Post-bankruptcy credit cards are a subset of the overall credit card market. If you have completed a bankruptcy filing and are looking to get a new credit card, you are likely to find that many credit cards are not available to you.

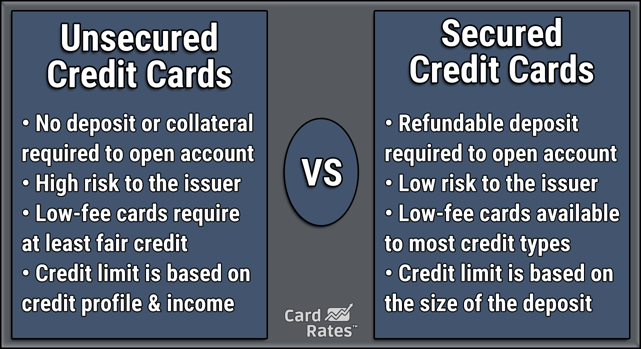

These post-bankruptcy credit cards are specifically targeted toward those whose credit and credit card debt history is less than ideal. Some post-bankruptcy cards are unsecured while others require a security deposit upon approval.

So, if you have late payments or a payment history that is not perfect, these credit cards may be worth checking out.

Unsecured Cards | Secured Cards | FAQs

Unsecured Post-Bankruptcy Credit Cards

Unsecured post-bankruptcy credit cards require no deposit or funds to secure the credit line associated with the card. A credit card company or other card issuer will often attach other securities to an unsecured card for someone with a lot of credit card debt or poor credit history — including bankruptcy.

This could be a higher APR, a high annual fee, or other fees associated with having the card. Make sure you review the details before signing up for any new credit card.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

The Surge® Platinum Mastercard® is specifically designed for people who have no credit history or a poor credit score.

The Surge Mastercard does have a hefty annual fee, and it also charges monthly maintenance fees that are waived during the first year of having the card. The lender also assesses fees for a returned or late payment, cash advances, and additional credit cards.

Surge reports payment history to each credit bureau, and with as few as six on-time monthly payments, Surge will review your credit card account for a possible credit line increase.

2. Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay says it all in its name: prior bankruptcies are okay. There are actually three separate products available under the Indigo name, and the exact credit terms depend on which card you’re approved for. You’ll be approved for a specific unsecured credit card based on your past debt and credit history and creditworthiness.

You may be charged an annual fee and/or setup fees based on your specific situation. The amount of setup fees will be automatically assessed and subtracted from your total available credit limit.

Like many post-bankruptcy credit cards, the Indigo Unsecured Mastercard reports payment history to each major credit reporting agency. You also have the ability to easily access your account from a mobile device, allowing you to review your account while on the go.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 - $125

|

Bad, Fair, or No Credit

|

The Reflex® Platinum Mastercard® is another post-bankruptcy credit card that is targeted to those with no, little or poor debt or bad credit history.

The Reflex® Platinum Mastercard® comes with an annual fee as well as a monthly maintenance fee that is not charged during the first year of card membership. There are also fees for additional cards, a returned payment, or a late payment. You can use the Reflex® Platinum Mastercard® anywhere that Mastercard is accepted, and you will have $0 in fraud liability.

After six months of monthly payments, your credit card account will be reviewed for a possible credit limit increase. Your payment history with the Reflex® Platinum Mastercard® will be reported to all three major credit bureaus, which can help you build or re-establish credit history.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

The Milestone® Mastercard® accepts applicants with less than favorable credit history. If you have a bankruptcy filing or a bankruptcy discharge on your credit report, you are welcomed to submit a quick and easy application online.

The annual fee on the card will be assessed when you open the account and will be subtracted from your overall available credit line.

You are not eligible to be approved for a Milestone Mastercard if you already have an existing Milestone Mastercard account or if you’ve ever had a Milestone account that was charged off due to delinquency. The Milestone® Mastercard® reports payments to each credit bureau as a way to help you build or repair your credit history.

5. Progress Credit

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Progress Credit offers both an unsecured Visa card as well as a secured Mastercard card. The Progress Credit unsecured Visa is a real Visa card — not a debit card or a prepaid card. You can get an application decision in as little as 60 seconds, and you can choose from one of six different designs for your unsecured credit card.

The Progress Credit credit card comes with a one-time program setup fee, which is assessed upon account approval and subtracted from the initial credit line.

You’ll be charged an annual fee beginning in your second year of card membership and have to pay monthly maintenance fees. You will also be assessed fees for additional cards, cash advances, a late payment, and returned payments.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair, Bad Credit

|

The Total Visa® Card is an unsecured credit card that can be used anywhere Visa is accepted. When you apply, you can choose from one of six different card designs for your card.

