In these cash card reviews, we examine several categories of cash back credit cards. Whether you have a good, fair, or poor credit score, we can recommend several cards that may be perfect for your needs. We also cover cards for students and businesses.

If you are a fan of cash back rewards, read on to discover the cream of the crop.

Good Credit | Fair Credit | Bad Credit | Students | Business

Cash Card Reviews For Good Credit (670+ FICO Score)

Scores above 670 are considered “good” in the FICO Score range. The cards in this category offer generous cash back rewards and plenty of other perks.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card offers unlimited cash back — once when you buy, again when you pay. It is a market-leading flat-rate card and it also happens to be a high-ranking balance transfer card, too.

The APR is fair and the card charges no annual fee. You can redeem your Citi ThankYou Points for cash back as a direct deposit to your checking or savings account, a statement credit, or via a check in the mail.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® lets you earn cash back on every purchase made, every day. You can earn bonus cash by spending the specified amount on purchases during the first three months after opening the account.

The cash back rewards don’t expire as long as the account remains open, and there is no minimum redemption amount. There is a 0% APR on purchases during an introductory period and no annual fee.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card has quarterly rotating categories of merchants that, when activated, can earn cardholders bonus cash back. The rotating categories include grocery stores, gas stations, restaurants, and more.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card lets you earn unlimited 3% cash back on entertainment, dining, and grocery stores, plus 1% on all other purchases. The card charges no annual or foreign transaction fee and offers a one-time welcome bonus to new cardmembers who spend the required amount during the first three months.

You also get a 0% APR on purchases during an introductory period after opening the account.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card is a good choice for consumers who want a simple cash back system. You earn unlimited cash back on all purchases and pay no annual or foreign transaction fees.

There is a one-time cash bonus available after you spend the required amount during the first three months. Purchases during the introductory period have a 0% APR for new cardholders.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Chrome rewards cardholders specifically for purchases at gas stations and restaurants. You can redeem your cash back rewards in any amount and at any time. Rewards never expire as long as the account is open.

7. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The Chase Freedom Flex℠ card offers you bonus cash back on up to the purchase limit in quarterly purchases in rotating merchant categories that you activate each quarter. Also earn tiered cash back rates on travel, dining, and drugstore purchases plus an unlimited 1% cash back on all other purchases. You can earn a cash bonus by spending the required amount on purchases during the first three months.

The card offers an introductory 0% APR on purchases to new cardmembers during an introductory period and charges no annual fee. Rewards do not expire as long as the account remains open.

Cash Card Reviews For Fair Credit (580-669 FICO Score)

You have fair credit if your FICO score falls between 580 and 669. Although the credit cards in this group do not offer the best rewards, they still provide cash back and other benefits that may surprise you.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card provides you unlimited 1.5% cash back on every purchase, every day. You can use this card to help improve your credit score by paying your bills on time.

The card may offer you a higher credit limit if you make your first five payments on time. You have access to the CreditWise® app that allows you to monitor your credit profile. This card comes with $0 fraud liability on stolen or lost cards.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Fortiva® Mastercard® Credit Card lets you prequalify to see whether you have good approval odds before you officially apply. It also happens to offer generous cash back rewards on eligible purchases.

You’ll also have access to your free VantageScore from Equifax. You can improve your chances of qualifying for an increase by making on-time payments.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Aspire® Cash Back Reward Card, issued by the same bank as its sibling card above, offers the same cash back reward structure and nearly identical terms. You may receive a generous initial credit limit upon approval.

Checking to see whether you prequalify for this card does not hurt your credit score.

Cash Card Reviews For Bad Credit (<580 FICO Score)

Your credit is considered bad if your FICO score is below 580. The following secured credit cards are among the few that offer cash back rewards to folks with bad credit.

The Capital One Quicksilver Secured Cash Rewards Credit Card is a solid offer that charges no annual fee. All purchases earn the same rate of cash back, making it easy to keep track of your rewards.

Just be sure to pay your balance off each billing cycle so your interest charges don’t eat away at your earnings.

The Discover it® Secured Credit Card allows you to build your credit score when used responsibly. Your refundable security deposit serves as your credit limit.

Another stand-out feature of this card is its cash back rewards, something you won’t find offered on most secured cards.

Cash Card Reviews For Students

There’s no better way for young people to learn about credit than to get a student credit card. The following three cards offer cash back rewards and other perks for college and beyond.

The Capital One SavorOne Student Cash Rewards Credit Card is ideal for any student who uses their card for food purchases, including at restaurants, take-out and delivery services, and grocery stores.

