Obtaining one of the best prepaid debit cards with direct deposit can make your financial life a whole lot easier if you’re one of the approximately 7.1 million American adults who don’t have a checking or savings account.

These cards allow you to directly deposit checks into your prepaid card account to keep your money safe and allow you to spend it as you would with a credit or bank debit card.

That means you can pay bills, rent a car, or conduct card-based transactions without having to pay annoying money order fees or other charges — which saves you money in the long run.

Cards that Facilitate Direct Deposits Up to 2 Days Faster

A card that accepts direct deposits allows you to receive your money faster than if you were to deposit a paper check — as much as two days faster in some cases. Plus, you won’t have to pay any check-cashing fees or worry about storing your money in a safe place.

Even better, some of the cards listed below will eliminate some (or all) of your monthly maintenance fees if you receive consistent direct deposits into your account.

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

You may recognize the Brink’s name from those large armored trucks that transport money from businesses to banks (and vice versa). The company, which recently celebrated its 160th birthday, puts just as much security into its Brinks Prepaid Mastercard.

Not only does this card accept direct deposits of your paychecks, tax refund checks, and government benefits checks, but you can also tap into the card’s mobile application to take a photo of the front and back of any paper check you receive and digitally deposit the funds into your card’s account.

The app also allows you to check your card’s balance, see transaction history, and receive real-time text message alerts whenever you use your card or receive funds into your account.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The NetSpend® Visa® Prepaid Card ranks among our favorite prepaid cards for its flexibility and low fees.

Netspend posts any direct deposits to your account as soon as the check arrives. Many banks and credit unions wait until the check clears before posting the funds to your account. This helps you get access to your money faster.

And Netspend’s direct deposit terms aren’t just for paychecks. You can also directly deposit tax refund checks, government benefits checks, and other forms of recurring payments into your account.

This version of the NetSpend® Visa® Prepaid Card looks and acts very much like its sibling card listed at No. 1. But one key difference separates the two.

This card has one flat maintenance fee — which tops out at $9.95 every month. If you don’t regularly use your card, but still want access to the direct deposit feature, this could be your best option.

The other option has a variable monthly fee based on how often you use the card. The more you swipe, the less you pay each month. If you plan to use your Netspend card as your regular form of payment, you’re better served with the card atop this list. If not, this card is likely your best option.

Either way, you’ll still gain access to the full portfolio of direct deposit options, as well as the ability to use your funds at any merchant or service provider that accepts Visa — which is just about everywhere.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

PayPal is the foremost name in the online payment space, and the company’s PayPal Prepaid Mastercard® lets you easily move your funds between the digital and real worlds.

You can transfer money back and forth between your PayPal account and your card account in real time — with no waiting for the funds to clear before you can use them. You can also use the card account to receive direct deposits of your paychecks, government benefits checks, or tax refund checks.

But what really sets this card apart is the ability it gives you to earn cash back rewards through PayPal. This optional program gives you cash back on qualifying purchases, while also taking advantage of valuable offers from PayPal and its partners. Similar programs are virtually impossible to find in the prepaid space.

The Bluebird® American Express® Prepaid Debit Account gives you all the benefits of a bank account without signing up with a bank or credit union. This includes a full range of direct deposit features for any checks you receive as well as payment options at any merchant or service provider that accepts American Express.

The family accounts feature allows you to give up to four linked cards to anyone you choose. You’ll also have the power to set limits on spending, ATM access, and other security features for each cardholder.

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

*Please see site for full terms and conditions.

The Walmart MoneyCard® provides cash back rewards on select purchases made at Walmart stores, Walmart.com, and Walmart fuel stations. Rewards are credited to your account as one lump sum at the end of the year.

You’ll receive your paycheck up to two days before your payday and the monthly fee will be waived when you have $500 or more deposited into your account each month. Accounts with eligible direct deposits also qualify for optional overdraft protection.

The Serve® American Express® Prepaid Debit Account allows free direct deposits that you’ll receive up to two days sooner than if deposited into a traditional bank account.

You also get free withdrawals from MoneyPass ATM locations, timely transfers when you need to send or receive money, and Online Bill Pay features to organize and pay your bills.

What is the Best Prepaid Card For Direct Deposit?

Every card listed above accepts direct deposit of paychecks, government benefits checks, and tax refund checks into your card account. Most will give you access to your funds as soon as the check arrives.

