In the following article, we’ll present some of our experts’ top picks for the best no-interest credit cards.

As any gardener knows, weeds are capable of multiplying exponentially in a matter of weeks if left to grow in the garden untended. The very same thing can happen, as many cardholders learn, if you allow your credit card’s interest fees to grow without interference.

But, the same way a good bit of mulching can help keep weeds in check without constant supervision, so, too, can a solid introductory 0% APR offer help keep interest fees from accumulating on your credit card without needing to pay your balance in full each month.

However, while any gardener with a few bucks can pick up a bag of mulch, only cardholders with good credit or better can typically qualify for a quality no-interest credit card. Our favorite offers include exceptionally long promotional periods as well as extras like purchase rewards or cellphone protection. Have a look at our picks, including the best overall cards, cards for new purchases, balance transfer cards, and more.

Overall | New Purchases | Balance Transfers | Rewards | Student | Business | FAQs

Top Overall Cards for No Interest Fees

The reasons for seeking out a no-interest credit card are just as varied as the cards themselves, so the best card for any given consumer will depend on what they really want out of the card. For example, if your only concern is having a 0% APR, then you may pick a card with a longer promotional period but no perks.

On the other hand, if you want to both earn rewards and save on interest, then you may be willing to exchange a few months of 0% APR for cash back or points. With these differences in mind, our top overall cards with no-interest offers include both exceptionally long promotional periods as well as an option for consumers seeking rewards.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The unlimited cash back earned on every purchase means cardholders can rack up solid rewards on their new purchases while enjoying the ability to pay an introductory 0% interest on those purchases during the promotional period. The card also offers an attainable signup bonus, and it charges no annual fee.

The Capital One Quicksilver Cash Rewards Credit Card is a solid option for saving on interest thanks to its long 0% APR introductory offer good on both new purchases and balance transfers.

In addition to a competitive introductory offer, this card comes with a number of benefits, including unlimited cash back, free FICO credit scores and $0 liability protection.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

Another card with a crazy long period of no interest, this option allows you to make qualifying balance transfers up to four months from the date of account opening. The balance transfer fee is on the high side, but the long promotional period can be well worth the fee for big balances. Plus, the card charges no annual fee that will add to your costs.

Honorable Mentions: While our top three cards are good overall picks, if you have a specific use in mind for your card, you may want a more specialized option. The Amex EveryDay® Credit Card is worth a mention if a balance transfer is your goal, while the Capital One SavorOne Cash Rewards Credit Card can help you earn while you save.

Top Cards for No Interest Fees on New Purchases

Before 0% APR offers were common, financing a big purchase for six months or so would have meant a costly installment loan. Now, consumers with good credit can get 12, 15, or even 18 months with no interest on new purchases with the right introductory 0% APR credit card offer.

What’s more, if you select a card that offers both an introductory 0% APR and purchase rewards, you can both save on interest and earn rewards on your new purchases at the same time. Pick a card with no annual fee for even more savings.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

This card is also one of our top overall picks — and for good reason. Not only does the card have a long promotional period and no annual fee, but it also provides unlimited cash back rewards on every purchase, with no rotating categories to track or activate. Plus, if you happen to have a card that earns Ultimate Rewards® points, you can turn that cash back into points, allowing you to get extra value from your rewards.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

On the surface, this card offers most of the same features as the Chase Freedom Unlimited®, including promotional APR periods and unlimited cash back rewards potential on every purchase. However, what this card has going for it is that it isn’t subject to Chase’s strict 5/24 Rule, which makes this card much easier to get for anyone with more than a handful of credit cards.

Honorable Mentions: If your new purchases will fall into a common rewards category, then the Discover it® Cash Back and the Chase Freedom Flex℠ could be good picks. If you’re just interested in a long promotional period for a big purchase, the U.S. Bank Visa® Platinum Card is well worth a mention.

Top Cards for No Interest Fees on Balance Transfers

When you’re carrying expensive credit card debt, a good balance transfer offer can easily save you hundreds of dollars in interest fees. And that’s even after you include the 3% to 5% balance transfer fee charged by most credit cards.

The main downside to a balance transfer interest rate offer is that most will require you to make your transfers within a few months of opening your account, so be sure you’re ready to transfer your debts when you apply for your new card.

