Several years ago, you could easily access prepaid cards without SSN requirements. But as these anonymous cards became popular among thieves and money launderers, the government enacted laws that require prepaid card issuers to collect a cardholder’s Social Security number before the card can be activated.

Today, only a few prepaid card issuers don’t require a SSN for activation, requiring instead an alternate form of identification — such as an Individual Taxpayer Identification Number, or ITIN, or other foreign ID number. For the most part, though, you will have to prove your identity in some way to get a card.

But you still have options if you don’t have a Social Security number or you prefer not to provide your SSN to a card issuer, including the cards we’ve identified below that will accept an alternate form of identification.

Prepaid Cards | Alternatives | Tips | FAQs

Prepaid Cards that Don’t Require a SSN

The U.S. Patriot Act made it almost impossible to activate — or even apply for — a traditional prepaid card without a Social Security number. But some cards on the market allow you to apply using an alternate form of identification, such as an ITIN.

The Bluebird® American Express® Prepaid Debit Account will accept an ITIN in lieu of a Social Security number. This is a great prepaid card that won’t drain your account with fees, unlike many prepaid card accounts on the market today.

Not to mention the card is issued by a major credit card company and payment network, and it is regularly rated as one of the best prepaid debit card options available.

Another offer from American Express, the Serve® American Express® Prepaid Debit Account trio of cards will similarly accept an ITIN in lieu of a SSN. This card charges a monthly fee, unlike its Bluebird sibling above, but will waive the fee if you make a monthly direct deposit of $500.

This card boasts no credit check, no minimum balance, and no hidden fees as some of its perks. You’ll also get free ATM withdrawals at over 30,000 MoneyPass ATM locations nationwide, which is a nice perk considering most prepaid cards charge an ATM fee for every ATM withdrawal.

- Mango is a safe and convenient way to manage and access your money when and where you need it

- The Mango Card is a prepaid card account and there are no hidden fees or interest charges. See your Cardholder Agreement for fees and details.

- You can use your Mango Card everywhere debit Mastercard is accepted

- Manage your account anywhere you are. Securely check your balance, transaction history, and send money to friends and family.

- Once you activate and load your Mango Card, you can open a Savings Account with as little as $25 and get up to 6.00% Annual Percentage Yield with up to 6 transfers out each month

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

The Mango Prepaid Mastercard® will accept your national identification number (or national ID number, personal code, or ID code) in place of a SSN. This makes it easier to activate your prepaid card if you are a foreign exchange student or are not a permanent resident of the U.S.

The best part about the card is that it doesn’t require a credit check, and it attaches to a high-yield savings account you can access through your desktop computer or mobile device. You can reload funds at participating Green Dot Bank retailers, through your PayPal account, or via direct deposit, among other options.

Card Alternatives that Don’t Require a SSN

The following cards provide access to a revolving line of credit that can help you build — or rebuild — your credit history with responsible use, even if you don’t have a Social Security number.

And with a bank that will accept your ITIN instead of a Social Security number, you can continue your financial journey by upgrading to new cards instead of having to apply for a new card when your credit score improves.

The Capital One Platinum Secured Credit Card requires borrowers to make a refundable security deposit to open an account. The bank relies on your creditworthiness to determine the amount of your required deposit, so if you don’t have a credit history (which is likely if you don’t have a SSN), expect to pay the full deposit.

Once approved, Capital One will continue to monitor your account and may provide complimentary credit limit increases that do not require an additional deposit.

The Capital One Platinum Credit Card is the bank’s entry-level unsecured credit card and one of the best such products on the market. This no-frills card provides a modest credit line with flexible credit requirements for approval.

And since Capital One maintains a robust portfolio of credit cards, your responsible behavior and on-time payments can help you qualify for an upgraded Capital One card in the future.

The Deserve® EDU Mastercard was specifically created for international students who don’t have a Social Security number. It’s easy for students to qualify online and receive their new card in a matter of days. What sets this card apart is the added perks that every cardholder receives.

