If you’ve ever tried to pay for dinner with a credit card that the restaurant didn’t accept, then you’ll be very interested in our rundown of the best credit cards accepted everywhere. As it turns out, not all cards are accepted by all merchants. Most often, the reason why some merchants say no to cards from particular payment networks boils down to relatively high fees charged by those networks.

Fees are the lifeblood of the four payment networks: Visa, Mastercard, American Express, and Discover. The first two don’t issue their own credit cards, but rather process the payments for hundreds of card issuers. The latter two do double duty as payment processors and issuers, which accounts for their different fee structures.

That being said, the historical low-fee advantage Visa and Mastercard have enjoyed almost disappeared after Amex lowered its fees. Still, the most widely accepted cards carry the Visa or Mastercard logo, and those are the ones we review in this article. Note that most can be used with Google pay and other mobile wallets.

Best Overall | Travel | Cash Back | Points | Balance Transfer | Business | Students |

Fair Credit | Bad Credit | FAQs

Best Overall Card Accepted Everywhere

Chase Freedom Unlimited® is a Visa card that does everything well. It welcomes new cardmembers by offering a long-lived 0% introductory APR on purchases and an easy-to-fulfill signup bonus. The card offers different reward tiers that vary by the merchant type, all while charging no annual fee.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The card’s relatively low APR range is aimed at consumers with good to excellent credit. A balance transfer is available at the same APR as purchases, and a cash advance has an APR that is just a little higher (fees apply). You can use the card’s My Chase Loan feature to arrange a low-APR loan without the need for an application or credit check.

Best Travel Credit Card Accepted Everywhere

The Capital One Venture Rewards Credit Card is a widely accepted air miles card that offers a generous signup bonus and a simple flat rewards rate on all purchases. You can redeem your Venture card miles for any airline, hotel, or car rental, among other options.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

You earn bonus Venture card miles when you purchase hotel stays and car rentals through Capital One Travel. You can redeem miles by applying redeemed miles to book new travel purchases or converting your miles into cash, gift cards, and more.

Best Cash Back Card Accepted Everywhere

The Visa Chase Freedom Unlimited® is popular for many reasons, including a signup bonus, tiered rewards on all purchases, and 0% introductory APR on purchases by new cardmembers. Rewards are denominated in Chase Ultimate Reward points that you can easily convert into cash back. There is no minimum redemption amount for cash rewards, and your rewards don’t expire as long as the account remains open.

The reward points you earn on eligible purchases are not just for cash back. If you prefer, you can redeem your points for a Visa gift card selection and purchases at the Chase Ultimate Rewards site. You can also transfer your points to another Chase credit card, including the Sapphire cards that inflate point values when used to purchase travel from Chase.

Best Points Card Accepted Everywhere

The Chase Sapphire Preferred® Card is our top choice among widely accepted points cards. While offering no introductory 0% APR promotion, it does let you earn a generous signup bonus. This Visa card gives you tiered rewards on purchases for a moderate annual fee.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

You can exchange your reward points for cash, gift cards, and travel, among other options. The card occasionally offers special reward promotions with various partners such as Peloton.

Best Balance Transfer Card Accepted Everywhere

The U.S. Bank Visa® Platinum Card offers to new cardmembers an unusually long period of 0% introductory APR on purchases and on balance transfers completed in the first 60 days after account opening (fees apply). This card’s APR range for purchases, transfers, and cash advances is lower than that of many competitors.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 21 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 21 billing cycles

|

0% for 21 billing cycles

|

18.74% - 29.74% (Variable)

|

$0

|

Excellent Credit

|

Additional Disclosure: The information related to this card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this product.

The card gives you 24/7 access to VantageScore® credit scores, credit alerts, and Score Simulator through the TransUnion CreditView™ Dashboard. You can use the U.S. Bank Mobile App to view transactions, check your balance, and make payments, among other options. You can also set up AutoPay to avoid late fees and interest, and the card’s monthly payment due date is yours to choose.

Best Business Card Accepted Everywhere

The Ink Business Preferred® Credit Card is another Chase card that increases the value of points you redeem for travel through Chase. The signup bonus is not complemented by a 0% introductory APR offer, but you can order employee cards at no extra cost. The moderate annual fee is offset by no foreign transaction fees.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

Points are tiered in value based on merchant type. As with other Chase cards, you can Pay with Points through the program or directly to merchants, as well as redeem points for cash, gift cards, experiences, and more, or you can transfer points 1:1 to leading frequent travel programs. You get $0 liability protection, trip cancellation/interruption insurance, extended warranty protection, auto rental collision damage waiver, purchase protection, and much more.