Your payment history will be reported to all three credit bureaus, and you can get an approval decision in as little as 60 seconds. You must have a checking account to apply for the Total Visa® Card.

The Total Visa® Card comes with some extensive fees and a high interest rate. The APR for this card is at the high range, even for credit cards targeted to those who have a bankruptcy discharge on their credit report.

You’ll also pay a program fee AND an annual fee upfront, as well as a monthly maintenance fee, though the maintenance fee is waived the first year.

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99%

|

$99

|

Fair/Poor/Bad

|

The FIT™ Platinum Mastercard® offers potential applicants two useful features. First, it will give you access to your credit score when you sign up for electronic statements. Then it will automatically and periodically review your account for potential credit line increases after six on-time monthly payments. You are not liable for any fraudulent use of your card and can use your card anywhere within the global Mastercard network.

The FIT™ Platinum Mastercard® is an unsecured card that comes with a wide array of fees you will want to be aware of, including a one-time program setup fee and a recurring annual fee. You’ll also be charged monthly maintenance fees starting in the second year of card membership.

The card also assesses fees for additional cards, late payments, returned payments, and cash advances. The APR on the FIT™ Platinum Mastercard® is in the average range as compared to other post-bankruptcy credit cards.

- Earn 1% cash back rewards on payments made to your First Access Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Bad Credit

|

The First Access Visa® Card is offered by another credit card issuer that targets people who have bad credit including a possible bankruptcy. As the name suggests, you are able to use this unsecured credit card anywhere within the Visa network. A checking account is required to be approved for this card, and the status of your monthly payments is reported to each credit bureau.

The First Access Visa® Card comes with a one-time program setup fee and an annual fee. In the second year, you’ll pay a lower annual fee but you will begin paying monthly maintenance fees for having the card. These monthly maintenance fees are waived the first year but begin in the second year you have the card.

You’ll also be charged for late payments, returned payments, and cash advances. The APR on the First Access Visa card is higher than that of other cards of this type.

Secured Post-Bankruptcy Credit Cards

While having access to an unsecured credit card is a solid financial goal, if your past credit card debt or credit history does not support it, you may be better off with a secured card. A secured credit card requires you to make a refundable deposit to the credit card issuer. This deposit amount becomes your credit line.

If you default on your secured card, then the bank will keep your security deposit — but if you close the account with a $0 balance, then the credit card company will return your deposit.

Because you are putting your own money down, secured credit cards usually come with lower fees and a lower interest rate. So if you’re able to come up with enough money to put down a deposit on a secured card, you will likely save yourself a lot of money on fees.

Getting a secured credit card — instead of an unsecured card that charges users hundreds of dollars in combined program setup fees, annual fees, and monthly maintenance fees — can be one of the best returns on your investment ever.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

The Capital One Platinum Secured Credit Card comes with no annual fee and no program setup fee. There are fees for late payment or for cash advances, but those fees can be easily avoided. This is a real Mastercard that reports payment history and status to the credit bureaus, not a prepaid card or debit card, and you can use it anywhere in the Mastercard network.

Your initial credit line with the Capital One Platinum Secured Credit Card is based on the amount of money that you put down as a refundable deposit. The larger your deposit, the higher your initial credit line will be. You are required to have access to an authorized bank account to make your initial security deposit.

The APR on this secured card is high but in line with other secured credit cards. With the Capital One Platinum Secured Credit Card, you will also be automatically considered for a higher credit line after as little as six on-time monthly payments.

- Better than Prepaid...Go with a Secured Card! Load One Time - Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR - Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit - Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

9.99% Fixed

|

$48

|

Poor/Fair/Limited/Damaged

|

The Applied Bank® Secured Visa® Gold Preferred® Credit Card is another option for people with bad credit looking for a secured credit card. You must make a minimum deposit when opening the account, and your initial credit line will be determined based on your deposit amount.

You can increase your credit line by making additional deposits at any time. The Applied Bank® Secured Visa® Gold Preferred® Credit Card does report monthly payment history to all three credit bureaus.

The Applied Bank® Secured Visa® Gold Preferred® Credit Card states that approval is guaranteed and that there is no credit check or minimum credit score required. But while the card has an APR that is significantly lower than some of the other credit cards in this list and no penalty APR, there are some significant trade-offs.

Unlike many other credit cards, there is no grace period for interest, even on purchases. Interest starts accruing on the transaction date, so even if you pay your balance in full on your monthly statement, you still may be charged interest.

