You may have a 450 to 500 credit score, but you’re probably not very happy about it. This article should cheer you up just a little. The companies that offer the reviewed loans and credit cards cater to consumers with bad credit scores.

These issuers and lenders understand that a borrower may have experienced score-shredding financial challenges, so they deliver products that address immediate concerns while providing the opportunity to rebuild credit.

We’ll show you how to get the right personal loan, auto loan, or credit card, despite your lower credit score. Just as importantly, we discuss ways for you to mend your credit. That should help brighten your mood!

-

Navigate This Article:

Personal Loans For a 450 to 500 Credit Score

These three companies work with networks of lenders that provide some of the best personal loans to consumers with subprime credit. They prequalify your loan request without any charge, obligation, or damage to your credit score. It’s a quick way to solicit a bad credit loan from dozens of lenders via a single application.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- Not available in NY or CT

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

2. CashUSA.com

- Loans from $500 to $10,000

- All credit types accepted

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

You request an online personal installment loan by submitting information about your identity, income, work status, and housing costs. To prequalify, you must be at least 18 years old and a US citizen or permanent resident. You must also have a reliable monthly income, an active bank or credit union account, an email address, and a phone number.

You’ll receive one or more offers from direct lenders that will evaluate you for a bad credit loan that can put money into your checking account as soon as the next business day.

Auto Loans For a 450 to 500 Credit Score

Not everyone can or wants to take a bad credit car loan from the financing arm of a car manufacturer. For one thing, carmakers may set credit standards that disqualify you, and their interest rates may not be all that attractive, especially for long-term loans.

The following auto loan networks are often a better choice for the credit-impaired.

- Dealer partner network has closed over $1 billion in auto loans

- Can help those with bad credit, no credit, bankruptcy, and repossession

- Established in 1999

- Easy, 30-second pre-qualification form

- Bad-credit applicants must have $1500/month income to qualify

5. LendingTree

- Purchase or refinance a new or used car.

- Their lenders have solutions for most credit situations.

- Get up to 5 offers from competing lenders!

- Complete a simple and secure online form in minutes.

- Save on your current or new monthly car payment.

6. RefiJet

- Potentially reduce your payments by hundreds of dollars

- Skip your next car payment

- Quick and easy 2-minute preapproval process

- Prequalifying does not affect your credit score

- Completely free

- No additional costs or fees

These companies distribute your bad credit car loan request to networks of car dealerships and other lenders. You can use them to line up a loan before shopping for a car or after choosing one.

They can also find you cash-out refinancing of existing vehicle loans when you have sufficient equity (i.e., the surplus of the automobile’s value above your loan balance).

Credit Cards For a 450 to 500 Credit Score

A poor credit score calls for a secured credit card with a credit limit backed by a cash deposit. These cards are much easier to get than their unsecured credit card cousins. Some even offer cash back rewards on eligible purchases.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

You may want to consider applying for a credit card from a credit union, as it may be easier than a bank-issued card to obtain.

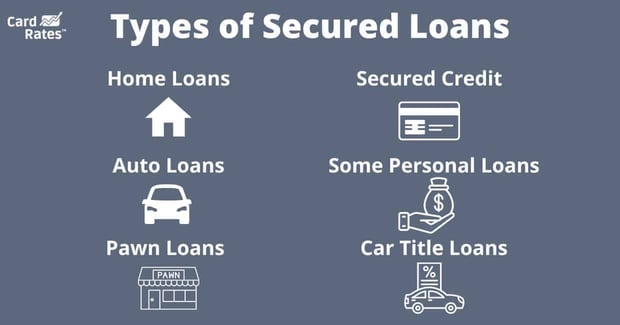

Other Types of Bad Credit Loans

Every borrower wants choices, even those with bad credit. Here are four types of loans that don’t require a good credit score.

The first three types of lenders don’t check credit scores but charge a much higher interest rate, and you can’t use them to rebuild credit because they don’t report to the credit bureaus. The fourth loan type approves scores as low as 500 and charges a much lower interest rate.

Payday Loans

A payday loan is a cash advance on your next paycheck. You have a one- to four-week loan term until you must repay the entire loan (including interest) or roll it over to a new period.

With APRs in the 300% to 700% range, payday loans may send you into a debt spiral that could land you in bankruptcy court.