There’s no annual fee, but the variable APR is on the high side, so be sure to pay your balance off each month to avoid expensive interest fees being added to your bill.

The Discover it® Student Cash Back card offers bonus cash back at a roster of rotating merchants, including grocery stores, gas stations, and restaurants, up to a purchase limit. You must activate the new merchant category each quarter to earn these rewards.

The Discover it® Student Chrome rewards students with cash back for purchases made at gas stations and restaurants. All other purchases earn a lesser reward rate.

Students can earn a reward in the form of statement credits when friends they refer submit applications and are approved. The card also has first-rate security features such as fraud alerts and the ability to freeze and unfreeze card activity in case the card is lost or stolen.

Cash Card Reviews For Businesses

Businesses often use their credit cards for heavy spending on supplies, transportation, entertainment, and equipment. That makes business cash back cards especially rewarding.

The Ink Business Cash® Credit Card is a Visa Signature card from Chase that earns you 5% cash back on the first $25,000 spent each anniversary year on combined purchases at office supply stores and providers of internet, phone, and cable services. You earn 2% cash back on the first $25,000 spent each anniversary year on combined purchases at restaurants and gas stations. All other purchases earn 1% cash back.

The card offers a cash back bonus when you spend the required amount during the first three months after opening the account. You can add employees as authorized users on the card.

The Ink Business Unlimited® Credit Card lets you earn unlimited cash back on all purchases with no annual fee. You can earn a cash bonus for spending the specified amount on purchases during the first three months.

In addition, you get a 0% APR on purchases for the introductory period. Employee cards are free, and you can redeem your cash back at Chase Ultimate Rewards®.

The Capital One Spark Cash Select for Good Credit gives you cash back on every purchase. You can add employees for free and collect cash back on all of their purchases.

Purchases made during an introductory period are charged a 0% APR. This business credit card has no annual fee and offers many business-related benefits.

How Does a Cash Back Card Work?

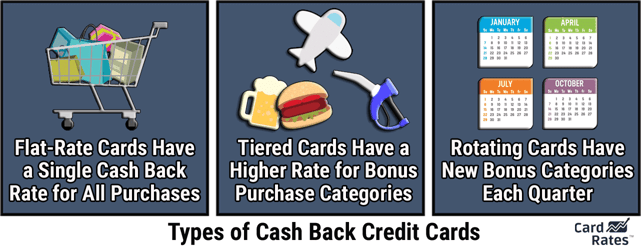

Cash back cards rebate you a percentage of your spending on purchases. The percentage can be fixed for all purchases or can vary for purchases at selected merchants. There are three cash back variations:

- Rotating categories: These cards provide an elevated cash back percentage on select merchant types that revolve every quarter. For example, in one quarter the card may pay elevated cash back on purchases at grocery stores and then switch to purchases at gas stations in the next quarter. The amount of spending that earns the higher rate each quarter may be limited. You must activate your higher rewards every quarter. All other purchases earn rewards at a lower fixed rate, typically 1%. Examples of rotating cash back cards include the Chase Freedom Flex℠ and Discover it® Cash Back.

- Tiered categories: In this variation, credit cards offer high, medium, and low cash back percentages for purchases at different merchant categories. The categories do not revolve. For example, a card may offer high rewards for purchases at restaurants, medium rewards at gas stations, and low rewards on all other purchases. The higher rewards may be limited to a set amount of spending for the quarter or may be unlimited. The low reward level is always unlimited. Examples of cash back cards with tiered categories include the Capital One® Savor® Cash Rewards Credit Card and the Capital One SavorOne Cash Rewards Credit Card. (Information for this card not reviewed by or provided by Capital One.)

- Fixed category: The card pays a fixed, flat-rate percentage of cash back on all purchases. The percentage is usually in the 1% to 2% range and is unlimited. This kind of card appeals to consumers who want a simple cash back scheme that applies to all purchases. Examples of flat-rate cash back cards include the Capital One QuicksilverOne Cash Rewards Credit Card and the Capital One Quicksilver Cash Rewards Credit Card.

Normally, revolving, and tiered rewards are offered by cards for consumers with better credit scores, while fixed rewards can span all types of credit.

Once you receive your cash back rewards, you can apply them to your statement balance as a credit, have the money transferred to a bank account, or have a check mailed to you, among other options. This effectively lessens the price of everything you buy using a cash back card. Check with the issuer to see its specific redemption options.

What Credit Card Gives the Most Cash Back?

Several cards give you 5% cash back on select merchant categories that revolve each quarter after activation. However, the amount of spending that earns the 5% cash back is limited to $1,500 per quarter.

