If financial mistakes can make a mess of your credit history, then the best credit cards after collections or charge-offs are the ultimate clean-up crew.

We’ve compiled our list of the best cards for your unique situation. These cards all consider applications from consumers who have bad credit as well as recent charge-offs or collection accounts. Some will even approve you with a recent bankruptcy.

With the right credit card in your wallet, you can begin the process of rebuilding your credit score by replacing old, negative information on your credit report with new and positive data. And since the cards listed below report to all three major credit bureaus, you can speed up the process with responsible behavior.

Unsecured Cards | Secured Cards | FAQs

Unsecured Credit Cards After Collections or Charge-Offs

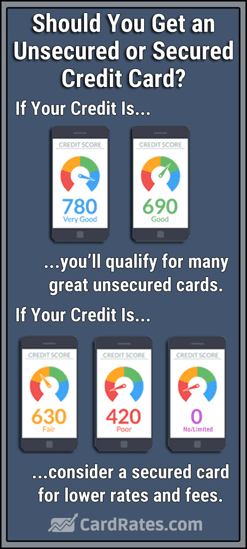

An unsecured credit card won’t require a deposit for approval and will use your credit score to determine eligibility. Still, the cards listed below have forgiving approval standards and often approve applications from consumers who have a poor credit score.

Just be aware that an unsecured credit card for bad credit will likely come with a low starting credit limit and may charge an annual fee and high interest rate.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

The Surge® Platinum Mastercard® may provide qualified applicants with one of the largest initial credit limits on this list. That’s because the card issuer has generous credit standards and forgiving approval criteria. The bank will determine your eligibility and credit limit based on its own standards, so you aren’t guaranteed a high credit line to start.

That high credit line may also come with one of the highest potential interest rate offerings on this list. If you tend to carry a balance from month to month, the larger credit limit may end up costing you more over the long haul.

The Reflex® Platinum Mastercard® offers unsecured credit lines to consumers with previous financial mistakes, but don’t expect your credit card to be light on your wallet.

This card provides generous credit lines, but tacks on substantial fees along the way. Besides a higher-than-average interest rate, this card also features a very high annual fee that will also include a monthly maintenance fee starting during your second year depending on your credit limit.

The Milestone® Mastercard® is also a great card for building credit after a slip up. Your account history will be reported to all three major credit bureaus, and you can access your account at any time on your mobile app. Be sure to read the terms and conditions so you know what your APR, annual fee, and other charges will be.

Being a Mastercard, cardholders enjoy all the benefits that come along including the Mastercard Global Service program, which is available 24 hours a day, 365 days a year. You’ll also have emergency replacement of lost or stolen cards, emergency cash advances, and ATM location services.

The Total Visa® Card is another potentially expensive option that you should research before applying. You must pay a program fee before you can even open your credit card account and the bank will charge your first annual fee to your credit card account upon activation. After your first year with the card, you’ll also start incurring monthly maintenance fees alongside your annual fee.

All of those charges will likely only net you a low credit limit with a higher-than-average interest rate. But if you’re in a pinch and need access to credit, Total has forgiving approval standards and offers fast approvals for new applicants.

Secured Credit Cards After Collections or Charge-Offs

A secured credit card requires a refundable security deposit for approval. The amount of your security deposit typically equals your card’s spending limit. Despite the higher upfront cost, these cards often have competitive interest rates, lower fees, and may not even require a credit check for approval.

You can use your secured card as you would an unsecured card — to make purchases online or in-person or to pay bills, rent a car, or reserve a hotel room. And the cards below can also help you rebuild your credit by reporting to each major credit bureau.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

The Capital One Platinum Secured Credit Card is the only option on this list that may not require a full security deposit that matches your new card’s spending limit. That’s because Capital One uses your credit history to determine how much of a deposit it will require from you.

Based on your creditworthiness, you can open your account with a small deposit that’s only a fraction of your spending limit. Just note that all new cardholders start out with the same credit line. If you’re looking for a larger spending limit, this may not be the card for you.

The OpenSky® Secured Visa® Credit Card doesn’t require a credit check, which makes this card an easy way to get access to credit after a collection or charge-off. And since this card has low minimum deposit requirements, and large maximum allowances, you can have the flexibility of choosing your own credit line based on your financial needs.

