Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Cash back rewards are a small refund when you buy something with a credit card. Card issuers that offer cash back rewards usually return a percentage of what you spend. This reward encourages you to use their cards for your purchases. Other reward cards may offer points or miles instead of cash back.

-

Navigate This Article:

How Cash Back Rewards Work

Cash back seems like a simple thing, but this type of rewards program can be complex. To get the most from cash back cards, you must understand how you earn rewards, how much you can earn, how to redeem your cash back, and any limits or restrictions on the rewards you can collect.

Earning via Purchases

You can use credit cards to purchase items in stores, online, or over the phone. When shopping in person, you swipe, insert, or tap your card on a reader to pay. You get a receipt after paying, which can be paper or digital.

You can also add your credit card to a mobile wallet on your phone, such as Apple Pay or Google Pay, to make in-person purchases. Just tap your phone on the card reader instead of using your physical card. It’s fast and secure, uses a unique code for each transaction, and doesn’t share your actual credit card number with the store.

After you complete your purchase, you’ll receive a confirmation with your order details. Keep this to track your order (and the cash it will earn) or in case you need to return something.

If you return an item, online stores just need your order number, but physical stores may ask for your card. Returned items do not earn cash back — if you have already received your reward, the card issuer will revoke it.

After you use the card to make an eligible purchase or pay a bill, the credit card company calculates how much cash back you earn. It bases the amount on how much you spent and the card’s applicable cash back rate. It then adds cash back to your rewards balance.

Cards credit your cash back at the time of purchase and/or when you pay your bill.

You can view your cash back online, in your card’s mobile app, and on your monthly statement. As you make more purchases, your cash back rewards accumulate. As I’ll explain below, you can redeem your rewards in one or more ways.

Types of Reward Programs

You need to understand the kinds of cash back rewards you can earn and what you need to buy to earn them. The simplest cash back cards give you a flat percentage, usually 1% to 2%, of cash back on eligible purchases.

Tiered rewards cards offer bonus cash back, often 2% to 5%, on certain items such as gas, restaurant meals, and groceries. They often pay a smaller percentage, usually 1%, on other purchases.

Some cards change their bonus categories every three months or let you pick a category to earn more cash back. You must activate the category to earn the bonus cash back rate, often quarterly. You can do so online or in the credit card’s app.

Some cards offer both rotating and tiered reward categories, and they all have a default rate for spending that doesn’t qualify for a bonus rate. Flat-rate cards are the easiest to manage but usually pay less than the other types.

The Fine Print

Issuers also attach various terms and conditions to their cards. You should read the fine print online in the card member agreement that must accompany the card application. Pay attention to the rules regarding any cash back rewards, including:

- Caps: These are limits on how much cash back you can earn. For example, a card may give you a 5% bonus cash back on the first $1,000 you spend in a month or quarter and then a lower percentage after that. Caps often apply to rotating and tiered bonus categories but not flat rates.

- Expiration dates: Look for any periods after which you can’t use your rewards. Some cash back may expire after a certain period or if you (or the issuer) cancel the card.

- Qualifying purchases: Only some things you buy will earn rewards. The terms will list what counts or doesn’t count. For example, cards do not pay rewards on cash advances, gambling, or illegal items.

- Limited redemptions: Be aware of the ways you can redeem your cash back and any minimum amounts that apply.

You need to read the fine print to know how attractive a cash back offer really is and if it fits well with your spending patterns.

Maximizing Your Cash Back

While earning cash back is automatic, you can employ strategies to maximize your rewards.

While increasing your rewards may take some extra effort, the additional money you’ll earn could be well worth it. Here are three ways to extract the maximum cash back from your credit cards.

Redemption Strategies

Not every card distributes your rewards the same way — and that can be a good thing.

Some cards only allow you to redeem your rewards as statement credits, meaning the cash back you accrue pays down part of the balance you owe. Some cards do not allow you to apply statement credits to your monthly minimum payment.

