Interest charges for credit card purchases don’t have to cost an arm and a leg — or even a finger or toe.

With its relatively high interest rates, credit card debt can be among the most expensive debt you’ll ever experience. But a few smart habits can set you up to never pay a penny of credit card interest, which can save you hundreds or thousands of dollars that you can reallocate to higher priorities, such as living expenses, savings, and investments.

The first thing you need to know to accomplish this feat is when the interest starts on your cards.

It Depends On Your Card’s Billing Cycle

The day credit card interest starts depends on the card’s billing cycle and its grace period.

Most cards use a monthly billing cycle, which means you’ll normally receive one bill each month. Each bill will have a minimum payment and payment due date printed on it. You must pay at least the minimum on or before the due date to keep the card in good standing.

Most due dates include a grace period of about 21 days. During this period, you can carry your current purchases as a balance without paying purchase interest. The grace period generally starts the day your card’s billing cycle closes and ends on the day your payment’s due.

The exact dates for billing cycles, grace periods, and payment due dates may vary from month to month due, in part, to weekends, holidays, and months of differing lengths (i.e., 28, 29, 30, or 31 days).

If you don’t pay at least the minimum on or before the due date, interest will be added to the balance. The applicable APR will be applied to your balance, and the balance will carry over into the next billing cycle. Interest will continue until your balance is paid off.

Cash advances are a special case. There’s typically no grace period for these transactions. Instead, interest charges start when the cash is withdrawn.

Your Interest (APR) Is Based On Several Factors

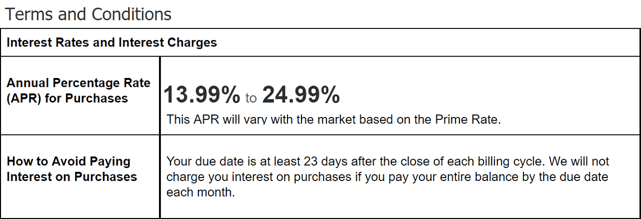

Credit card interest is usually expressed as annual percentage rates, or APRs. Each card may have multiple APRs that can be used to calculate interest.

For example, a card may have:

- An APR for an initial balance that’s not paid within the grace period or a balance that’s carried over from a previous billing cycle.

- An APR for new purchases during a billing cycle.

- A temporary or lower promotional APR for new purchases, outstanding balances, or balance transfers with a new card.

- A penalty APR for new purchases and existing balances after a late or missed payment.

The specific APRs you’ll be charged depend on the prime rate, your bank’s rate policies, the type of card you have, and your credit scores.

If you have good or excellent credit, you should be able to qualify for most cards, including many with a more attractive range of APRs. With fair credit, you may still qualify for many good cards, although the range of APRs likely will be somewhat higher. With poor credit, you likely won’t qualify for most unsecured cards with relatively attractive rates.

Most Cards Offer an Interest-Free Grace Period

Most cards don’t charge interest for new purchases if you pay your balance in full on or before the due date each month. If your card doesn’t offer a grace period, interest charges can start immediately for every purchase you make.

The charges you don’t pay become your unpaid or outstanding balance. Unpaid balances are rolled over, or carried over, to the next month — and the next and so on until you pay them off.

The grace period doesn’t apply when amounts are carried over, so interest charges continue to be added daily until the balance is paid.

Because interest doesn’t stop once it starts, your balance could increase from one month to the next, even if you made a partial payment or didn’t use your card for any new purchases.

Card interest is usually charged daily, even though it doesn’t appear on your statement until your billing cycle closes. Interest that’s charged daily is called compound interest. Interest that’s charged monthly is known as simple interest.

Compound interest costs you more than simple interest because you’re paying interest every day on your balance plus your accumulated previous interest. The minimum payment printed on your statement may not be high enough to pay off all the interest charges for that month.

How to Pay $0 Credit Card Interest

Avoiding paying credit card interest may not be easy, but it’s an excellent financial habit to learn. If you’re disciplined about it, you can use cards for their convenience, reward programs, and other perks without ever paying interest.

The secret is to pay your balance in full every month on or before the due date (i.e., within the grace period). If you’re not able to make your payment every month, you may need to rethink your budget or spending habits.

