Reloadable debit cards provide an effective way to pay with plastic without incurring debt. You use them to spend money you’ve already deposited, so credit is unnecessary, and a bank account is optional. You can also say goodbye to late fees and overdrafts.

We review the best debit cards — a healthy mix of prepaid and bank-issued products. You can use these cards to make purchases, pay bills, withdraw cash from ATMs, and send money to other individuals.

Best Reloadable Prepaid Debit Cards

These debit cards share the same basic features but differ in their details. Choose a card that has low fees, cash back rewards, convenient cash reloads, or family-friendly features to suit your needs.

- Cashback – Earn 1% cash back on up to $3,000 in debit card purchases each month

- No. Fees. Period. That means you won’t be charged an account fee on our Cashback Debit account.

- Early Pay – Get your paycheck up to two days early with no charge

- No Credit Impact – You can apply without affecting your credit score.

- Fraud Protection – You’re never responsible for unauthorized debit card purchases. If you suspect someone else has used your debit card without your permission, let us know.

- Member FDIC

- Fee-free overdraft protection

- No minimum opening deposit and no minimum balance

- Add cash into your account at Walmart stores nationwide

- Cash access at over 60,000 no-fee ATMs nationwide

- 100% US-based customer service available 24/7

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

No Credit Needed

|

You receive a Discover® Cashback Debit when you open an online checking account at Discover® Bank. It’s our Editor’s Top Pick because of its low fees, cash back rewards, and accelerated direct deposit. The card provides a fee-free overdraft service, access to more than 60,000 no-fee ATMs, and robust security features.

Indeed, its fees are scarce — the card doesn’t charge for monthly maintenance, low balances, inactivity, insufficient funds, expedited delivery, check reordering, or official bank checks. The only fee is a service charge for each outgoing wire transfer from your Discover® Checking Account.

2. GO2bank

- Overdraft protection up to $200 with opt-in and eligible direct deposit*

- No monthly fees with eligible direct deposit, otherwise $5 per month

- Earn up to 7% cash back when you buy eGift Cards in the app

- Get your pay up to 2 days early – Get your government benefits up to 4 days early.*

- High-yield savings account, 4.50% APY paid quarterly on savings up to $5,000.*

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

All Credit Types Considered

|

The GO2bank mobile banking account (from Green Dot Bank) comes with a Visa® debit card and operates through a full-featured app. You can opt for up to $200 of overdraft protection after accepting the required volume of direct deposits.

GO2bank covers debit card purchases exceeding your available account balance if you enroll in overdraft protection. You have 24 hours to settle your overdrawn account balance to avoid a fee. There’s no charge if you overdraw your account by $10 or less.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The NetSpend® Visa® Prepaid Card provides several ways to load cash into your account. You can deposit money at thousands of retail locations nationwide, perform mobile check deposits through your phone, and accept direct deposit of your wages or government benefits at no extra charge. Netspend continually ranks among the best prepaid debit cards.

You can use its reloadable prepaid card anywhere that accepts Visa®. The card lets you earn cash back rewards at select merchants when you shop in person or online. This version of the card charges a per-use fee for each transaction instead of a flat monthly charge.

- Greenlight is a debit card for kids, managed by parents

- Parents set flexible controls and receive real-time alerts while kids monitor their balances, set goals, and learn how to manage money

- Feel secure knowing Greenlight blocks unsafe spending categories

- Receive Mastercard’s Zero Liability Protection

- Upload a photo of your choice to create a unique custom card

- Debit cards are FDIC-insured up to $250,000

- Easily turn your Greenlight card on or off and receive real-time spending notifications

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

See Pricing

|

Not applicable

|

The Greenlight – Debit Card For Kids offers cash back on all purchases, and your cash back rate depends on how much you spend. The top rate applies to monthly purchases of at least $4,000. Lower reward rates apply to monthly spending above and below $1,000.

The account lets you set up direct deposits and chore-based allowances for up to five children. You can set flexible controls and get real-time notifications of your children’s spending activity. The Savings Account Goals earn up to 5% while training your children to save.

5. Netspend® All-Access® Account

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Netspend® All-Access® Account is an online mobile bank account that offers an optional Visa® debit card. It lets you pay bills and make purchases using a debit card or mobile app.