Other ways you may receive your cash back include paper checks, deposits to your linked checking or savings account, and gift cards. Many cards let you apply your cash back to pay for selected purchases. Some also let you donate your rewards to an eligible charity.

If you have a card that pays rewards points instead of a cash back percentage, you could still redeem those points for cash back, among other rewards. Each credit card issuer sets the value of its points and may offer varying redemption values.

Clicking around in your issuer’s rewards portal shows you how the value of your rewards may fluctuate if you apply them to travel, cash back, merchandise, and other categories.

However, some points cards offer more flexibility than cash back cards because they provide additional redemption options. They may even offer increased values when you transfer them to an issuer’s partner loyalty program.

Make sure you redeem your rewards before you close your account or the card imposes any expiration dates.

Using Multiple Cards

To maximize rewards with multiple cash back cards, match each card to its best earning category. It would help if you considered the factors that enhance or reduce your rewards.

Here’s how:

- Match cards to categories: Use each card that offers the highest cash back rate on certain purchases. For example, one card might be best for groceries, another for gas, and another for dining.

- Mind annual fees: Some cards have yearly fees. Make sure the rewards you earn outweigh these costs.

- Stay updated: Rotating bonus categories change over time. You may have to adjust which card you use for particular purchase categories.

- Consider credit inquiries: Applying for several cards can affect your credit score because of hard credit inquiries. Wait about six months between new card applications.

- Watch spending limits: Switch to another card once you hit a card’s monthly or quarterly reward limit.

Balancing these factors helps you get the most out of your cash back cards without hurting your finances or credit score. Let’s work through an example:

Case 1:

Imagine you have a tiered cash back card (Card A) that offers 4% back on groceries, 3% on gas, and 1% on all other purchases.

If you spend $500 on groceries, $500 on travel, and $300 on gas in a month, using Card A would earn you:

- $20 from groceries (4% of $500)

- $9 from gas (3% of $300)

- $5 from travel (1% of $500).

That’s a total of $34 cash back for $1,300 of purchases.

Case 2:

You have a travel rewards card (Card B) that gives you 3X points on all travel purchases and 1% on all others. The points are worth one cent each. Suppose you purchase a $500 airline ticket and spend $800 on gas and groceries. You would earn:

- $15 from travel (3% of $500)

- $8 from groceries and gas (1% of $800)

In this scenario, Card B gives you $23 on $1300 in spending.

Case 3:

Let’s assume you own both cards. Your earnings could be:

- $20 from groceries (4% of $500 using Card A)

- $9 from gas (3% of $300 using Card A)

- $15 from travel (3% of $500 using Card B)

In this scenario, you wind up with $44 in rewards. You maximize your earnings by deploying two cards according to their bonus categories.

I’ve assumed that these cards have no annual fees. The net outcome would change if they did impose a yearly fee or if the amounts or types of spending were different. The bottom line is that you should choose complementary cards when you own more than one and use them to their best advantage.

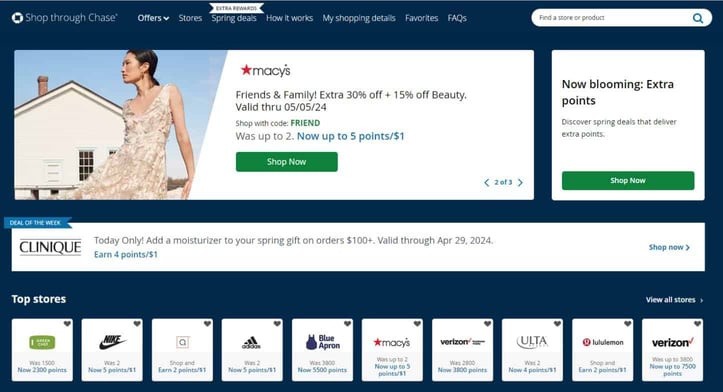

Dedicated Shopping Portals

When you shop online, using shopping portals and apps can increase your cash back or points. Issuers often partner with retailers to offer extra rewards or discounts when you shop through their portals. They may also increase the value of point redemptions as compared to cashing in the points.