6. Discover it® Balance Transfer

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The Discover it® Balance Transfer is no longer available and the offer details may be outdated.

This card is designed for balance transfers, and it offers a nice long promotional period for its introductory APR offer on transfers. While you won’t earn rewards on balance transfers, the card’s cash back purchase rewards mean it can still be useful long after your introductory offer expires.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

This card’s introductory 0% APR period takes the cake in terms of length, but its balance transfer fee is a bit higher than that of other card issuers. Either way, this card charges no late fees or penalty APRs and has a fairly low ongoing APR after the promotional one ends.

Honorable Mentions: If you’re really concerned about paying a balance transfer fee, credit unions can be a good place to find cards without balance transfer fees. The Citi® Diamond Preferred® Card and the U.S. Bank Visa® Platinum Card charge transfer fees, but they offer really long promotional periods.

Top Rewards Cards with No Interest Fees

One of the best things about the introductory 0% APR deals that come with most open-loop credit cards is that you can still earn rewards on all of your new purchases while the no-interest offer is active. So, you can both earn cash back and carry a balance without fees with the right card.

That being said, don’t expect the top-tier rewards cards to come with intro-APR offers; none of the big-budget points cards will offer you a no-interest deal. However, you can still find a range of cards that offer good rewards, no annual fee, and additional cardholder benefits, all while giving you well over a year of 0% APR on your purchases.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

One of the quintessential cash back cards, you’ll get both a long intro-APR period and the potential for lots of rewards if you can align your purchasing with the card’s bonus categories.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

This card not only offers a long introductory period, but it also comes with 3% cash back on dining, grocery store, and entertainment purchases, making it an ideal pick for financing a family vacation or other big event. And, in addition to a no-interest offer and solid rewards, the card also charges no annual fee and comes with an attainable signup bonus.

Honorable Mentions: Another good rotating rewards card with an intro-APR offer is the Chase Freedom Flex℠, which offers categories similar to the Discover it® Cash Back. You can also find good introductory offers from cards with unlimited flat-rate rewards instead of bonus categories like the Capital One Quicksilver Cash Rewards Credit Card.

Top Student Cards with No Interest Fees

Being a student can come with a lot of expenses. And what’s worse, those expenses tend to come in waves — often right at the beginning of the semester. Student credit cards with 0% interest offers can be valuable tools for those semesters when you just need a little time to catch up on college costs.

Although you can find student cards with decent introductory offers, student credit cards are primarily designed to help build credit, so don’t expect an 18-month top-shelf interest rate deal. But, you can still get six months or more of 0% APR on your new purchases if you pick the right card.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

This card is a good student credit card on nearly all fronts. New cardholders enjoy a decent promotional APR period on new purchases, with a lesser deal for balance transfers, plus cash back rewards. And that’s all in addition to the card’s competitive standard APR.

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students has one of the best introductory offers for students, providing a full year of 0% APR on both new purchases and balance transfers (must request the transfer within 60 days of account opening).

The card also offers some competitive rewards, giving users their choice of six different bonus rewards categories, plus 2% cash back on grocery store and wholesale club purchases. And the card never charges an annual fee.

Honorable Mentions: Most of the student credit cards from the major banks will come with some sort of intro-APR deal. The ones worth mentioning include the BankAmericard® for Students and the Wells Fargo Cash Back College℠ Card, which may also allow you to use a cosigner.

Top Business Cards with No Interest Fees

In the modern digital era, the types of expenses faced by your typical small business have shifted; instead of countless sheets of printer paper, we now have broadband and web hosting. But, while the expenses are different, they haven’t gone away, and a good business credit card with an intro-APR offer can be just as valuable as ever.

As with the consumer card market, you won’t get promotional APR deals from the top-tier cards, but you can still find business cards with solid interest rate deals that also offer purchase rewards. Introductory 0% APR deals for new purchases are common, though balance transfer offers are rarer in the business card world.

This card offers no-russ rewards in the form of cash back with no rotating categories or activations to concern yourself with. It also offers a long period of 0% interest to help you finance a large expense — all with no annual fee.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

Easily one of the best business credit cards overall, this card comes with a long intro-APR deal good on new purchases and charges no annual fee. It also has high-rate bonus rewards categories that can net cardholders extra cash back on things like wireless phone service and office supplies.

