Low interest credit cards are important when it comes to those big purchases that may require you to carry a balance for a while. This article explores some of the top low interest cards on the market today.

According to a 2018 survey on credit card ownership from Statista, more than half of the consumers from every age group over 18 reported using credit cards. Of those abstaining from card use, a common reason cited is the potential for accumulating debt.

They have a fair point; collectively, Americans owe more than $1 trillion in credit card debt. The fact is, however, that credit cards aren’t, on their own, inherently dangerous for your finances. The real culprit is actually the high interest rates and fees that often come with your new card.

Thankfully, choosing the right credit card can go a long way toward reducing the debt risks associated with card use, and, of course, personal spending restraint. For instance, paying your balance fully each month will let you avoid interest altogether. For necessary balances, find cards that charge low (or better, no) interest rates.

Excellent Credit | Balance Transfers | Good Credit | Fair Credit | Bad Credit

The Best No-Interest Card Offers for Excellent Credit

At the top of the credit food chain, those with excellent credit typically have credit scores north of 750. These consumers have demonstrated good credit behaviors, such as paying their bills on time every month, as well as maintaining low balances and being stingy about new accounts.

In the credit world, financial diligence gets rewarded, often in the form of low rates and fees. When it comes to credit cards, consumers with excellent credit can find a wide range of great no-interest offers on both new purchases and balance transfers, with many offers lasting 12 months or more.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

For those with excellent credit, the choice of 0% APR cards may come down to comparing the non-interest-rate features, rather than simply the terms of your introductory offer. This includes looking at the card’s cash back rewards and signup bonuses, keeping your personal spending habits in mind when comparing rewards programs.

Best No-Interest Introductory Balance Transfer Offers

While choosing the right low-APR offer can help you avoid accumulating a balance on a high-interest card in the first place, it’s not too late if you’ve already made a poor choice for your purchases. All you need is a shiny new balance transfer offer.

In essence, a balance transfer is what it sounds like: you transfer your credit card balance from one credit card to a second credit card with a lower interest rate. The best balance transfer credit card offers will actually come with a 0% introductory APR, meaning you won’t have to pay any interest on your transferred balance for the length of the introductory terms.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

+See More Balance Transfer Offers

On the downside, issuers aren’t going to give you a balance transfer entirely without cost. Most credit cards will charge a balance transfer fee, typically equal to 2% or 3% of the total transferred balance. That said, the interest rate savings over an 18-month period can more than make up for the fees.

Another thing to note is that you generally can’t transfer a balance between two cards if they are both from the same issuer. For example, you can’t transfer a balance from one Bank of America card to another.

You’ll also want to be careful to continue making payments on your original card until you’ve received confirmation from both your old and new cards that the balance has been transferred. A balance transfer can generally be completed within 10 days.

The Best No-Interest Card Offers for Good Credit

Consumers who are in the “good” credit category generally have credit scores of 700 and up. These applicants will qualify for a number of quality intro 0% APR offers, but may not receive terms as favorable as those offered to their excellent-credit counterparts.

For instance, offers for good credit consumers may have shorter introductory periods than offers for consumers with excellent credit. These offers may also specify the type of balances that qualify for the low introductory rates — new purchases versus balance transfers — rather than offering the same introductory rate for both.

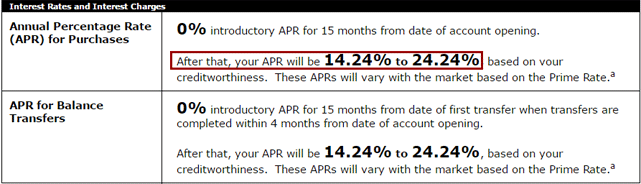

One of the most important things to remember about 0% APR introductory offers is the “introductory” part. The rate (or lack thereof) being offered is, by nature, a temporary rate, and will expire at the end of the introductory terms.

Introductory offers providing 0% APR will revert to a higher APR at the end of the offer terms.

Because they are temporary rates, you’ll want to determine the interest rates you’ll be charged after the offer period ends when comparing offers. To avoid paying interest fees on your balances, be sure to pay it off completely before the end of the offer.

The Best Low-Interest Cards for Fair Credit

Possessing credit scores in the 600s, those with fair credit are likely in the process of building — or rebuilding — their credit. As such, the credit card offers these consumers receive will reflect the higher credit risk they represent.

Indeed, no-interest offers for fair-credit consumers will often have much shorter introductory offer terms than the 0% APR offers received by those with better credit. Fair-credit offers may also have other requirements, such as status as a student.

For some applicants, especially those on the lower end of the “fair” category, the choice may come down to selecting a card that simply has a lower all-around interest rate. The rates for these cards will vary based on your individual creditworthiness.

The Best Low-Interest Cards for Bad Credit

As most consumers with bad credit are likely already aware, few issuers are willing to offer low-interest cards to those who present the highest credit risk. In most cases, this means credit scores below 600, though each credit card issuer (and even each specific credit card) will have its own particular credit standards.

For those with bad credit, the lowest interest rates will likely be found on secured credit cards. Requiring a cash down payment to open, a secured credit card otherwise will act exactly like a regular unsecured credit card when you make purchases.

When it comes to choosing a card with bad credit, you’ll want to be sure your new card reports to all three major credit bureaus. This will allow you to build your credit and increase your credit score over time as you (responsibly) use your new card.

The Best Way to Avoid Interest is to Pay Your Bill in Full

For many, the idea of paying the average 16.6% APR on their credit card purchases (or worse, more) can be scary — but it doesn’t have to be. Today’s consumers have a variety of options available to avoid paying high interest rates on both new purchases and an existing balance.

Of course, the best way to avoid paying interest on your purchases is to completely pay your credit card balance every month. But qualified applicants can still find interest-fee-free ways to carry a balance on their cards with a little research and a sweet low-interest credit card offer.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![11+ Best Low-Interest Credit Cards ([updated_month_year]) 11+ Best Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/low-int-1.png?width=158&height=120&fit=crop)

![15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year]) 15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/cheap.png?width=158&height=120&fit=crop)

![8 Low Interest Credit Cards For Beginners ([updated_month_year]) 8 Low Interest Credit Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Low-Interest-Credit-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)

![5 Best Low-Interest Personal Loans ([updated_month_year]) 5 Best Low-Interest Personal Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Low-Interest-Personal-Loans.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![8 Low Credit Score Credit Cards ([updated_month_year]) 8 Low Credit Score Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Low-Credit-Score-Credit-Cards.jpg?width=158&height=120&fit=crop)