This includes a free Amazon Prime Student account for your first year with the card, as well as cellphone protection insurance (when you charge your monthly bill to the card) and no international transaction fees. Cardholders can also earn cash back on every purchase with no annual fee.

Tips For Getting a Credit Card Without a SSN

You may have trouble finding a card that will give you full access to its benefits and features if you don’t have a Social Security number or you don’t want to disclose it to a prepaid card issuer.

But before you throw in the towel, consider the following options to get the prepaid card you need without providing a SSN:

- Check Your SSN Eligibility: You may qualify for a Social Security number without realizing it. Noncitizens authorized to work in the United States by the Department of Homeland Security can qualify for a SSN, as can noncitizens under other specific circumstances. Acquiring a SSN can open the doors to many benefits and financial products you may otherwise not have access to.

- Consider Getting an ITIN: An Individual Taxpayer Identification Number (ITIN) is a tax processing number that is issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number, but who do not have and are not eligible to obtain a Social Security number. The prepaid card issuers above will accept an ITIN number in place of a SSN when you activate your prepaid card.

- Use Your Passport: Your government-issued passport will contain an identification number that most card issuers will accept as a valid means of ID. If your passport is up to date, you can bypass having to provide your Social Security number and still get the card you need.

- Become an Authorized User: If none of the options above work, you can attempt to become an authorized user on a loved one’s unsecured credit card account. Authorized users receive a card with their name on it and have access to the full line of credit provided by the card account. Just make sure you use the card responsibly to keep the main user’s account in good standing.

Prepaid debit card issuers are required by law to collect a government-issued identification number from anyone who attempts to activate a card. There is no way around this formality, and you should anticipate needing to provide an identification number of some sort when you create your card account.

Do All Prepaid Cards Require a Social Security Number?

There was a time when most grocery store and convenience store racks were filled with over-the-counter prepaid debit card options that had no identification requirements for activation. Some major banks even allowed consumers to open a checking account without proper identification.

But as these cards became popular with people who wanted to remain anonymous or simply didn’t have a SSN, they also became popular with money launderers. New laws went into effect that made it more difficult to acquire a debit card, including prepaid cards.

Some card issuers will accept other government-issued forms of identification, including an Individual Taxpayer Identification Number (ITIN), passport number, or your native country’s identification number. Other issuers may accept your driver’s license number when you activate your card.

Issuers only require this information to properly identify you before granting access to an account. This information is not used to run background checks or to view your personal credit history.

How Can I Activate My Prepaid Card Without a SSN?

Anyone can purchase a prepaid card since many retailers sell them in-store and over the counter. But you may have issues activating your card if you cannot — or will not — provide your Social Security number to the card company.

Some issuers will still allow you to activate your card without a SSN, but you should expect limited access to your account and funds until you provide some form of identification. For example, the Walmart MoneyCard® won’t let you activate without a SSN, but it will allow you to spend any funds loaded onto the card as a gift card, which means it can’t be used again when the balance hits $0.

In place of a Social Security number, the card issuer may accept other identifying information from you. Just keep in mind that every credit card company has its own rules as to what form of ID is required for activation.

Check with a card’s issuer before you purchase the card to see if your preferred identification method will suffice. If so, you may be able to provide your:

- Passport book number

- Individual Taxpayer Identification Number (ITIN)

- Native country’s personal identification number

- Alien registration number

- Driver’s license number

The card’s issuer will also likely require you to provide a valid home address, phone number (or cellphone number), and date of birth. This information is meant to provide positive identification to ensure the cardholder is not using the card for illegal purposes.

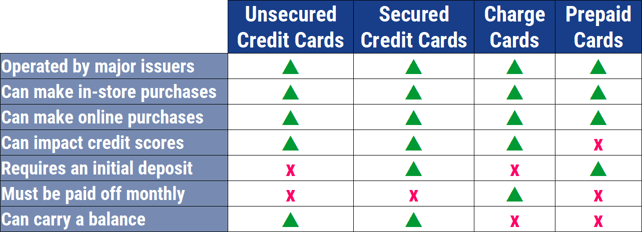

What is the Difference Between a Prepaid Card and a Credit Card?