Cardholders also pay an annual fee and fees for additional cards, replacement cards, cash advances, optional payments, stopping payments, and reinstatement.

11. Bank of America® Customized Cash Rewards Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Bank of America® Customized Cash Rewards Secured Credit Card is a Visa card that reports payment status and payment history to all three major credit bureaus. With on-time and regular monthly payments, this can be a great way to build up your credit report and have access to an increased credit line. You can track your credit-building progress on Bank of America’s website or mobile app, where you get free access to your FICO score each month.

You are required to put a minimum amount down as a refundable security deposit to open this secured card. Bank of America will periodically review your account and payment history and possibly refund some of your initial deposit proactively.

The Bank of America® Customized Cash Rewards Secured Credit Card charges fees for late payments, returned payments, and cash advances, but no annual or monthly maintenance fees. If you don’t pay off your balance each month, you will be charged a high APR, but lower than that charged by other post-bankruptcy credit cards.

One feature of the Bank of America® Customized Cash Rewards Secured Credit Card that distinguishes it from some of the other secured cards is that it gives you the ability to earn cash back rewards that don’t expire as a rebate on your spending.

12. BankAmericard® Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to BankAmericard® Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

Similar to the Bank of America® Customized Cash Rewards Secured Credit Card, the BankAmericard® Secured Credit Card is offered by Bank of America and is designed those who have no, limited, or bad credit history. You will need to make a minimum refundable deposit at the time of application.

Bank of America will periodically review your account and may increase your credit limit or refund some of your deposit based on your overall credit history.

You’ll pay no annual fee on the BankAmericard® Secured Credit Card and the APR is lower than that of some other cards in this category. The card charges fees for returned or late payments, cash advances, foreign transactions, and balance transfers.

Cardmembers will also be able to access their FICO score monthly through Bank of America’s online banking site and mobile app.

Can I Get Approved for a Credit Card After Bankruptcy?

It is possible for a debtor to get approved for a credit card after bankruptcy, but you’ll want to make sure you are in a stable financial situation. Many bankruptcies are caused by the inability to pay medical bills or manage other unforeseen or one-time financial situations that are difficult to recover from.

If that was the case for you, you may be in a better position to be approved for a credit card after bankruptcy. You’ll want to make sure that you are managing your financial responsibilities well, including controlling your spending, adhering to a budget, regularly saving a portion of your paycheck, and maintaining a good credit rating.

This also means you have stable job and housing situations and an emergency fund to handle the unexpected. You’ll want to start with some of the credit cards on this list that are targeted for people who are recovering from a bankruptcy filing.

Which Credit Cards are Good for After Bankruptcy?

You can start your research with some of the cards on this list. They all are specifically designed for people who have no, limited, or bad credit history — even prior bankruptcies. Our top-rated unsecured card is the Surge® Platinum Mastercard®, and our top-rated secured card is the Capital One Platinum Secured Credit Card.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 – $125

|

See website for Details*

|

- No annual or hidden fees. See if you’re approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

You likely won’t be approved for higher-tier credit cards right away with a past bankruptcy on your credit report. You’ll need to build your credit history, your credit score, and your history of on-time payments.

Rebuilding your credit rating can take time, and it’s wise not to rush into getting a new credit card too soon.

Once you have built your credit score back up a bit, it may be time to apply for a new credit card. Be realistic about your financial situation — you can check your credit reports to get an idea of how you will appear to lenders.

Can I Get the Same Credit Card After Bankruptcy?

Whether you can get the same credit cards you had before your bankruptcy filing depends on which cards you had. If you had a credit card that was targeted for people with good or excellent credit, you will likely not be able to get the same credit card after bankruptcy.

Some companies also specifically prevent people who have a previous discharge on the same credit card from being approved in the future.

Your best bet is to take it slow and put yourself on solid financial footing before you start applying for a new credit card. Make sure that you have an emergency fund in place, and then save up money to be able to put down as a refundable deposit for a secured credit card.

As you start making regular on-time monthly payments, your credit score will improve along with your overall financial picture.

Will American Express Approve After Bankruptcy?

American Express is known to be much stricter about approving a new credit card for applicants after a bankruptcy. In fact, American Express will often immediately close down credit card accounts once it becomes aware that a cardholder has entered the bankruptcy process.

It is possible for American Express to approve you after bankruptcy — it just takes time.

Focus on building up to a good credit score by making solid financial decisions. Build up an emergency fund and stabilize your income, and you will be well on your way.

