In 1989, a credit score with the brand-name Beacon was made commercially available by Equifax in partnership with a little-known company based in San Rafael, California, called Fair, Isaac and Company. Thirty-plus years, a name change, and hundreds of billions of scores later, checking your FICO (the acronym for the Fair Isaac Corporation) credit scores remains standard operating procedure by thousands of lenders in the United States.

One small but important point has to be made before any discussion of FICO scoring. That point is that no one person has a single FICO score. Instead, we have dozens of FICO credit scores.

So whenever you read an article about your FICO Score or you get advice about how to check your FICO Score, it’s not worded as precisely as it should be. Every single time you consider your FICO Score, you really should be considering your FICO scores.

How Did We End Up With So Many Scores?

FICO’s scores are calculated by their scoring software. And, as with all software, it must be updated from time to time. In fact, you should think about FICO scores as you think about iPhones or your Windows operating system. Every few years, a new generation is released that does many of the same things the prior generations did, save for some new features, better security, better graphics, and a better user experience.

This happens every few years in the credit scoring world and is called score redevelopment.

As with iPhones and Windows, just because a new FICO Score has been developed doesn’t mean the prior versions don’t work any longer or that they’re going to be decommissioned in place of the new version.

How many of you toss your phone the minute a new one is made available? Probably some of you, but likely not everyone.

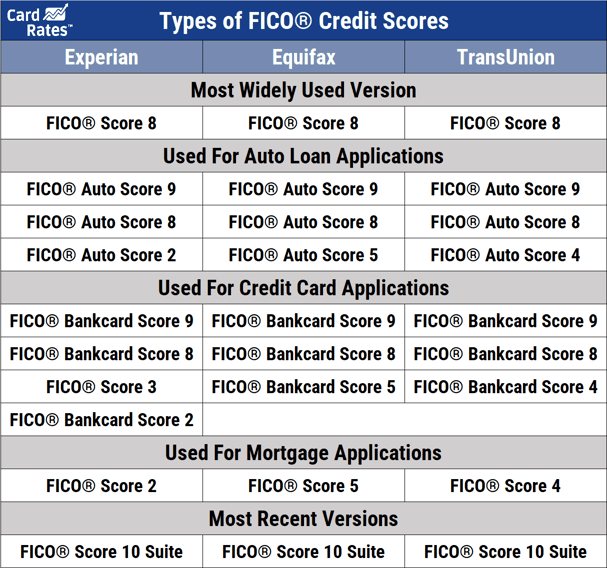

When newer scoring software becomes available, the prior versions continue to be used. The result is that we now have many generations of the FICO Score still in use. As of the publication date of this article, there are five generations of the FICO scoring software available from each of the credit bureaus, amounting to 15 different scores.

But it doesn’t end there. Each of those different scores has variants or, formally speaking, “Industry Options.”

These variants are best described as semi-customized versions of the FICO software designed for specific industries or credit products. For example, when you apply for an auto loan, the lender will likely use the FICO score variant for auto lending, called the FICO Auto Industry Option score.

When you apply for a credit card, the issuer will likely use the FICO score variant for credit card underwriting, called the FICO Bankcard Industry Option score.

Multiply five score generations by the variants from three credit bureaus, and you can quickly lose count. This explains why there are so many different FICO scores in circulation. And, it’s also why it’s more appropriate to talk about our scores instead of our score.

NOTE: Nothing in this article is intended to be, nor should it be, interpreted as a criticism of FICO or the credit bureaus. Neither FICO nor the bureaus control which credit score version their collective 10,000+ customers choose to use for risk assessment. As long as a bank, credit union, government agency, or credit card company continues to use a score they are comfortable with, the credit bureaus must continue to make it available.

FICO Score Generations and Variants

Much like the iPhone and operating systems, FICO’s scores have brand names. Those names are intended to differentiate one score version from another. The point is, when you’re looking at a credit report with a score, it’s not hard to figure out which FICO score is being used as part of the calculation process.

FICO 10 and 10T

Let’s start with the most current version of FICO’s scoring software, the FICO 10 Suite. This generation includes two scores, FICO 10 and FICO 10T, and two industry option variants for auto and credit card approvals (bankcard).