A prepaid card is similar to a bank-issued debit card to which you make a deposit that you use to pay for things, whereas a credit card allows the cardholder to borrow funds with which to pay for goods and services.

A prepaid card — or reloadable card — allows you to store in an account, similar to a bank account, and use that money to make purchases. Every time you make a purchase using your card, the purchase amount is automatically deducted from your card account.

There is no line of credit attached to this card, which means it will not help you build credit or develop a personal credit history. That’s because prepaid cards are not reported to any credit bureau and will not appear on your credit report.

Most cards will allow you to access your money through an ATM withdrawal and to make in-person or online purchases. You can obtain a replacement card or temporary card if yours is lost or stolen.

Many prepaid cards also charge an ATM fee and will likely impose a monthly fee for maintenance or other transaction fees. In some cases, a card issuer may waive your monthly fee for maintenance if you receive regular direct deposits to your account.

Since your card attaches to a bank account, you can use your card account to receive direct deposits of your government benefits checks, payroll checks, economic impact payment checks, or current and future stimulus payment checks. You may have even received your stimulus payment via the Economic Impact Payment Card, or EIP Card, which is a Visa debit card.

A credit card provides a revolving line of credit that you can use over and over again after each completed payment. Bank-issued credit cards extend credit to you that you repay through monthly payments.

When you make a purchase with your prepaid card, the money along with any associated transaction fees is deducted from your personal savings. When you make a purchase with your credit card, the card issuer pays for the purchase and you repay that bank — with interest charges — through your payments.

Since a credit card features a line of credit, you can build — or rebuild — your credit history through responsible use.

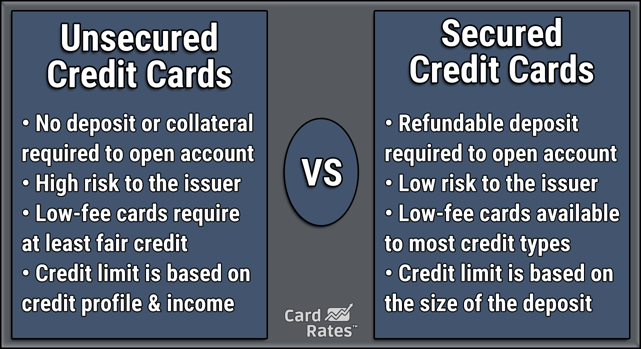

There are two main types of credit cards — a secured credit card and an unsecured credit card. A secured card will require a refundable security deposit for approval. The amount of your deposit will typically equal your secured card’s credit limit. For example, a $500 deposit will net you a $500 credit limit.

An unsecured credit card will not require a deposit for approval. This is a traditional credit card with a credit line that is determined by your personal credit history and credit score.

Since a prepaid card does not provide a line of credit, you may not have to undergo a credit check for approval. Some prepaid card issuers will still require a credit check, but many — such as a Netspend card — will not.

A credit card will require a full credit check with at least one of the three major credit bureaus for approval. A credit check lets the bank know how likely you are to repay your debt and limits its risk when extending new credit.

Do Prepaid Cards Help You Build Credit?

A reloadable prepaid card does not help you build credit. These cards attach to a savings account and only allow you to spend up to the amount of money you have deposited into the account.

There is no line of credit associated with these cards, and so they do not report to the credit bureaus and their use will not impact your credit score. These cards are very similar to a bank-issued debit card or a gift card that only allows you to spend the amount of money loaded onto the card.

You must borrow money from a bank or other lender to build credit. You can build credit with a credit card, a personal loan, an auto loan, or any other type of loan that reports borrowing activity to the credit bureaus.

When you repay a debt, the lender will report your payment history and account balance to one, two, or all three credit bureaus. This information builds over time and is used to generate a credit score in your name. Your score represents your history of repaying debt and is used to predict your likelihood of repaying future debt.

