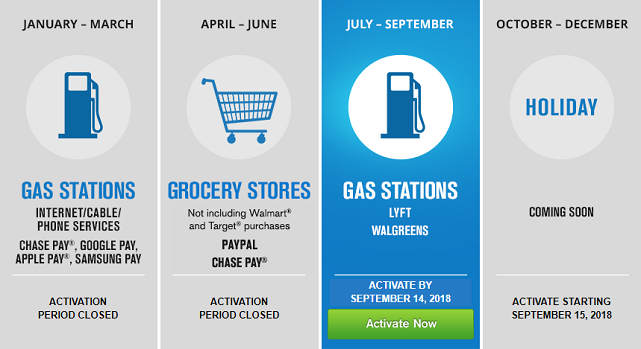

For those consumers whose spending typically occurs at popular locations, such as grocery stores or restaurants, the bonus rewards offered by the Chase Freedom Flex℠‘s category-based cash back program can offer a lot of value. The bonus earnings category does have a purchase limit per quarter, but users will still earn cash back on all other purchases.

Cardholders can earn 5% bonus cash back in new categories every quarter with their Chase Freedom Flex℠.

You’ll also need to go online to activate your new bonus categories each quarter to ensure you earn your bonus cash back. This can be done through your credit card account page or by entering your information into Chase’s rewards activation page. You can typically activate a new quarter 30 to 60 days before the start of that quarter.

If the idea of rotating categories isn’t appealing or your spending simply doesn’t conform to popular categories, the Chase Freedom Unlimited® instead offers unlimited cash back on every purchase, without the tracking of rotating categories for your purchases. As its name suggests, the Chase Freedom Unlimited® has no maximum to how much cash back you can earn, and you won’t need to activate anything to start earning.

Regardless of which card you select, your cash back rewards won’t expire so long as your account remains open and in good standing. Most rewards will post the following statement cycle and you can then redeem your cash back at any time, for any amount. You can also choose to redeem your rewards for gift cards to dozens of popular merchants.

Cardholders Enjoy a Variety of Additional Benefits

While cash back rewards are certainly the flashiest and most popular perks of a Chase Freedom Flex℠, they’re hardly the only benefits. Your new card will also have a range of built-in benefits that you may not even know about.

To start, you won’t have to pay an annual fee for either the Chase Freedom Flex℠ or the Chase Freedom Unlimited® card. The Freedom cards also come with attractive signup bonuses, made easily attainable with reasonable spending requirements. Remember that you can only receive one signup bonus per card per 24-month period, regardless of whether you’ve closed the card within that period.

The Chase Freedom Flex℠ card comes with a variety of card benefits, including protection against unauthorized users.

Users can also enjoy shopping and travel benefits when using their Chase Freedom Flex℠ or Chase Freedom Unlimited®. These perks include purchase and extended warranty protection for products paid for with your card, as well as auto rental collision damage waivers and roadside dispatch (for Visa cardholders) or roadside assistance (for Mastercard cardholders).

Chase Freedom: Popular Everyday Cards

As evidenced by its decades of experience and millions of customers, Chase has certainly learned how to give people what they want in a credit card — and the Chase Freedom Flex℠ and Chase Freedom Unlimited® are hardly an exception. Offering generous credit limits and favorable rewards, the Chase Freedom cards are a popular choice for an everyday credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Key Differences: Chase Slate vs. Freedom Flex vs. Freedom Unlimited ([updated_month_year]) 3 Key Differences: Chase Slate vs. Freedom Flex vs. Freedom Unlimited ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/12/chase-slave-vs-freedom.jpg?width=158&height=120&fit=crop)

![Chase Freedom vs. Discover it® Cards ([updated_month_year]) Chase Freedom vs. Discover it® Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Chase-Freedom-vs.-Discover-it.jpg?width=158&height=120&fit=crop)

![Is the Chase Freedom a Visa or Mastercard? ([updated_month_year]) Is the Chase Freedom a Visa or Mastercard? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/chasevisa.png?width=158&height=120&fit=crop)

![Chase Sapphire: Credit Limit & Pre-Qualifying ([updated_month_year]) Chase Sapphire: Credit Limit & Pre-Qualifying ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/chaselimit2.jpg?width=158&height=120&fit=crop)

![Chase Slate: Credit Limit & Pre-Qualifying ([updated_month_year]) Chase Slate: Credit Limit & Pre-Qualifying ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/chaseslate.png?width=158&height=120&fit=crop)

![6 Highest-Limit Chase Credit Cards ([updated_month_year]) 6 Highest-Limit Chase Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Chase-Credit-Cards.jpg?width=158&height=120&fit=crop)