Best Card For Fair Credit Accepted Everywhere

Our card choice for consumers with fair credit is the Capital One Platinum Credit Card. This is a basic credit card with no rewards, limited benefits, and no annual fee. It is distinguished from unsecured cards for bad credit by its lack of additional initiation or management fees and the possibility of an initial credit limit greater than $300.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

Another feature of this card is the ability to use virtual card numbers via Capital One Eno® to make online purchases more secure. You can also access Capital One CreditWise® to monitor your TransUnion VantageScore® 3.0 credit score and receive alerts about changes to your credit reports or appearances of your information on the dark web.

Best Card For Bad Credit Accepted Everywhere

The Capital One Platinum Secured Credit Card is a good choice if your credit is bad because it is the only widely accepted secured credit card that allows some applicants to deposit less than the minimum initial credit line. There is a fee for cash advances, which has the same APR as that for purchases. The card will report your activity to at least one credit bureau, and probably all three.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

Before you open the account, you can deposit more than the initial required security deposit to increase the card’s credit line up to the $1,000 maximum. To qualify for this card, your monthly income must exceed your monthly rent or mortgage bill by at least $800. Like other Capital One cards, this one also gives you access to Eno® and CreditWise®.

Which Credit Cards Are Most Widely Accepted?

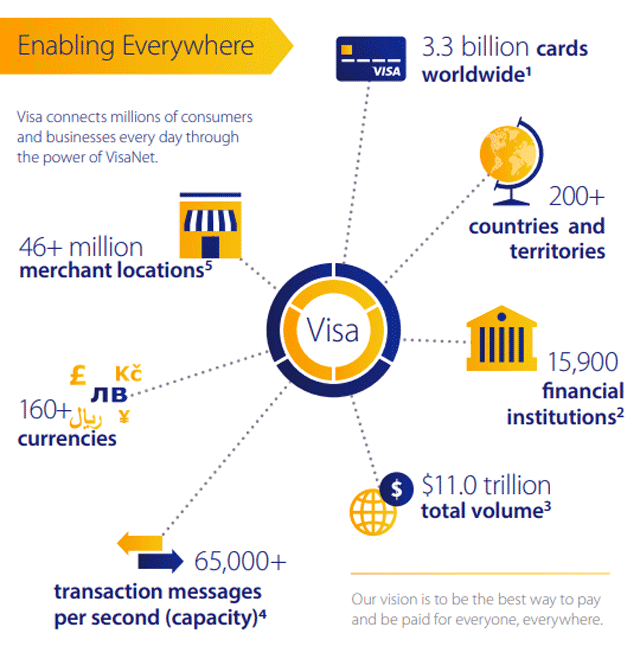

Credit cards carrying the logo of the Visa or Mastercard payment networks are the most widely accepted by merchants. More than 46 million merchants in over 200 countries and territories accept Visa cards, and 37 million accept Mastercard. Almost 11 million U.S. merchant locations accept both cards.

The other two networks, American Express and Discover, trail behind with slightly lower acceptance rates.

The principal reason for this market structure has its historical roots in the economics of payment networks — i.e., how much it costs merchants to accept credit cards for payments.

Payment Networks 101

The following entities participate in credit card transactions:

Cardholder

This is the person or business making the purchase. Transactor cardholders pay the full credit card balance each month, whereas revolver cardholders pay a portion (but not less than the minimum payment) for the billing cycle and accrue interest on the remainder.

Merchant

A merchant is the entity selling the goods or services to the cardholder. Merchants send information to and request payments from issuing banks. The payments are deposited into merchant accounts at acquiring banks.

Acquiring Bank

This is the bank where the merchant’s business accounts reside. The acquiring bank creates the accounts that allow merchants to accept credit cards and receive payments.

Each acquiring bank is a licensed member of one or more credit card payment networks. Acquiring banks verify the merchant’s account for each credit card transaction. They accept payment authorization requests from merchants and send them to issuing banks via a credit card payment network.

The acquiring banks also receive information from issuing banks, which they forward to merchants.

Issuing Bank

This is the financial institution that issues the credit card to the cardholder, maintains the cardholder’s credit card account, and approves/declines the payment authorization requests it receives from the merchant’s acquiring bank or merchant processor. Chase, Citibank, Wells Fargo, and Bank of America are all examples of an issuing bank.

Card Payment Network

Intermediate entities (Visa, Mastercard, American Express, and Discover) operate payment networks that process credit card transactions, distribute information among merchants, acquiring banks, issuing banks, and cardholders, and control interchange fees. They are responsible for collecting transaction information, forwarding payment authorization requests to issuing banks, and sending responses to acquiring banks or merchant processors.

Merchants can select the payment networks with which they will work — some merchants are exclusively tied to just one payment card network while others accept cards from multiple networks.

Merchant Processor

Also called the acquiring processor or service provider, the merchant processor connects a merchant to its bank — the acquiring bank. Merchant processors can operate with third-party sales services called independent service organizations (ISOs) or they can deal directly with merchants.

Square, Stripe, and PayPal are examples of ISOs. Of course, a PayPal account can be used for many other purposes.