Since a prepaid card is not debt, it is not considered a credit product. This is why most reloadable prepaid card products on the market will not require a credit check for approval.

Some secured credit card offerings will also bypass a credit check because your security deposit acts as collateral for your account. Those cards will still likely require a Social Security number or other government-issued identification number for activation.

Can a Non-U.S. Citizen Get a Prepaid Card?

Most prepaid card issuers provide ways for noncitizens to acquire a prepaid card by using their National Identification Number. A noncitizen can also apply for an Individual Taxpayer Identification Number (or ITIN) that will work to activate a prepaid debit card.

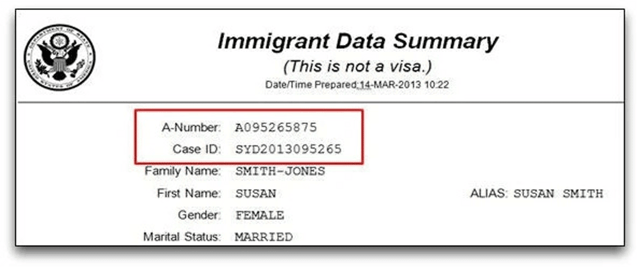

Noncitizens authorized to work in the United States by the Department of Homeland Security can qualify for a Social Security number, which will also provide access to any prepaid card on the market. You can also use your Alien Registration Number (or A-Number) to activate your account.

You can locate your A-Number on your Immigrant Data Summary, among other sources.

If you are not a U.S. citizen, you may have other options besides a prepaid card. No laws state that you must be a U.S. citizen to open a bank account. As long as you have your country’s proper identification methods, you can open a bank account and have access to a debit card that allows you to spend however much money you deposit into your account.

Just keep in mind that any U.S. bank account will require proper identification when you sign up. If you cannot provide that identification, you will have trouble accessing an account — or even activating a prepaid debit card.

Does Netspend Require a SSN?

As with most prepaid card issuers, Netspend must collect an applicant’s identifying information, including a Social Security number and proof of residency, before granting him or her access to an account. This mandate is part of the U.S. Patriot Act and is used to verify identities to protect against illicit activities, including acts of terrorism, money laundering, or other illegal activities.

Since you can purchase a Netspend prepaid card directly from many U.S. grocery or convenience stores, your Netspend card will not show your name, but it will contain a unique card number.

A Netspend prepaid card has no value until you add money to your Netspend account and activate the card. During activation, Netspend will require your identifying information. If you cannot provide the data, Netspend will suspend your account until you can.

Which Banks Don’t Require a SSN?

Every major American bank and financial institution requires either a SSN, ITIN, or passport number to open a bank account. In many cases, you can also provide your government-issued identification number from your native country to create an account.

You will not be able to open a bank account or get a debit card, secured credit card, or unsecured credit card without this information.

Here is a rundown of the requirements set forth by most of the major U.S. banks:

- American Express: SSN, ITIN, or passport number

- Chase: SSN or ITIN number

- Bank of America: SSN, ITIN, or passport number

- Citibank: SSN, ITIN, or passport number (select cards only)

- Capital One: SSN or ITIN

- U.S. Bank: SSN or ITIN (secured cards only)

- Discover: SSN

- Wells Fargo: SSN or ITIN (secured cards only)

- Barclaycard: SSN

- Synchrony Bank: SSN

- USAA: SSN

Keep in mind that each bank sets its own requirements for identification, and those requirements can change at any time and without notice. Check with the issuing bank to clarify its identification requirements for account activation before attempting to sign up or apply for any type of prepaid card or credit card.

Who Can Legally Ask for Your SSN?

Federal law mandates that state departments of motor vehicles, tax authorities, welfare offices, and other governmental agencies request your Social Security number as proof that you are who you claim to be.

The Privacy Act of 1974 requires government agencies at the local, state, and federal levels to disclose to the public whether submitting a Social Security number is required, how this information is used, and the law or authority that requires its use.