Honorable Mentions: The only other business cards from major issuers that offer a deal on balance transfers are the U.S. Bank Business Edge™ Platinum Card and the Wells Fargo Business Platinum Credit Card. For new purchases, consider the Chase Ink Business Unlimited℠ Credit Card for promotional terms and cash back rewards.

What is an Interest-Fee Grace Period?

While there’s no denying the utility of a good 0% APR interest rate deal, they do have a few downsides. For one thing, introductory offers are, well, introductory; the promotional rate will expire at some point, and the APR you’re charged will revert to the regular ongoing APR after your deal expires.

For another thing, the majority of credit cards with no-interest deals are marketed to consumers with at least good credit, which often puts them firmly out of reach of anyone with less-than-ideal credit. And, even if a so-so score doesn’t keep you from making it through the door, it will likely prevent you from obtaining a credit limit that allows you to take full advantage of an introductory offer.

In either case, you may not need a 0% APR offer to avoid paying interest on your credit card purchases. That’s because the vast majority of credit cards offer an interest-fee grace period on new purchases that can give you at least a few weeks of interest-free financing.

So, how does it work? Basically, credit cards with a grace period won’t charge you interest on your balance so long as you pay the balance in full before the due date. This means you have the time from when a purchase posts until the due date for that billing cycle to pay off your purchases without being charged interest.

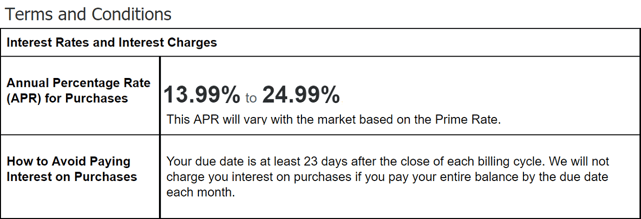

Your credit card’s grace period can be found on your cardholder agreement or terms and conditions documentation.

Generally, the due date for any given billing period must be at least 21 days from the end of the statement period, but some cards offer 25 days or more. This means that, depending on when you make your purchase, you could potentially gain six weeks or more of interest-free financing without needing a special deal.

The caveat here is that you really do need to pay off the full balance to avoid interest. If you only make a partial payment, you’ll still be charged interest on your balance. And, of course, if you don’t pay at least the minimum, you’ll be charged both interest and, likely, a late payment fee.

Do No-Interest Cards Hurt Your Credit?

Maintaining a positive consumer credit history has become a key part of good personal finances, but few schools offer a comprehensive education on how to establish and build good credit. As a result, there is a lot of confusion around what can impact credit scores.

In the case of credit cards with 0% APR offers, the answer is a little complicated. Technically, the new cardholder offer that allows you to pay no interest on your purchases or balance transfers won’t impact your credit by itself. It’s just like the signup bonus or the annual fee — it has no direct impact on your credit.

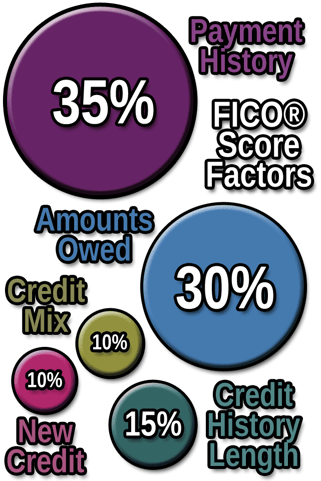

That being said, if you open a new credit card account (with or without an intro-APR offer), that action can impact your credit in a few ways, starting with the application. Each time you apply for new credit, the card issuer will check your credit profile to determine your credit risk. This results in a hard credit inquiry on your credit report.

One or two hard credit inquiries at any given time won’t have much impact on your credit scores. However, multiple hard inquiries in a short period of time can cause your credit score to noticeably decrease, as lenders and scoring algorithms consider it a sign that you may be trying to take on debt.

A new credit card account can also impact your average account age, which is a part of your credit history factor and can be worth up to 15% of your credit score. Creditors like to see long credit histories and prefer your average account age to be at least two years.