In effect, an ISO is a marketing and logistical frontend to backend processor, whereas direct processors work with merchants to set up their processing without using a third-party ISO. Functionally, there isn’t much difference between the two models, although ISOs have the potential to offer better pricing and customer service.

In some cases, the acquiring bank performs the merchant processor function. However, that’s not always true. In either case, the merchant processor usually provides the merchant with the required software and hardware, including virtual terminals, point-of-sale (POS) systems, and card terminals.

Above all else, the merchant processor acts as a gateway connecting a merchant to its acquiring bank, where the merchant account resides, and to the payment network. All these participants must cooperate smoothly, so merchants receive prompt payment for customer eligible purchases charged on credit cards.

Anatomy of a Credit Card Transaction

From a high-level view, inbound traffic starts when the merchant submits a consumer’s credit card charge. The merchant processor sends the transaction information to the acquiring bank and subsequently to the issuing bank via the payment network.

After clearing the transaction, the issuing bank routes approvals, payments, and transaction information outbound to the acquiring bank, merchant, and consumer.

Visa and Mastercard are payment networks only, whereas American Express and Discover are also card issuers. In other words, an Amex or Discover card is part of both an issuing bank and a payment network.

The payment networks facilitate the following steps when a consumer uses a credit card to purchase goods or services:

- Card submission: A consumer swipes, taps, inserts into a chip reader, or otherwise presents a credit card to a merchant payment terminal (physical or online) to pay for a purchase. The payment terminal sends the transaction, via phone line or the internet, to the acquiring bank using the system set up by the merchant processor.

- Card authorization: The merchant processor forwards the transaction data to the appropriate payment network, which clears the payment and requests the issuing bank to authorize the payment. (For an Amex or Discover card, the payment network is the issuing bank). The authorization request includes the credit card number, expiration date, billing address, payment amount, and card security code.

- Card authentication: When the issuing bank receives the authorization request from the payment network, it authenticates the data items in the request and verifies the card’s security code. At this point, the issuing bank approves or declines the transaction, transmitting the decision back to the merchant processor via the payment network. Assuming the transaction was authorized, the issuing bank puts a hold on the merchant’s account for the purchase amount. The approved authorization message is sent to the merchant, at which point the customer may sign a printed receipt and take a copy. Throughout the day, the merchant’s terminals collect the approved authorizations in preparation for the end-of-day batching, or the system may transmit the authorizations as they are approved. In either case, no cash has flowed yet, and credit cards have not yet been charged. It normally takes one to three days for approved transactions to generate cash flows from the issuing bank to the acquiring bank.

- Batching the transactions: The merchant batches all its authorized card transactions at the end of the day and forwards the data to the acquiring bank or merchant processor, which in turn routes the batch to the payment card network for settlement. The network sends each approved transaction, including payment instructions, to the responsible issuing bank.

- Issuing bank sends payment: The issuing bank prepares the payment over the next 24 to 48 hours but subtracts and pockets an interchange fee for its services. Part of the interchange fee, known as the assessment fee, is shared with the payment network to pay for its services. The issuing bank sends the payment to the acquiring bank, which also collects fees before posting the remaining money to the merchant’s account.

- Billing the customer: Every billing cycle, the issuing bank sends out a billing statement to the customer, listing new purchases as well as any balance left over from previous cycles. The customer pays some or all of the balance but no less than the minimum amount. Consumers who pay less than the full balance will pay interest on the unpaid amount.

The size of each fee depends on many variables, including the payment network, card issuer, type of card (travel, cash back, student, secured, etc.), type of merchant, method of card capture, and so forth.

Types of Fees

These are the most important fees involved in credit card processing:

- Discount rate: Also called the merchant fee or the merchant discount rate, this is the fee a merchant processor charges a merchant to handle the merchant’s credit card transactions. This is a composite fee comprising several others, including the interchange, assessment, and authorization fees. The discount rate is expressed as a percentage plus a flat fee. The percentage portion is based on the risk that a bank won’t receive the payment it’s due. Percentages are tied to merchant category codes that reflect industry-dependent payment risks. The flat fee portion represents the fixed costs of doing business, including costs stemming from computer hardware, software, and personnel.

- Interchange fee: This is a portion of the discount fee that the issuing bank collects for each transaction based on an interchange rate set by the payment network. Fees vary for multiple reasons, with higher fees associated with, for example, travel cards, business cards, card-not-present transactions, high-price low-volume merchants, riskier businesses (e.g., financial services, gambling, hotels), and other factors.

- Assessment fee: The fee charged by the payment network for the use of their card brand. This fee is based on total monthly sales rather than individual transactions. Factors affecting this fee include transaction volume and processing of foreign transactions.

- Merchant bank fee: The percentage fee an acquiring bank charges for its services. Like other fees, this one varies by the amount of sale, industry, processing volume, and many more factors.