Since each card has the same features for direct deposit, you must look at other perks to decide which is truly the best prepaid card for direct deposit.

Depending on your needs, here are our verdicts.

- Best for Regular Use: Netspend Visa Prepaid Card

- Best Mobile Experience: Brinks Prepaid Mastercard

- Best for Cash Back: PayPal Prepaid Mastercard®

- Best for No Fees: Bluebird® American Express® Prepaid Debit Account

- Best for Bill Payments: Serve® American Express® Prepaid Debit Account

- Best for Walmart Shoppers: Walmart MoneyCard®

Let’s look at why each card is the best in their respective categories.

Netspend® Visa® Prepaid Cards: Best for Regular Use

The No. 2 and No. 3 cards on our list share the same name and issuer but have a few specific differences. To find out which card best suits your needs, you must estimate how often you’ll use your card.

The No. 3 card charges a flat monthly fee that tops out at $9.95 every month. The No. 2 card offers a variable monthly fee that’s based on how often you use your card. The more you use it, the lower the fee.

On the flip side, if you don’t use your card very much, you could end up paying more than you would for the same features with the No. 3 card.

Brink’s Armored™ Account: Best Mobile Experience

Brinks knows all about security. So, it’s only natural that the company’s mobile application would offer robust features while keeping your data safe from unwanted eyes.

The Brinks Prepaid Mobile App allows you to check your balance, transfer money, or find the nearest reload location from your mobile phone. Best of all, Brinks offers this service for free (mobile data charges may apply).

You can also digitally deposit checks, receive real-time account alerts, and view all of your transaction history.

PayPal Prepaid Mastercard®: Best for Cash Back

Very few companies can compete with PayPal in the digital payments space. Since its inception as an eBay-affiliated company, PayPal remains the most popular way to send money, pay bills, or make payments online.

With the PayPal Prepaid Mastercard®, you can transfer money in real time between your PayPal and card accounts. You can also use the card at any location that accepts Mastercard, while potentially earning cash back rewards for eligible purchases.

PayPal’s rewards are called Payback Rewards and they post automatically to your online account center. Rewards can then be redeemed for cash deposited to your card account balance.

Bluebird® American Express® Prepaid Debit Account: Best Prepaid Card with No Fees

Bluebird gives you many of the same features you’d expect from a traditional bank account — but with far fewer fees than you’d typically find with a prepaid card. You can withdraw money for free at more than 30,000 MoneyPass ATM locations. You can also withdraw or add money within your account for free at any Walmart checkout line.

Most surprisingly, this card features no monthly fee. But it isn’t completely fee-free. If you decide to add money at a non-Walmart location, that business may charge you up to $3.95 to process the funds.

Serve® American Express® Prepaid Debit Account: Best Prepaid Card for Online Bill Payments

The Serve® American Express® Prepaid Debit Account has a dedicated Bill Pay feature that allows you to organize your bills and pay them when they’re due to help you avoid costly late fees.

You must add a payee to your online account center to send money, which you can do in six easy steps. Once a payee is added you won’t have to add it again. You can also schedule bill pay reminders.

Note that subaccount users do not have access to the Pay Bills feature.

Walmart MoneyCard®: Best Prepaid Card for Walmart Shoppers

The Walmart MoneyCard® is a solid option for anyone who regularly shops at Walmart or its gas stations, thanks to its generous cash back rewards.

Rewards are credited annually at the end of the year in one lump sum. The maximum amount of cash back you can receive is $75. But if you have eligible direct deposits and your monthly fee is waived, that’s free money you can get just for being a cardholder.

The card is free to sign up for online, but you’ll have to pay a small fee to buy one in a Walmart store.

Do Banks Issue Prepaid Debit Cards?

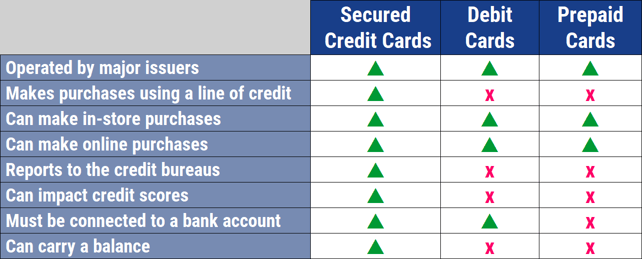

Just about every bank or credit union will offer debit cards to account holders, but they aren’t the same as prepaid cards. While prepaid cards and bank-issued debit cards act in many of the same ways, a few significant differences separate the two, such as the need for a bank account.