One potentially positive way opening a new card can impact your credit scores is by improving your credit utilization. Your credit card utilization rate is how much credit you are using over how much you have available; boosting your available credit — without taking on more debt — can improve your utilization and, in some cases, boost your credit score.

How Do 0% APR Credit Card Offers Work?

Using your typical 0% APR introductory credit card offer won’t generally require much work on the part of the cardholder once the application process is over.

Basically, you just need to find a card with an intro-APR offer and apply. If you’re approved, you’ll activate your new card as you would any other credit card and start swiping. Your promotional APR should be applied automatically, allowing you to carry a balance from month to month without accruing interest for the duration of the promotional period.

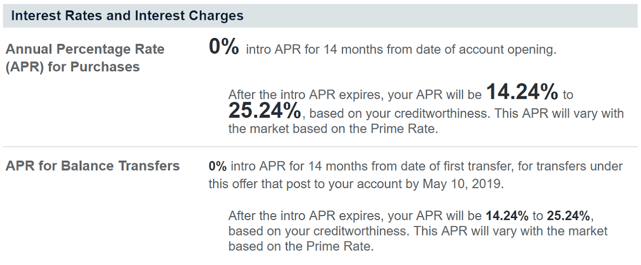

Introductory offers providing 0% APR will revert to a higher APR at the end of the offer terms.

Keep in mind that you’ll still need to make at least your minimum required payment each month the same as you would if you didn’t have a promotional APR — “no interest” is not the same as “no payments.” If you miss a payment or make a late payment, the issuer can (and usually will) terminate your promotional offer and start charging you interest at the regular APR.

So long as you keep your account in good standing, you’ll enjoy the 0% APR for the length of the promotional period. At the end of that time, your APR will revert to the regular or ongoing APR that is listed in your cardholder agreement. Any balance that remains past the end of the promotional period will start accruing interest at that rate.

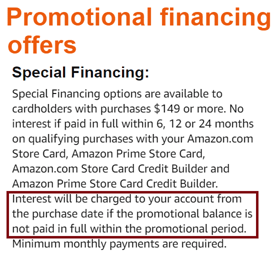

One thing that’s important to understand is that there is a big difference between a regular, open-loop credit card with an introductory 0% APR offer, and a store-branded credit card that offers special financing. While both types of deals can mean you pay no interest on your purchases, the special store financing likely has a potentially expensive addition: deferred interest.

Essentially, special financing with deferred interest gives you a set amount of time to pay off your purchases without interest. If you pay off your entire financed balance before the special financing expires, you pay no interest. However, if you have even a penny of your balance left when the offer ends, you’ll pay interest on the entire purchase amount from the beginning.

So, in summary, a bank-branded credit card that offers an introductory 0% APR reverts to the regular APR after the offer ends, but it won’t charge you back interest if you still have a balance. A store-branded credit card with special financing will typically include deferred interest and will charge you back interest on your entire purchase if any of the balance remains after terms expire.

What Is a Go-To or Regular APR?

As with most good things, the intro-APR offer that comes with a new credit card must come to an end eventually. Once your promotional rate expires, your new purchase and/or balance transfer APR will revert back to the regular APR, also sometimes called the go-to rate or ongoing APR.

The regular APR for any given credit card should be listed, along with all other important rate and fee data, in your cardholder agreement, as well as being included on your credit card statements. In most cases, the purchase APR and balance transfer APR will be the same, but some cards may charge different rates for each transaction type.

Your regular credit card APR is determined based on a combination of the specific card’s set APR range and your individual creditworthiness. For example, a given credit card may have a potential APR range of 13% to 18%; someone with good credit may be offered a regular APR of 13%, while someone with average credit would likely be offered a rate closer to 18%.

Although not widely known, you may be eligible to receive an interest rate reduction from your credit card issuer — if you ask for it. While issuers will rarely offer unsolicited APR decreases, studies have found that asking for a lower interest rate works more than half the time, and it can be especially effective if you’ve recently improved your credit scores.

Are Balance Transfers Bad for Your Credit Scores?

Similar to the question above about no-interest credit cards, this question has no real answers. At the basic level, no, the act of transferring a balance won’t, in itself, impact your credit scores. However, that being said, the effects of transferring a balance can impact your scores in several ways.