- Authorization fee: This is the payment processing fee a merchant pays for merchant processor services. It is what remains of the discount fee after the merchant processor pays out all the other fees (i.e., it is the processor’s revenue). Note that the merchant processor may charge other fees, including ones for setup, monthly usage, and cancellation.

- Surcharge: Some merchants charge a checkout fee for the use of a credit card rather than cash to make a purchase. This surcharge is collected by the payment network on behalf of the merchant. Some states prohibit or limit checkout fees, and the surcharge cannot exceed the merchant’s discount fee.

Fees can be categorized as wholesale or markups:

- Wholesale fees: Comprised in interchange and assessment fees. These fees are non-negotiable and fixed regardless of the merchant processor you choose.

- Markups: These are the remaining fees, principally the authorization fee. They are negotiable and vary among merchant processors.

The wholesale fee plus markups equal the discount fee.

The fees a merchant pays for each credit card transaction is often quoted as the sum of the percentage rate and a flat fee. An example may be (2.8% + $0.35) per transaction. Therefore, a merchant with this fee structure would pay $2.80 + $0.35, or $3.15, on a $100 credit card sale.

Be aware that merchant processors may charge a variety of incidental fees, such as ones for canceling a contract or for moving money from a merchant’s payment processing account to its business checking account.

The following are incidental wholesale fees:

- Fixed acquirer network fee: A fee charged by Visa based on merchant type and monthly volume.

- Merchant location fee: An annual fee that Mastercard charges for each merchant location. It is usually waived for small, religious, and charitable organizations.

- Processing integrity fees: A penalty fee for transactions improperly authorized or settled.

The following are incidental markup fees charged by merchant processors:

- Monthly fee: A fixed monthly charge usually associated with call center costs.

- Annual fee: Covers the basic use of a processor’s services.

- Statement fee: Pays for printing and mailing of credit card statements. You may be able to avoid this fee is you use e-statements.

- Online reporting fee: Instead of a statement fee, users are charged this fee for viewing online statements.

- Monthly minimum fee: The minimum fee a merchant must pay if it fails to reach a monthly or annual transaction quota.

- Terminal fee: A leasing fee for terminals, charged to physical retail locations where cards are accepted. Merchants can avoid this by purchasing their terminals.

- POS software fee: Merchants pay this fee for point of sale software supplied by the merchant processor. Sometimes, this fee is rolled into the monthly fee.

- Payment gateway fees: These are fees charged to online merchants in lieu of terminal fees.

- PCI compliance fees: Merchant processors charge these fees to pay for compliance to Payment Card Industry Standards. Merchants pay this fee to ensure they remain in compliance with regulations.

- IRS reporting fee: Charged for reporting transactions on IRS Form 1099-K.

- Application/setup fee: Some merchant processors charge a one-time setup fee, but many don’t.

- Early termination fee: A penalty for early cancellation of the contract with your merchant processor.

- Account closure fee: A relatively small fee charged whenever an account is closed for any reason.

- Address verification service: For eCommerce and telesales businesses, a transactional fee charged when addresses are keyed in.

- Voice authorization fee: A fee for those times when a merchant must call a toll-free number to verify information before a transaction can be authorized.

- Chargeback fee: A fee for a chargeback, which is when a sale is reversed.

- Retrieval request fee: A fee for expenses stemming from customer disputes to a merchant’s charge, as part of the chargeback protocol.

- Batch fee: Also called a batch header, this fee is charged each time a merchant terminal submits a batch of authorized transactions for payment.

- NSF fee: Assessed when there are non-sufficient funds in the merchant’s business account to cover expenses.

- PCI non-compliance fee: A monthly penalty if a merchant doesn’t meet PCI standards.

What we’ve presented is a simplified version of a complex system that includes various pricing models. The merchant processor is responsible for collecting fees according to the pricing model used:

- Flat-rate pricing: The merchant pays a flat fee for each transaction, independent of actual costs. The flat rate bundles all the different fees as described earlier. An example is 2.8% + $0.35 per transaction.

- Interchange plus pricing: The merchant processor charges a fixed markup fee in addition to the interchange fee. For example, the fee may be expressed as 2.0% + $0.35 per transaction on top of a 1.8% interchange rate. More than 300 interchange rates vary from one transaction to the next. This pricing model lets merchants see the precise interchange fee they are charged for each transaction.

- Subscription/membership pricing: Similar to interchange plus pricing, this model doesn’t include a percentage markup. Instead, you pay a flat subscription fee each month. Large merchants can significantly reduce processing costs with this model.

- Tiered pricing: This is a simplified version of interchange plus pricing in which a transaction’s interchange rate is categorized into three tiers. The tiered rate is quoted on each transaction. The three tiers are qualified (the lowest prices, for credit card swipes/inserts), mid-qualified (midlevel prices, mainly for key-entered transactions), and nonqualified (highest prices, for all other transactions, including online).

