Myths about credit scores abound. They tend to get passed on from one person to the next, and by the time the stories get to you, they can be hard to shake. However, if you believe them, your credit scores and financial health may suffer. It’s time to learn the correct information.

Here are eight of the most pervasive credit scoring myths.

1. There is Only One Real Score, FICO, and the Rest are Fake

FICO may be the most widely known and used of all the credit scores, but it is by no means the only one. There are plenty of versions of the FICO score from which a lender can choose, and they are all calculated by diving into the data listed on your consumer credit reports from each of the three agencies – TransUnion, Equifax, and Experian.

Your FICO scores will vary depending on which credit reporting agency is used. VantageScores are also commonly used by lenders, and the numbers are consistent among the credit reporting agencies. In addition, each of the credit reporting agencies has its own scores. All credit scores are real. Although you have no control over which score a business will choose to access, you can ensure that each score is high by using credit products responsibly.

2. Paying Past the Due Date Will Lower Your Credit Score

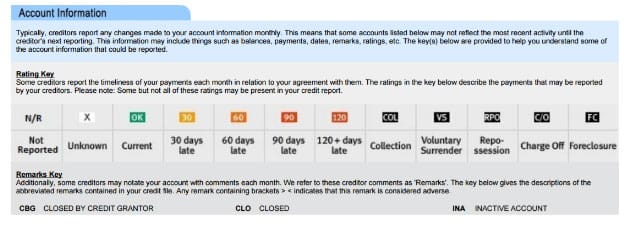

Not necessarily. If you send your credit card payment after the due date, you will be hit with a late payment fee, but the issuer won’t report you as delinquent until you miss an entire billing cycle. If you do, it will show up as “30 days late” on your report and your credit scores will take a hit.

Paying 30 days or later will show on your credit report and your credit scores will take a hit. Image courtesy of CafeCredit.com.

Skip another and it will show as 60 days late, and so on. The more delinquencies you have on your report, the worse the credit damage will be. If you’re just a few days behind, though, that activity will be absent from your credit report and won’t be factored into your scores.

3. Employers Will Check Your Credit Scores

When you apply for a job, an employer may ask your permission to pull your credit report to see if you’re a desirable applicant. If so, you’ll be given a form to complete that allows them to access it, but your credit scores won’t be part of the deal.

That’s because credit scores are designed to help lenders make super swift judgments about you without having to examine all the data listed on the reports. A score allows them to approve a loan or line of credit in mere minutes. An employer doesn’t need (or want) to make such instantaneous decisions.

4. To Have a Credit Score, Credit Card Debt is Essential

Your history of borrowing and repaying money is required for a score to be developed, but hanging on to credit card debt is not. In fact, it’s detrimental to your credit score. Charging often but paying the balance to zero is always ideal. Mind that having a loan you’re paying incrementally can be positive for your credit score. By paying on time and showing a steadily declining balance, you’re proving to other lenders that you know how to handle that kind of credit product.

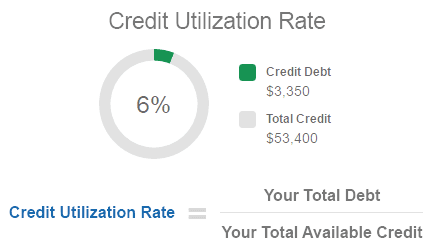

5. You Can Prevent a Scoring Ding if You Owe Less than 30% of the Credit Limit

There is no magic ceiling of debt acceptability. Think about it this way: imagine your credit card has a $1,000 limit and your balance is $299, a debt that is just under the 30% credit utilization mark.

If you believe the myth, your scores should be in terrific shape. But now imagine that you charged a large cafe latte with that card, putting your new balance at $305. Your scores won’t plummet off the scoring cliff because you’re a smidgen over the 30% mark. So keep it simple: carry no credit card debt.

6. Married Couples Have Merged Credit Reports and Scores

There is no such thing. Every individual who has borrowed or owes money will have a personal consumer credit report, and each credit report will have its own separate credit score.

The only time you will see your spouse’s account on your credit report is when they’re shared. For example, if you made your husband an authorized user on your credit card, it will be on both of your credit reports. Bought a car or house together? The loan will be on each of your reports, as well. Yet if you applied for and received an account in your name only, it will not be on your spouse’s report and won’t be factored into his or her score.

7. Applying for Credit Will Hurt Your Credit Score

Each scoring system is slightly different, but in general, the most important factors by far are the way you make your payments and the debt you owe relative to the amount you can borrow. If you send all payments in on time and keep your debt load very low, your scores will quickly rise to the excellent range.

Applications — also called hard inquiries — are factored into most scores, but in a minor way. Should you pursue credit products all over town? No, because that would make you look desperate to a lender. Your score will then drop a little, especially if you have few accounts or are new to credit.

That said, if you want to get a loan or credit card and your scores are in good shape for qualification, go for it.

8. Credit Scores are Discriminatory

Credit scores are based solely on the financial data listed on your consumer credit reports. All of that information is entered into a mathematical algorithm that predicts lending risk.

How you have managed your accounts in the past to the present is credit scoring food. Therefore your gender, race, address, age, or religion are never considerations. Nor do scores factor in your profession, income, and whether you’re a renter or a homeowner, though you may be asked to provide that information on a credit card or loan application. In short, the way you use credit products dictates your scores — that’s it.

Now that you know the facts about credit scores, you can pass them on to friends and family members. These myths stop with you.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Walmart Credit Card: Bad Credit OK? ([updated_month_year]) Walmart Credit Card: Bad Credit OK? ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Walmart-Credit-Card.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Building Credit ([updated_month_year]) 12 Best Credit Cards for Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/BUILD.jpg?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)