These days it can seem like you pay fees on your money no matter whether you’re trying to earn it (taxes), store it (bank accounts), or spend it (credit and debit cards).

For some folks, prepaid debit cards can be a no-fuss way to cash paychecks and make a few purchases without needing to deal with bank accounts or credit cards.

But even prepaid cards can come with an abundance of fees. So, we’ve found some of the most fee-free of the bunch to help you find the right prepaid card.

- Best with No Monthly Fees: Current Visa Debit

- Best with No PIN Transaction Fees: PayPal Prepaid Mastercard®

- Best with No Signature Transaction Fees: NetSpend® Visa® Prepaid Card

- Best with No Reload Fees: NetSpend® Visa® Prepaid Card

- Best with No ATM Fees: Serve® American Express® Prepaid Debit Account

- Best with No Foreign Transaction Fees: Bluebird® American Express® Prepaid Debit Account

Don’t let the short list fool you, though. These aren’t the only prepaid debit cards on the market that can help you avoid fees. With the right pick, you can find ways to skip everything from monthly fees to foreign transaction fees.

No Monthly Fees | No PIN Fees

No Signature Fees | No Reload Fees

No ATM Fees | No Foreign Transaction Fees

Best Prepaid Debit Cards with No Monthly Fees

While plenty of consumers are shopaholics, swiping their cards left and right all the live-long day, not everyone needs their debit cards to offer unlimited purchasing power. No, some folks just want a simple, convenient way to enjoy direct deposit and pay their bills.

That’s where these cards can be worthwhile. Instead of charging a monthly fee — whether you use your card that month or not — these card options offer pay-as-you-go functionality that means you pay only for the transactions you make.

Current says, “We’ll never charge you money to use your money.” It backs that up by not charging monthly fees, minimum balance fees, overdraft fees, bank transfer fees, or in-network ATM withdrawal fees.

This Netspend Visa Prepaid Card offers two plan types: monthly and pay-as-you-go. Under the pay-as-you-go plan, you’ll pay just $1.00 for each signature transaction and $2.00 for each PIN transaction. The card charges no fees for direct deposits.

The Bluebird® American Express® Prepaid Debit Account is about as low-fee as you get, charging no monthly fee, no transaction fees, and no direct deposit fees.

Reloading is also free through direct deposit, mobile check capture, or check or cash reloads at Walmart. Plus, cardholders enjoy fee-free ATM access at thousands of MoneyPass® ATMs around the country.

Best Prepaid Debit Cards with No PIN Transaction Fees

In most of the world, signature-based payment verification has fallen by the wayside, replaced almost entirely by PIN-based verification. While the US has yet to adopt PIN-based verification for credit card transactions, debit card purchases have long required the more secure authentication method.

Many prepaid cards distinguish between PIN and signature transactions, and they will often charge more for PIN-based transactions in per-transaction payment plans. Choose a prepaid card with a monthly plan to avoid paying fees for each PIN transaction.

This card allows users to make fee-free transactions by PIN or by signature, as well as online, in exchange for a monthly fee. Otherwise, it’ll cost you $1.50 each time you use your card, which means if you plan to use the card more than six times per month, you’ll come out ahead by opting for the monthly plan.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

This card charges a small monthly fee instead of charging customers each time they use the card. If this is going to be your primary spending card, paying monthly is definitely the way to go. Best of all, this is one of the only prepaid cards available that offers its members cash back rewards for using their card.

Another card with multiple payment options, this card offers two types of monthly plans, both of which include fee-free PIN transactions as well as fee-free signature transactions. PIN transactions have a $2.00 per-transaction fee under the pay-as-you-go plan.

Best Prepaid Debit Cards with No Signature Transaction Fees

In general, in-person digital payment transactions (e.g., credit and debit cards) are verified in one of two ways: with a PIN or with a signature. Although the majority of retailers and merchants will happily accept a PIN-authorized transaction, some only allow signature-based authentication.

While this can mean trouble for some prepaid cardholders, the cards below won’t charge you an extra fee for signature-verified transactions, giving you the option to use your card with more merchants.

If you have either of the monthly Netspend plans, you can enjoy fee-free PIN and signature transactions. If you are on the pay-as-you-go plan, signature transactions will carry a lower fee than PIN transactions, charging $1.00 per purchase.

Similar to the Netspend® card, this card has both pay-per-transaction and monthly plans. All PIN and signature transactions are free under the monthly plans, while the pay-per-transaction plan charges $1.00 per signature transaction.