This card also features a nominal annual fee and includes an interest rate that’s right around the average of the secured cards on this list. In all, this is a good card for rebuilding your credit without paying tons of fees along the way.

You won’t need to pass a credit check to get the Applied Bank® Secured Visa® Gold Preferred® Credit Card, which makes this card pretty easy to get. But applicant beware — the low regular APR is nice, but there is no grace period on purchases — your purchases begin to accrue interest the day they’re made.

Nonetheless, this card reports to all three credit bureaus to help you improve your credit with on-time payments, and you can increase your credit limit by making additional deposits any time after your application has been approved.

Can I Get a Credit Card With a Collection or Charge-Off on My Credit Report?

Some credit card issuers will consider your application even if you have a collection or charge-off on your credit report. These cards are specifically designed for consumers who have a bad credit history, so they offer more forgiving approval standards.

Like any credit card for bad credit, you should expect these cards to come with a high interest rate, potential annual fees, and other charges that can make them expensive options for rebuilding your credit score.

If you can afford a higher upfront cost, you may save a substantial amount of money by considering a secured credit card. These cards will require a refundable security deposit to open your account, but you’ll find that most have very low interest rates, and some won’t charge an annual fee for membership.

If you can afford a higher upfront cost, you may save a substantial amount of money by considering a secured credit card. These cards will require a refundable security deposit to open your account, but you’ll find that most have very low interest rates, and some won’t charge an annual fee for membership.

Even better, many secured credit card offerings won’t require a credit check for approval — so your previous financial mistakes won’t come back to haunt you.

Either card will report your payment history and balance to at least one credit bureau to help you improve your credit score with responsible behavior. You can speed up this process by making timely payments and paying your balance in full each month.

Not only does a low balance look good on your credit report, but it lowers your potential credit costs. You’ll pay interest to your credit card company for any credit card balance you carry from month to month. Your interest charges post to your monthly payment, which increases your unpaid debt and makes it harder to pay off your total balance.

This will also increase your credit utilization ratio and overall credit card debt, which makes up 30% of your overall FICO credit score.

What Is a Collections Account?

A collections account is an account that the original lender writes off as bad debt and sells it to a debt collection agency.

This happens with unsecured debt that has missed payments and has had no activity for some time. The original lender can decide to sell the delinquent debt to a debt buyer at any time after you’ve gone at least 90 days without making a payment or contacting the lender.

The debt collector purchases the bad debt for pennies on the dollar and becomes your new debtholder. The debt collection agency can then begin contacting you to collect on your debt or offer a debt forgiveness deal that settles the debt for a fraction of what you owe.

Once the original creditor sells the debt, you’ll only have contact with the debt collector that buys your account. The credit reporting from the bad debt will show as a charge-off through the original creditor and show as active and delinquent debt for the new debtholder.

This has large ramifications for your credit score. Even with a debt settlement or debt forgiveness deal, you’ll still take a substantial hit to your credit score.

What Is a Charge-Off?

A charge-off takes place when a lender does not receive payment on a debt — be it credit card debt, an auto loan, a student loan, or any other type of installment loan — and writes it off as bad debt.

When you have a late payment, a lender will report it to each credit bureau as 30 days late, 60 days late, or 90 or more days late. Once you’re in the last stage, the lender can decide at any time to charge-off your account. This is a mostly clerical process that moves your debt from an active file to an inactive file and allows the lender to write off the bad debt for tax purposes.

When you have a late payment, a lender will report it to each credit bureau as 30 days late, 60 days late, or 90 or more days late. Once you’re in the last stage, the lender can decide at any time to charge-off your account. This is a mostly clerical process that moves your debt from an active file to an inactive file and allows the lender to write off the bad debt for tax purposes.

When this happens, the lender can decide to sell your debt to a debt collection agency to recoup some of its lost money. If you have a charge-off for a car loan, the lender can begin the process of repossessing your vehicle. A mortgage lender will typically start the foreclosure process of your home following a charge-off.

You can typically avoid this process by contacting your lender to create a plan to get back on track with your payments. Lenders don’t want to sell your debt at a loss and are often willing to renegotiate your monthly payment terms to help you bring your account back into active status.