Merchant processors can offer quotes using any of the pricing models. Merchants thus have ample opportunity to figure out which model will minimize their costs.

Summary of Processing Fees

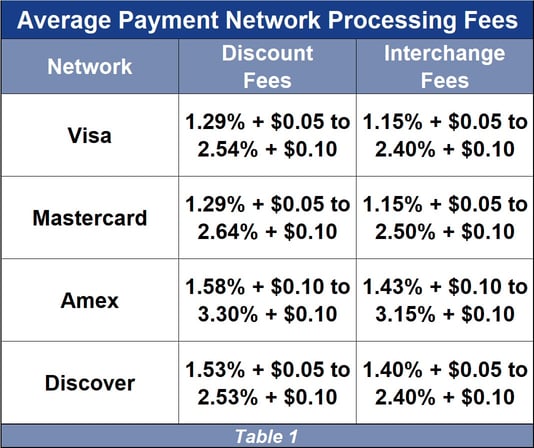

The following table summarizes the average recent processing fees for each payment network, courtesy of Motley Fool. While these figures may change over time, the relative price relationships are long-lasting. Outlying prices have been removed.

Table 1 helps explain why Visa and Mastercard lead in availability among merchants — the two networks are cheaper.

The average transaction cost a small business (i.e., a company with annual credit card volume between $10,000 and $250,000) will experience ranges from 2.87% to 4.35%. Note that these businesses face additional fees of 28% to 60% above the initial quoted rate.

What Credit Cards Can You Use Anywhere?

General-purpose credit cards (often called open-loop cards) are accepted just about everywhere. When you attempt to use a credit card to make a purchase, the merchant will indicate whether it accepts the payment networks used by your card — Visa, Mastercard, American Express, and Discover. All U.S. merchants that accept credit cards use at least one of these payment networks.

Many store credit cards are closed-loop, with limited acceptance compared to general-purpose cards — you can use them only at the issuing retailer. For instance, the Ann Taylor Card is only accepted for online and in-person eligible purchases from the Ann Taylor store. These cards tend to have higher APRs but often offer exclusive benefits and rewards to cardholders.

Automotive credit cards also provide limited acceptance. Gas cards, including those from Shell, BP, etc., are accepted only at the corresponding gas stations and frequently offer discounts on gas and/or accumulation of point rewards.

A closed-loop store credit card generally has lower credit standards than does a general-purpose card. These cards seldom operate on the major payment networks and are often a good place to establish or rebuild credit. Typically, they don’t charge an annual fee.

A co-branded store credit card is open-loop, meaning you can use it everywhere you would a regular credit card. These cards still may offer special benefits and rewards when used for purchases at the co-branding retailer.

Some stores only accept cards from a particular network. For example, Costco only accepts Visa cards, whereas Kroger doesn’t accept Visa.

Is Visa More Accepted Than Mastercard?

Visa is the most widely accepted credit card, welcomed at over 46 million merchant locations spanning more than 200 countries and territories. Mastercard is accepted by 37 million merchant locations in more than 210 countries and territories.

Visa is the most widely accepted payment network in the world.

In the United States, both cards are accepted at just under 11 million merchant locations.

Visa has 52.8% of the cards that use one of the four major payment networks, comprising 335 million Visa cards in circulation. Mastercard has 31.6% of the market with 200 million cards in use. There are 323 million Visa cardholders and 191 million Mastercard cardholders.

What Are the Differences Between Visa and Mastercard?

There are few differences between Visa and Mastercard. These credit card brands are accepted at the same number of merchants in the U.S. and share common functionality.

In addition to credit cards, Visa and Mastercard can handle a debit card, gift card, and prepaid card (including a prepaid debit card). A Visa debit card has different fees than a Visa credit card (a Visa debit card costs less to process).

Neither brand issues credit cards (nor a debit, gift, or prepaid card) — they simply process transactions for cards issued by banks under the brand name. The honor all cards rule dictates that a merchant that accepts any Visa or Mastercard credit card must accept all Visa or Mastercard credit cards. The same is true for American Express and Discover.

However, it would be an overstatement to say that the two brands were identical or monolithic. For example, the Visa card brand may offer a particular benefit, such as rental car collision damage waiver, but that doesn’t mean every Visa card offers that benefit. Conversely, card issuers frequently offer benefits not offered by the payment network.

In terms of merchant costs, Table 1 shows that Mastercard’s average interchange fee is 0.10 percentage points higher than Visa’s. For most merchants, this is a negligible difference, which explains why both brands have equal acceptance in the United States.

Visa cards offer three benefit levels:

- Traditional: Visa cards of this type offer basic benefits, including emergency card replacement, auto rental collision damage waiver, $0 fraud liability, and emergency roadside assistance.

- Signature: In addition to the Traditional benefits, this benefit level includes worldwide travel and emergency assistance, and extended warranty protection.