Although this card has a $4.95 monthly fee, PIN and signature transactions alike are free. Keep in mind that you’ll need to use your PIN (by choosing the “debit” option) if you wish to get cash back with your purchase to avoid ATM fees.

Best Prepaid Debit Cards with No Reload Fees

While prepaid debit cards can be convenient, the fees that many charge can cut into that convenience factor quite a bit. Especially when they charge counterintuitive fees — like reload fees. Really, who charges you money to give them money?

These cards all have multiple options for reloading your prepaid card, sans fees, making it much more affordable to actually use your prepaid debit card.

This Visa debit card offers a couple of options for reloading your card without a fee, including direct deposit and online account-to-account transfers. Additionally, Netspend® charges no cash value load fees at Netspend Reload locations, though some locations may charge third-party fees. You’ll also earn Payback Rewards, an optional feature that lets you earn cash back at select merchants.

This card offers multiple ways to reload your card without paying fees, including with cash or a debit card at Walmart stores. You can also add funds for free through direct deposit, online with a debit card, and through mobile check capture.

Besides having a few ways to reload your card for free, you can also make free transactions, pay bills for free, and enjoy fee-free withdrawals at thousands of MoneyPass® ATMs.

This card is free of cash reload fees, transaction fees, and ATM withdrawal fees, making it a great option to carry around in your wallet. From what we can tell, it doesn’t charge a monthly fee either, but it will charge an inactivity fee of $3 per month after a year (12 months) of inactivity.

Best Prepaid Debit Cards with No ATM Fees

No matter what other features your prepaid debit card offers, fee-free ATM withdrawals can be the most valuable; after all, what use is direct deposit if you can’t get to your money without paying big fees?

But it’s not enough to simply offer $0 ATM withdrawals if there are no conveniently located ATMs. These cards have extensive ATM networks that allow you to take out funds, for free, at thousands of locations across the country.

The American Express Serve cards make it easy to withdraw money by charging no ATM fee at any MoneyPass ATM. Non-MoneyPass® withdrawals come with a $2.50 fee, plus any ATM operator fees.

In addition to free withdrawals, the card also offers free transactions, as well as free cash reloads at over 45,000 retailer locations, including CVS/pharmacy, Walmart, and participating 7-Eleven locations.

This card offers free ATM withdrawals at more than 30,000 MoneyPass® ATMs across the country. Withdrawals from non-MoneyPass® ATMs will result in a $2.50 fee for each transaction, plus any ATM operator fees.

In addition to fee-free ATM usage, cardholders pay no monthly card fee or reloading fees when funds are added through direct deposit, mobile check capture, or by using cash or a debit card at Walmart.

This card doesn’t charge for ATM withdrawals, purchases, reloads, or replacement cards. However, despite being marketed as a travel card, it charges the highest foreign transaction fee — 5.50% — I’ve seen charged by any card issuer. This may be a solid fee-free option for domestic travel, but certainly not international travel.

Best Prepaid Cards with No Foreign Transaction Fees

While you can use your regular checking account debit card at many foreign ATMs, especially in the UK — provided it has an embedded chip — you may not want to be running all over a foreign country with the key to your bank accounts. That’s where a prepaid debit card can come in remarkably handy.

You can make purchases abroad without worrying about your card falling into the wrong hands — or being charged outrageous currency conversion or foreign transaction fees — with the following card:

This is one of the only prepaid cards available that doesn’t charge a foreign exchange fee, making it as handy abroad as it is at home. Cardholders can also enjoy fee-free ATM access in the US at thousands of MoneyPass® ATMs, as well as reload for free via direct deposit, mobile check capture, or at a local Walmart store.

How Do Prepaid Cards Work?

Although prepaid debit cards have a lot in common with bank debit cards, prepaid cards vary in a few key ways that are important to understand before you start using them.

The most important difference between prepaid cards and bank cards is that prepaid cards aren’t typically associated with a specific bank account. Prepaid cards are freestanding accounts that can have money added to them through a variety of methods.

Bank debit cards, on the other hand, are typically tied to a single bank account or user, and can only draw on the funds associated with that account. When you open a checking or savings account with a bank, that bank may give you a debit card that can be used to make purchases from that account and withdraw money from the account at an ATM.

While you can often connect your checking or savings account to your prepaid card account as a reloading method, it doesn’t have to be the bank that issues the prepaid card, and some prepaid cards don’t require a bank account at all.

Once you sign up for a prepaid debit card, you’ll need to add funds. While this can be done through a bank transfer as stated above, some prepaid cards also allow you to add funds through direct deposit, check deposits, or by using a debit card or cash at a retail location.