You have no legal obligation to provide your SSN to a business unless you’re engaging in a transaction that requires notification to the Internal Revenue Service or you’re initiating a financial transaction that is subject to federal Customer Identification Program rules.

Among the transactions subject to these rules are large purchases or applications for credit, and any transaction that includes moving money from one account to another — such as moving cash into a prepaid card account.

These laws are intended to counteract terrorism, money laundering, or other illegal activities. If you choose not to provide your SSN or other identifying numbers, the business can choose not to do business with you.

Besides lenders, prepaid card issuers, and credit card issuers (including business credit card issuers), other businesses that may require your SSN include:

- Insurance companies

- Investment advisors and brokerages that must report your purchases and sales to the IRS

- Real estate services

Any company that sells items or services of more than $10,000 will require your Social Security number and must report the transaction to the IRS. These companies can include automobile dealerships, large machinery sales, or other large purchases.

What Can I Do If I Don’t Have a SSN?

Although most banks and prepaid card issuers prefer that you provide your Social Security number when you activate your account, they understand that an applicant may not always have one.

In these cases, you can provide an Individual Taxpayer Identification Number (or ITIN), an Alien Number (or A-Number), or your native country’s government-issued identification number.

Not every prepaid card issuer will accept any of these numbers. Check with the card issuer before attempting to purchase or sign up for a prepaid card without a SSN.

Can I Refuse to Give My SSN?

You can refuse to give your Social Security number to any business that requests it. But the business can then opt not to continue its transaction with you.

You must give your Social Security number to continue with a transaction in some instances. This includes any sale or purchase of $10,000 or more that must be reported to the IRS. Investment purchases or sales also require a SSN, as will the purchase of insurance products, credit reporting services, and banking accounts.

If a business requests your Social Security number, you can always check to see if it will accept an alternate form of identification, such as an ITIN or driver’s license number.

Compare Prepaid Cards Without SSN Requirements

A prepaid card or gift card is a popular gift option any time of the year. But many gift-givers don’t realize that some of these cards will require personal identifying information — such as a Social Security number — for activation.

These cards also make it easier to make purchases without carrying cash. A prepaid card can be a valuable tool for accepting a direct deposit without a traditional bank account from a financial institution. But you will have trouble finding prepaid cards without SSN requirements.

Most prepaid card issuers will activate your account using an alternate form of identification. If you check with the card’s issuing bank to see which types of identification it accepts, you can still access a prepaid account without having to provide a SSN. And remember that the best prepaid card is the one that costs you least in fees, so be sure to read through the terms so you understand the costs associated with the account.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Credit Cards without SSN Requirements ([updated_month_year]) 8 Credit Cards without SSN Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-without-SSN-Requirements--1.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards Without a Bank Account ([updated_month_year]) 8 Prepaid Debit Cards Without a Bank Account ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Prepaid-Debit-Cards-Without-Bank-Account.jpg?width=158&height=120&fit=crop)

![How to Get a Black Card – American Express® Requirements ([updated_month_year]) How to Get a Black Card – American Express® Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/03/How-to-Get-a-Black-Card-2--1.jpg?width=158&height=120&fit=crop)

![7 Credit Card Requirements & Minimums to Apply ([updated_month_year]) 7 Credit Card Requirements & Minimums to Apply ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/req.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year]) [card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/shutterstock_465713531.jpg?width=158&height=120&fit=crop)

![Capital One Credit Score Requirements By Card ([updated_month_year]) Capital One Credit Score Requirements By Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/caponecredit.png?width=158&height=120&fit=crop)

![[card_field card_choice='5861' field_choice='title'] Review & Deposit Requirements ([updated_month_year]) [card_field card_choice='5861' field_choice='title'] Review & Deposit Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_680176312.jpg?width=158&height=120&fit=crop)

![Citi Double Cash Credit Score Requirements ([updated_month_year]) Citi Double Cash Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Double-Cash-Credit-Score.jpg?width=158&height=120&fit=crop)