- Infinite: This level also includes travel accident insurance, lost luggage reimbursement, trip cancellation and interruption insurance, return protection, and purchase protection.

Similarly, Mastercard offers three levels of benefits:

- Standard: You get identity theft protection, emergency card replacement, and zero fraud liability, but extended warranty protection and price protection are no longer included.

- World: Additional benefits include trip planning and travel benefits through Mastercard Travel & Lifestyle Services, cellphone insurance, concierge service, and select retailer promotions and discounts.

- World Elite: You get World benefits plus additional promotions and discounts as well as golf benefits.

The upshot is that it is more important for consumers to choose credit cards based on what the issuer offers rather than favoring the Mastercard or the Visa logo.

Is American Express Better Than Visa or Mastercard?

American Express is certainly different from Visa and Mastercard. The biggest difference is that American Express does double duty as a payment network and a card issuer, whereas Visa and Mastercards are solely payment networks.

All cards bearing the American Express logo are issued by Amex, although other card issuers may choose American Express as their payment network.

The fact that Amex is the card issuer and payment network probably has little impact on consumers since all credit cards share the same functionality. A more important difference is that Amex issues both credit cards and charge cards.

Charge Card vs Credit Card

As originally conceived, charge cards have certain features that differ from credit cards:

- Payments: Charge cards do not allow you to carry a balance beyond the current month. In other words, charge cards don’t extend credit to cardmembers, who are expected to pay their bill in full each month or else face late fees and penalties. Credit cards allow you to pay less than the full balance due (but no less than the specified minimum payment), and they charge interest on the unpaid amount.

- Spending limits: Charge cards have no pre-set spending limits, although that doesn’t mean cardmembers can exercise unlimited spending. Amex considers your payment history, financial resources, and credit record when setting the charge card’s purchasing power. Credit cards establish a credit limit and don’t permit balances higher than that limit.

- Target market: Charge cards are meant for individuals and businesses that can comfortably pay the full balance each month and want a flexible spending limit. Credit cards are for customers that have unpredictable cash flows and want the option to finance purchases over longer periods.

Interestingly, Amex has added a credit feature, called Pay It Plan It® (PIPI) to several of its charge cards that allow cardmembers to finance purchases over multiple months. PIPI allows you to split large purchases that you pay back over time. You pay a fixed monthly fee rather than interest for this flexibility.

You can select up to 10 purchases of $100+ to combine into the plan. Amex then specifies the monthly fee you’ll pay until the balance is repaid — you can make payments below $100 under the PIPI plan. The card offers the same travel rewards whether or not you use PIPI.

Through PIPI, Amex charge cards can loosely resemble credit cards since both allow you to finance purchases over time. Moreover, businesses can sign up for another Amex charge card option, Pay Over Time (POT). This option more closely resembles regular credit card behavior in that it charges interest for purchases that you repay over multiple months.

POT moves purchases exceeding a threshold amount (from $100 to $1,000) into a separate balance that charges interest when you stretch out payments over time. As with credit cards, POT offers payment flexibility as long as you pay the minimum amount for the month.

The balance you can run up under the POT option is limited. You must repay in full any amount exceeding the POT balance limit. Amex can adjust the POT limit over time and will inform you if that is their intention. POT is not available for Amex consumer credit cards.

If you consider PIPI and POT to be complicated workarounds to give charge cards some credit features, you can instead choose an Amex credit card and avoid the hassle.

Eligibility Criteria

Compared to other credit cards, the ones from American Express are pitched to a clientele with higher credit scores. Most Amex cards require a FICO score of 670 or higher. The company issues several cards with high annual fees and high spending limits meant for the affluent.

Without a doubt, the Amex card with the highest eligibility standards is the Centurion® Card, otherwise known as the Black Card. You can get this card only by invitation, and you must be a multi-millionaire with excellent credit to be invited. According to Motley Fool, only 0.1% of the population is eligible for this card.

Reportedly, you can only get the Black Card if you make purchases exceeding $250,000 per year. The card has a $2,500 annual fee and a one-time initiation fee of $7,500. In other words, it will cost you $10,000 in the first year to acquire the card — presumably, what an applicant would spend for a fancy meal at a 4-star Parisian restaurant (including first-class airfare).

One step below the Black Card is The Platinum Card® from American Express. With an annual fee of merely $550, this charge card can be yours if you have excellent credit. The card offers good travel rewards and benefits, although I think the Chase Sapphire Reserve® gives you more for your money.

Why Isn’t Amex Widely Accepted?

Visa and Mastercard are more widely accepted than American Express, although the gap has narrowed in recent years. Approximately 10.6 million U.S. merchants accept Amex credit cards, about 1% less than those that accept Mastercard and Visa cards.

While most U.S. merchants accept American Express cards, you’ll find them less accepted when you travel abroad. This is an important consideration if you travel overseas often.