You can generally start making purchases with your prepaid card as soon as the funds clear your account. Once you use up the preloaded funds (i.e., once you reach a $0 balance), you’ll need to add more funds to your reloadable prepaid card to continue making purchases.

When it comes to actually using a prepaid card, it operates the same way as any other debit card. You can use your prepaid card to make purchases anywhere the card’s network is accepted (check for the Visa, Mastercard, American Express, or Discover logo to see the network on which your card operates).

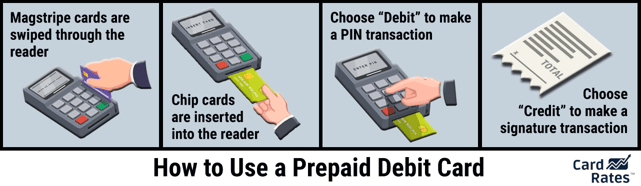

If your prepaid card has chip technology, you simply insert it into the chip reader; for magnetic stripe cards, swipe the card through the reader with the stripe down.

Depending on the terminal, you may be asked to choose a debit or credit transaction. Choosing a debit transaction will usually prompt a PIN verification while selecting a credit transaction will likely result in a signature verification.

Can Prepaid Cards Build or Establish Credit?

People use prepaid debit cards for various reasons, often as a simple way to get their paychecks when direct deposit is required by their employer. But prepaid cards are also a tool used as an alternative to credit cards by consumers who struggle with bad credit.

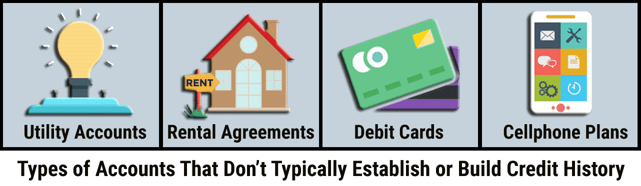

That being the case, perhaps the most important thing to realize about prepaid debit cards before you start using them is that they can’t be used to establish or build your credit history.

In fact, a prepaid debit card account will generally have nothing to do with your credit report at all. While this is handy for some folks — it means you don’t need to submit to a credit check to open a prepaid card — it can be a double-edged sword if you’re trying to boost your score.

Basically, your credit history is used by lenders and other creditors to determine your credit risk, or how likely you are to repay any money you borrow. As such, credit reports typically only include accounts based on lines of credit — i.e., agreements that involve borrowing funds.

While there’s a push toward including so-called alternative data sources (rental history, checking accounts, etc.) in consumer credit reports, currently only accounts associated with credit lines are reported. This includes installment accounts, such as personal loans and home mortgages, as well as revolving credit accounts like credit cards.

If you want a “prepaid credit card” that will help you build credit, consider a secured credit card. Your deposit establishes your secured card’s credit line and your payments are reported to the credit bureaus.

Manage Your Money with a Prepaid Card

While it’s often hard to avoid fees, sometimes a little research is all it takes to find the best prepaid debit card for you. With a broad selection of prepaid cards at your fingertips, for example, it’s possible to find low- and no-fee options for nearly any financial need.

But remember that, although prepaid cards can be a useful way to manage your money, they’re not a perfect solution; in most cases, you’ll wind up paying some sort of fee, be it a monthly fee or a per-transaction fee. Be sure to read the cardholder agreement so you’ll know exactly which fees the card charges.

You also need to keep in mind that you’re not building credit while using a prepaid debit card, so if improving your credit score is your goal, you’ll likely want a credit card instead. There are a number of good credit-building card options, even for those with bad credit, so long as you manage your card responsibly.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Debit Cards With No ATM Fees ([updated_month_year]) 9 Best Debit Cards With No ATM Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Debit-Cards-With-No-ATM-Fees.jpg?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year]) 7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/shutterstock_609135914-edit1.jpg?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year]) 7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Prepaid-Debit-Cards-with-Direct-Deposit--1.jpg?width=158&height=120&fit=crop)

![9 Best Prepaid Debit Cards For Minors ([updated_month_year]) 9 Best Prepaid Debit Cards For Minors ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Prepaid-Debit-Cards-For-Minors.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)

![6 Custom Prepaid Debit Cards ([updated_month_year]) 6 Custom Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Custom-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year]) 7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Prepaid-Debit-Cards-With-Mobile-Check-Deposit.jpg?width=158&height=120&fit=crop)

![5 Best Prepaid Debit Cards For Vacations ([updated_month_year]) 5 Best Prepaid Debit Cards For Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Prepaid-Debit-Cards-For-Vacations.jpg?width=158&height=120&fit=crop)