For example, if you have a dedicated travel card, you may use the issuer’s portal to book flights, hotels, or rental cars. Your points could be worth much more when you use them this way.

Some credit cards offer discounts and/or credits when you shop through their browser extensions. For example, Capital One Shopping and Citi Shop offer extensions that help you find deals and promotions. Capital One Shopping also awards you with credits you can redeem for gift cards.

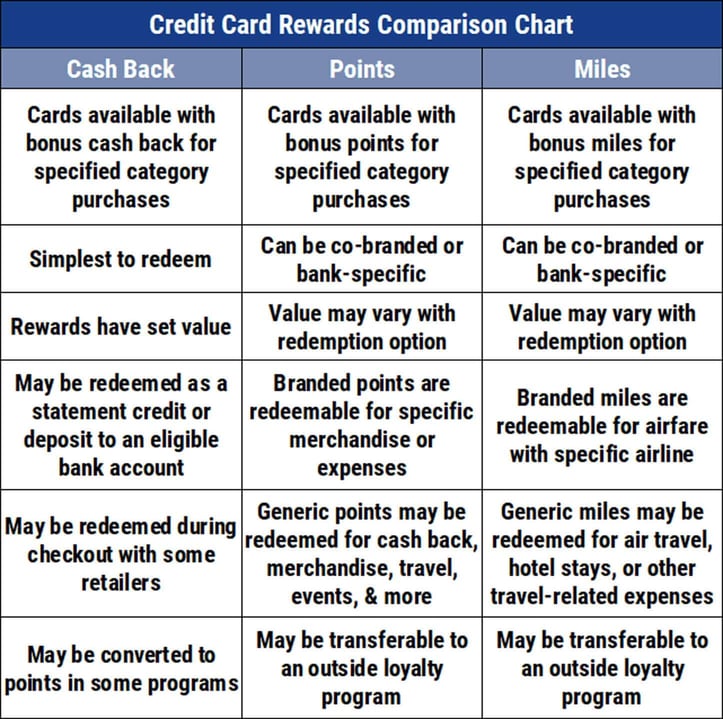

Cash Back vs. Points and Miles

Credit card companies are always trying to attract new users. They offer rewards, which can be points, cash back, or miles to attract new applicants. The following chart compares all three types of rewards:

Remember that you don’t have to settle for just one card. Owning one of each type can mean even more rewards and benefits.

When to Opt for Cash Back Over Other Rewards

Cash back cards may be a good fit for your needs. Here are three examples of why you may prefer cash back rewards:

- You’re on a fixed budget: Cash back can directly reduce your monthly bills. For example, if you get cash back on groceries and gas, you can use those savings to lower your credit card balance.

- Simplicity and flexibility: Cash back is straightforward and versatile. You always know the value of your rewards. Flat-rate cards give you a simple percentage back on your purchases that you can use for anything.

- You travel infrequently: Miles won’t help you much if you don’t travel often. In this case, cash back lets you benefit from every purchase, regardless of the category or your frequency of travel.

Many good cash back cards do not charge an annual fee. And even if you have bad credit, you can get a secured credit card with cash back rewards.

The Impact of Spending Patterns

Your spending habits can determine whether cash back or other rewards are better for you. If you spend a lot on specific categories, such as groceries or gas, then a cash back card that provides extra rewards for those may be best.

But if you travel often and spend money on flights or hotels, a travel rewards card could offer much more value. These cards can offer points or miles that save you money on travel.

If you often shop at certain stores or for specific brands, you may find a card that offers special cash back rewards for those businesses. If you prefer simplicity and want rewards that are easy to use on anything, cash back is straightforward because you get money back to use however you want.

Ultimately, the best choice depends on where and how you spend your money. If your spending is varied and doesn’t fit into specific categories, cash back may be the way to go. But if you have focused on spending, especially on travel, then travel rewards or brand-specific options may be better for you.