Bank cards require an account: You can’t just go into a bank or credit union and open a prepaid debit card account. You must first open a checking account that links to your debit card.

If you aren’t eligible for a bank account, don’t have a bank near you, don’t have the means to maintain minimum balances, or you simply don’t trust banks, then this option may not work for you.

Prepaid debit cards only require you to create an account in which you can add funds to use with your card, either online or at a retail location. Most cards partner with retailers all over the country for you to add cash to your account easily.

Some bank cards expire: Many bank and credit union debit cards feature an expiration date in which you can no longer use the card. Most banks will issue you a new card just before the expiration date, but it’s still something you have to keep track of.

Prepaid debit cards rarely include expiration dates and allow you to use your card for as long as you maintain your account.

Many bank cards have intraday spending limits: As a form of fraud protection, most banks and credit unions limit how much you can spend using your debit card on any given day. If you’re looking to make a big purchase — or several purchases — this can become annoying.

Prepaid debit cards rarely feature such limits — though you can add them to your card if you so choose.

Are Prepaid Cards Safe to Use?

Prepaid debit cards remain just as safe as any other credit or debit card on the market. That’s because nearly all of these cards run on the same processing networks.

So, while you don’t have to worry about the safety of your transactions, each card issuer does have varying degrees of security surrounding its mobile applications and desktop interfaces. Still, the cards listed above have no long-standing security issues or records of data breaches.

Besides, it’s hard to argue with the security of a card when it’s issued by a company such as Brink’s — which has provided secure money transfers for banks and other financial institutions for more than 160 years.

If you’re unsure about your card issuer’s cyber safety, the first step you can take is to look at your browser’s address bar when you’re visiting the company’s website. If you see a little padlock icon to the left of the website’s URL, you’ll know that the site uses the most current SSL security and encryption standards, which makes it far more difficult for malicious hackers to access your information.

If you don’t see the padlock, you can visit a site such as Why No Padlock and type in the website’s address to get a full report of its security flaws.

You can also search for the security history of any card issuer with whom you’re considering opening an account. News travels fast on the internet, and if there are any breaches or other security flaws, you’ll most certainly find out about them through a brief search.

The best way to maximize your card’s security is to only access your account on trusted WiFi networks — never through public WiFi channels — and only use approved and supported mobile applications.

Do Prepaid Cards Build Credit?

Unfortunately, a prepaid card cannot help you build credit. But secured credit cards can.

Secured credit cards work somewhat similarly to prepaid cards in that they require an upfront cash deposit, but you don’t get to spend the money you deposit as you would with a prepaid card or gift card.

Secured card issuers hold onto that money and return it to you after a series of on-time payments. The issuer will report your account activity to the credit bureaus to help you build credit. You may be able to get a secured card with a deposit of as low $49 with the Capital One Platinum Secured Credit Card.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

You can see more secured cards that can help you build credit here.

Manage Your Money Easily with a Prepaid Card

If you’re one of the more than 7 million U.S. adults without a bank account, you may find a prepaid debit card to be the easiest way to manage your money while still maintaining access to a credit card network.

That’s because the cards listed above provide a safe environment to directly deposit your paychecks, government benefits checks, or tax refund checks while allowing you quick access to your money — both electronically and as cash.

And, with the best prepaid debit cards with direct deposit, you won’t find yourself stuck paying enormous fees to use your money. That gives you more cash to use on the things you want in life.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year]) 7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Prepaid-Debit-Cards-With-Mobile-Check-Deposit.jpg?width=158&height=120&fit=crop)

![6 Best Prepaid Debit Cards with No Fees ([updated_month_year]) 6 Best Prepaid Debit Cards with No Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/prepaid--1.png?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year]) 7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/shutterstock_609135914-edit1.jpg?width=158&height=120&fit=crop)

![9 Best Prepaid Debit Cards For Minors ([updated_month_year]) 9 Best Prepaid Debit Cards For Minors ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Prepaid-Debit-Cards-For-Minors.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)

![6 Custom Prepaid Debit Cards ([updated_month_year]) 6 Custom Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Custom-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Prepaid Debit Cards For Vacations ([updated_month_year]) 5 Best Prepaid Debit Cards For Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Prepaid-Debit-Cards-For-Vacations.jpg?width=158&height=120&fit=crop)

![12 Free Prepaid Debit Cards ([updated_month_year]) 12 Free Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Free-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)