If paying off your balance each month isn’t possible, you can reduce the amount of interest you pay by making more than one payment each month. You don’t have to wait until your payment is due to make a full or partial payment. Pay more and pay sooner whenever you can.

A Balance Transfer Can Lower Interest Charges

If you’re already carrying a balance, you may be able to stop paying interest for a while with a new balance transfer card. Balance transfer cards give you a lower promotional APR, often 0%, for balances that you transfer from other cards.

Balance transfers usually charge a fee of between 3% and 5% of the amount transferred. The amount you can transfer is usually capped.

Balance transfers aren’t a cure-all for unaffordable card debt, but they offer a short-term respite for you to pay off amounts you already owe with lower or 0% interest. Here are our top three balance transfer card recommendations:

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% – 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% – 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

When you transfer a balance, keep track of the date when your promotional rate ends, and try to pay as much of your balance as you can before then. The full APR will likely be much higher than the promotional APR.

If a balance transfer doesn’t give you enough relief to manage your debt, you may need to consider other options, such as a card repayment plan.

When you shop for a balance transfer card, look for one that has no annual fee, a promotional 0% rate for new purchases, and a competitive rate for any balance you carry over after your promotional balance transfer period ends.

Some great balance transfer cards offer 0% rates for up to a year or longer.

How to Calculate Credit Card Interest

You don’t typically need to calculate credit card interest yourself. Instead, your interest charges will be calculated for you by your card issuer and included in your balance for each billing cycle.

If you want to figure out in advance how much interest you’ll be charged for a specific transaction or balance over a set period, the best option is to use an online interest calculator.

Alternatively, you can make rough calculations with paper and a pencil. You’ll need to know the amount of the purchase or balance and your APR for that amount.

The first step is to divide your APR — the annualized rate — by the number of days in the year. The result is the daily periodic rate or DPR.

Some card companies use a 360-day year; others use a 365-day year. The 360-day year is a convenient fraction based on 12 months, each with exactly 30 days.

The difference between a 360-day year and a 365-day year generally isn’t material for most basic interest calculations. For example, a 25% APR with a 365-day year results in a DPR of approximately 0.068493%. The same APR with a 360-day year results in a DPR of approximately 0.069444%.

A DPR of 0.068493% 0.069444% adds about seven cents ($0.07) for each $100 of your outstanding balance each day.

If your outstanding balance were, say, $3,500, you’d owe about $2.45 in interest for one day. For 30 days, the interest would amount to about $74. Here are the calculations:

$3,500 / $100 = 35

35 x $0.07 = $2.45

$2.45 x 30 days = $73.50

This calculation isn’t accurate to the penny because it doesn’t compound the interest daily, but it’s still useful as a quick guide. For a relatively short period and a modest balance, the difference likely won’t be material.

Over a longer period, you can use the APR rather than the DPR to calculate the interest.

If you want an exact calculation for a period less than one year, you’ll need to contact your card company and ask whether they use a 360-day or 365-day year for your card.

Are You Ready to Change Your Card Habits?

Despite the popular perception, credit card interest isn’t evil. Nor is it necessarily a poor financial habit to pay some card interest from time to time. Interest is simply the price you pay for the privilege of carrying a balance from one month to the next. Many people choose to pay that price.

If you’ve fallen into the habit of paying high interest charges and you’re looking for some relief, 0% balance transfer offers, 0% promotional rates for new cards, and a firm resolve to curtail your spending and pay down your balances may help you avoid more interest charges in the future.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How Does Credit Card Interest Work? ([updated_month_year]) How Does Credit Card Interest Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/interestworks.png?width=158&height=120&fit=crop)

![What is Deferred Interest & How Does it Work? ([updated_month_year]) What is Deferred Interest & How Does it Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1759160015.jpg?width=158&height=120&fit=crop)

![How to Start Building Your Credit at 18 ([updated_month_year]) How to Start Building Your Credit at 18 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/04/How-to-Start-Building-Credit-at-18.jpg?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![How Long Does It Take to Get a Credit Card? ([updated_month_year]) How Long Does It Take to Get a Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/howlong2--1.png?width=158&height=120&fit=crop)

![How Does a Prepaid Credit Card Work? ([updated_month_year]) How Does a Prepaid Credit Card Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/How-Does-a-Prepaid-Credit-Card-Work.jpg?width=158&height=120&fit=crop)