Capital One secured credit card reviews provide the best opportunity to compare your options before actually applying for your next secured credit card. This prevailing comparison review of Capital One’s best secured cards is no different.

Capital One offers a few cash back rewards credit cards with no annual fee. And now, you can take advantage of some of these benefits even with a secured credit card.

Secured credit cards are one of the best ways to improve your credit score, whether you have bad credit or average credit. With a better credit score, you can take advantage of options like low-fee and low-interest loans, and unsecured rewards credit cards, and save thousands in interest over time.

Here’s a review of each Capital One secured credit card available right now along with some alternative card options to consider.

-

Navigate This Article:

1. Capital One Quicksilver Secured Cash Rewards Credit Card: Best For Cash Back

The Capital One Quicksilver Secured Cash Rewards Credit Card is a new secured credit card that allows you to earn a competitive cash back rate with every purchase. This is a great card for anyone who has fair or average credit and is looking to rebuild their credit by adding some positive payment history.

- No annual or hidden fees, and you can earn unlimited 1.5% cash back on every purchase, every day. See if you’re approved in seconds

- Put down a refundable $200 security deposit to get a $200 initial credit line

- Building your credit? Using a card like this responsibly could help

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

As with most secured credit cards, you will need to make a deposit that serves as your initial credit line. As a Capital One cardholder, you can also track your credit score for free through CreditWise. This card has no foreign transaction fee and no annual fee.

2. Capital One Platinum Secured Credit Card: Best For Rebuilding Credit With a Low Deposit

The Capital One Platinum Secured Credit Card gives you different options for your initial deposit, which is refundable after a period of responsible card use. Instead of being assigned a due date based on a predetermined statement cycle, Capital One offers flexible due dates for your payment so you can choose the date that works best for you and your budget.

- No annual or hidden fees. See if you’re approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

If you use your card wisely and pay your bill on time, you could be eligible for a credit limit increase in under a year. Capital One will examine your account, payment history, and creditworthiness to increase your credit limit with an additional deposit required.

This card also has no annual fee, and it offers protections like zero fraud liability, security alerts, and an instant card lock feature if your card ever gets lost or stolen.

Top Alternatives to Capital One’s Secured Cards

Capital One is just one credit card issuer that offers secured cards. There are several other quality secured credit cards to consider from other major banks and financial institutions.

When considering a secured credit card, you’ll want to watch out for fees and make sure there are flexible credit limit options since you’ll have to deposit your own money to establish your credit limit. While having a $1,000 credit limit may sound nice, you would need to deposit that much money, which could be challenging.

The following secured cards all offer some of the best terms, low or no fees, and help provide you with the means to build your credit so you can easily transition to an unsecured credit card in the future.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

The Discover it® Secured Credit Card reports all your payments to the three major credit bureaus. You’ll also earn unlimited cash back on all your purchases and additional cash back on eligible purchases made in specific categories. In addition to those rewards, Discover will match your cash back earnings during the first year of using the card.

People looking to rebuild their credit are encouraged to apply. Discover will also look at a few factors that include your credit report and creditworthiness during the application process. The required security deposit is refundable as long as you pay off your balance in full if you ever close the card.

Another way to get your deposit back is to just keep using the card and paying your bill on time. After an introductory period of positive payment history and card usage, Discover will automatically review your account and consider you for one of its unsecured cards. At that point, you will get your initial deposit for the Discover it® Secured Credit Card back.

Bank of America® Customized Cash Rewards Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Bank of America® Customized Cash Rewards Secured Credit Card offers tiered cash back but has higher minimum security deposit requirements compared with other secured credit cards. The Bank of America® Customized Cash Rewards Secured Credit Card has a variable interest rate and no annual fee.

Over time, Bank of America will periodically review your account and overall credit history to see if you qualify to have your security deposit returned.

Citi® Secured Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Citi® Secured Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

CitiBank offers some great balance transfer and cash back credit cards as well as a secured Mastercard. The Citi® Secured Mastercard® is an ideal option for anyone with limited to no credit history who wants to build a better credit profile. This card reports payments to the three major credit bureaus and even lets cardholders choose their payment date.

This is also a contactless-chip enabled card with digital wallet features for safe and streamlined shopping and spending. Citi provides added benefits to cardholders, including zero fraud liability and identity theft solutions. Unlike the Discover it® Secured Credit Card and the Bank of America® Customized Cash Rewards Secured Credit Card, this card doesn’t offer any rewards, and it charges a foreign transaction fee.

Capital One secured credit card reviews wouldn’t be complete without closely comparing some of the strongest alternatives. The fact that you can skip out on the fees, earn rewards, and possibly qualify for a credit limit increase in just a few months make these cards worthwhile to consider.

Doing your research and learning more about how secured cards work can be very helpful. Check out our FAQs below to get answers to some common questions you may have about secured credit cards.

How Does a Secured Card Work?