How to Choose the Right Cash Back Card

Look for a card that matches your biggest monthly expenses, such as dining out or gassing up the car. Compare card features and benefits, including the cash back reward structure, annual fees, and extra perks. Also, read customer reviews and ratings to find out how other users like the card.

Assess Your Spending Habits

Look at your personal or household spending patterns. Check your bank statements or credit card bills from the past few months to see where you spend the most money. Do you spend a lot on groceries, gas, dining out, or online shopping? Find out which categories you spend the most in, and then consider cash back cards that offer higher rewards for specific types of purchases.

| Steps for Assessing Your Spending Habits |

|---|

| 1. Review your bank statements and credit card bills. |

| 2. Note where you spend the most money. |

| 3. Consider cash back cards offering rewards that align with your spending habits. |

Also, consider if a card has an annual fee and if the cash back you earn will offset this cost. By matching a card’s cash back rewards with your biggest spending areas, you can maximize the amount of money you get back.

Compare Card Features and Benefits

You want to compare the features and benefits of cash back cards to find the best value for your specific spending habits. Different cards offer varying cash back rates, bonus categories, and perks. By comparing them, you can maximize your rewards and benefits.

The following chart summarizes what to look for when choosing a cash back card:

| FEATURE | WHY IT’S IMPORTANT |

|---|---|

| Cash Back Rate | Determines how much money you get back for your purchases. Higher rates mean more rewards. |

| Bonus Categories | Some cards offer higher cash back rates in specific categories like groceries or gas. |

| Sign-up Bonus | A one-time reward for spending a certain amount within a set time period of opening the account |

| Annual Fee | This is the yearly cost of the card. Ensure the benefits outweigh this fee. |

| Introductory APR | A lower interest rate offered at the start, useful for large purchases or transferring balances |

| Regular APR | The ongoing interest rate that applies to balances carried from month to month |

| Foreign Transaction Fees | Fees on purchases you make outside the country |

| Redemption Options | How you can use your cash back (i.e., statement credits, bank deposits, or gift cards) |

| Additional Perks | Benefits that may include extended warranties, purchase protection, or travel insurance |

By evaluating these features, you can choose a card that matches how you live and gives you the most savings.

Read Customer Reviews and Ratings

Seek out customer reviews to see how a card performs in the real world. Customer reviews and ratings can tell you about a card’s reliability, benefits, and customer service.

For example, it’s likely a good sign when many users report it is easy to redeem a card’s cash back. On the other hand, frequent complaints about hidden fees, difficulty in earning or redeeming rewards, or poor customer service are red flags.

Reviews can highlight issues that the card issuer’s marketing materials don’t address, such as delays in getting your rewards or misidentifying the merchant category.

Online reviews help you make better choices. You’ll want to select a cash back card that delivers good value and is hassle-free.

Leverage Cash Back Rewards for Your Financial Benefit

You can save the most on regular purchases by choosing a cash back credit card that matches how you typically spend your money. Use your cash back wisely to reduce your overall expenses.

You still want to stay informed about your card’s features and those of competing cards. That way, you can save money and improve your lifestyle by making informed decisions.

![11 Best Credit Cards for Cash Rewards ([updated_month_year]) 11 Best Credit Cards for Cash Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/CASHBACKREWARDS.png?width=158&height=120&fit=crop)

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![7+ Best “2% Cash Back” Credit Cards ([updated_month_year]) 7+ Best “2% Cash Back” Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/2-percent.png?width=158&height=120&fit=crop)

![Best Cash Back Visa Cards of [current_year] Best Cash Back Visa Cards of [current_year]](https://www.cardrates.com/images/uploads/2019/12/Best-Cash-Back-Visa-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Bank of America Cash Back Credit Cards ([updated_month_year]) 5 Best Bank of America Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Bank-of-America-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 Highest-Limit Cash Back Credit Cards ([updated_month_year]) 9 Highest-Limit Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year]) 5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Credit-Cards-With-Air-Miles-Cash-Back.jpg?width=158&height=120&fit=crop)