You can open and register the account by verifying your identity. Pathward, N.A., Member FDIC, provides banking services for the All-Access Account. The Payback Rewards program offers cash back on qualifying purchases. You can use the card at nationwide MoneyPass ATM locations for unlimited, surcharge-free withdrawals.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Up-to $9.95 monthly

|

Not applicable

|

This version of the NetSpend® Visa® Prepaid Card charges a monthly fee that you can have reduced if you receive qualifying direct deposits of payroll checks or government benefits.

In all other respects, this Netspend prepaid card is identical to the per-use version. You can acquire the card online for free or at a retail location for a one-time purchase fee. The card accepts direct deposits and standard mobile check loads for free but charges a small fee when you add money at a retail location.

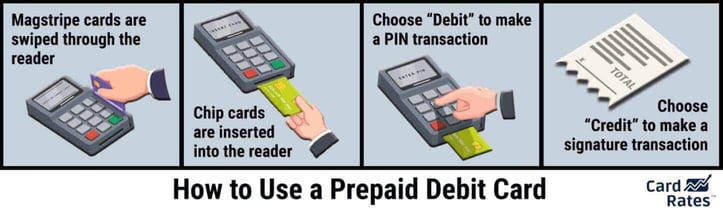

What Is a Reloadable Debit Card?

The term “reloadable debit card” typically applies to any card that allows you to add money through a linked bank account or card-specific prepaid account.

This card’s underlying account holds a balance you accumulate via cash, checks, direct deposits, transfers, and cash back rewards. You can spend your account balance using the card for purchases, bill payments, transfers to other individuals (and sometimes, other accounts), and cash withdrawals.

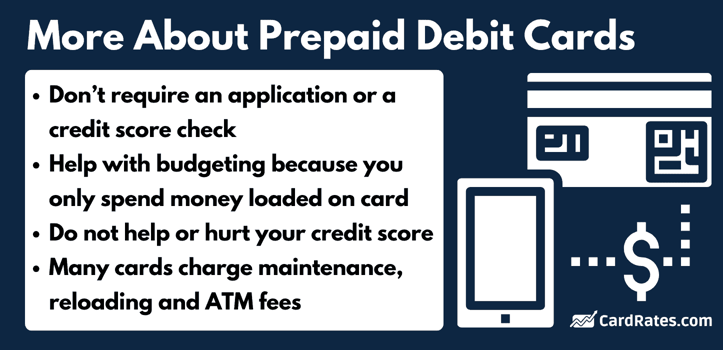

These cards don’t impose late or overdraft fees. They don’t charge interest because they are not associated with a line of credit. Nevertheless, you should carefully read your cardholder agreement because even the best prepaid debit cards are not 100% fee-free.

Many consumers use a reloadable debit card to avoid carrying cash. These cards make an excellent tool for creating a budget, as they only allow you to spend the money you load into the linked account.

You usually receive faster funds access when your reloadable card account accepts a direct deposit of your paycheck or government benefits. Digital delivery often puts money in your hands up to two days faster than if you were to receive a paper check through the mail.

How Do I Reload a Debit Card?

The method of reloading a debit card depends on whether it is prepaid or bank-linked.

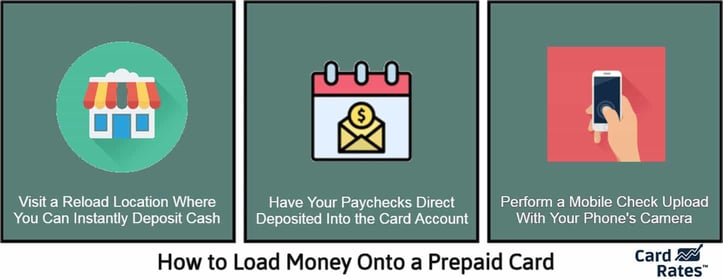

Reloading a Prepaid Debit Card

Nearly every issuer allows cardholders to accept direct deposits into their prepaid accounts to add money. The best prepaid card issuers waive or reduce your monthly fee if you receive regular direct deposits.

Prepaid card issuers partner with retail convenience stores and gas stations throughout the US to accept your deposits and load them into your card account. Alternatively, you can load funds by purchasing a reload pack from a retail location or online. You can also upload a mobile check to add money to your account.

Netspend, for example, has more than 130,000 reload locations nationwide, which makes it the best prepaid card for adding money to your account in just about any town or city.

Reloading a Bank Debit Card

Reloading isn’t quite the right term to use because this type of debit card accesses your bank account balance, not a separate card balance. Your bank balance may change frequently due to your financial activity. Modern payment systems quickly update your bank balance when you use your debit card.