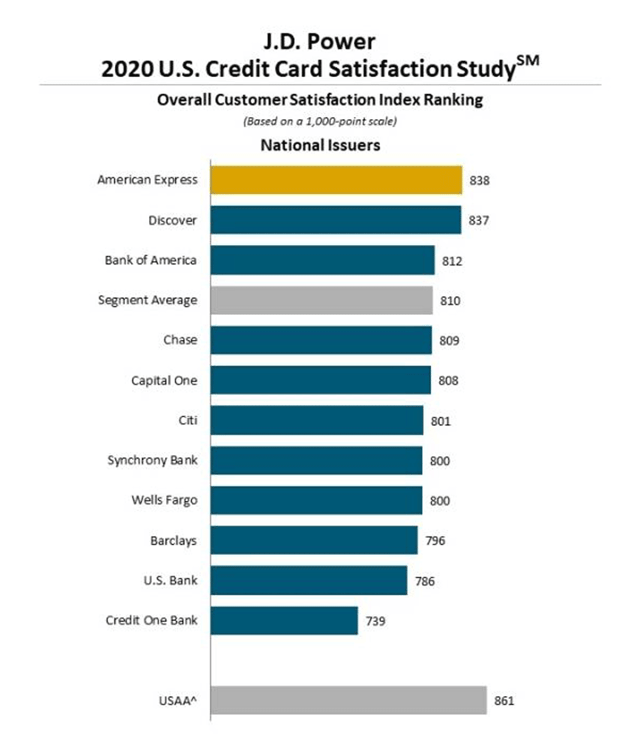

On the other hand, Amex is known for its excellent customer service, ranked Number One in the 2020 U.S. Credit Card Satisfaction Study by J.D. Power.

Table 1 reveals why fewer merchants accept Amex: It has significantly higher interchange fees. However, Amex claims to have reduced the fee differential in recent years. Furthermore, small businesses can continue to use their current merchant processors when they start accepting Amex cards, possibly reducing their costs for card processing.

The issue of why fewer U.S. merchants accept Amex cards may be the brand’s reputation for high processing costs rather than the actual cost differential.

Why Isn’t Discover Widely Accepted?

In the United States, Discover ranks third in merchant acceptance, behind Visa and Mastercard but ahead of American Express.

However, about 99% of places that take credit cards in the U.S. accept Discover. Worldwide, it owns 8.1% of the credit card market and boasts 58 million cardholders.

All Discover cards share certain characteristics that affect their acceptance and popularity, including:

- Discover is both a payment network and a card issuer, similar to American Express. Table 1 reveals that its average interchange fees can be more expensive than those of Visa and Mastercard.

- Discover issues only eight Discover it® cards. There is a student credit card pair, one is for business, one is secured, and there is a card cobranded with the National Hockey League.

- Discover is less accepted abroad, making it less attractive when you want a widely-accepted travel credit card. Discover claims moderate acceptance in Australia, Canada, and the U.K., but low acceptance in France and Spain, among others. The card is generally not accepted in Africa and the Middle East, as well as in several countries in South America, Europe, and Asia.

- On the plus side, all Discover cards have no annual or foreign transaction fees, offer generous 0% introductory APR promotions, and all provide new cardmembers with a Cashback Match or Miles Match at the end of the first year following account opening. Discover cards can be widely used across the globe to get cash from an ATM, even if it is otherwise not accepted in a particular country.

It’s a pity that Discover cards are not as popular as its main competitors because we feel they offer solid value and some unique benefits.

How Can I See Where My Card is Accepted?

Within the United States, all four card brands are widely accepted. In fact, about 99% of merchants that accept credit cards accept all four brands.

Those are good odds, but if you want to verify whether a particular brand is accepted at a specific merchant, you can:

- Check online: If the store permits online sales, it will have a checkout page that lists the credit card brands it accepts. The same may be true if the card has a mobile app. This also pertains to a store card.

- Call or email the merchant: The merchant can tell you whether your card will be accepted.

- Call your card’s customer service line: The issuing credit card company can tell you whether your card will work at a particular store. Alternatively, you may get the same information by texting with a service rep online when you’re visiting the website.

- Use ATM maps: Your card may offer online or mobile app maps showing ATMs where you can use your credit card for free. A store card won’t work as an ATM card.

If American Express or Discover has issued you what you consider to be your primary card, you may consider getting a secondary card from Visa or Mastercard, which have the highest acceptance rates in the U.S. This way, if a merchant doesn’t accept your primary card, you’ll have the option of using your secondary card.

Can I Use My Credit Card For Everything?

You can use your credit card for most things as long as the merchant accepts your card brand. However, some merchants and businesses don’t accept any credit cards. They may accept a debit card, but some may require payment by cash or check.