Approach a payday loan with extreme caution — it’s best used as an emergency loan that you repay quickly.

Payday loans are available from online and storefront lenders. Some of the online installment loan networks reviewed above offer payday loans, and you can apply for them from the comfort of your own home.

Storefront lenders require you to apply in person, and you may not relish the idea of walking out of the establishment with a wallet full of cash.

Auto Title Loans

If you own your vehicle outright without any outstanding loans, you can hand the title to a lender as collateral for a loan. The title loan amount is small compared to the car’s value.

Failure to repay by the end of the loan term will prompt the lender to repossess and auction your car. For this reason, you should consider it as strictly an emergency loan.

Title loans are costly, but they are available without a credit check. They make the most sense when you need money for only a short period, and you’re sure you can repay it on time.

Pawnshop Loans

You can get a no-credit-check loan by walking into a pawnshop with some personal property to collateralize the loan. You can hock a camera, musical instrument, or other property for about 30% to 50% of its value.

APRs for pawnshop loans are in the triple-digit range. If you fail to repay on time or roll over the loan, the pawnbroker will put your property up for sale.

FHA Loans

The Federal Housing Administration (FHA) is a governmental agency that guarantees mortgages and other home loans for eligible borrowers. Agency-approved banks, credit unions, and other institutions provide these loans to borrowers who successfully navigate the FHA application process.

FHA loans usually have a lower interest rate and less stringent credit requirements than conventional mortgages. You may qualify with a poor credit score as low as 500, but you must also satisfy several other requirements to get an FHA loan guarantee.

These loans require a 10% down payment (or 3.5% if your credit score is above 580), mortgage insurance, and a monthly payment for the life of the loan.

You can lose your home if you default on the loan. If you have trouble making a monthly payment, contact your lender and explain the problem. Many mortgage lenders will try to accommodate borrowers rather than foreclosing on a home, which is time-consuming and costly.

How Bad Is a 450 to 500 Credit Score?

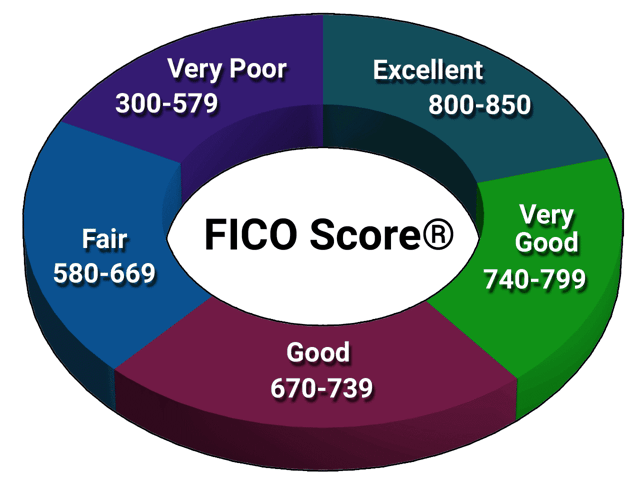

We won’t sugar coat it: These numbers indicate very poor credit. For context, the FICO score range is 300 (worst) to 850 (perfect), and the US average is 714, according to Experian data from September 2021.

Very poor credit has pervasive consequences, including:

- Hampering the acquisition of certain products and services, such as utilities and phone contracts

- Harming your job-hunting prospects

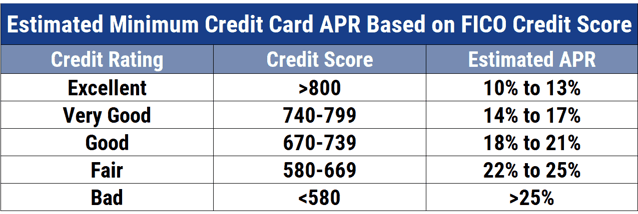

- Imposing a high interest rate on loans and credit cards

- Increasing your insurance costs

- Limiting access to loans

- Making it harder to find housing

- Putting better-quality credit cards out of reach

As you can see, the fallout from bad credit can significantly damage your lifestyle and elevate your cost of living.

Can I Get Approved With a 450 Credit Score?

Approval doesn’t come easy when your credit score is 450. In many cases, you will have to rely on collateral if you want to borrow money or get a credit card.