You may also consider an installment loan for debt consolidation that will bring your account active or research debt settlement programs that may allow you to pay less than what you owe to settle the debt.

Is it Better to Pay Off Collections or Charge-Offs?

Paying off your collection or charge-off accounts will make you look better in the eyes of future potential lenders, but you will still see a hit on your credit score from the previous late payments.

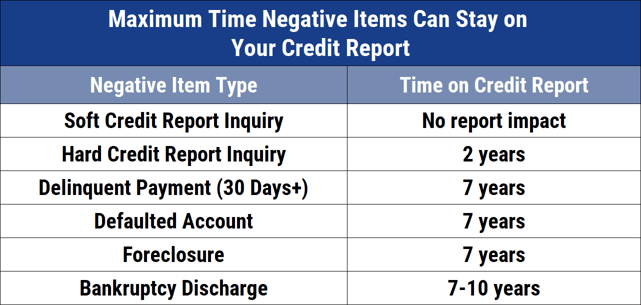

Collections or charge-off accounts show that you have seriously delinquent debt. When you repay the amount owed (or whatever amount you agree to in debt settlement), the loan is reported to the bureaus as settled, but still remains on your credit history for seven years.

In some cases, you can negotiate a pay for delete deal with the creditor to have the item deleted from your credit history if you pay the amount owed in full.

In the case of a collections account, this deal would remove the collection from your credit history, but the late payment reports from the original creditor would remain. This will still cause damage to your credit score.

Before you consider paying off a collections or charge-off account, be sure to request a debt validation letter from the debtholder. This letter will detail how much you owe and the source of the debt. Make certain that the number is correct before agreeing to pay any amount.

By law, a lender must provide a debt validation letter if one is requested.

What’s the Difference Between a Secured and Unsecured Credit Card?

A secured credit card will require a refundable security deposit for approval and an unsecured credit card will not require any upfront deposits to open your account.

The amount of your security deposit typically matches your secured card’s credit limit. Aside from the deposit requirement, secured and unsecured cards act very much the same way at the register. Other differences and similarities include:

- Both will report your payment history and balance to at least one credit bureau, which will help improve your credit score with responsible use.

- Unsecured cards for bad credit may have low initial credit limits, whereas many secured cards will allow you to choose your credit line based on the amount of your security deposit.

- Unsecured cards require a credit check for approval, but some secured cards will skip the credit check altogether.

- Many secured cards have lower interest rates and fees than their unsecured siblings.

While a secured credit card has higher upfront costs due to the deposit requirement, you can still save money over the long term by avoiding annual fees and other charges that you’ll never get back. You’ll receive a complete refund of your security deposit when you cancel your card account as long as you have no outstanding debts to the bank at the time.

Can I Get Collections or Charge-Offs Removed From My Credit Report?

In some cases, you can negotiate a pay-for-delete deal with a debtholder that will have the negative reporting removed from your credit report in exchange for full repayment of the debt. This is a controversial tactic, though, as it falls in a gray area in legal terms.

You can also consider hiring a credit repair firm to take on the task of contacting the lender on your behalf. Lexington Law, for example, partners with credit lawyers and paralegals around the U.S. who maintain relationships with lenders, and can leverage their expertise in an attempt to remove these negative items from your credit report.

Credit repair isn’t guaranteed. Technically, any legitimate negative item on your credit profile is supposed to stay there until it ages off. In some cases, though, you may be able to have that item removed before their expiration date.

Compare the Best Credit Cards After Collections or Charge-Offs

Mistakes happen in life. What’s important is how you get up, dust yourself off, and get back in the game. With the best credit cards after collections or charge-offs, you can begin to rebuild your credit while maintaining access to a secured or unsecured line of credit.

With timely payments and a low balance, you can begin to replace previous negative items on your credit report with new, positive data. Over time, you will see a positive shift in your credit score that can help you qualify for a better — and more affordable — credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Credit Cards for Approval With Old Charge Off ([updated_month_year]) 8 Credit Cards for Approval With Old Charge Off ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1523119754.jpg?width=158&height=120&fit=crop)

![What is a Charge Card? Definition + 3 Top Cards ([updated_month_year]) What is a Charge Card? Definition + 3 Top Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/what-is-a-charge-card--1.png?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)