Bank and prepaid debit cards share several reload methods, including ATM deposits, transfers, direct deposits, and remote check deposits. Bank debit cards also accept teller deposits at bank branches but usually do not offer reload packs or retail store deposits.

What Fees Are Associated With Reloadable Debit Cards?

Reloadable card fees vary by issuer and card type (prepaid vs. bank). The following table summarizes the most common charges:

| RELOADABLE CARD FEE TYPE | EXPLANATION | PREPAID CARD EXAMPLE AMOUNTS | BANK CARD EXAMPLE AMOUNTS |

|---|---|---|---|

| Activation Fee | Charged when you first purchase and activate the card | $3 to $10 | Not Typically Applicable |

| Monthly Maintenance Fee | Recurring monthly fee for maintaining the account | $0 to $10 per month | $0 to $15 per month for the underlying checking account |

| Per Use Fee | Fee charged every time you make a purchase or transaction | $0.50 to $2 per transaction | Not Typically Applicable |

| Reload Fee | Cash reload fee for adding money to the card balance | $2 to $5 per reload | Not Typically Applicable |

| Reload Pack Fee | Fee for purchasing a reload pack to add cash to your card | $3 to $6 | Not Typically Applicable |

| ATM Fees (Out-of-Network) | Fee for using an ATM outside the bank’s network | $1 to $3 per withdrawal | $2 to $5 per withdrawal |

| Balance Inquiry Fee | Fee for checking the card/account balance at an ATM | $0.50 to $1 per inquiry | $0.50 to $2.50 per inquiry |

| Foreign Transaction Fee | Fee for making purchases or ATM withdrawals in a foreign currency | 2% to 3% of the transaction | 1% to 3% of the transaction |

| Inactivity Fee | Fee if the card/account remains unused for a certain period | $2 to $5 per month | Not Typically Applicable |

| Card Replacement Fee | Fee for replacing a lost or stolen card | $5 to $10 per replacement | $5 to $25 per replacement |

| Over-the-Counter Cash Fee | Fee for withdrawing cash at a bank teller instead of an ATM | $2 to $5 per withdrawal | Not Typically Applicable |

| Bank Teller Deposits | Fee for depositing money into the account through a bank teller | $0 to $5 per deposit | Often Free |

| Paper Statement Fee | Fee for a mailed physical statement | $1 to $3 per statement | $1 to $5 per statement |

| Overdraft Fee | Fee charged when a purchase exceeds the account balance | Not Typically Applicable | $25 to $35 per occurrence |

| Transfer Fee | Fee for transferring money to another account, especially to another bank | Not Typically Applicable | $1 to $5 per transfer |

| Stop Payment Fee | Fee for requesting the bank to stop a payment that was previously authorized | Not Typically Applicable | $20 to $35 per request |

This chart contains general information that may differ from a specific card’s fee structure. Some reloadable cards minimize fees while others pile them on. Check the actual costs in the cardmember agreement.

Are Reloadable Debit Cards Safe to Use?

Using reloadable prepaid and bank debit cards is much safer than walking around with cash. Let’s delve into the safety aspects of both card types.

Safety of Prepaid Cards

Prepaid cards are safe from certain fees but do not provide all the security protections you get from a bank debit card.

Advantages

- No Overdraft Fees: You can only spend what you load, preventing overspending and the risk of overdrafting.

- Limited Exposure: Your potential losses cannot exceed the balance of a lost or stolen card.

- Protected by PIN: Most of these cards support a Personal Identification Number (PIN) for transactions, providing an added security layer.

Disadvantages

- Less protection: While many prepaid cards offer fraud protection, some may not provide the same protection as bank debit cards.

- Potential for misplacement: You may not be as concerned about losing the card since it doesn’t connect to your primary bank account. This attitude may increase your risk of losing the card.

Remember that you may not get a refund if you lose your prepaid card.

Safety of Bank Debit Cards

Bank debit cards usually provide better fraud protection but may be more vulnerable to hackers.

Advantages

- Direct Access: They provide direct access to your bank account funds, making transactions straightforward.

- Fraud Protection: Most bank debit cards come with robust fraud protection. You can dispute unauthorized transactions, and many banks offer zero liability.

- PIN and Chip Security: The introduction of EMV chip technology enhances the security of bank debit cards, making them harder to clone. Plus, the availability of a PIN for in-store transactions adds another layer of protection.