Secured personal loans are available, though they may be hard to find. The reviewed lending networks include secured loan providers, and many issuers offer secured credit cards.

It will be challenging to get a mortgage, as the minimum credit score for an FHA loan is 500. You may have better luck getting a car loan since the vehicle serves as collateral.

You can improve your chances for approval by enlisting a cosigner or co-borrower with a good credit score. Lenders welcome cosigners, but many credit card issuers forbid them.

You may also gain access to a credit card by becoming an authorized user of another person’s credit card. You’ll then have the opportunity to charge purchases and rebuild your credit rating.

What Interest Rates and Fees Will I Pay With a 450 to 500 Credit Score?

If you’re in the 450 – 500 score range, expect to pay up to 36% for an unsecured personal loan, and perhaps somewhat less for a secured one. Even the best personal loans may include an origination fee. The same rates apply to subprime credit cards.

The typical unsecured credit card for bad credit imposes nuisance fees, including a signup fee (up to $129), an annual fee (up to $99), and a monthly maintenance fee (around $6/month starting in the second year of card ownership).

Secured cards don’t charge as many fees, and the security deposit is refundable. These credit cards are a cheaper alternative for consumers with very bad credit scores.

The average car loan interest rate for borrowers in the deep subprime credit tier is about 15% for new vehicles and 21% for used ones. The lender usually requires money down and may impose semimonthly or weekly billing.

A lower credit score (i.e., below 500) will probably lock you out of the mortgage market, as that’s the minimum required for an FHA loan. With a 500 score, expect to pay well above 7% for a mortgage.

Your credit score doesn’t matter when you apply for a title, pawnshop, or payday loan. All three charge triple-digit interest rates, usually starting at 300%, but capable of going much higher.

How Do I Get My Credit Score Back From 450?

You can rebuild credit in several ways:

- Pay your bills on time: FICO calculates 35% of your score on your payment history. Payments more than 30 days late appear in your credit history, where they remain for seven years and cause scores to tumble by dozens of points. If you always pay on time, your score should improve within a year.

- Reduce your credit card debt: Another 30% of your FICO score is based on how much debt you owe. You want to drive your credit utilization ratio (i.e., credit used divided by total credit available) below 30% to raise your credit score.

- Fix your credit history: Errors on your TransUnion, Equifax, or Experian credit bureau reports can unnecessarily harm your credit score. You can dispute inaccurate information, either on your own or with the help of a credit repair company.

Your credit score will also benefit if you keep your old credit cards open, refrain from applying for a new credit account too frequently, and increase the variety of your credit account.

Most negative items (e.g., defaults, write-offs, collections, repossessions, bankruptcies) evaporate from your credit bureau reports in seven to 10 years. They no longer drag down your credit score once they disappear, so patience alone can help your credit score heal.

You Still Have Options Even With Very Poor Credit

Consider a 450 to 500 credit score a challenge rather than a barrier. The good news is that this review’s lenders and credit card issuers design their products for consumers with poor credit. Moreover, you can improve your credit by adopting creditworthy habits such as reducing your debt and paying your bills on time.

You can click on the APPLY NOW links in the offer boxes to get more information about any of the loans or credit cards featured above. To avoid surprises, read all the disclosures before agreeing to any offer.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 500-550 Score ([updated_month_year]) 9 Best Loans & Credit Cards: 500-550 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/loans-and-credit-cards-for-500-to-550-credit-scores.jpg?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/550-to-600-Credit-Scores.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year]) 7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/850.png?width=158&height=120&fit=crop)

![7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year]) 7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/650.png?width=158&height=120&fit=crop)

![8 Best Loans & Credit Cards: 650-700 Score ([updated_month_year]) 8 Best Loans & Credit Cards: 650-700 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/08/700.png?width=158&height=120&fit=crop)

![8 Best Loans & Credit Cards: 700-750 Score ([updated_month_year]) 8 Best Loans & Credit Cards: 700-750 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/7501.jpg?width=158&height=120&fit=crop)

![7 Best Loans & Credit Cards: 750-800 Score ([updated_month_year]) 7 Best Loans & Credit Cards: 750-800 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/800-plum.png?width=158&height=120&fit=crop)