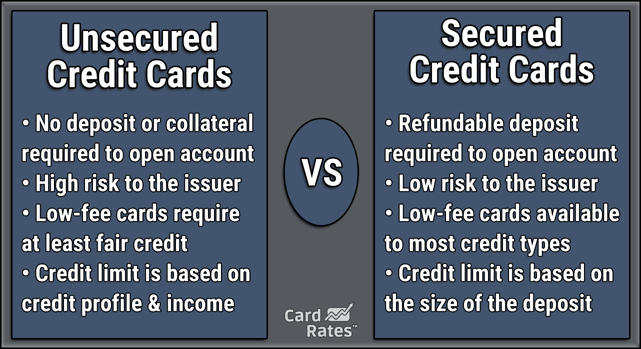

Secured credit cards are geared toward people who have bad credit and work like a regular unsecured credit card. The main difference is that the cardmember has to make a minimum security deposit that establishes their initial credit line — or credit limit — for the card.

Most card issuers will allow you to choose your security deposit amount or may require a minimum amount that you must deposit. The Capital One Platinum Secured Credit Card has one of the lowest required security deposits around.

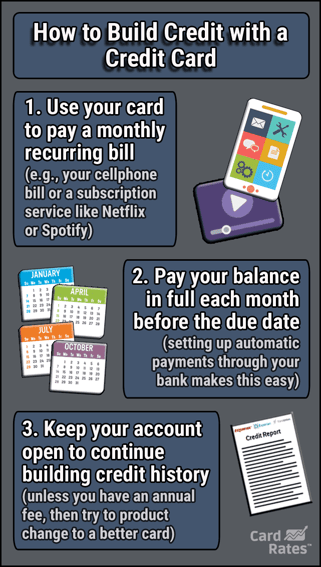

You can use your card for purchases just as you would with any other credit card, but you shouldn’t spend more than 30% of your available credit limit. Then, you can pay the bill off each month to avoid interest charges.

Secured credit cards report your payments to the three major credit bureaus — Experian, Equifax and TransUnion — to help you build a credit history.

With unsecured credit cards, your credit limit is provided without requiring that you make a deposit when you apply because it’s based on your creditworthiness. Since secured credit cards know that your credit may not be so good, you need to make a deposit to eliminate the risk that if you don’t pay your bill, the credit card company won’t get paid.

Do your best to avoid making a late payment to keep your account in good standing and prevent damage to your credit score.

Most secured credit cards, including Capital One’s secured cards, allow you to get your security deposit back after some time if you use the card wisely and make on-time payments. However, this may not always be an option if you fail to abide by the credit card’s terms.

How Do I Apply For a Capital One Secured Card?

You can apply for a Capital One card online.

The application form will need you to enter your basic information, including your Social Security number and home address. Collecting your Social Security number allows Capital One to run your credit report to see if you have credit card debt or other outstanding loans.

Capital One also wants to know your:

- Employment status

- Total monthly income

- Monthly rent or mortgage payment

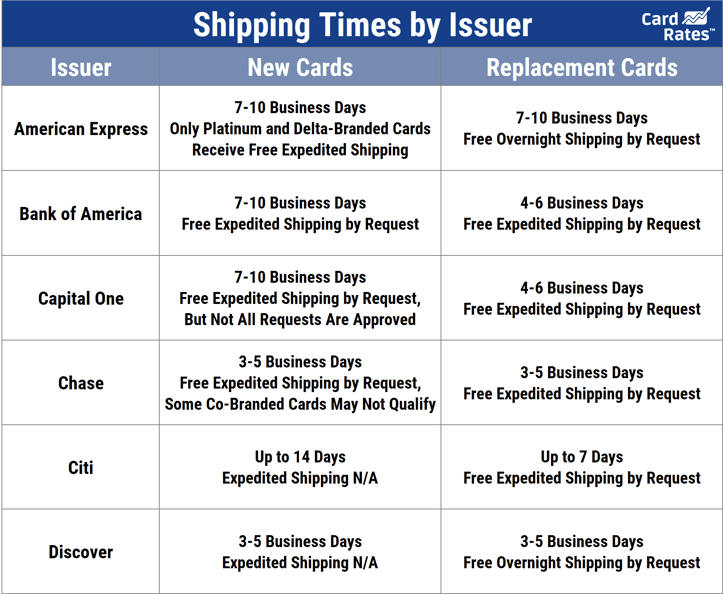

When you complete the online application, you should receive an answer in just minutes or less. If you’re approved for a Capital One Secured card, you’ll receive it in the mail in seven to 10 business days.

If you were denied, you’ll receive a letter in the mail explaining why you were denied or what was on your credit report that caused the denial.

Keep in mind that Capital One may not deny you for a secured credit card solely based on credit issues. It also looks at factors like your income and debt to see whether you can comfortably afford to pay off your credit card bill each month.

What Credit Score Do You Need For a Capital One Secured Card?

Capital One does not explicitly state the credit score you need to get approved for a secured credit card. However, we know that secured credit cards are geared toward people with less than perfect credit.

Whether you have negative marks on your credit or no credit history at all, Capital One’s two secured credit cards are options to highly consider.