FICO 10 is a redevelopment of FICO’s immensely popular general-use credit score. FICO 10T is the first tri-bureau FICO score that considers trended data or what’s also called “time-series data.”

Trended data is the 24-month history of your accounts, including the minimum payment requirement and the actual amount paid. This data allows scoring systems to differentiate between people who pay their balances in full each month and those who revolve some portion of their balance, among other things.

FICO 9

FICO 9 has been around since late 2014. It was a redevelopment of, you guessed it, FICO 8. The primary differentiating features of FICO 9 include the consideration of rental accounts (if they are on your credit reports), reducing the impact of medical collections relative to other types of collections, and excluding all third-party collections that have been paid. FICO 9 also has bankcard and auto loan variants.

Just to be clear, as this is commonly misreported, the word reducing does not mean ignore. Unpaid medical collections, while less influential to your score in FICO 9, are not entirely ignored.

FICO 8

FICO 8 has been around since mid-2009 and remains wildly popular even today. In fact, if you check your FICO scores through one of your lenders, a program called Open Access, it’s likely to be one of your FICO 8 scores.

FICO 8 was different from prior versions in several ways. It has a greater sensitivity to highly utilized credit card accounts (called revolving utilization) and is more forgiving of isolated low-level late payments. It’s also more punishing to those who have numerous late payments, and it’s inclusive of logic that attempts to discount the benefit of what FICO calls tradeline renting.

FICO 8 also ignores collections and public records with an original balance of less than $100, a process called bypassing. Since FICO 8’s release in 2009, tax liens and judgments, both public records, have been purged from credit reports. FICO 8 also includes bankcard and auto loan variants.

Older Versions

Once you get older than FICO 8, the naming of the FICO scores becomes a little inconsistent across credit bureaus. There is no FICO 7 or FICO 6, but there are FICO 5 and FICO 4 scores at Equifax, FICO 4 and FICO 98 scores at TransUnion, and FICO 3 and FICO 2 scores at Experian. And yes, all of those scores include the bankcard and auto loan variants.

If you are an old-school credit veteran, you may remember Beacon, Empirica, and the Experian/Fair Isaac Risk Model. Those are all the former names of the older FICO versions, but those names aren’t used any longer except in articles like this that address the chronology of FICO scoring models.

Mortgage Versus Every Other Industry

Lenders choose which credit score they use, except in the mortgage industry.

In fact, non-mortgage lenders don’t even have to pull your scores or your credit reports. It’s entirely voluntary. The choice of which credit score or scores they pull is also entirely voluntary.

You cannot say the same about the mortgage industry. Thanks to the Federal Housing Finance Agency (FHFA) mandate, if you apply for a conforming mortgage loan (those owned by Fannie Mae and Freddie Mac), the lender is required to pull all three of your credit reports and three of your FICO credit scores. The scores required by the FHFA mandate are FICO 2 at Experian, FICO 4 at TransUnion, and FICO 5 at Equifax.

While these much older scores still work perfectly fine, they certainly do not have the same aforementioned features and benefits as FICO 8, 9, and 10.

Focus On Your Credit Reports, Not Your Scores

I’ve told people for many years that trying to manage your countless credit scores is like trying to herd cats. It’s also entirely unnecessary.

Every credit score listed above and those that compete with FICO, such as VantageScore, are based entirely and exclusively on your three credit reports. This means that if you have three great credit reports, you’re going to have countless excellent credit scores, regardless of the brand, generation, or variant.

You can check your credit reports for free every week through the end of 2022 at AnnualCreditReport.com. That is the central source for free credit report disclosures under Federal law. Make sure they contain accurate information, or your scores could be misrepresentative of your actual credit risk.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards By FICO Score ([updated_month_year]) 7 Best Credit Cards By FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/fico.png?width=158&height=120&fit=crop)

![9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year]) 9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Balance-Transfer-Cards-For-600-700-FICO-Score.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For Scores Under 600 ([updated_month_year]) 7 Credit Cards For Scores Under 600 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Scores-Under-600.jpg?width=158&height=120&fit=crop)