Disadvantages

- Linked to Bank Account: Someone who gains unauthorized access could drain a connected bank account. While protection may be in place, the temporary loss of funds can cause inconvenience and distress.

- Overdraft fees: Unlike prepaid cards, bank debit cards can lead to overdraft fees if you spend more than what’s available in the account.

Always use your card’s PIN to protect your bank account information from theft.

Can I Use Reloadable Debit Cards for Online Purchases?

You can use reloadable debit cards for online purchases, but you’d be wise to consider certain aspects. Most online merchants accept reloadable debit cards just as they would a credit card, especially if they display a major card network logo, such as Visa®, Mastercard®, or American Express®.

You must register and/or activate your debit card before using it for online transactions. To enable your card, you typically provide your name, address, Social Security Number, and other personal information, which helps online merchants verify your identity.

Ensure that you have enough funds on deposit to cover your online purchases. Otherwise, the issuer will decline the transaction (unless you have overdraft protection).

As with any other online transaction, purchasing from only reputable websites is crucial. Using secure and encrypted websites (look for “https://” in the URL) helps protect your card information.

Some online services, including car rental companies and hotels, may either refuse your debit card or place a temporary hold on an amount larger than the actual purchase price. An oversized hold can tie up funds on your reloadable card until the merchant releases it.

Remember to keep the card funded if you use a reloadable debit card for subscriptions or other recurring payments. These transactions may fail if the card balance is too low.

How Do I Choose the Best Debit Card For My Needs?

This chart will help you select a debit card that satisfies your financial requirements and spending habits.

| CRITERIA | CONSIDERATIONS | WHY IT’S IMPORTANT |

|---|---|---|

| Type of Card | Bank Debit Card, Reloadable Debit Card | Different cards cater to various financial situations, such as whether you want a bank account. |

| Fees | Monthly maintenance, ATM withdrawal, foreign transaction, overdraft | Compare fees — lower costs can save you money in the long run. |

| Access to ATMs | Availability of in-network ATMs, fees for out-of-network usage | Look for convenient access to cash without excessive fees. |

| Overdraft Protection | Availability, terms and conditions, and associated fees | It helps prevent declined transactions and potential fees. Usually available only as an option. |

| Rewards & Benefits | Cash back, points, discounts at specific merchants | Rewards provide added value for everyday spending |

| Security Features | EMV chip technology, fraud alerts, card control features (e.g., freezing the card) | You’d like maximum protection against unauthorized transactions. |

| Account Management | Online banking, mobile app, text or email alerts | Tools help you conveniently monitor and manage your account on the go. |

| Customer Service | 24/7 support availability, methods of contact (e.g., chat, phone, email) | Reliable support encourages prompt resolution of any issues. |

| Additional Services | Check writing capabilities, bill pay service, mobile check deposit | Decide what you need to get the desired overall banking experience. |

| Usage Requirements | Minimum balance, transaction frequency requirements | Try to avoid potential fees and usage disruptions. |

Choosing the wrong reloadable prepaid card isn’t much of a problem since you can easily cancel it and get another. Things are a little dicier with a bank debit card, as opening and closing these accounts can be a hassle.

Are Reloadable Debit Cards Worth It?

Whether a reloadable debit card is worth it depends on your financial requirements. A reloadable debit card may be a good fit if you value the flexibility and control it offers without needing a bank account or credit check. However, keep in mind the fees and limitations.

On the plus side, reloadable debit cards do not create debt, so you can only spend the money you have. The reviewed debit cards do not require credit checks, making them an excellent choice for consumers with limited or bad credit.

They’re safer than cash, and you can easily replace lost or stolen cards. The best debit cards offer fraud protection. These cards make shopping in stores and online easy, and you’ll never pay an overdraft fee.

Debit cards aren’t perfect. Some have too many fees, and none help you build credit. Prepaid debit cards offer fewer features than bank cards.

Before getting a debit card, check whether you can access deposits quickly. Remember that hotels and car rental companies may not accept debit cards.

What Happens if I Lose My Debit Card?

Losing a debit card is stressful, but timely action can minimize potential damage. Immediately contact your card issuer to report the loss or suspected theft. Doing this swiftly to protect yourself from fraudulent transactions is crucial.

Report unauthorized activity to your issuer at once. The sooner you respond, the better protected you may be against liability for those transactions.

Once you’ve reported the loss, ask the issuer to send you a replacement card. You may have to pay a fee for the new card. Changing your PIN when you receive your new card is essential, especially if you suspect theft.