A new Amex card may be a bit of a status symbol, but it’s best to focus on other credit cards first post-bankruptcy.

How Long After Bankruptcy Can I Get an Unsecured Credit Card?

Most lenders or credit card companies will not approve you for a card while you are going through the bankruptcy process. After your bankruptcy is discharged, the amount of time it takes before you’re likely to be approved for an unsecured credit card depends on which type of bankruptcy filing you did.

You could be approved for a new credit card after just months of filing bankruptcy through Chapter 7. But it could take years before you are approved for a new card if you filed for Chapter 13 bankruptcy.

Before you apply for a new credit card post-bankruptcy, look at your overall financial situation. You want to make sure that your financial habits and situation have changed from those that caused you to file bankruptcy. If your situation is the same or similar, you may find yourself heading right back toward bankruptcy.

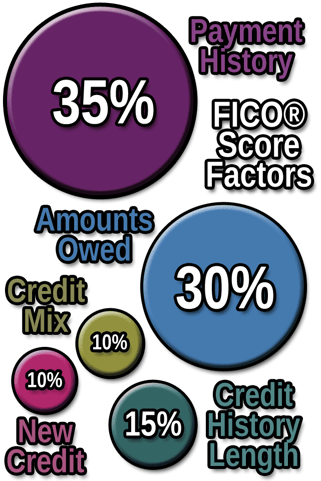

How Do I Rebuild My Credit After Bankruptcy?

There are no easy roads or secret tricks to rebuilding credit after bankruptcy. Post-bankruptcy, you are given a bit of a fresh start from past obligations to work on building credit back up.

The best way to rebuild your credit after bankruptcy is to focus on paying your monthly bills on time, every month. If you have a car loan or other installment loan, make sure that you are making those monthly payments each month.

Do your best to minimize signing up for new credit and focus on building up an emergency fund. Having an emergency fund to handle unexpected expenses is another good way to rebuild your finances.

One way to build savings and your credit history is through a credit builder loan. These are available through specialized online lenders or your local credit union.

Having a checking account or savings account can be another good step toward building credit history.

You may be anxious to get a new credit card as soon as possible, but most unsecured credit cards for poor credit come with significant upfront and ongoing fees. It may be better to wait and focus on getting a secured credit card that comes with lower or no fees.

What Options Do I Have if I’m Declined for Credit?

If you’re declined for credit, you may want to take an honest look at your situation. This can help you determine what type of credit card or installment loan you should be applying for.

If you are having trouble being approved for an unsecured card, consider getting a secured credit card instead.

Your best bet is to find a creditor that offers a credit card that is targeted to people who are coming off a bankruptcy. Finding a creditor or lender that specializes in lending to people who have a bankruptcy on their credit report isn’t impossible — this page has several examples. You’ll just need to be diligent about checking the interest rates, fees, and other information for the new credit card.

What is the Difference Between a Secured Credit Card and an Unsecured Credit Card?

An unsecured credit card is one in which the credit card company gives you a specified credit line without any security deposit backing the credit line. With an unsecured card, there is no monetary deposit required to be approved for the credit card.

Depending on your overall credit profile, a lender may not be willing to give you unsecured debt. In that case, a secured credit card or secured loan may be an option.

With a secured loan or secured credit card, you put down a portion or all of your credit limit as part of the application process. If you default on secured debt, then the credit card company will keep your security deposit.

Post-Bankruptcy Credit Cards Can Help You Start Anew

The best post-bankruptcy credit cards featured above can help you begin to rebuild your credit when you make your payments on time and keep your balance well below the credit limit. These cards are meant as tools to help you begin fixing your credit score, rather than a means of financing purchases over time.

Remember that these cards generally charge high APRs and fees to offset the risk you pose as a borrower with bad credit, so read the terms carefully before deciding to apply. But with responsible use and a little time, your score should rise and you can graduate to a better card offer with better terms and a higher credit limit.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Credit Cards After Bankruptcy Discharge ([updated_month_year]) 9 Best Credit Cards After Bankruptcy Discharge ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/after-bankruptcy.png?width=158&height=120&fit=crop)

![7 Unsecured Credit Cards After Bankruptcy ([updated_month_year]) 7 Unsecured Credit Cards After Bankruptcy ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Unsecured-Credit-Cards-After-Bankruptcy.jpg?width=158&height=120&fit=crop)

![7 Best Auto Loans After Bankruptcy ([updated_month_year]) 7 Best Auto Loans After Bankruptcy ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/09/Best-Auto-Loans-After-Bankruptcy.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)