Some merchants only accept cash because they can’t afford, or don’t want to pay, the extra costs involved in accepting credit cards. These are usually businesses with a thin profit margin. Typically, they display large signs warning you that they don’t take credit cards (or that they require a minimum credit card payment of up to $10) so you aren’t caught unawares when the bill comes.

Some utility companies do not accept credit cards. The reason is that credit cards serve to increase clientele, but utilities are usually monopolies that don’t need to boost their customer bases. They know that if you live in the vicinity and want their service, you have to go through them.

Some utility companies, small businesses, and lenders, among other entities, do not accept credit card payments.

Another area that can be problematic involves debt-for-debt transactions. For example, you can’t pay your mortgage or student loan with a credit card (even a student credit card), as this is exchanging one form of debt for another. The problem with debt-for-debt transactions is that they can lead you into a debt spiral by substituting high-interest debt for low-interest debt.

Some businesses that may not accept credit cards include independent restaurants, nail salons, vending machines, and laundromats.

Nevada prohibits you from buying gambling chips with credit cards — that’s why Las Vegas casinos are heavily populated with ATMs. Speaking of vice, American Express won’t let you purchase online porn, medical marijuana, or lottery tickets with one of its cards.

Other things you can’t pay for (or buy easily) with a credit card include financial assets (stocks, mutual funds, etc.), money orders (because you’re buying cash with borrowed money), tuition at some colleges, and cryptocurrency. You can’t pay a credit card bill with another credit card, although you can arrange a balance transfer between cards.

Purchases that require equity, such as homes and automobiles, don’t permit you to make the down payment with a credit card. The purpose of a down payment is to motivate you to make your monthly payments lest you risk losing your equity — you’ve put “skin in the game.” Using a credit card means putting the issuer’s skin in the game if you default on your payments.

Third-party services exist that allow you to pay certain bills that don’t accept credit cards. This is true of rentals that don’t permit you to pay your rent with a credit card. However, you can use a third-party service that will pay your rent bill in cash and charge you a credit card payment that includes a hefty fee for the service.

Some merchants form partnerships with a particular credit card brand and won’t accept other brands. For example, Costco stores accept only Visa cards. If you show up with another card brand, it will be refused, and you’ll have to pay with cash (or leave the store empty-handed and muttering to yourself).

What is the Most-Used Credit Card in the USA?

Approximately 72% of American adults have a credit card. Within this population, Visa is the most used payment network, with just under half the group having at least one Visa credit card. By 2026, Visa is expected to reach a purchase volume of $6.33 trillion.

The most popular credit card company is Chase, as measured by outstanding balances. Here are the top five credit card issuers:

- Chase (16.6% of outstanding balances): Chase is the dominant credit card issuer in the United States, with total outstanding balances nearing $1 trillion, 91.8 million cards in circulation, and 72.5 million cardholders. The issuer’s popularity is due principally to its rewards cards, including travel and cash-back cards. The Chase Ultimate Reward program is probably the top rewards program in the industry, and Chase’s credit card popularity is no doubt helped by loyalty to Chase Bank, the largest in the country.

- Citi (11.6%): Citi offers a wide selection of cash back and points cards, backed by its Citi ThankYou Rewards program that offers numerous redemption options. More so than Chase, Citi offers cards for establishing and rebuilding credit, as well as many cards co-branded with large corporate partners. Citibank is one of the top four largest U.S. banks.

- American Express (11.3%): Amex offers many credit and charge cards for travel and cash back. American Express Membership Rewards is a first-rate rewards program. Its third-place ranking may be due to its relatively small banking department, high annual fees, and a reputation for narrower acceptance.

- Bank of America (10.7%): The strong Bank of America, the second-largest U.S. bank, helps attract many credit card applicants, as does its Preferred Rewards program. The program has various reward tiers, each providing valuable benefits and bonuses.

- Capital One (10.5%): Credit cards from Capital One attract applicants who value affordability and simplicity. Many cards share the same rewards scheme and offer convenient redemption options. The annual fees on its cards range from $0 to $95.

If you’re looking for the most popular credit card in the United States in terms of web searches, we have a virtual tie between the Chase Sapphire Reserve® and Chase Freedom Unlimited®. The former is Chase’s premium travel card, with generous rewards but a hefty annual fee. The latter card charges no annual fee and is one of Chase’s most versatile offerings. Both are Visa cards.

Other popular credit cards include the Costco Anywhere Visa® Card by Citi, Best Buy® Credit Card, and Southwest Rapid Rewards® Premier Credit Card, all cobranded Visa cards.

Carry Cards From Two or More Payment Networks

Any Visa or Mastercard will have maximum merchant acceptance in the United States. Discover and American Express are almost as widely accepted.

We think it makes the most sense to select the credit cards that work best for you across two or more payment networks. This way, you should be ready for any acceptance contingencies among the merchants you patronize.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards Accepted at Costco ([updated_month_year]) 7 Best Credit Cards Accepted at Costco ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/costco--1.png?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)