Therefore, the maximum amount you can earn at the high rate is (4 x 0.05 x $1,500), or $300. These cards pay 1% cash back on all other purchases, but some may have additional earnings tiers. Cards in this category include the Chase Freedom Flex℠, Discover it® Cash Back, and Discover it® Student Cash Back.

Let’s assume you spend $20,000 on purchases during the year and you earn the maximum amount on each category. Your total reward will be 5% of $6,000 plus 1% of $14,000, or $440.

The Discover it® Cash Back and the Discover it® Student Cash Back are the leading cards in this category, at least for the first year. That’s because of Discover’s competitive year-end bonus for new cardholders.

Therefore, in our example case of $20,000 in spending, you could earn twice the $440 reward, or $880, but for the first year only.

The Ink Business Cash® Credit Card from Chase pays 5% cash back on combined purchases at selected merchants, up to spending of $25,000 per year. Purchases at other selected merchants provide 2% cash back, while the remainder earns 1%.

If you assumed $20,000 in spending at the top category of merchants, the cash back reward would be $1,000, clearly the most cash back. However, if your total credit card spending was $20,000, then it’s likely it will span a variety of merchants, thereby reducing the overall cash back amount.

For example, if you spend $5,000 at merchants in the 5% group, $5,000 at the 2% group and $10,000 at the 1% group, you’d receive ($250 + $100 + $100), or $450. As they say on TV, your results will vary.

A more realistic example of $5,000 spent at 4% merchants, $5,000 spent at 2% merchants, and $10,000 spent at 1% merchants would earn ($200 + $100 + $100), or $400 per year in cash back.

What Kinds of Cash Back Cards Are Available?

Cash back cards vary by issuer. But there are cards available for different types of credit ratings, students and business owners, and with tiered or fixed rewards.

- Good Credit: These are cards that are geared toward consumers with credit scores above 670, including the Citi Double Cash® Card, Discover it® Cash Back, Capital One SavorOne Cash Rewards Credit Card, Capital One Quicksilver Cash Rewards Credit Card, Discover it® Chrome, and the Chase Freedom Flex℠.

- Fair Credit: These cards are targeted toward consumers with credit scores between 580 and 669. This group includes the Capital One QuicksilverOne Cash Rewards Credit Card, Fortiva® Mastercard® Credit Card, and Aspire® Cash Back Reward Card.

- Bad Credit: The Discover it® Secured Credit Card and Capital One Quicksilver Secured Cash Rewards Credit Card offer cash back to consumers with credit scores below 580.

- Students: For college students and beyond, this group includes Discover it® Student Cash Back and the Discover it® Student Chrome.

- Business: Businesses deserve rewards too, and this group includes the Ink Business Cash® Credit Card, Ink Business Unlimited® Credit Card, and Capital One Spark Cash Select for Good Credit.

As you can see, there is a smorgasbord of choices, and chances are that at least one is perfect for you.

Cash Back Cards Are Available for All Credit Scores

Our cash card reviews give you the low-down on the best cash back credit cards for a variety of consumer segments. You can choose a cash back card based on your credit score or how you want to earn cash back rewards.

If you don’t mind chasing rotating categories, you can maximize your savings at a variety of merchants. If you want a simple, straightforward way to earn cash back, a flat-rate rewards card is a good option. Whatever you choose, use the card responsibly to build or maintain a good credit score.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Credit Card Reviews: 5 Best Cards by Category ([updated_month_year]) Credit Card Reviews: 5 Best Cards by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Expert-Reviews_-5-Best-Cards-by-Category.jpg?width=158&height=120&fit=crop)

![Credit One Bank: Reviews & 5 Best Offers ([updated_month_year]) Credit One Bank: Reviews & 5 Best Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/creditone.png?width=158&height=120&fit=crop)

![Capital One Secured Credit Card Reviews of [current_year] Capital One Secured Credit Card Reviews of [current_year]](https://www.cardrates.com/images/uploads/2021/11/Capital-One-Secured-Credit-Card-Reviews.jpg?width=158&height=120&fit=crop)

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![2 Methods: How to Get Cash from a Credit Card ([updated_month_year]) 2 Methods: How to Get Cash from a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/cash.png?width=158&height=120&fit=crop)

![3 Steps: Get Cash Back On a Credit Card? ([updated_month_year]) 3 Steps: Get Cash Back On a Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Can-You-Get-Cash-Back-on-a-Credit-Card-Feat.jpg?width=158&height=120&fit=crop)