The initial impact on your credit will be from opening a new card. When you open a new card to get an introductory interest rate deal for your balance transfer, that new card can impact your credit scores with a hard inquiry and a reduced average account age.

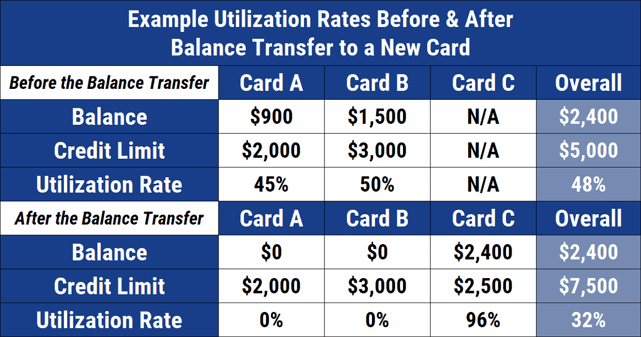

Additionally, a new credit card can also affect your utilization rates — effects that can become complicated once you start moving balances around.

Your utilization rate is the amount of credit you are using over the amount of credit you have available. For instance, if you have a credit card with a credit limit of $1,000 and a balance of $250, your credit utilization would be: $250 / $1,000 = 0.25 = 25%.

Creditors and scoring models will look at both your overall utilization rate — your total credit card debt over your total available credit — as well as the individual rates for each of your credit cards. Lower utilization is considered better for your credit scores.

So, when you open a new credit card (without taking on more debt), the credit limit for that card is added to your total available credit and your overall credit utilization rate improves. And that holds true even if you transfer some of your balances to the new card — as long as you don’t charge up any new debt, that is.

However, you need to be careful about how much debt you transfer to your new card. While it may seem like a good idea to move over as much debt as you can to take advantage of the lower rates, the more debt you put on one credit card, the higher that card’s utilization rate will climb.

A credit card with a high utilization rate — or, worse, a card that is maxed out (i.e., has a balance equal to its credit limit) — is seen as a serious credit risk. This can not only result in significant damage to your credit scores, but it may also cause you to be denied new credit lines.

On the plus side, that damage can be reversed simply by paying down your balance to reduce your utilization rate again. So, if you need to transfer a large amount of debt to a single credit card, be sure you can start paying it down quickly.

Don’t Let Interest Fees Hold You Back

In the spring and summer, leaving a garden untended can result in acres of weeds almost before you turn around. For high-interest credit cards, the potential for overgrown fees is year-round, making it necessary to always keep an eye on your balances and interest rates.

As with a good mulching, however, a good intro-APR credit card can help give you a little breathing room, making it easier to keep interest fees under control. Without worrying about interest fees taking over your balance, you can use your credit cards to affordably finance large purchases or pay down high-interest debt.

Of course, there is more to healthy credit than keeping interest fees in check. Be sure you work to keep your credit in good shape by ensuring you always make at least the minimum payment on time each month, and by keeping an eye on your credit utilization.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![11+ Best Low-Interest Credit Cards ([updated_month_year]) 11+ Best Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/low-int-1.png?width=158&height=120&fit=crop)

![8 Best Low-Interest Credit Cards with 0% Intro ([updated_month_year]) 8 Best Low-Interest Credit Cards with 0% Intro ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/low-interest.png?width=158&height=120&fit=crop)

![15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year]) 15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/cheap.png?width=158&height=120&fit=crop)

![6 Best No-Interest Credit Cards for 18+ Months ([updated_month_year]) 6 Best No-Interest Credit Cards for 18+ Months ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-No-Interest-Credit-Cards-for-18-Months-Feat.png?width=158&height=120&fit=crop)

![7 Best 0% Interest Credit Cards (Best ([updated_month_year]) 7 Best 0% Interest Credit Cards (Best ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_1620611278.jpg?width=158&height=120&fit=crop)

![9 Best Deals on Credit Card Interest Rates ([updated_month_year]) 9 Best Deals on Credit Card Interest Rates ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/INTEREST.jpg?width=158&height=120&fit=crop)

![7 Best Credit Card Interest Rates ([updated_month_year]) 7 Best Credit Card Interest Rates ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Best-Credit-Card-Interest-Rates.jpg?width=158&height=120&fit=crop)