If you have any recurring payments linked to your lost card, update them with your new card details to avoid missing payments. Remember to keep your card in a safe place and shield the keypad if you use a PIN for in-store purchases.

Can I Build Credit With a Debit Card?

Unfortunately, you cannot build credit with a debit card because the cards don’t extend credit. Banks, credit unions, and other financial institutions do not report your debit card transactions to credit bureaus since you’re not borrowing money.

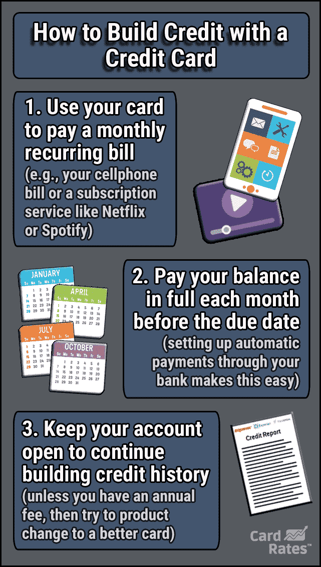

Consider using a credit card if you’re looking to build or improve your credit.

Other financial products, including secured credit cards, loans, and credit-builder loans, can also establish or help improve your credit.

Always pay credit card balances in full and on time, maintain a low credit utilization rate, and avoid applying for too many credit accounts in a brief period. Over time, these sound practices will help boost your credit score.

Whether you qualify for a secured or unsecured credit card depends on your credit history. Those with good credit scores will qualify for unsecured cards with relatively low fees, whereas people with no credit or bad credit will best benefit from a secured card.

In terms of rewards, secured cards have come a long way, and most of the best options offer rewards programs and quick consideration to move to an unsecured card, some in as soon as six months.

Can Minors Use Reloadable Debit Cards?

Several reloadable cards, including Greenlight and the Famzoo Prepaid Card, cater directly to the parents of minors. Parents can add their children to a prepaid or bank debit account as authorized users, and each child should receive a card.

When selecting a family debit card, ensure it provides the necessary safeguards. Look for the option to set individual spending limits for each child. You should have tools to control and monitor spending, prevent purchases from specific merchants or merchant types, receive transaction alerts, and even lock the card if necessary.

Family debit cards usually trumpet their value in helping young people learn about budgeting and personal finance. Many allow parents to automate allowances and enforce a savings account plan.

If you aren’t ready to hand out debit cards to your children, consider starting them off with gift cards. A gift card is easy to get and available in small denominations. You can then promote them to a debit card if they use their gift cards responsibly.

Add a Reloadable Debit Card to Your Financial Toolkit

A reloadable debit card supports realistic budgeting by allowing you to spend only what you’ve loaded, preventing debt accumulation. It provides a safer alternative to cash, especially during travel, and you can easily obtain a replacement for a lost or stolen card.

You can get these cards without a bank account or good credit. Yet, they offer bank-like features such as online purchasing and money transfers, making transactions convenient. Lastly, they’re a valuable tool to teach financial responsibility to minors while enabling parents to monitor and control spending.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Reloadable Credit Cards ([updated_month_year]) 9 Best Reloadable Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/reloadable-credit-cards-2--1.jpg?width=158&height=120&fit=crop)

![7 Best Reloadable Visa Cards ([updated_month_year]) 7 Best Reloadable Visa Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Reloadable-Visa-Cards.jpg?width=158&height=120&fit=crop)

![4 Best Online Bank Accounts With Instant Debit Cards ([updated_month_year]) 4 Best Online Bank Accounts With Instant Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/The-Best-Online-Bank-Accounts-With-Instant-Debit-Cards.jpg?width=158&height=120&fit=crop)

![9 Best Debit Cards With No ATM Fees ([updated_month_year]) 9 Best Debit Cards With No ATM Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Debit-Cards-With-No-ATM-Fees.jpg?width=158&height=120&fit=crop)

![7 Best No-Fee Debit Cards ([updated_month_year]) 7 Best No-Fee Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/11/best-no-fee-debit-cards.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year]) Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/can-i-use-my-debit-card-as-a-credit-card--1.jpg?width=158&height=120&fit=crop)

![7 Things to Know About the Discover Debit Card ([updated_month_year]) 7 Things to Know About the Discover Debit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/11/7-Things-to-Know-About-the-Discover-Debit-Card.jpg?width=158&height=120&fit=crop)