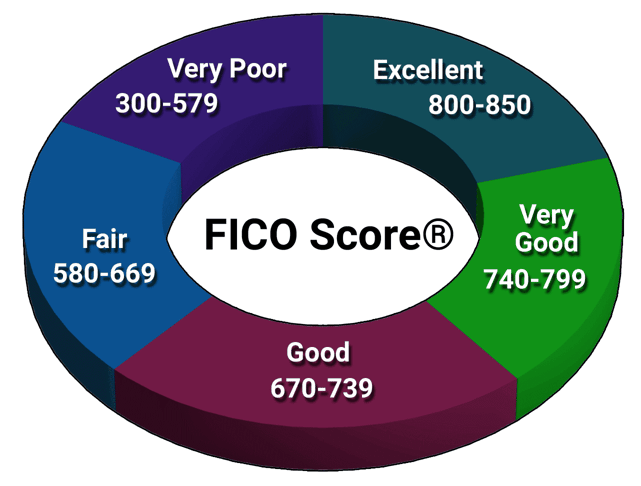

According to Experian, a major credit bureau, a bad credit score is anything at or below 579. A fair credit score, which is slightly better, ranges from 580 to 669.

If you know you have a low credit score, it’s best to make sure you meet the other requirements for a secured credit card, which usually involve:

- Active employment

- Meeting a certain income requirement

- Paying your rent or mortgage consistently

But, generally, secured credit cards are among the easiest credit cards to be approved for.

How Do These Cards Help Build Credit?

Secured credit cards help with building credit because they usually report your payments to the three major credit bureaus. Each credit bureau operates independently, so knowing that your payments are getting reported to all of them at the end of each statement can be reassuring and helpful.

The only catch is that you must use your card responsibly and make payments on time.

If you have a secured credit card and max out your limit or fail to pay your bill on time, then that information will get reported to the credit bureaus, and it can really hurt your credit.

To use your secured card wisely and build your credit, you’ll want to keep your spending below 30% of your credit limit. This means if you made a $300 deposit that became your line of credit, you shouldn’t spend more than around $90 each month on your secured card.

If you make a larger deposit so you have a higher credit limit, you can spend more and still maintain a 30% utilization rate.

Another thing that can help is to pay your bill in full each month so you can avoid interest. If you can’t afford to pay the bill in full, make sure you pay the minimum payment so you can avoid late fees and negative marks on your credit report.

With any credit card, try not to get caught up in paying too many fees, whether it be a cash advance fee or a balance transfer fee, and try to set a spending limit for the month based on your budget. That way, you can build credit quickly without having to spend extra money.

Does a Capital One Secured Card Ever Become Unsecured?

Yes, a Capital One Secured card can become an unsecured card if you qualify in the future. An unsecured card is also known as a regular credit card because if you’re approved, you’ll be given a credit line (or limit) to borrow against every month based on your creditworthiness.

Unsecured credit cards for people with good credit scores also tend to have lower interest rates and fees and better rewards. Getting a secured card is an excellent way to build your credit and prepare you to upgrade to an unsecured card.

Capital One may invite you to apply to become an unsecured cardmember if you are managing your secured card well. At that point, you’d likely get a higher credit limit. Or, you can try calling customer service and request that your secured card be graduated to an unsecured card.

Of course, you’ll need to apply, and Capital One may run your credit. The bank offers both an unsecured Capital One Platinum Credit Card and the Capital One Quicksilver Cash Rewards Credit Card you may be able to upgrade to. Or you can try applying for a different unsecured credit card from Capital One.

How Long Does It Take to Get a Capital One Card?

You will receive your Capital One secured card in the mail within one to two weeks after you make your initial deposit. This is a standard time frame for most credit cards.

Be sure to review your statement cycle end date so you know when your first payment is due. Continue to make on-time payments and you may qualify for a higher credit limit before you know it.

Compare Capital One’s Secured Credit Card Offerings Before Applying

It’s important to read Capital One secured credit card reviews before applying so you’ll have a clear understanding of how each card works and determine the best option for you. Getting a secured credit card can help you improve your credit so you can take advantage of other opportunities in the future.

Whether you’re looking for a business credit card, an ultimate rewards card, or better interest rates on your next loan, a secured credit card can help tremendously when you use it wisely and avoid late payments.

Capital One’s secured credit cards have low fees, flexible initial deposit requirements, and make it easy for you to get a higher credit line and upgrade to an unsecured card in the future. If you’re looking for a secured card to help you rebuild your credit, consider getting approved for a Capital One card or any of the other alternatives mentioned in this article.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Credit Card Reviews: 5 Best Cards by Category ([updated_month_year]) Credit Card Reviews: 5 Best Cards by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Expert-Reviews_-5-Best-Cards-by-Category.jpg?width=158&height=120&fit=crop)

![Credit One Bank: Reviews & 5 Best Offers ([updated_month_year]) Credit One Bank: Reviews & 5 Best Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/creditone.png?width=158&height=120&fit=crop)

![9 Best Cash Card Reviews ([updated_month_year]) 9 Best Cash Card Reviews ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Cash-Card-Reviews-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Secured Credit Cards: No Credit Check ([updated_month_year]) 7 Best Secured Credit Cards: No Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/Best-Secured-Credit-Cards-with-No-Credit-Check.jpg?width=158&height=120&fit=crop)